Global Equity Investment Philosophy

Our philosophy is centred on the search for "Future Quality" in a company. Future Quality companies are those that we believe will attain and sustain high returns on investment. ESG considerations are integral to Future Quality investing as good companies make for good investments.

The four pillars we use to assess the Future Quality characteristics of an investment are:

Franchise—does the company have a sustainable competitive advantage?

Management—does the company make sound strategic and capital allocation decisions?

Balance Sheet—is growth appropriately financed?

Valuation—are the company’s prospects under-appreciated by the market?

We believe that investing in Future Quality companies will lead to outperformance over the full market cycle. Our strategy is based on fundamental, bottom-up research therefore sector and country allocations are a function of stock selection. The Global Equity strategy is a concentrated, high conviction portfolio with a high active share ratio.

Market Review

Central banks around the world responded to softening economic data by turning the liquidity taps back on. Political risks eased as the US and China reached an agreement over the terms of phase one of a trade deal. Although less important, the long drawn out saga of Brexit looks like it may start moving towards a solution post December’s general election in the UK.

The quarter saw a diminishing bid for safety as a result. Bond yields have increased (although they remain at exceptionally low levels by historical standards) and the US dollar has depreciated too (although it remains above the levels seen before the US and China started imposing tariffs on each other’s goods in April 2018). The exception to this statement is gold. Although the gold price fell in sympathy with other low risk assets in the first half of the quarter, it recovered its losses later in the year. As more and more money is effectively printed by central banks and debt piles continue to swell, it looks increasingly challenging for fiscal policy to reverse-gear without an inflationary boom or a deflationary bust. In either case, a physical store of value, like gold, could be a sensible insurance policy.

There was some evidence of mean reversion in terms of sector performance this quarter, with some of the year’s underperformers enjoying better returns (financials and materials). Although financials outperformed slightly in aggregate (banks more than insurance), the strongest performance came from information technology (IT) and healthcare. IT benefitted from increased demand for certain cyclicals (like semiconductors, where 5G is improving sentiment) and renewed strong performance from parts of the FAANG cohort of stocks. Healthcare outperformed despite the bid for cyclicality. The worst performers this quarter were defensives. Utilities, consumer staples and real estate all underperformed significantly. Part of the weakness in staples was attributable to stock-specific issues, with several big players announcing disappointing quarterly results. Energy also underperformed over the period.

With IT comfortably outperforming financials and Big Oil struggling to make much ground (despite rising tensions again in the Middle East), growth once again outperformed value over the quarter. Regionally, emerging markets generally outperformed. This was especially true of Asia, as news trickled through about positive trade talks. The UK also outperformed after the clear outcome provided by the general election in December. However, Japan and Europe ex UK underperformed this quarter.

Comparative returns are against the MSCI All Countries World Index

Market Outlook

Investor optimism continues to increase, helped by ever-increasing amounts of liquidity. In 2019 it was confirmed that the US Federal Reserve is as motivated by asset price stability as it is by the more traditional growth and inflation aspects of its mandate. Although Fed Chairman Powell was adamant that last year’s resumption of balance sheet expansion was not quantitative easing, investors did not seem to notice much difference.

Helped by this phenomenon, economies remain in reasonably good shape. This is especially true now that the short-term overhang from China/US trade has cleared. For now, it’s likely there is little to be gained by focusing on areas of longer-term dispute, such as intellectual property protection. This will be especially true if the apparent truce is enough to encourage global manufacturers to rebuild inventories from current low levels, leading to faster economic growth as we move through 2020.

Aside from the spectre of inflation and the potential for an end to this fiscal largesse, the main risk that remains is the political one. Can politicians globally be trusted to remain predictable enough for a more sustained uptick in investment? One factor that is predictable is that incumbent politicians have a better chance of remaining incumbent if their economy is performing well and voters are more positive about their financial circumstances. No-one knows this better than US President Trump. It is unlikely that he will intentionally do anything to damage the prospects of the US economy. However, the unintended consequences of his actions remain more difficult to discern and remain a source of risk this year.

The New Year is often seen as a good time to rehabilitate the underperformers of the previous year. If the mean reversion does not work after all, there is plenty of time to recover any losses. Could it be time, for instance, for the US market to pass the leadership baton to someone else? This call has been made many times and almost always involves a call on relative valuation. Certainly, the US looks more expensive on most earnings-based multiples relative to other areas. For us, much of this premium valuation remains supported by best-in-class innovation and a lower exposure to market sectors facing more structural challenges (for instance, Europe has a far higher exposure to banks and basic materials).

If the US market has peaked, can global equity indices make much ground? There are not many recent examples of equity investors committing significant capital to the EU or Japan at the same time that the US is underperforming global indices.

The one region where this has been the case is emerging markets, which performed well over the 2000–2007 period, even as the US lost ground in a relative sense. Mean reversion calls in this regard certainly look appealing, especially as the US dollar trades off, following the conclusion of phase one trade talks between the US and China.

We continue to look for exciting Future Quality opportunities in these markets. However, we will only invest where we have confidence in sustainably high and improving returns. We also require the same level of financial reporting and corporate governance, irrespective of where a company is listed. This can count against investments in emerging market regions.

Another laggard economy where consensus could potentially shift in 2020 is the UK. The ballot boxes are now being packed away for five years and a measure of domestic political stability looks likely. It remains to be seen if the UK government sees more to be gained from pivoting towards the regulation-light US economy or maintaining a close relationship with the EU, complete with some of the structures that led UK voters to reject EU membership in 2016. Either way, credit markets seem relatively becalmed with the UK able to borrow 30-year money for 1.2%. In light of this, why wouldn’t the Chancellor of the Exchequer be tempted to put forward a debt-funded domestic investment programme (to offset any drag in investment until trade talks are finalised) when he presents his budget in March 2020?

It feels like political headwinds are easing and economic fundamentals remain reasonable. As a result, we remain cautiously optimistic regarding an uptick in economic growth and equity markets. Although the economic weather is improving, this picture can shift abruptly. Living in Scotland certainly prepares you for that. We continue to spend our time looking for businesses that can deliver growth and rising returns irrespective of the fiscal policy or exchange rate climate.

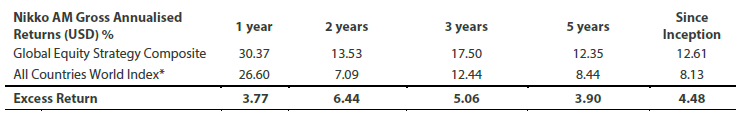

Global Equity Strategy Composite Performance to Q4 2019

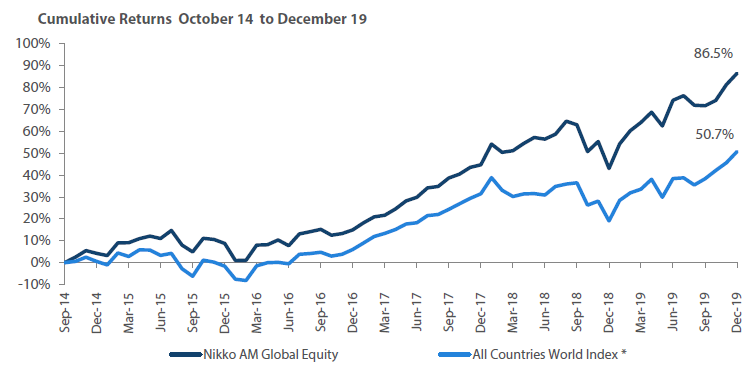

Cumulative Returns October 2014 to December 2019

Past performance is not indicative of future performance. Source: Nikko AM, FactSet, Bloomberg. The track record for Nikko AM portfolio is based on a composite portfolio from 01 October 2014 to 30 December 2019. *The benchmark for this composite is MSCI AC World Index. The benchmark was previously the MSCI All Countries World Index ex AU since inception of the composite to 31 March 2016. Returns are US Dollar based and are calculated gross of advisory and management fees, custodial fees and withholding taxes, but are net of transaction costs and include reinvestment of dividends and interest.

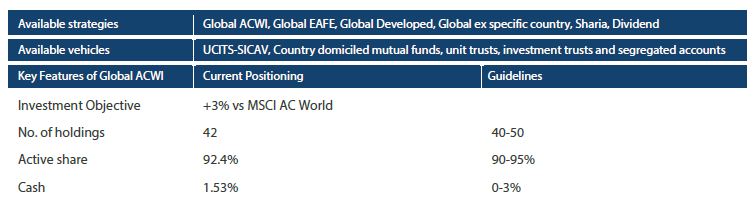

Nikko AM Global Equity: Capability profile and available funds (as at 30 December 2019)

Past performance is not indicative of future performance.

This is provided as supplementary information to the performance reports prepared and presented in compliance with the Global Investment Performance Standards (GIPS®). Nikko AM Representative Global Equity account. Source: Nikko AM, FactSet.

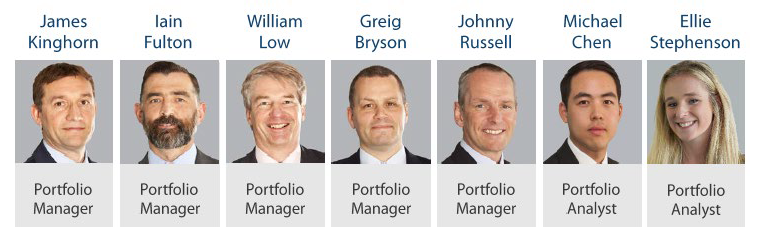

Nikko AM Global Equity Team

This Edinburgh based team provides solutions for clients seeking global exposure. Their unique approach, a combination of Experience, Future Quality and Execution, means they are continually “joining the dots” across geographies, sectors and companies, to find the opportunities that others simply don’t see.

Experience

Our five portfolio managers have an average of 23 years’ industry experience and have worked together as a Global Equity team for eight years. Two portfolio analysts, Michael Chen (joined in February 2019) and Ellie Stephenson (joined in September 2019) are the first in a new generation of talent on the path to becoming portfolio managers. The team’s deliberate flat structure fosters individual accountability and collective responsibility. It is designed to take advantage of the diversity of backgrounds and areas of specialisation to ensure the team can find the investment opportunities others don’t.

Future Quality

The team’s philosophy is based on the belief that investing in a portfolio of Future Quality companies will lead to outperformance over the long term. They define Future Quality as a business that can generate sustained growth in cash flow and improving returns on investment. They believe the rewards are greatest where these qualities are sustainable and the valuation is attractive. This concept underpins everything the team does.

Execution

Effective execution is essential to fully harness Future Quality ideas in portfolios. We combine a differentiated process with a highly collaborative culture to achieve our goal: high conviction portfolios delivering the best outcome for clients. It is this combination of extensive experience, Future Quality style and effective execution that offers a compelling and differentiated outcome for our clients.

About Nikko Asset Management

With USD 246 billion* under management, Nikko Asset Management is one of Asia’s largest asset managers, providing high-conviction, active fund management across a range of Equity, Fixed Income, Multi-Asset and Alternative strategies. In addition, its complementary range of passive strategies covers more than 20 indices and includes some of Asia’s largest exchange-traded funds (ETFs).

*Consolidated assets under management and sub-advisory of Nikko Asset Management and its subsidiaries as of 31 December 2019.

Risks

Emerging markets risk - the risk arising from political and institutional factors which make investments in emerging markets less liquid and subject to potential difficulties in dealing, settlement, accounting and custody.

Currency risk - this exists when the strategy invests in assets denominated in a different currency. A devaluation of the asset's currency relative to the currency of the Sub-Fund will lead to a reduction in the value of the strategy.

Operational risk - due to issues such as natural disasters, technical problems and fraud.

Liquidity risk - investments that could have a lower level of liquidity due to (extreme) market conditions or issuer-specific factors and or large redemptions of shareholders. Liquidity risk is the risk that a position in the portfolio cannot be sold, liquidated or closed at limited cost in an adequately short time frame as required to meet liabilities of the Strategy.