Summary

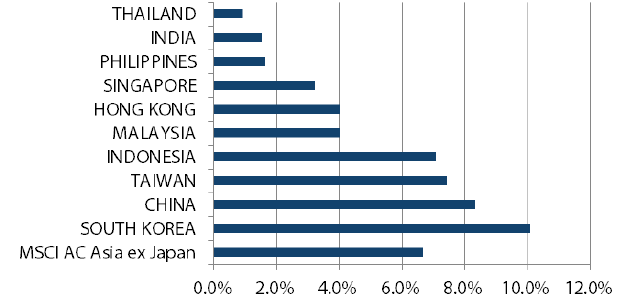

- The MSCI AC Asia Pacific ex Japan Index surged 6.7% in US dollar (USD) terms in December, owing to a US-China trade truce that halted fresh US tariffs on Chinese goods due in the middle of the month. South Korean and Indonesian stocks posted the strongest USD gains, while Thai and Indian equities underperformed their regional peers.

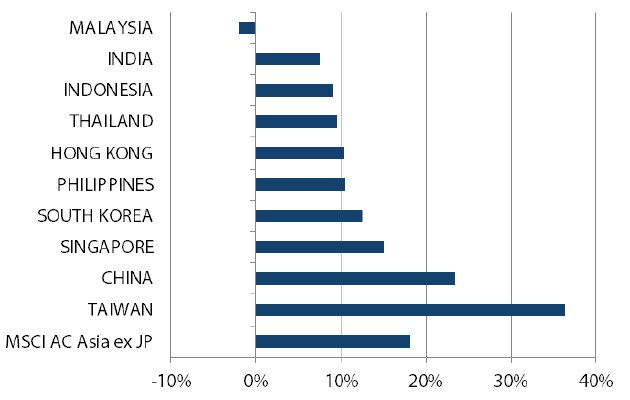

- South Korean and Taiwanese stocks—as measured by the MSCI indices—surged10.1% and 7.4%, respectively, in USD terms in December, boosted by strong gains in technology shares. China also outperformed with a gain of 8.3% in USD terms.

- In India, stocks managed to eke out USD gains of 1.5% over the month, amid mass political protests over a citizenship law that was perceived to be discriminatory towards Muslims. Early in the month, Thailand saw its biggest protests since a coup in 2014, when a military junta seized power. The protests took place after the authorities banned a party that had rallied the opposition against the government of Prayuth Chan-ocha, the former leader of the military junta who is currently the premier.

- We expect the ongoing long-term narrative of positive structural reforms in Asia to continue apace in China and India. With valuations still supportive across the region, we continue to find sustainable returns in reasonably-valued structural areas across technology, healthcare and select consumer sub-sectors.

Asian equity

Market review

Asian equities surge during the month

Asian stocks enjoyed a strong year-end rally in December, owing to a US-China trade truce that halted fresh US tariffs on Chinese goods due in the middle of the month. The anticipated signing of a "Phase One" US-China trade deal in January, together with the backdrop of central bank stimulus, also lifted market sentiment in December.

Over the month, the MSCI AC Asia ex Japan Index surged 6.7% in US dollar (USD) terms. Within the region, South Korean and Chinese stocks posted the strongest USD gains, while Thai and Indian equities underperformed their regional peers.

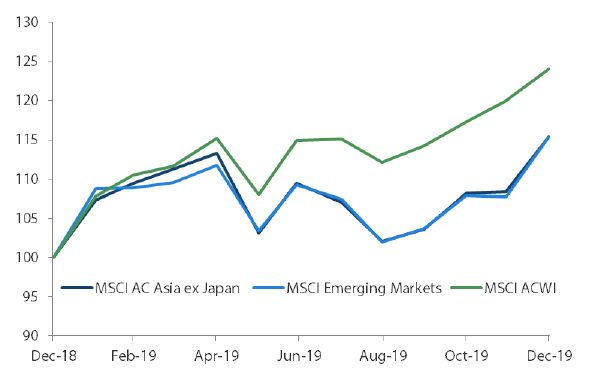

1-year market performance of MSCI AC Asia ex Japan versus Emerging Markets versus All Country World Index

Source: Bloomberg, 31 December 2019. Returns are in USD. Past performance is not necessarily indicative of future performance.

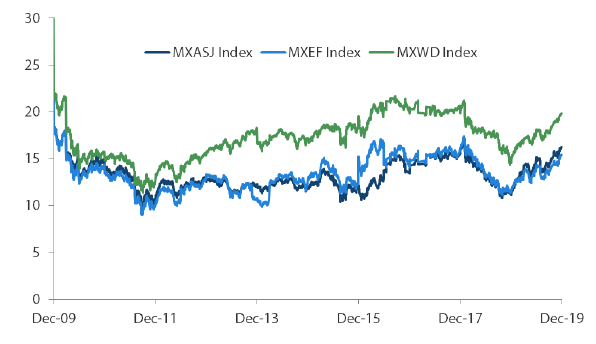

MSCI AC Asia ex Japan versus Emerging Markets versus All Country World Index price-to-earnings

Source: Bloomberg, 31 December 2019. Returns are in USD. Past performance is not necessarily indicative of future performance.

North Asian markets outperform

South Korean and Taiwanese stocks—as measured by the MSCI indices—surged 10.1% and 7.4% respectively in USD terms in December, boosted by strong gains in technology shares. Market sentiment in South Korea was further lifted by better-than-expected exports numbers, which was down 5.2% in December from a year ago, the smallest decline since April.

In Taiwan, a higher 2020 economic growth forecast from its central bank and an improving manufacturing purchasing managers' index (PMI), which rose to 50.8 in December 2019 from 49.8 a month earlier, also buoyed stocks. Elsewhere, China stocks gained 8.3% in USD terms during the month as investors cheered a preliminary Sino-US trade deal and upbeat data released. Growth in China's industrial and retail sectors beat expectations in November, while the Caixin China General Manufacturing PMI edged up to a near three-year high of 51.8 in November 2019 from 51.7 in the previous month. Hong Kong stocks tracked the regional uptrend and turned in decent USD gains of 4.0% in December.

India turns in marginal gains

In India, stocks managed to eke out USD gains of 1.5% over the month, amid mass political protests over a citizenship law that was perceived to be discriminatory towards Muslims. Protests against Prime Minister Narendra Modi's Hindu nationalistic agenda resulted in violent clashes between protesters and police officers in the state of Uttar Pradesh, where rioting was among the most intense, leaving over 15 dead.

Indonesia outperforms, Thailand lags

In the ASEAN region, the MSCI Indonesia, Malaysia, Singapore and Philippines indices rose 7.1%, 4.0%, 3.2% and 1.6% respectively in USD terms in December, while MSCI Thailand turned in marginal gains of 0.6%. In Indonesia, its annual inflation rate in December moderated to 2.72%, which was the slowest increase in consumer prices since March. Early in the month, Thailand saw its biggest protest since the 2014 coup after authorities banned a party that has rallied the opposition against the government of former military ruler and current premier Prayuth Chan-ocha.

MSCI AC Asia ex Japan index1

For the month ending 1 December 2019

Source: Bloomberg, 31 December 2019

For the period from 31 December 2018 to 31 December 2019

Source: Bloomberg, 31 December 2019

1Note: Equity returns refer to MSCI indices quoted in USD. Returns are based on historical prices. Past performance is not necessarily indicative of future performance.

Market outlook

A mild global reflationary cycle on the cards

2019 was a year largely characterised by rising geopolitical tensions, slowing global growth and dovish global central banks. Whilst we do not expect the protracted conflict between the US and China to be resolved anytime soon, we think relations between the two countries could be stabilising for a period of time, with positive steps taken in the recent “Phase One” deal. The stabilising geopolitics, coupled with global restocking, could see a mild global reflationary cycle return as we head into 2020. Pertinently, we began to observe some green shoots of recovery in the form of restocking in the technology sectors of Taiwan and South Korea during the last quarter of the calendar year. More importantly, we expect the ongoing long-term narrative of positive structural reforms in Asia to continue apace in two of Asia's leading growth engines, China and India. With valuations still supportive across the region, we continue to find sustainable returns in reasonably-valued structural areas across technology, healthcare and select consumer sub-sectors.

Positioning for growth in China and India

November's activity growth in China was particularly encouraging, with industrial production reaching a five-month high. This could portend a modest recovery heading into next year, especially if a Phase One deal with the US goes through successfully. Commendably, despite softer growth in the past year, China has demonstrated a disciplined approach to its new policy regime of "quality over quantity" and we expect their targeted support for strategic structural areas to continue, coupled with further reforms in the financial sector which are long-term positives. Hence, we continue to be positioned in areas of domestic structural growth and consolidations, namely insurance, healthcare, software, industrial automation and select consumer sub-sectors—albeit with a preference for relative value.

Despite worries about India's slowing growth in the near term and the fragilities of its non-bank financial sector, we think India is in the midst of one of its most exciting periods since independence in 1947 after a prolonged period of positive structural reforms under Prime Minister Modi. Productivity bottlenecks are gradually resolved as a large swath of the informal sector gets increasingly formalised. Investment should also get a boost in the coming years as reforms such as the goods and services tax (GST), bankruptcy laws and corporate tax reduction make India more competitive in a world of shifting global supply chains. Against this positive macro backdrop, we remain invested in areas that should benefit from formalisation, under-penetration and long-term growth, namely private banks, real estate and logistics.

Improving outlook for South Korea, sanguine on Indonesia

Restocking by global hyperscalers (such as Amazon, Google and Microsoft), the 5G rollout and better global smartphone sales are driving a nascent recovery in the technology sectors of South Korea and Taiwan. We expect this to eventually support the domestic economies of both countries. South Korea's economy, in particular, should be further aided by the bottoming out of the shipping, refining and chemical sectors. We continue to focus on long-term beneficiaries of 5G, Internet of Things (IoT) and cloud development within our technology exposure.

Regardless of negotiation outcomes between the US and China, we think the relocation of global supply chains into places like the ASEAN region will continue as a long-term structural theme. Indonesia, in particular, stands out not least because of its cost advantage. Indonesian President Joko Widodo's renewed mandate also offers the possibility of real and long overdue structural reform.

Appendix

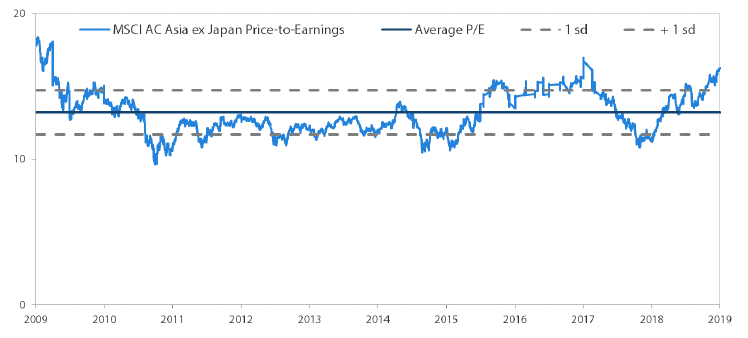

MSCI AC Asia ex Japan price-to-earnings

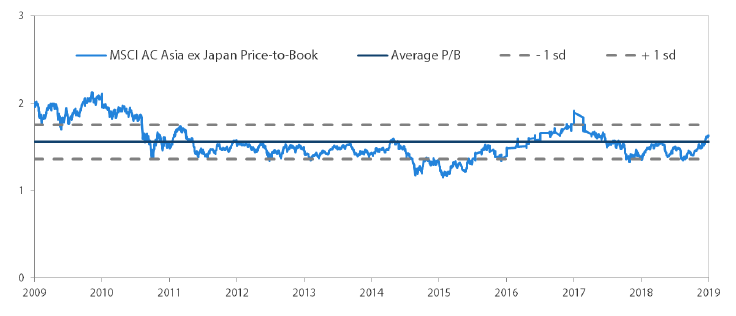

MSCI AC Asia ex Japan price-to-bookk

Source: Bloomberg, 31 December 2019. Ratios are computed in USD. The horizontal lines represent the average (the middle line) and one standard deviation on either side of this average for the period shown. Past performance is not necessarily indicative of future performance.