Summary

- The MSCI AC Asia Pacific ex-Japan Index slumped 4.5% in US dollar (USD) terms in January on fears that the coronavirus outbreak could trigger a global economic downturn. Within the region, markets in Thailand and the Philippines were the hardest hit, while those in India and Indonesia declined the least.

- Thai stocks nosedived on concerns that China's ban on group tours would hurt Thailand's tourism industry, which is a key driver of economic growth. Stocks in the Philippines were weighed down by the country’s disappointing 2019 GDP growth of 5.9%, its slowest full-year growth in eight years.

- China, the epicentre of the coronavirus outbreak, dragged the region down. China’s market ceded 4.8% although it was closed for the last week of the month for Lunar New Year celebrations.

- Indian stocks were relatively resilient in January, dipping 0.8% in USD terms on the perception that India was a relative safe haven in the Asian context as its economy is more domestically-driven compared to its regional peers.

- We believe that prospects for Asia ex-Japan markets are improving. China and India have only recently embarked on the path of monetary easing. Coupled with fiscal stimulus, notably in India and increasingly in China, economic growth in the region will receive a fillip. At a more fundamental level, a number of countries, including India, China and Indonesia, have advanced the reform agenda in a bid to address long-standing structural issues.

Asian equity

Market review

Asian equities slump on coronavirus fears

Carrying on from the strong finish to 2019, Asian stocks started the month positively, buoyed by the signing of a "Phase One" US-China trade deal in mid-January. However, market sentiment swiftly turned negative in the third week of the month on news of an outbreak of a novel coronavirus in Wuhan, China. The virus, which killed more than 200 people in China as of end-January, has since spread to other parts of the world, prompting the World Health Organization to declare the outbreak a Public Health Emergency of International Concern.

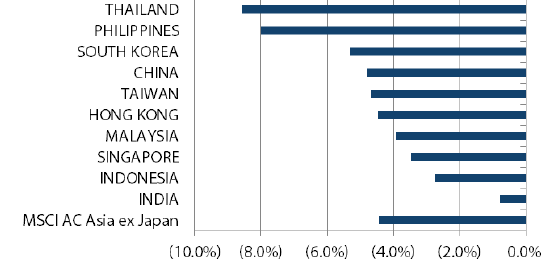

Regional stocks bore the brunt of the global equity sell-off on fears that the coronavirus epidemic could trigger a global economic downturn; the MSCI AC Asia ex Japan Index slumped 4.5% in US dollar (USD) terms over the month. Within the region, markets in Thailand and the Philippines were the hardest-hit, while those in India and Indonesia declined the least.

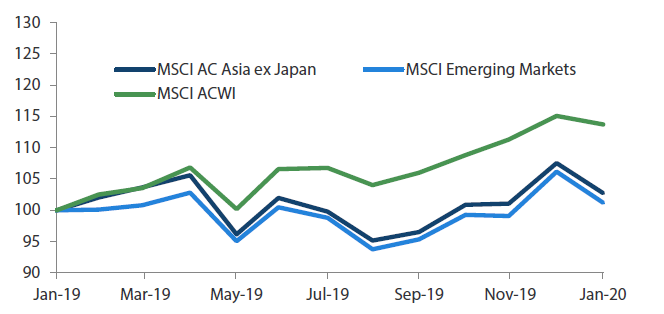

1-year market performance of MSCI AC Asia ex Japan versus Emerging Markets versus All Country World Index

Source: Bloomberg, 31 January 2020. Returns are in USD. Past performance is not necessarily indicative of future performance.

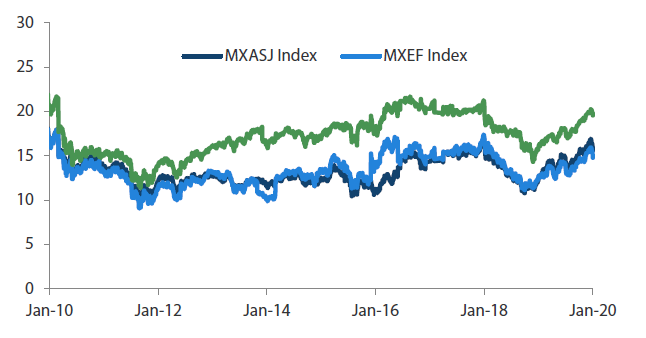

MSCI AC Asia ex Japan versus Emerging Markets versus All Country World Index price-to-earnings

Source: Bloomberg, 31 January 2020. Returns are in USD. Past performance is not necessarily indicative of future performance.

Thai and Philippine stocks lag

Thai stocks nosedived 8.6% in USD terms in January on concerns that China's ban on group tours would hurt Thailand's tourism industry, which is a key driver of economic growth. Thailand cut its 2020 GDP growth forecast to 2.8% from 3.3% projected three months ago because of weak exports, a delayed budget and the spread of the coronavirus. In the Philippines, stocks sank 8.0% in USD terms, reaching a one-year low during the month. The market in the Philippines was weighed by coronavirus fears and the country’s disappointing 2019 GDP growth of 5.9%, the slowest full-year growth in eight years. In USD terms stocks in Malaysia, Singapore and Indonesia fell 3.9%, 3.5% and 2.7%, respectively.

North Asia tracks regional downturn

Spooked by the coronavirus outbreak, South Korean and Taiwanese stocks fell 5.3% and 4.7% in USD terms, respectively, during the month. In Taiwan, incumbent President Tsai Ing-wen of the Democratic Progressive Party was re-elected to a second term after the Taiwanese presidential election in January. Amid the recent market downturn, Chinese stock markets remained closed for an extended period from the eve of the Lunar New Year on 24 January to 3 February, as the country grappled with the worsening virus crisis. Despite the extended closure, Chinese stocks still fell 4.8% in USD terms in January, alongside Hong Kong stocks, which ceded 4.5%.

India the most resilient market

Indian stocks were relatively resilient in January, dipping 0.8% in USD terms on the perception that India was a relative safe haven in the Asian context as its economy is more domestically-driven compared to its regional peers. India's annual retail inflation rose to 7.35% in December, reaching its highest level in over five years. This was largely on the back of rising food prices.

MSCI AC Asia ex Japan Index1

For the month ending 31 January 2020

Source: Bloomberg, 31 January 2020

1Note: Equity returns refer to MSCI indices quoted in USD. Returns are based on historical prices. Past performance is not necessarily indicative of future performance.

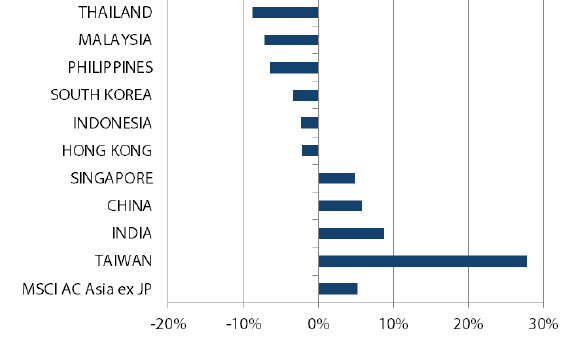

MSCI AC Asia ex Japan Index1

For the period from 31 January 2019 to 31 January 2020

Source: Bloomberg, 31 January 2020

1Note: Equity returns refer to MSCI indices quoted in USD. Returns are based on historical prices. Past performance is not necessarily indicative of future performance.

Market outlook

Monetary easing and fiscal stimulus will boost regional growth

Generating investment returns in a world with already low but still declining rates, weak inflation, and sluggish growth will require balancing risk aversion with risk taking. This is especially true after a year in which, despite the unpredictability of US President Donald Trump, global markets (as measured by the MSCI World index) gained over 27% in USD terms. Markets are increasingly dominated by ephemeral attention spans, investment silos and the rise of passive funds. The proliferation of quant strategies, each deploying some variant of an "AI model" backed by "big data analytics", has impaired the information that can be gleaned from asset prices. In addition, the extravagant provision of private capital to perennially loss-making businesses has distorted the perceived price of money and of value.

That said, prospects for Asia ex-Japan markets are improving. Abundant and cheap capital is a boon. A weaker USD has been positive for risk markets. Furthermore, China and India have only recently embarked on the path of monetary easing, after most developed markets have gone much further ahead. Coupled with fiscal stimulus, notably in India and increasingly in China, economic growth in the region will receive a fillip. At a more fundamental level, a number of countries, including India, China and Indonesia, have advanced the reform agenda in a bid to address long-standing structural issues.

Positioned in areas of structural growth, innovative technology

China continues to embrace change by choosing to focus on quality, rather than quantity; as such, it is not resorting to wasteful fixed asset investment to reflate the slowing economy. China is also allowing state-owned enterprises to go bankrupt on a selective and sporadic basis, In addition, the country is steadily moving up the value chain, not just in low value-added manufacturing, but also in high technology. Hence, we continue to be positioned in areas of domestic structural growth, such as insurance, healthcare, software and industrial automation.

The ubiquity and increasing sophistication of technology in our daily lives have positive long-term implications for the supply chain, the bulk of which is based in Taiwan and South Korea. Nonetheless, the absence of a clear resolution to the technology cold war between the US and China requires vigilance; therefore, we continue to focus on long-term beneficiaries of 5G, Internet of Things and cloud development within the technology universe.

India's economy appears to be emerging from a cyclical nadir brought on by the less-than-fortuitous timing of a number of structural reforms, in tandem with the global growth slowdown. The Modi government is aware of the opportunity for India to play a much larger role in global supply chains. Against a macro backdrop that is slowly starting to turn positive, we remain invested in areas that should benefit from formalisation, under-penetration and long-term growth: namely private banks, real estate and logistics.

ASEAN, and notably Indonesia, is the other region that ought to benefit from the redesign of supply chains that currently rely heavily on China.

Appendix

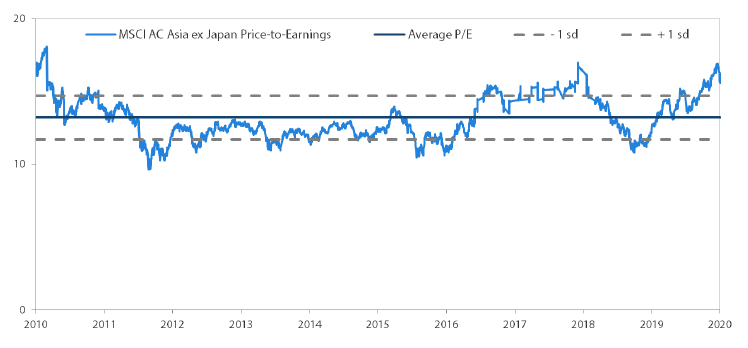

MSCI AC Asia ex Japan price-to-earnings

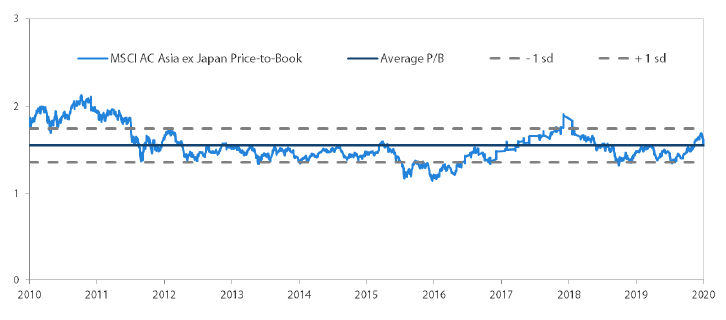

MSCI AC Asia ex Japan price-to-book

Source: Bloomberg, 31 January 2020. Ratios are computed in USD. The horizontal lines represent the average (the middle line) and one standard deviation on either side of this average for the period shown. Past performance is not necessarily indicative of future performance.