Key points

- We continue to be sanguine on China equities from a bottom-up, stock selection perspective. While geopolitical concerns about the US-China trade war could continue to cause volatility, we remain focused on stocks with policy support, strong domestically-driven earnings and quality franchises. These stocks are in the technology and software, automation, high-value-added manufacturing, healthcare, insurance sectors and select consumer sub-sectors.

- A further worsening of the US-China trade disputes wouldn’t be good for global financial markets. But it wouldn’t be all bad for China stocks. There are still stocks and investment themes in China that could benefit from the current trade war with the US, such as in the areas of semiconductors, electronic components, 5G and high-end industrial goods/machinery. The ongoing inclusion of China A-shares in global equity indices could also continue to boost interest in China stocks.

- Moreover, the quality of China’s current economic growth is much better than that of yesteryear, as the country is increasingly focused on achieving sustainable growth through consumption, research and development and targeted investments in innovative industries.

A volatile but rewarding year for China stocks

There was certainly no shortage of unnerving market events in 2019. The volatile year saw multiple flare-ups in the US-China trade disputes, with a barrage of tit-for-tat tariff measures from the world’s two biggest economies. It also saw relentless political protests in Hong Kong, fears of a global recession and many other risk-off developments. Yet, despite all the market hullabaloos, as we enter the final stretch in 2019, China equities (as measured by the the Shanghai Shenzhen CSI 300 Index) have still managed to deliver gains of more than 20% on a year-to-date basis1.

The sizable returns achieved by China stocks in 2019 shouldn’t be too surprising if one delves into the reasons behind them. At the outset, China—despite its enormous size—is still one of the fastest-growing economies in the world and has been supported by accommodative monetary policies throughout 2019. The country continues to progress steadily on its financial and economic reform journey, while its stock markets remain home to a vast number of fast-growing innovative companies. At the same time, valuations of China stocks remain cheap compared with those of US stocks. Increasingly, global equity indices, such as those of MSCI, are adding China A-shares as constituents. All these factors have helped propel China equities meaningfully higher during the year.

Will China stocks continue to shine in 2020? Time will tell, but there are reasons to be optimistic. In a nutshell, we continue to be sanguine on China equities from a bottom-up, stock selection perspective. While geopolitical concerns about the US-China trade war could continue to cause volatility, we remain focused on stocks with policy support, strong domestically-driven earnings and quality franchises. These stocks are in the technology and software, automation, high-value-added manufacturing, healthcare, insurance sectors and select consumer sub-sectors.

Higher quality of growth in China

The Chinese economy recently posted 6% growth on a year-on-year (YoY) basis in 3Q 2019. Straightaway, countless news reports latched on to the negative angle that the quarterly growth was the slowest in nearly 30 years. To be sure, most years from 1980 to 2011, annual economic growth in China was in excess of 10%. But China’s economy is much different today from where it was in the 1980s, 1990s and 2000s. In the 1990s, for instance, it was about one-tenth the size of that of the US. Today, the Chinese economy is only about half the size of the US economy and is the second largest in the world. In the current context, given the sheer size and maturity of China’s economy, sustaining annual growth rates of around 6% is still a remarkable feat in our view.

Moreover, the quality of China’s current economic growth is much better than that of yesteryear, when its GDP was largely driven by infrastructure investments funded by debt. China’s past economic model—driven by exports and fixed asset investments in infrastructure and property—produced a number of undesirable results, such as pollution, corruption, a high level of leverage and over-capacity. The model also pushed too much capital into less productive areas, resulting in a decline in overall economic efficiency.

All things considered, the days of economic stimulus through massive infrastructure and real estate investments are over for China. In recent years, the country has been increasingly focused on achieving quality and sustainable growth through consumption, research and development, and targeted investments in innovative industries.

Although China’s current GDP growth isn’t as high as it once was, it is now of higher quality, and that is positive for many Chinese companies, which used to be dogged by sub-par earnings and poor profitability due to overcapacity issues.

In our view, China’s economic priority of “quality over quantity” bodes well for many consumer-related companies and high-value-added industries, such as automation, electric vehicles, artificial intelligence, robotics, semiconductors and advanced manufacturing, all of which better represent China’s future economy. At the same time, the new economic milieu in China provides a rich hunting ground for active equity managers in search of alpha.

A-shares inclusion in global indices to boost further interest in China stocks

In late November 2019, MSCI announced that it completed the final phase of its 20% partial inclusion of China A-shares in its widely-tracked equity indices. Increasing the weights of China A-shares in MSCI indices by raising the inclusion factors to 20% has boosted the global exposure of China domestic equities, induced more foreign funds to buy China A-shares and injected liquidity into China’s stock markets, which are now more accessible to global investors.

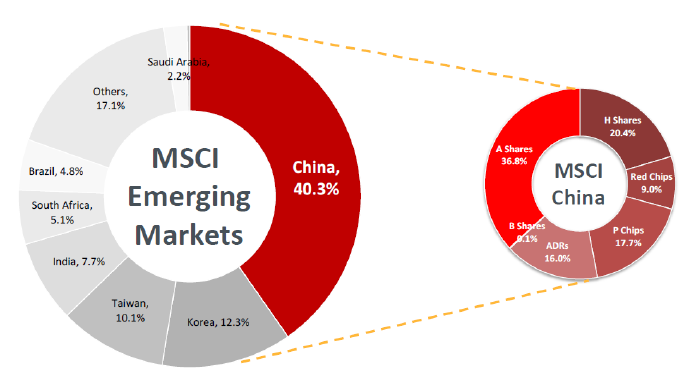

Under MSCI’s inclusion plan, China A-shares currently have weights of 0.5% in the MSCI All Countries World index, 4.1% in the MSCI Emerging Markets index and 11.7% in the MSCI China index. Looking ahead, on a full inclusion basis, China stocks, including A-shares, could make up around 40% of the MSCI Emerging Markets index, according to MSCI (see Illustration 1).

Illustration 1: China equities could constitute 40% of the MSCI EM Index in a full inclusion scenario

Source: MSCI, Consultation on Further Weight Increase of China A-Shares in the MSCI Indexes report, Dec 2018

Given its share fair of inclusion factors, China can become one of the largest countries in a number of equity indices, even the global ones. With the recent MSCI inclusion, China A-shares are estimated to have received more than USD 25 billion in inflows this year2.

We believe the inflows of foreign funds into China stocks will continue in 2020 and for years to come, as more index providers (including FTSE Russell and S&P Dow Jones Indices) start to include more China A-shares in their equity indices. The full inclusion of China A-shares could take a while; it took six years for South Korea and nine for Taiwan to move from partial to full inclusion by MSCI. Nonetheless, the A-shares inclusion factor could continue to be an enduring investment theme for longer-term investors in China stocks.

Hukou reforms and urbanisation drive

In order to cultivate a more dynamic and freer economy as well as to speed up urbanisation and improve labour mobility, China has started to reform its “hukou” system, which is the country’s household registration scheme. In essence, hukou—akin to an internal passport or identification document for Chinese citizens—has been developed by the Chinese government to regulate population distribution and labour resources by restricting intercity migration and the mobility of Chinese workers.

Under the system, Chinese citizens are categorised into two groups—agricultural (or rural) hukou holders for people living in rural areas and non-agricultural (or urban) hukou holders for those who reside in larger cities. In the past, workers from rural towns and villages who wanted to work in larger cities would only be granted an urban hukou if they were able to meet certain educational and technical skills criteria.

In recent years, the Chinese government has eased the restrictions on new migrants to second and third-tier cities. In 2016, for instance, the Chinese State Council set a target of granting urban residency status to 100 million rural migrants by 2020. Recently, under China’s 2019 urbanisation plan, cities with populations of one million to three million have done away with all hukou restrictions, while those with populations of three million to five million have also reduced hukou restrictions on new migrants, especially those who graduated from universities and vocational institutions.

Hukou reforms, through channeling labour and resources from rural to urban areas, enable China to urbanise without the need to build new metropolises or modernise cities. In addition to speeding up the rate of urbanisation in the country, the reforms enhance social productivity, reduce inequality between rural and urban hukou holders and boost domestic consumption, all of which will help China sustain a higher quality of economic growth.

Can China survive a prolonged trade war with the US?

Without a doubt, a long-drawn-out trade war with the US will have negative consequences for America, China and many other countries. But bear in mind that since China is no longer as dependent on the US as it once was, it will not be easy for America to pressure China through trade tariffs. And the impact of US trade tariffs on Chinese goods may not be as devastating to the world’s second largest economy as some would think. This is because exports and imports are no longer the key drivers for China’s economy. For more than a decade, exports have increasingly become a smaller part of the Chinese economy (see Illustration 2) as the country shifts focus towards services and consumption, and higher valued-added manufacturing.

Illustration 2: Exports/imports no longer key drivers for China’s economy

Source: World Bank

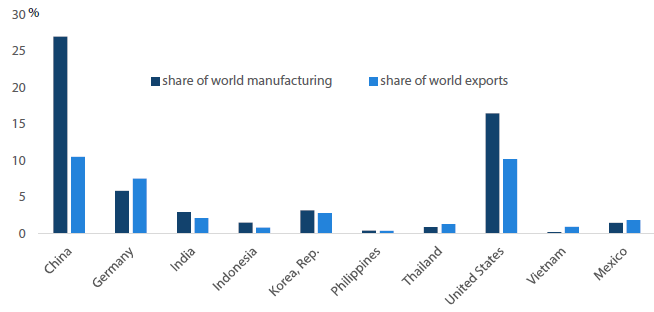

Furthermore, contrary to what headlines might suggest, a significant part of China’s manufactured goods is actually consumed domestically. This is unlike Germany or other Asian countries, whose share of exports are higher than their share of world manufacturing capability (see Illustration 3). Currently, less than a one-quarter of Chinese exports go to the US.

Illustration 3: China’s share of world manufacturing and world exports

Source: IMF, Dec 2018

If the ongoing US-China trade war worsens significantly, we could end up in a bifurcated world, where countries and people have to take sides between the US and China. This isn’t our base-case scenario. But should such a scenario unfold, it will not be a total disaster for China, which can survive on its own given the sheer size of its domestic economy. In a bifurcated world, China could lead the emerging markets, whereas the US could lead the developed economies.

With the ebb and flow of the US-China trade talks and the capricious moods of US President Donald Trump, it is futile to attempt to predict where the US-China trade/technology war is heading. Either way, the disputes with the US on trade and technological dominance will strengthen China’s resolve to develop its own semiconductor industry—an area where it wants to be more self-sufficient and self-reliant. Looking ahead, the Chinese will likely invest much more in semiconductors because they do not want to be reliant on US chips.

A further worsening of the trade war wouldn’t be good for global financial markets. But it wouldn’t be all bad for China stocks, many of which tend to be domestically driven. There are still stocks and investment themes in China that could benefit from the current trade war with the US, such as in the areas of semiconductors, electronic components, 5G and high-end industrial goods/machinery. And fundamentally-focused portfolio managers, who have the skillsets to find quality companies with sustainable earnings power, could still outperform in a challenging macro environment.

Footnotes

1Source: Bloomberg LP, as at 3 December 2019.

2Nikko AM estimate based on data deemed reliable.