Global Equity Investment Philosophy

Our philosophy is centred on the search for ‘Future Quality’ in a company. Future Quality companies are those that we believe will attain and sustain high returns on investment. ESG considerations are integral to Future Quality investing as good companies are good investments.

The four pillars we use to assess the Future Quality characteristics of an investment are:

Franchise—does the company have a sustainable competitive advantage?

Management—does the company make sound strategic and capital allocation decisions?

Balance Sheet—is growth appropriately financed?

Valuation—are the company’s prospects under-appreciated by the market?

We believe that investing in Future Quality companies will lead to outperformance over the full market cycle. Our strategy is based on fundamental, bottom-up research therefore sector and country allocations are a function of stock selection. The Global Equity strategy is a concentrated, high conviction portfolio with a high active share ratio.

Market Review

Global equity indices continued to struggle to make any ground in Q3, exiting September exactly where they were at the end of June. Uncertainty regarding the eventual outcome of global trade talks has plagued markets. Regional issues like the initiation of impeachment proceedings against President Trump, Brexit and the ongoing unrest in Hong Kong have done little to help.

Although August saw these concerns reflected in an inverted US yield curve and fear of a US recession increase, the quarter ended on a slightly more positive tone. As ever, this positivity was driven by hopes over more monetary support from central banks around the world in the form of rate cuts in the US and China, as well as renewed quantitative easing from the ECB. A changing of the guard at Europe’s central bank even led to rumours of more overt intervention, with direct financing of infrastructure investment.

Despite some fairly significant sector and investment style rotation in September, most of this quarter’s best performing sectors were those that traditionally offer more defensive growth: utilities, consumer staples and real estate. The information technology sector has also continued to do well suggesting a continued interest in growth. By contrast, the worst performers were cyclicals. Energy was particularly weak despite the intra-quarter spike in oil prices caused by a drone attack on Saudi Arabia’s oil infrastructure. Materials also underperformed on renewed fears over global economic growth. Despite the ongoing bid for defensives, healthcare underperformed in Q3 as noise on potential reforms heated up ahead of next year’s US Presidential election.

Regionally, Japan and the US led the way. Although it has softened, US economic data has generally remained firmer than that of its trading partners. The USD held onto its gains relative to other currencies as a result—damaging sentiment towards emerging markets.

Having meaningfully outperformed year-to-date, ‘growth’ ceded leadership to ‘value’ in September.

Market Outlook

September saw US economic data continue to soften, the initiation of impeachment proceedings against President Trump, and the UK’s protracted divorce from the EU looking increasingly acrimonious. Some investors saw an opportunity in this turbulent environment and this led to a reasonably vicious rotation out of the sectors that have led markets in recent times in favour of the laggards.

Central banks certainly seem to be bowing to mounting political pressure, providing even more liquidity. With so much of the latter having already been provided, and the resultant asset price inflation largely failing to feed through into improved economic activity, it feels to us that a new strategy is probably required.

While it appears politics are becoming increasingly partisan, with positions becoming more entrenched by endless social media commentary, one factor remains constant: politicians generally support whatever is required to be re-elected. With an increasing number of voters unhappy with their lack of benefit a decade into economic recovery, what can politicians do to reduce this inequality and increase their popularity at the same time? One possible solution is directed infrastructure investment.

Such a measure would require even greater support from central banks, who have remained willing to pay some governments for their debt in recent times. It must be tempting to issue more debt, to finance more road building and to enact other voter-friendly initiatives. However, such measures would make central bankers even more complicit in supporting political agendas, paying less heed to economic fundamentals in the overall process.

It remains uncertain as to whether the environment is actually that dire in key markets, like the US and Germany, to support such a radical step. This is certainly not the case at a consumer level, where real wages are rising and confidence is at elevated levels. Ironically, things may need to get worse before they get better…for a while, at least.

In the short term, markets may get more instant gratification from a de-escalation in the ongoing trade spat between the US and China. Has the US overplayed its hand, given they represent only 17% of China’s exports and these exports are heavily tilted towards areas deemed less strategically important by China (furniture and textiles)? Will President Trump really push ahead with another raft of tariffs in December when these would quickly turn up in price increases for US consumers less than a year out from asking the same people for a second term? His track record does not suggest so but time will tell.

The US election cycle is becoming an increasing headwind for the healthcare sector as President Trump and the Democrats vie for the most eye-catching policies that are designed to control healthcare costs. There is no doubting the imperative to deliver healthcare as cost effectively as possible, with 20% (and rising) of US GDP already spent in this area. The challenge remains, however, on how to deliver these savings without jeopardising the quality of care that patients receive.

Recent surveys suggest that just over half of US voters support initiatives such as ‘Medicare for All’ that could reduce costs, but voters are much less supportive where this means paying more taxes or restricting their options in choosing their own healthcare. These unintended consequences could become a reality if new, lower government payments lead to some hospitals becoming unprofitable and closing.

Are the private insurance providers like Anthem part of the problem (with ever increasing premiums) or part of the solution (making large investments to get ready for the long-awaited move to value-based care)? We continue to believe the latter view and see this transition as imperative if the US is to structurally gain more control over its spending. Cost containment generally remains a core theme within our healthcare holdings.

Given the scale of the potential developments in fiscal and monetary policy, it seems possible that we could be entering a period of above-average volatility and potential investment style rotation. Although the desire to rehabilitate cyclical offenders is very understandable and accommodative conditions could allow them to prosper in the short term, we doubt that many will be able to sustain the level of cash return on investment that we look for when judging Future Quality, especially in light of the structural headwinds facing some of these industries.

For our observations about the influence of multi-stakeholders on the rise, please refer to our September Future Quality Insights.

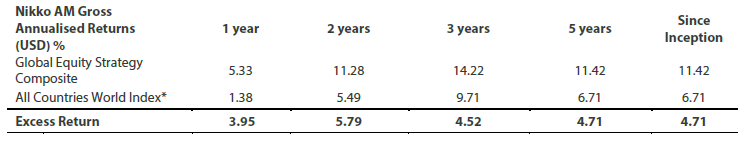

Global Equity Strategy Composite Performance to Q3 2019

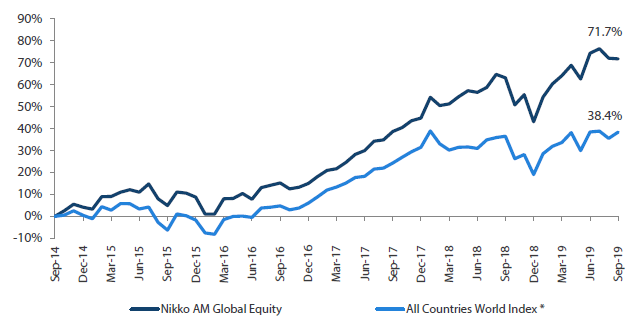

Cumulative Returns October 2014 to September 2019

Past performance is not indicative of future performance. Source: Nikko AM, FactSet, Bloomberg. The track record for Nikko AM portfolio is based on a composite portfolio from 01 October 2014 to 30 September 2019. *The benchmark for this composite is MSCI AC World Index. The benchmark was previously the MSCI All Countries World Index ex AU since inception of the composite to 31 March 2016. Returns are US Dollar based and are calculated gross of advisory and management fees, custodial fees and withholding taxes, but are net of transaction costs and include reinvestment of dividends and interest.

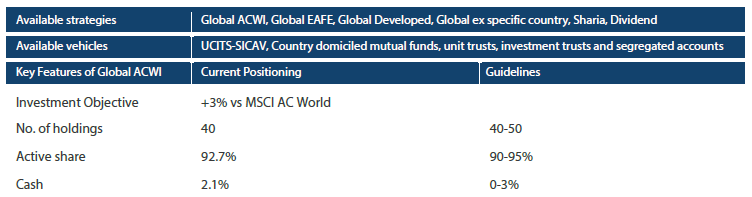

Nikko AM Global Equity: Capability profile and available funds (as at 30 September 2019)

Past performance is not indicative of future performance.

This is provided as supplementary information to the performance reports prepared and presented in compliance with the Global Investment Performance Standards (GIPS®). Nikko AM Representative Global Equity account. Source: Nikko AM, FactSet.

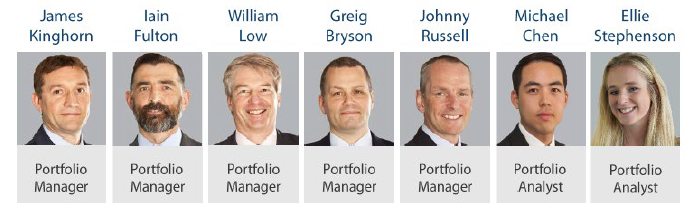

Nikko AM Global Equity Team

This Edinburgh based team provides solutions for clients seeking global exposure. Their unique approach, a combination of Experience, Future Quality and Execution, means they are continually “joining the dots” across geographies, sectors and companies, to find the opportunities that others simply don't see.

Experience

Our five portfolio managers have an average of 22 years' industry experience and have worked together as a Global Equity team for eight years. Two portfolio analysts, Michael Chen (joined in February 2019) and Ellie Stephenson (joined in September 2019) are the first in a new generation of talent on the path to becoming portfolio managers. The team’s deliberate flat structure fosters individual accountability and collective responsibility. It is designed to take advantage of the diversity of backgrounds and areas of specialisation to ensure the team can find the investment opportunities others don't.

Future Quality

The team's philosophy is based on the belief that investing in a portfolio of Future Quality companies will lead to outperformance over the long term. They define Future Quality as a business that can generate sustained growth in cash flow and improving returns on investment. They believe the rewards are greatest where these qualities are sustainable and the valuation is attractive. This concept underpins everything the team does.

Execution

Effective execution is essential to fully harness Future Quality ideas in portfolios. We combine a differentiated process with a highly collaborative culture to achieve our goal: high conviction portfolios delivering the best outcome for clients. It is this combination of extensive experience, Future Quality style and effective execution that offers a compelling and differentiated outcome for our clients.

About Nikko Asset Management

With USD 230.8 billion* under management, Nikko Asset Management is one of Asia's largest asset managers, providing high-conviction, active fund management across a range of Equity, Fixed Income, Multi-Asset and Alternative strategies. In addition, its complementary range of passive strategies covers more than 20 indices and includes some of Asia’s largest exchange-traded funds (ETFs).

*Consolidated assets under management and sub-advisory of Nikko Asset Management and its subsidiaries as of 30 September 2019.

Risks

Emerging markets risk - the risk arising from political and institutional factors which make investments in emerging markets less liquid and subject to potential difficulties in dealing, settlement, accounting and custody.

Currency risk - this exists when the strategy invests in assets denominated in a different currency. A devaluation of the asset's currency relative to the currency of the Sub-Fund will lead to a reduction in the value of the strategy.

Operational risk - due to issues such as natural disasters, technical problems and fraud.

Liquidity risk - investments that could have a lower level of liquidity due to (extreme) market conditions or issuer-specific factors and or large redemptions of shareholders. Liquidity risk is the risk that a position in the portfolio cannot be sold, liquidated or closed at limited cost in an adequately short time frame as required to meet liabilities of the Strategy.