The damage emerging market fixed income suffered in 2018 following two years of positive performance shocked many investors. The Federal Reserve’s (Fed) rate hikes had negative ramifications for the broader emerging market asset class, and idiosyncratic risks stemming from countries such as Turkey and Argentina also weighed on performance. A broadly pessimistic outlook for 2019 then emerged regarding emerging debt. But in contrast, we were cautiously optimistic about 2019, expecting better times ahead.

As it turned out, emerging market fixed income fared much better in 2019 than many had feared, despite occasional turbulence caused by news headlines. At the time of writing, external debt was the best performing segment within the emerging debt universe, gaining about 14% (JPM EMBI GD), followed by corporate debt, which rose by roughly 12.5% (JPM CEMBI BD) and then local debt, which gained almost 12% (JPM GBI-EM GD)1 .

So how did the emerging debt market shrug off the negative headlines—and investors’ cynicism about its prospects—and post strong returns this year?

2019 in review

The main story of the year, of course, was the ongoing trade conflict between the US and China. The spat rumbled on throughout 2019, and until very recently, it was unclear whether the US would implement tariffs on another USD 160 billion of Chinese goods on 15 December as scheduled. However, the two protagonists reached a compromise. Still, trade conflicts are not just about the US and China. In December, the US unexpectedly threatened to restore tariffs on steel and aluminium imports from Argentina and Brazil, despite President Trump’s previously friendly relationship with his Brazilian counterpart Jair Bolsonaro.

There have also been issues in individual emerging markets, reminding us of the importance of taking a selective approach when investing in the asset class. The Argentinean economy remained in crisis, crippled by ballooning debt and persistent political instability. And after its terrible performance in 2018, the Turkish lira weakened further this year, with the Turkish economy still mired by the country’s significant external financing needs and ongoing political mismanagement.

Investors have had to contend with social unrest in a number of emerging markets; we have seen turbulence in Latin America, with countries including Chile, Bolivia and Ecuador experiencing significant anti-government protests. There was also unrest in Lebanon and most prominently in Hong Kong, where the protests that have continued since June could ultimately hurt the Chinese economy.

Despite these concerns, global central bank policy was the one overwhelmingly supportive factor for emerging markets in 2019. Before 2019, the consensus was for a continued tightening in developed market monetary policy, which would have been a headwind for emerging market assets. Indeed, early in the year, expectations were for the Fed to hike rates several more times in 2019. All this changed in March when the Fed made a U-turn and signalled that it would not raise rates for the remainder of the year. The Fed then went on to cut rates three times, providing a significant boost to emerging market fixed income, and investors quickly went on a structural hunt for yield. Central banks in emerging markets were quick to follow the Fed. They cut rates by a combined 2,200 basis points (bps) over the course of the year to support their economies against a backdrop of weakening global growth, given the absence of inflationary pressure that may have prevented them from easing.

Going into 2020

Emerging debt provided much better returns in 2019 than most investors expected, but a repeat of such an impressive performance looks less likely next year. Gains in the low- to mid-single digits may be a more realistic outcome as lower US Treasury yields are unlikely to bolster the asset class and as sovereign spreads also look tight on a historical basis. However, after two years of underperformance, we think that emerging market currencies are particularly attractive and could boost the performance of local debt.

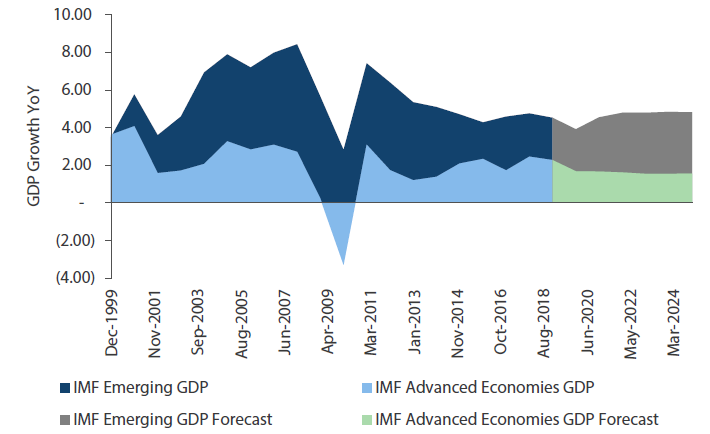

Nevertheless, in a world of slowing economic expansion, emerging markets’ relatively rapid growth is still likely to appeal to investors. While OECD economies are forecast to grow by just 1.8% in 2020, emerging markets are expected to expand by roughly 4.6%.

Chart 1: EM vs DM GDP Growth

Source: Nikko AM, as of 17 December 2019

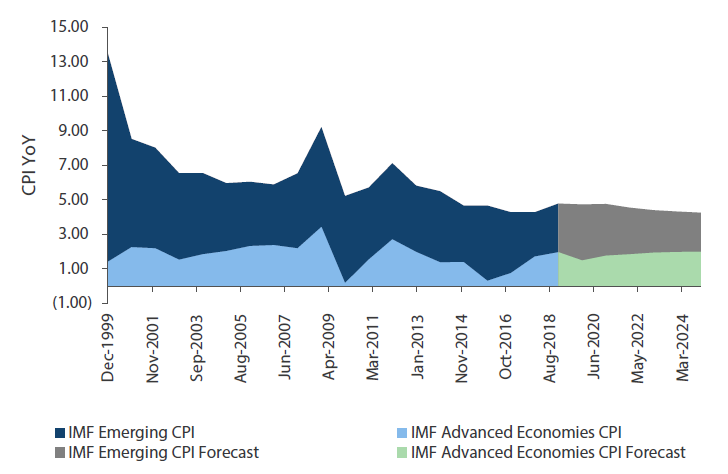

Headline inflation in emerging markets may accelerate slightly next year due to higher food prices in China. Yet central banks are likely to remain in accommodative mode, which should provide a further boost to the asset class. Emerging fixed income will continue to be a natural choice for investors hunting for yield at a time when many developed market sovereign bonds are offering negative yields.

Chart 2: EM vs DM Inflation

Source: Nikko AM, as of 17 December 2019

The US-China trade war remains the big unknown for 2020. Predicting with any certainty what President Trump will do next is impossible, but we believe that he wants to avoid damaging the US economy further in an election year. At the same time, China does not desire to see its economy lose further momentum. As such, the compromise the two economic superpowers reached should hold for the majority of 2020, in our view.

It is also worth noting that some countries have actually benefitted from US-China trade tensions. These include Vietnam, where many technology firms have moved their manufacturing operations; South Korea, which has been exporting more electronic goods to the US; Mexico, which has increased motor vehicle exports to the US; and Brazil, which has seen its soybean exports to China increase.

As always within emerging markets, we must also be mindful of ongoing political risk and the related uncertainty that may arise with it. Relatively few elections will take place next year, but turbulence continues in many South American countries. In addition, the strife in Hong Kong could drag on and weigh on investors’ sentiment towards China.

Finally, it is essential to watch debt levels, which are still rising in emerging markets in the wake of real yield compression. Overall, this should not pose a systemic risk as long as the US economy avoids a recession and central banks remain accommodative. Still, there are important implications for active investors as the number of high-debt emerging markets trading at distressed levels is increasing, representing either danger or opportunity.

Our action plan

Against a backdrop of relative winners and losers from trade tensions, social unrest and swings in risk sentiment, a selective approach to emerging fixed income could become more important than ever in 2020. As a general rule, we will continue to avoid exposure to countries where economies are over-reliant on commodity exports and/or excessive external financing—particularly where we do not see fair compensation for bearing such risks. And emerging market currencies should finally start grabbing the attention of investors after two years of lacklustre performance as valuations look highly compelling, particularly relative to rates and sovereign credit. Based on our top-down asset allocation, we will likely allocate more risk to this segment. We believe that our investment approach that combines our proprietary top-down asset allocation with detailed country-level assessment will be the best pathway to deliver attractive returns to emerging markets investors in the coming years.

Footnotes

1 As of 16 December 2019.