Many investors will be weighing the four concerns that Japan is expected to face in 2020: demographic challenges, negative effects from a slowdown in the tech cycle and the Chinese economy, a “typical” post-Olympics slump and the stagnation of improvements in corporate governance. We address each of these four factors and show that there are solid reasons to be optimistic on Japan in 2020:

- Tech cycle/Chinese economy: the tech cycle is showing signs of bottoming out and China’s economy appears to be picking up, with both to benefit Japan.

- Demographics: corporate profits are surging in negative correlation with the declining population.

- Post-Olympics: large construction projects will continue well after the games, preventing a slump.

- Corporate governance: reform in governance will continue, regardless of factors both internal (changes to foreign investment regulations) and external (trade wars etc.)

1) Japan to benefit from bottoming out of tech cycle, Chinese recovery

Semiconductor market showing recovery signs

Japan’s high technology sector is showing signs of bottoming out along with the broader global technology cycle, which is seemingly headed for a rebound. Semiconductor manufacturing production has recovered steadily from lows plumbed earlier in 2019 in the wake of US-China trade war concerns, while the shipment of electronic parts and devices has also followed a similar pattern and rebounded. Factors such as demand from growing usage of 5G equipment is expected to sustain the tech sector’s momentum in 2020.

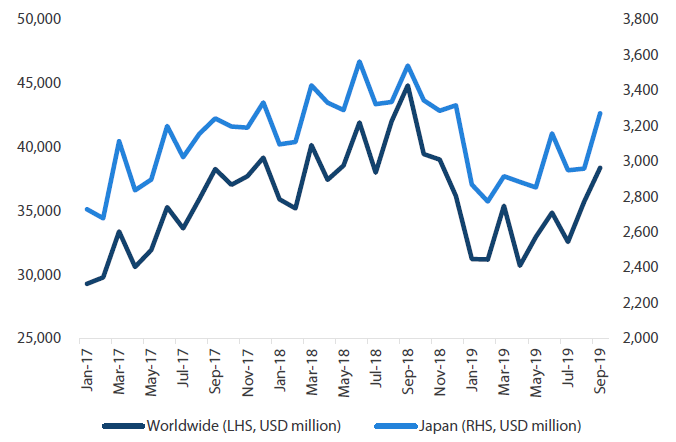

Chart 1: Worldwide, Japan semiconductor sales

Source: World Semiconductor Trade Statistics

Japan’s semiconductor market is showing recovery signs on the back of demand for servers, a seasonal upswing in smartphones sales and inventory adjustments in household appliances coming to an end. Overall semiconductor sales had fallen in 2018 due to a drop in the price of memory devices. But sales of household appliances and PCs began recovering in April 2019 as inventories were cleared, with the latter likely boosted by renewed investments into servers. Semiconductor sales are also recovering on a month-on-month basis following a concentration in demand for the production of iPhones in August.

Dynamic random access memory (DRAM) prices had been declining on weak demand and excessive supply. That said, actual DRAM volume has increased steadily and the market is displaying signs of bottoming out despite lower prices. Meanwhile, prices of DRAMs for servers have been edging higher since November.

Just like the DRAM market, excessive supply had taken a toll on Japan’s NAND flash memory market. But the decline in prices has prompted a switch from hard disk drives (HDD) to relatively cheap NAND; as a result, demand for NAND has been increasing. NAND prices are rising ahead of DRAM prices, steadily retracing their YoY price decline.

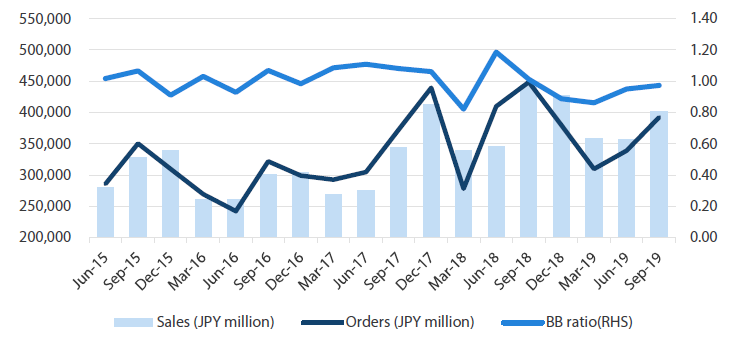

Figures from electronic components manufacturer Murata Manufacturing provide a glimpse into recovering semiconductor demand. Orders received by Murata Manufacturing have been recovering after bottoming out in 4Q 2018. The company’s book-to-bill ratio is also nearing 1, suggesting that the semiconductor cycle has bottomed out (Chart 2).

Chart 2: Murata Manufacturing – orders, sales and book-to-bill ratio

Source: Murata Manufacturing Co

Chinese recovery

Regarding China’s economic upswing, the data shows that China’s economy has clearly decelerated due to the trade war and corporate deleveraging efforts, but it continues to grow at quite a sturdy pace, especially by global standards. Several leading economic indicators, including corporate optimism surveys and credit impulse data, appear to have bottomed out, while consumer spending, housing construction and infrastructure spending continue to be firm. Very important to economic re-acceleration will be the upturn in the tech cycle, not only in smartphones, with the new 5G versions already ramping up sharply in the country, but also because China is investing heavily in semiconductor and OLED production. Japan supplies a large amount of the equipment, services and input materials to China for such production. The profitability of these Japanese products is usually very high, as they are “big-ticket” items that are often only produced in Japan. Moreover, a general upturn in China’s economy would increase demand for all sorts of Japanese goods and services, including tourism, as Japan has a strong economic relationship with the county.

Clearly, too, a trade deal with the US is critical to China’s economic upturn. Despite all the twists and turns of this economic war, of which there will likely be many going forward, there is a major chance of a lull in 2020 as both sides desire some stability. If somehow the trade relations deteriorate further, 2020 will not be such a positive a year, but it will, like 2019, not likely be too disappointing either.

2) Demographics: Corporate profits surging despite declining population

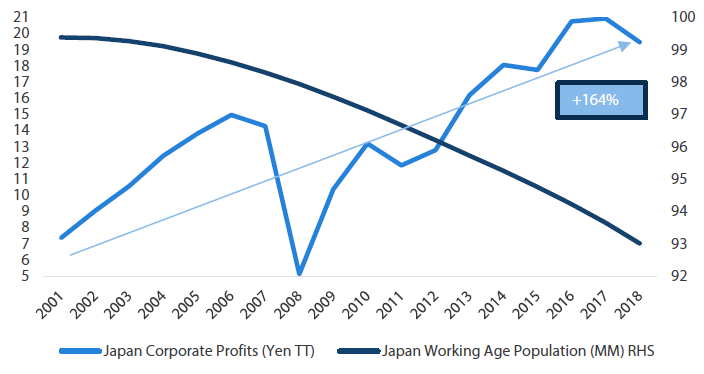

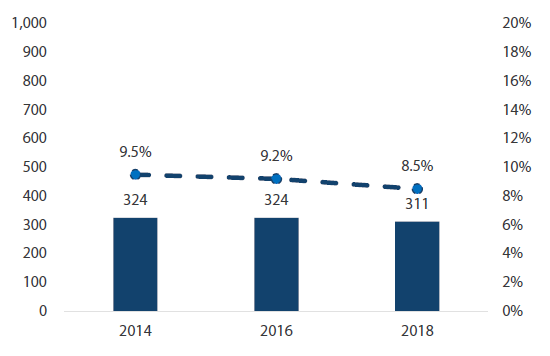

Investors have been worried for ages about Japan’s demographic challenges, and in 2020, we will likely continue to see more of such hand-wringing. However, many investors have realised by now that Japan has overcome this challenge in the past seven years of Abenomics due to the rising labour participation rate (particularly among women and the older age brackets), improved productivity via technology and logistics and effective utilisation of its highly educated and effective workforce. Combined with the structural improvement in corporate governance, corporate profits have surged during Abenomics, in negative correlation with the declining population (Chart 3).

Chart 3: Profits negatively correlated with demographics

Source: Bloomberg

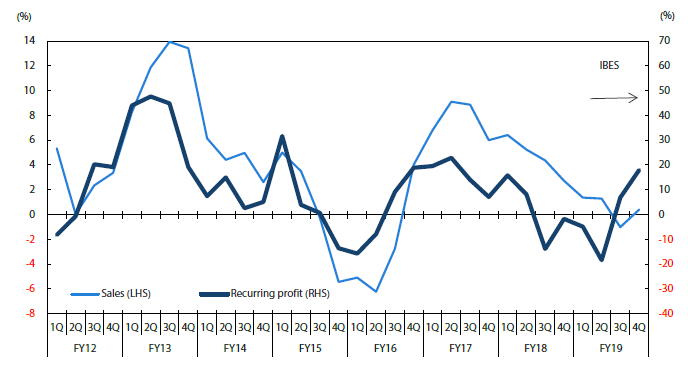

In a similar vein, Japan’s GDP has underperformed some other developed countries for many years. But since Abenomics began, this has not implied slow corporate profit growth or, even until the summer of 2018, underperformance of Japanese equities versus global markets in US dollar terms. The recent equity underperformance has been tied to the weaker Chinese economy, especially for capital goods, and to the weak global semiconductor cycle. Indeed, historically, Japanese corporate profits are actually heavily a function of global growth due to the multinationalisation of Japan’s production base as well as the conditions of export markets.

Chart 4: Sales, recurring profit growth for TSE first section firms (YoY, %)

Source: QUICK, DataStream

3) Corporate governance: Shareholder activists to play an even bigger role in 2020

A key development in 2019 was the expanding role played by shareholder activists, who are beginning to shed their negative image and increase their influence on Japanese corporate governance. We believe activists will play an even bigger role in 2020, unhindered by revisions to laws regulating foreign investments.

Activism or engagement?

Until recently, activists in Japan were often synonymous with “hostile suitors” or “greenmailers”: generally perceived as foreign and not always welcomed. However, we believe 2019 was an important year when the line between activism and “corporate engagement” began to blur in the eyes of the public.

The change in public perception towards activist shareholders coincided with the relatively aggressive stance that well-established Japanese companies took to enhance shareholder value. Such companies included Itochu (hostile takeover bid for Descente Ltd), Yahoo Japan (voting down the re-election of Askul Corp’s CEO) and HIS (hostile takeover attempt for Unizo Holdings).

Activism is no longer considered taboo in Japan, in our view, and it is seen increasingly as a social mechanism necessary to create value.

Some highlights for shareholder engagement and activism in 2019 were:

- Institutional shareholders took a tougher stance at annual general meetings (AGMs); for example, 345 companies saw their proposed agendas opposed by votes of more than 20 percent, a record high. (Source: IR Japan)

- An all-time high of more than 200 institutional shareholders, including activist hedge funds, expressed their intent to present proposals to corporate management teams. (Source: SMBC Nikko, in FY2019 as of 10 October 2019)

- International investors successfully brought back Lixil Group’s ousted CEO.

- Star Asia Investment’s merger proposal with Sakura Sogo Investment marked the first ever hostile acquisition in the REIT space.

- Corporate buyback plans increased 90% YoY in FY2019 (Source: Nikkei). This included Sony’s JPY 200-billion buyback plan, as well as Olympus buying back approximately USD 800 million of its shares held by Sony. US activist hedge funds are shareholders of both companies.

- Toshiba, which has many activist funds among its shareholders, opted to buy out three of its four listed subsidiaries in a bid to convert them into wholly-owned units.

Governance reform still intact even as Japan changes foreign investment regulations

The proposed revision to the Foreign Exchange and Foreign Trade Act is likely a source of concern for many investors. The revision aims to tighten rules for foreign investors seeking to invest in companies related to Japan’s national security. Foreign investors will be required to notify the government and receive prior approval if they want to purchase more than 1% of a designated company’s outstanding shares, down from the current threshold of 10%.

The cabinet approved the amendment bill in October 2019 and it was passed in an extraordinary session of Japan’s parliament on 22 November 2019. The amendment will take effect in the first half of 2020.

The Western media has been critical, widely reporting that the amendment will be a hindrance to corporate governance reform and portraying it as a government attempt to reduce the influence of foreign activists by preventing them from taking larger equity stakes in Japanese companies.

But given that the government still aims to increase foreign direct investments from JPY 19.2 trillion (as of end-2012) to JPY 35.0 trillion by 2020, such criticisms are unwarranted in our view. The Ministry of Finance (MOF) has said: “The Amendment Bill aims to further promote sound foreign direct investment while preventing leakage of information on critical technologies and disposition of business activities for national security reasons.” (Source: MOF’s FAQ, 31 October 2019).

The MOF also stated: “The screening for these actions will be conducted only from the viewpoint of preventing leakage of information about critical technologies as well as disposition of business activities for national security reasons.” The ministry also sought to reassure investors that the amendment bill does not seek to impose any restrictions to shareholders’ rights or engagement with companies.

Another factor to consider is that the GPIF, the government’s investment vehicle and the world’s largest pension fund, will need shareholder pressure on companies in order for the equities in its portfolio to go up in value.

The bill’s passage will be followed by the announcement of investment guidelines, and we will need to keep a close eye on how the revised foreign investment rule will be implemented. But we do not believe that it will hinder shareholder activism. In fact, we expect activists to play an even bigger role in 2020, either behind the scenes or in public, and make their demands heard by corporate management teams.

Government to continue pushing for reform

The previous revision to the Stewardship Code in 2017 called for greater transparency of proxy voting results. This led to institutional shareholders taking a tougher stance towards companies which manifested itself in a higher number of “against” votes at shareholder meetings. The next revision to the code, scheduled to take effect in 2020, is expected to result in a push for even greater transparency, with shareholders being urged to disclose the reasons for their voting decisions at AGMs.

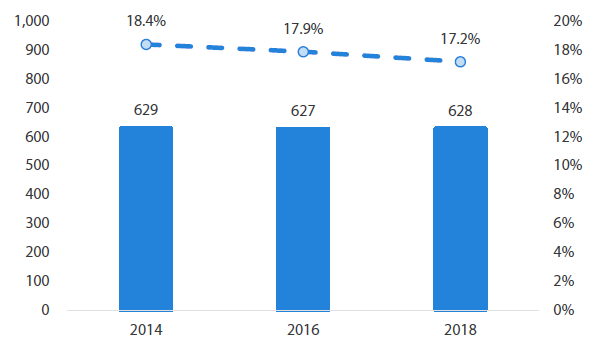

The issue of parent-subsidiary dual listings is another topic the government aims to tackle, potentially in its future revision to the Corporate Governance Code. The government now views parent-subsidiary dual listings, an arrangement unique to Japan, as a corporate governance issue as they can result in conflicts of interest between parent companies and the minority shareholders of their subsidiaries (see Chart 5 and Chart 6). Requiring companies to have independent directors on their board is one of the measures being considered to protect the economic interests of minority shareholders. We believe significant value can be created if companies take proactive action to resolve potential conflicts. For example, parent companies can take over their listed subsidiaries at a premium to gain full ownership; Bloomberg reported that the recent takeover premium was around 20%.

Chart 5: Number of firms with listed parent companies

Source: Council on Investments for the Future at the Prime Minister’s Office as of March 2019

Chart 6: Number of companies with controlling shareholders

Source: Council on Investments for the Future at the Prime Minister’s Office as of March 2019

4) Japan to avoid post-Olympic blues

There is a widespread belief that Olympic hosts experience a decline in investments and consumer spending after holding the events, and many think Japan will suffer the same fate following the 2020 Tokyo summer games. But we believe that a sustainable stream of construction projects and government measures will mitigate risks of a post-Olympics downturn.

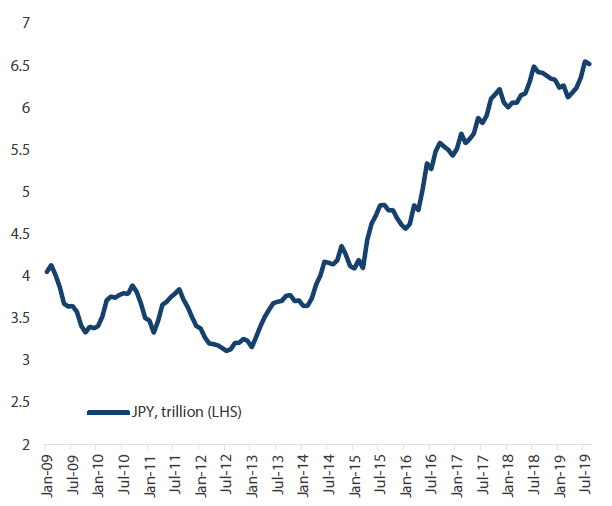

Construction boom to continue after the Olympics

As Chart 7 shows, many construction projects are already in the pipeline and are due to continue after the Olympics.

Chart 7: Backlog of non-residential building projects

Source: Ministry of Land, Infrastructure, Transport and Tourism

Examples of construction that will continue after the summer games are re-development projects in large metropolitan areas, building of logistic facilities to meet booming demand generated by e-commerce and development of hotels, theme parks and commercial complexes catering to thriving inbound tourism.

A shortage of workers is one of the reasons for the large backlog in construction. But more workers will become available once building projects related to the Olympics are completed. Building activity currently held back by labour shortages will then get under way and will, in turn, increase investments into construction.

Notable large-scale projects that will continue after the games include:

- Maglev bullet train project: Japan aims to connect Tokyo and Osaka, the country’s two largest cities, which are separated by a distance of approximately 440 kilometres, with a high speed magnetic levitation (maglev) rail system at an estimated cost of JPY 9 trillion. The 300-kilometre section between Tokyo and Nagoya is scheduled for completion in 2027.

- “Integrated resorts” (IRs) scheme: Japan plans to build large IRs, featuring casinos and other entertainment facilities, in three locations across the country by the mid-2020s. Each IR is expected to cost JPY 700 billion to JPY 1.2 trillion to construct.

- World Expo 2025: Osaka hosts the World Expo in 2025. Building projects for the Expo are estimated to cost JPY 125 billion.

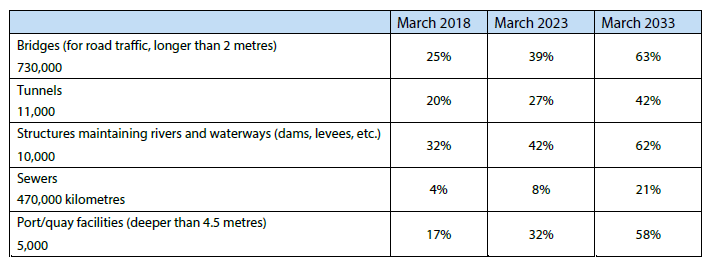

Aging infrastructure needs an overhaul

Japan also needs to address its aging infrastructure, as shown in Table 1. Much of the infrastructure is more than half a century old, with a significant amount damaged by the recent typhoons. The government on 5 December approved an economic stimulus package totalling JPY 13.2 trillion. Of the package, JPY 5.8 trillion will be earmarked to aid areas hit by natural disasters. Another JPY 3.1 trillion will be spent on addressing downside risks to the economy and the remaining JPY 4.3 trillion will be used to prevent a drop off in public works spending after the 2020 Tokyo Olympics. Regarding its aim to aid areas struck by natural disasters, the government aims to carry out its plan based on three initiatives: 1) reinforcing and reconstructing infrastructure, 2) boosting productivity of SMEs by helping them adopt measures such as factory automation and 3) possible extension of a subsidy programme that promotes cashless transactions and enables businesses to cope with booming inbound tourism.

Table 1: Percentage of public infrastructure older than 50 years

Source: Ministry of Land, Infrastructure, Transport and Tourism

Solid reason to be optimistic on Japan in 2020

As our analysis shows, we expect Japan to overcome the above-mentioned four concerns in 2020. Japan will benefit from recoveries in the Chinese economy and the tech cycle, while its corporate profits are robust despite a declining population. Corporate governance reform will continue, with activist shareholders likely to play an even bigger role, and a large construction backlog ensures that Japan will not suffer a post-Olympics slump. We therefore have a solid reason to be optimistic on Japan in 2020.