Summary

- Market sentiment was weak in January amid a heightening in geopolitics risks due to US-Iran tensions and fears over the coronavirus outbreak. The US and China signed the “Phase One” trade deal as expected, while the Federal Reserve (Fed) left monetary policy unchanged. Safe haven assets performed well and USTs rallied, pushing the 10-year yield down to a low of 1.51%. Overall, the UST yield curve briefly inverted. Yields on the 2-years fell 25 basis points (bps) to 1.32% and 10-year yields declined 41 bps to 1.51% over the month.

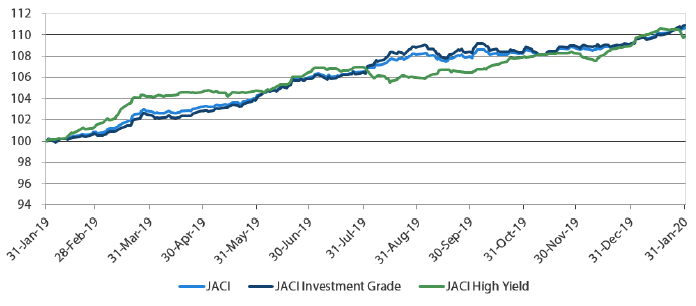

- Asian credits widened by 11 bps but still returned 1.36% in January, driven by the sharp fall in UST yields. Asia High-Grade (HG) credits performed better than their High-Yield (HY) counterparts, gaining 1.54% thanks to their longer duration, and their spreads widened by 9 bps. Asian HY credit spreads widened by 19 bps but still managed to return 0.78% for the month.

- Asian credit issuance volume started strong in January. The HG space saw 28 new issues amounting to about USD 15.4 billion, while the HY space had 51 new issues totalling roughly USD 21.4 billion. Primary market activity, however, slowed down sharply in the second half of the month due to the Lunar New Year holidays, and the risk-off environment caused by the virus outbreak.

- Inflationary pressures rose within much of the region. Malaysia's central bank surprised the markets by cutting policy rates, while Korea and Indonesia kept rates unchanged. The People’s Bank of China (PBOC) kept the 1-year and 5-year Loan Prime Rate (LPR) unchanged but injected liquidity through the renewal of targeted medium term-lending facility.

- Against the backdrop of the coronavirus outbreak, Asian central banks are expected to slightly reduce their growth forecast and employ accommodative monetary policies. We shifted to "neutral" from "negative" on low-yielding countries and continue to favour bonds from mid- to high-yielding countries such as Indonesia and Malaysia. On currencies, we are underweight on the Singapore dollar (SGD) and Thai baht (THB) vs the Philippine peso (PHP).

- As for Asian credit, we expect credit spreads to remain under pressure in the near-term. Nonetheless, a sharp recovery is possible once virus-related concerns subside.

Asian rates and FX

Market review

Market sentiment weak in January; UST yield curve briefly inverts

The year started off on a weak note, amid a heightening in geopolitics risks due to US-Iran tensions and fears over the coronavirus outbreak. News of an US airstrike in Baghdad which killed a top Iranian military commander stoked fears of a wider conflict in the Middle East. This led to a surge in oil prices and a decline in yields at the start of January. By mid-month, the US and China signed the “Phase One” trade deal as expected. For the rest of the month, financial markets were mostly in a risk-off mood as the tally of coronavirus infections and deaths continued to rise. The Fed left monetary policy unchanged at the end of the month, keeping the Fed funds rate in a 1.5–1.75% range. Safe haven assets performed well and USTs rallied, pushing the 10-year yield down to a low of 1.51%. Overall, the UST yield curve briefly inverted; 2-year yields fell 25 bps to 1.32% and 10-year yields declined 41 bps to 1.51% over the month.

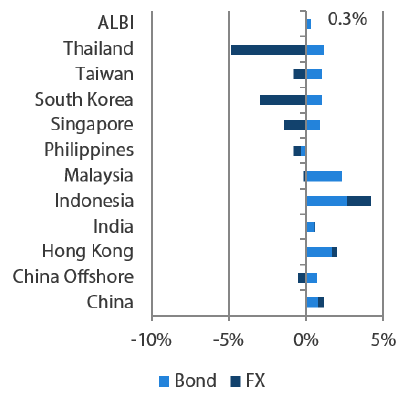

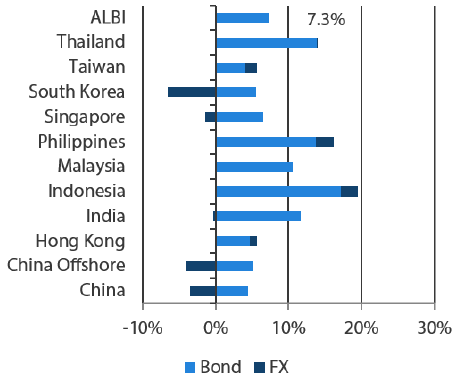

Markit iBoxx Asian Local Bond Index (ALBI)

For the month ending 31 January 2020

For the year ending 31 January 2020

Source: Markit iBoxx Asian Local Currency Bond Indices, Bloomberg, 31 January 2020

Note: Bond returns refer to ALBI indices quoted in local currencies while FX refers to local currency movement against USD. ALBI regional index is in USD unhedged terms. Returns are based on historical prices. Past performance is not necessarily indicative of future performance.

Region’s December inflationary readings mostly higher

Most of the region’s headline CPI December inflation prints were higher with the exception of Indonesia. India’s inflation increased 7.35% year-on-year (YoY), rising well above the central bank’s 2–6% target, primarily driven by surging vegetable prices. Inflation in the Philippines was stronger-than-expected at 2.5% YoY as typhoon damage drove up food prices, while Thailand’s inflation print improved to 0.87% YoY, the highest since July 2019. Singapore’s headline and core CPI also edged up. In contrast, Indonesian inflation fell to 2.7% YoY, below the midpoint of Bank Indonesia’s (BI) 2.5–4.5% inflation target. China’s CPI print was slightly lower-than-expected at 4.5% YoY as the spike in pork prices moderated.

Malaysia’s central bank unexpectedly cuts policy rates; Korea and Indonesia keep rates unchanged

Bank Negara Malaysia surprised the markets by cutting its monetary policy rate by 25 bps to 2.75% as a pre-emptive measure to ensure growth. On the other hand, the Bank of Korea kept its policy rate unchanged at 1.25%, striking a hawkish tone by indicating that domestic economic weakness has eased somewhat. BI also stood pat, keeping its policy rate unchanged at 5.0%.

China renews the targeted medium term-lending facility; LPR left unchanged

The PBOC kept the 1-year and 5-year LPR unchanged in January. The central bank, however, injected liquidity by renewing the targeted medium term-lending facility, keeping interest rate unchanged at 3.15%. Separately, China’s GDP grew 6.1% in 2019, meeting the 6–6.5% target. But China’s growth moderated from 6.6% in 2018 and also marked its weakest expansion since 1990.

Market outlook

Asian central banks expected to reduce growth forecast; Asian bonds seen doing well

While the coronavirus mortality rate is lower compared to the severe acute respiratory syndrome (SARS) that gripped the world in 2003, the rate of infection is higher. Hence, we will continue to monitor the situation closely. In the short-term, the main impact on Asia would be a slowdown in consumption growth, as the majority of the population would likely reduce shopping and travelling. However, most Asian countries are now better prepared and well equipped to handle the crisis, and the situation is expected to improve over time. Meanwhile, Asian central banks are expected to slightly reduce their growth forecasts and employ mostly accommodative monetary policies. Against this backdrop, Asian bonds are expected to continue performing well, possibly outperforming equities in the near-term. Within the Asian bond market, we shifted to "neutral" from "negative" on low-yielding countries as growth is expected to slow in the near-term. We continue to favour bonds from mid- to high-yielding countries such as Indonesia and Malaysia.

Underweight Singapore dollar (SGD) and Thai baht (THB) vs Philippine peso (PHP)

On currencies, we are underweight on the SGD and THB vs PHP, due to Singapore's open economy and Thailand's high reliance on the tourism, with a particular dependence on tourists from China. Moreover, Singapore and Thailand have some of the highest cases of coronavirus infections outside of China. We favour the PHP as it is a defensive currency. The country's lower reliance on tourism and healthy remittance flow should keep the PHP elevated.

Asian credits

Market Review

Asian credit spreads widen on coronavirus outbreak concerns

Asian credits widened by 11 bps but still returned 1.36% in January, driven by the sharp fall in UST yields. Asia HG credits performed better than their HY counterparts, gaining 1.54%, aided by its longer duration with spreads widening 9 bps. Asian HY credit spreads widened by 19 bps but still managed to return 0.78% for the month. Risk sentiment was positive and credit spreads tightened during the first half of the month. However, the outbreak of the coronavirus that spread across China and other countries led to a sharp decline in risk sentiment. This caused an unwinding of earlier tightening in credit spreads, which closed wider on the month.

Markets came back from the New Year break with news of escalating tensions between the US and Iran. The spat briefly impacted broader risk sentiment, causing Asian credit spreads to widen slightly. However, the conflict de-escalated almost as rapidly as it started, and credit spreads resumed tightening as risk sentiment improved sharply. The US and China officially signed the “Phase One” trade deal mid-month. The full details of the agreement, which were finally released after the signing, were largely in line with expectations. There was some disappointment that there will be no further tariff roll-back (beyond those already announced last month) under the latest deal, but the closure to this chapter of the trade conflict between the world’s two largest economies was enough to spur risk sentiment further. Technicals also remained strong throughout most of the month as large inflows were seen across credit funds, in Asia and globally, which helped offset the equally robust supply during the month. The positive risk momentum evident in the first half of the month was, however, reversed later in January as concerns grew regarding the potential negative impact of the coronavirus outbreak.

Strong start for primary market activity in January

Asian credit new issuances started strong in January. The HG space saw 28 new issues amounting to about USD 15.4 billion, including a USD 2 billion two-tranche Indonesian Sovereign issuance, a USD 1.3 billion floating-rate note by China’s Bank of Communications and a USD 1 billion issue by the Export-Import Bank of India. Meanwhile, the HY space had 51 new issues totalling close to USD 21.4 billion, with the Chinese property segment being a significant contributor. Primary market activity slowed down sharply in the second half of the month due to the Lunar New Year holidays, and risk-off sentiment caused by the virus outbreak.

JP Morgan Asia Credit Index (JACI)

Index rebased to 100 at 31 January 2019

Note: Returns in USD. Past performance is not necessarily indicative of future performance. Source: JP Morgan, 31 January 2020

Market Outlook

Credit spreads to remain under pressure near-term, but sharp recovery possible once virus-related concerns subside

The outbreak of the coronavirus upended the constructive backdrop for credit spread performance at the start of the year. Based on current information, we still expect the impact on Chinese—and Asian credits more broadly—to be relatively contained and within the range of the SARS experience, with some near-term widening followed by a possible swift recovery. That said, much will depend on the eventual severity and duration of the situation, and the flow-on impact on business and consumer confidence. Compared to the time of the SARS epidemic, the Chinese government is more proactive and has swiftly implemented strong measures to control the spread of the virus. While the situation remains fluid, hopes are that the government can bring the situation under control within a relatively short period of time and thereby lessen the negative impact on the economy and credit fundamentals. The early sharing of information with the international community has also hopefully reduced the potential spread of the virus across Asia and rest of the world.

Unless the situation worsens considerably, we do not expect the major central banks to implement any immediate rate cuts or additional quantitative easing-related measures. However, they are likely to highlight the downside risks in their upcoming policy meetings and reiterate their accommodative stance. Chinese authorities are already implementing a targeted monetary and fiscal easing strategy. We expect this to continue with perhaps a bit more intensity, together with additional measures to stabilise the financial markets in the near-term. These measures should help mitigate the widening pressure on credit spreads and support a recovery once the virus spread is contained.