Summary

- Overall market sentiment was positive in December amid hopes that an interim trade deal between the US and China was on course to be signed in January. The US Federal Reserve (Fed) kept policy rates unchanged as expected, and signalled no hikes in 2020. Overall, the yield curve steepened, with 2-year yields falling 4 basis points (bps) to 1.57% and 10-year yields rising 14 bps to 1.92% towards the month-end.

- Asian credits returned 0.34% in December, mainly due to credit spreads tightening by about 9 bps. High-grade (HG) credits gained 0.22%, with spreads tightening 6 bps, while high-yield (HY) credits returned 0.71%, with spreads tightening about 20 bps.

- Most of the region’s monetary authorities left rates unchanged in December, with the exception of The People’s Bank of China (PBOC), which lowered the 14-day reverse repo rate. The PBOC also announced that the Loan Prime Rate (LPR) will be the new benchmark to price all outstanding loans. Meanwhile, S&P upgraded Thailand’s outlook to “positive”.

- Issuance volume slowed in December going into the year-end. The HG space saw 11 new issues amounting to about USD 5.2 billion, while the HY space had 7 new issues totalling roughly USD 3.2 billion.

- We expect the overall market sentiment to be positive and risk assets to perform generally well on optimism that the US-China “Phase One” deal will be signed in January. We favour Indonesian and Malaysian bonds but are less positive on low-yielding markets such as Singapore. We also see value in Indian bonds after the sell-off in December.

- We expect Asian credit spreads and UST yields to remain range-bound for the time being, with a bias towards slightly tighter spreads and higher rates, with returns mainly coming from carry.

Asian rates and FX

Market review

Market sentiment positive in December, US yield curve steepens

Overall market sentiment was positive in December, on hopes that an interim trade deal between the US and China would be signed in January. The month began on news of US-China trade deal negotiations and better than expected US job reports, with both these factors pushing yields higher. US Treasury 10-year yields peaked to 1.91% after US President Donald Trump stated that the Washington and Beijing were "getting very close" to a "big deal". Investors shrugged off President Trump's impeachment trial but remained optimistic thanks to upbeat US indicators, which included housing and industrial production figures. Meanwhile, the Fed kept policy rates unchanged as expected, and signalled no hikes in 2020. Overall, the yield curve steepened, with 2-year yields falling 4 bps to 1.57% and 10-year yields rising 14 bps to 1.92% towards the month-end.

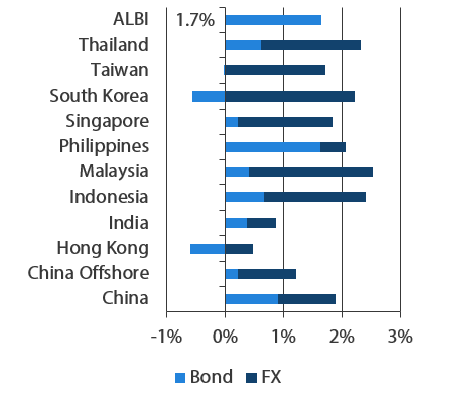

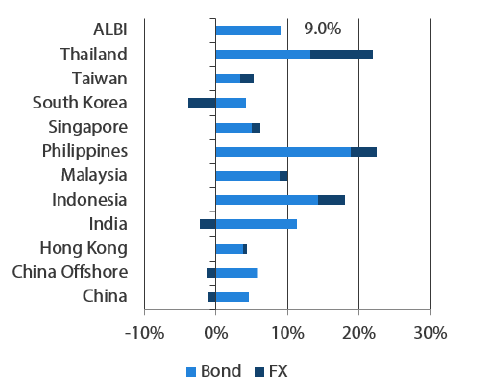

Markit iBoxx Asian Local Bond Index (ALBI)

For the month ending 31 December 2019

For the year ending 31 December 2019

Source: Markit iBoxx Asian Local Currency Bond Indices, Bloomberg, 31 December 2019

Note: Bond returns refer to ALBI indices quoted in local currencies while FX refers to local currency movement against USD. ALBI regional index is in USD unhedged terms. Returns are based on historical prices. Past performance is not necessarily indicative of future performance.

Inflationary pressures in the region mixed

The region’s headline consumer price index (CPI) November inflation prints were mixed. South Korea's CPI inflation edged up for the first time in four months on slower declines in food and oil prices, rising 0.2% year-on-year (YoY). In the Philippines, inflation rose 1.3% YoY, but it was still below Bangko Sentral ng Pilipinas' (BSP) 2–4% target. Headline inflation edged up in Singapore by 0.6% YoY, driven by an increase in private road transport inflation and smaller declines in costs of retail goods and accommodation which offset the easing of services inflation. China's CPI accelerated further to 4.5% YoY, driven mostly by a surge in pork prices. In contrast, both Indonesian and Malaysian inflation gauges eased in November.

Monetary authorities leave policy rates unchanged

The Reserve Bank of India (RBI) surprised the markets by keeping its policy rate unchanged after cutting rates by a total of 135 bps in 2019. As expected, both the Bank of Thailand (BOT) and BSP maintained their policy rates. The BOT slashed its growth outlook to 2.5% for 2019 (from 2.8%) and 2.8% for 2020 (from 3.3%); it also lowered its inflation forecast to 0.7% for 2019 (from 0.8%) and 0.8% for 2020 (from 1.0%). Separately, the BSP maintained a positive view on domestic demand recovery, expecting inflation pressures to be benign. BSP’s governor stated that the central bank is considering cutting rates by 50 bps in 2020. The BSP also lowered its inflation forecast for 2019 to 2.4% (from 2.5%), and kept its inflation forecasts for both 2020 and 2021 at 2.9%. Similarly, Bank Indonesia left its benchmark interest rate unchanged, although it reiterated its commitment towards keeping monetary policy accommodative in 2020.

PBOC lowers 14-day reverse repo rate; China to use LPR as benchmark for outstanding loans

The PBOC lowered the 14-day reverse repo rate to 2.65% from 2.70% while keeping the 7-day rate unchanged at 2.50%. The liquidity injection showed the central bank retained a flexible stance so it could keep money market rate volatility in check and allow year-end demand to be met. The PBOC also announced that the LPR will be the new benchmark to price all outstanding loans, instead of the 1-year lending rate. The move is expected to help to reduce financing costs, mainly for corporates, and shore up growth.

S&P upgrades Thailand's outlook to "positive"

S&P Global Ratings upgraded its outlook on Thailand's BBB+ rating to "positive" from "stable" on easing political uncertainties, opening the door for a possible upgrade in the next year or so.

Market outlook

Fed pause expected to support Indonesian and Malaysian bonds; value in Indian bonds after sell-off

Going forward, we expect overall market sentiment to be positive and risk assets to perform generally well on optimism that the US-China "Phase One" deal will be signed in January. However, the second phase of the deal might take longer and come in multiple stages.

We are positive on Indonesian and Malaysian bonds, as the extended pause in the Fed's easing cycle should attract inflows into higher-yielding emerging-market countries, such as Indonesia and Malaysia. However, we are less positive on lower-yielding markets such as Singapore. Singapore Government Securities yields closely track their US counterparts, which are expected to slowly move higher. We see value in Indian bonds after the sell-off in December and believe that there is still room for the RBI to cut rates. India's elevated headline inflation is temporary, in our view, and should taper off in the coming months as the rise in vegetable prices eases.

Asian credits

Market Review

Asian credit spreads tighten as trade developments remain the key driver

Asian credits returned 0.34% in December, mainly due to credit spreads tightening by about 9 bps on the month. HG credits gained 0.22%, with spreads tightening 6 bps, while HY credits returned 0.71%, with spreads tightening about 20 bps.

Markets started the month soft as the US was due to impose tariffs on USD 160 billion of Chinese imports on 15 December. A weaker set of economic data from Malaysia, South Korea and Hong Kong also weighed on the markets. The weaker indicators included contraction in both export and import data, and lower Markit Purchasing Managers’ Index numbers. HG credits remained firm but event-driven names dominated the majority of flows in the Asian HY space amidst the weaker sentiment and lower year-end liquidity. Asian credits began rallying mid-month as sentiment improved on news that a “Phase One” US-China trade deal had been agreed in principle. Subsequent confirmation of details from both sides led to a broad-based squeeze in credit spreads. Asian HY, in particular, performed well, driven by demand in Chinese property names. Weakness in the Chinese HY industrial space lingered through most of the month due to potential idiosyncratic credit events, before some positive outcomes towards the end of the month led to a sharp turnaround.

In terms of country specific developments, the RBI surprised the markets at its last policy meeting of 2019 by holding its key policy rate unchanged due to inflation concerns. Meanwhile, rating agency Moody’s cut India’s GDP growth forecast to 4.9% from 5.8% for FY2020, stating that the corporate tax cut, financial support to farmers and monetary policy will only have a marginal effect on the economy. Despite these developments, Indian bond spreads performed broadly in line with the rest of Asia, tightening towards the end of December along with the improvement in broader sentiment. Similarly, the continuing socio-political unrest in Hong Kong had a negligible impact on the territory’s credit spreads, with high-quality investment-grade names finding demand.

Primary market activity slows in December

With the year-end looming, new issuances of Asia credit slowed in December. The HG space saw 11 new issues amounting to about USD 5.2 billion, including a USD 1.5 billion multi-tranche China Huaneng Group bond issue. Meanwhile, the HY space had 7 new issues amounting to about USD 3.2 billion. Overall issuance in 2019 was around USD 298 billion with HG accounting for around 58% of the total. Issuance increased from USD 231 billion in 2018.

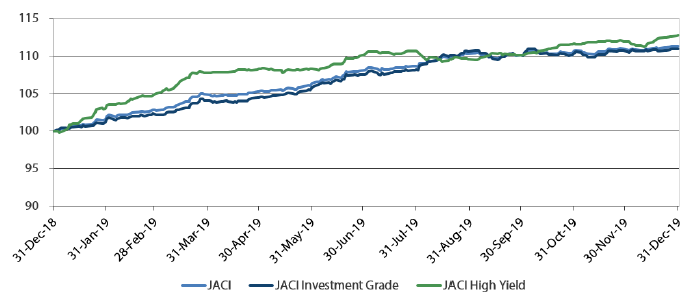

JP Morgan Asia Credit Index (JACI)

Index rebased to 100 at 31 December 2018

Note: Returns in USD. Past performance is not necessarily indicative of future performance. Source: JP Morgan, 31 December 2019

Market Outlook

Credit spreads to remain range-bound

While some of the major downside risk events have been averted towards the end of the year, uncertainties regarding global growth momentum and revival of geopolitical risks are likely to linger. Meanwhile, Asian credit fundamentals remain largely stable. We expect Asian credit spreads and UST yields to remain range-bound for the time being, with a bias towards slightly tighter spreads and higher rates with returns mainly coming from carry. Credits with a track record of operating through tough business and funding environments, and names that have gone through deleveraging, are likely to outperform. Within Chinese HY, we have a preference for short-dated property bonds over industrial bonds. Over the medium term, downside risks remain. Although a “Phase One” deal has been agreed upon, the scope of the trade agreement between the US and China looks likely to fall well short of the comprehensive deal that the US was aiming for. Resolution on the key strategic issues will likely take much longer and tension between the two countries is likely to persist and may re-escalate in 2020.