Summary

- Following losses in the previous month, regional stocks suffered another bout of selling in February, which was triggered by pandemic fears about the novel coronavirus (Covid-19). The MSCI AC Asia ex Japan Index, however, fell just 2.9% in US dollar (USD) terms, versus the 8.5% slump in the MSCI World Index. Within the region, Thailand and Indonesia were the hardest-hit markets, while China was the best performer after posting marginal gains in February.

- Thai equities slumped 12.2% in USD terms in February on concerns that Thailand’s vital tourism industry could be hurt by the impact of Covid-19, while Indonesian stocks fell 12.1% in USD terms, weighed down by country’s disappointing full-year 2019 GDP growth.

- Bucking the regional downturn, China stocks turned in USD gains of 1.0% for the month, buoyed by the stimulus measures of the People’s Bank of China (PBOC), which took steps to support the Chinese economy by reducing interest rates and flushing the market with liquidity.

- Asian markets have held up better than their global developed and emerging peers on a year-to-date basis, despite the virus originating in China. We have also witnessed an acceleration in trends that were already evident before the virus hit, namely digitalisation, de-globalisation, localisation and increased targeted stimulus in areas like renewables, 5G capital expenditure and automation. These trends continue to be reflected in our bottom-up stock selection. All in all, we continue to be positioned in areas of structural growth and innovative technology.

Asian equity

Market review

Resilient Asian equities outperform global stocks

Following losses in the previous month, regional stocks suffered another bout of selling in February, triggered by pandemic fears toward the novel coronavirus (Covid-19), which has spread beyond Asia to more than 4 0 countries across six continents. The nascent recovery in regional economies was overtaken by worries over global supply chain disruptions and Apple’s lowering of its 2Q20 quarter revenue guidance, all due to the impact of Covid-19. However, weakness in Asian stocks wasn’t as severe as the previous month, as regional governments and central banks rolled out fiscal support measures and monetary stimulus to reduce the economic fallout from the virus.

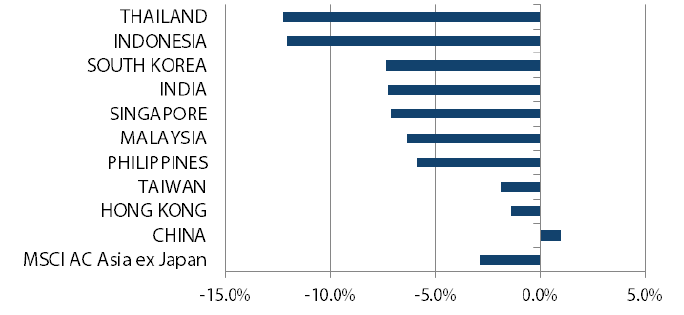

Over the month, the MSCI AC Asia ex Japan Index fell just 2.9% in US dollar (USD) terms, versus the 8.5% slump in the MSCI World Index. Within the region, Thailand and Indonesia were the hardest-hit markets, while China was the best performer after posting marginal gains in February.

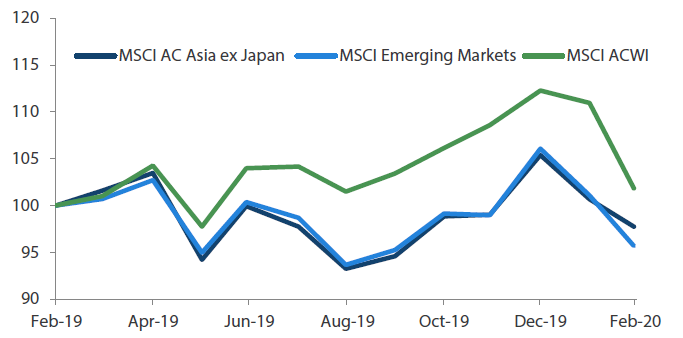

1-year market performance of MSCI AC Asia ex Japan versus Emerging Markets versus All Country World Index

Source: Bloomberg, 29 February 2020. Returns are in USD. Past performance is not necessarily indicative of future performance.

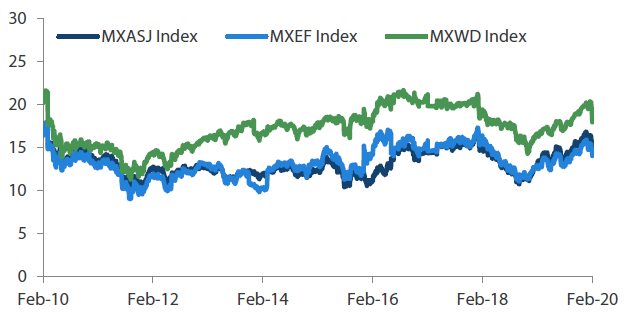

MSCI AC Asia ex Japan versus Emerging Markets versus All Country World Index price-to-earnings

Source: Bloomberg, 29 February 2020. Returns are in USD. Past performance is not necessarily indicative of future performance.

Thai and Indonesian stocks hardest hit in the region

In the ASEAN region, Covid-19 fears and political uncertainty, notably in Malaysia and Thailand, weighed on sentiment. Thai equities slumped 12.2% in USD terms in February on concerns that Thailand’s vital tourism industry could be hurt by the impact of Covid-19. The decision by the Thai court to dissolve Future Forward (a popular pro-democracy party) also dampened sentiment for Thai stocks. Likewise, Indonesian stocks underperformed their regional peers, falling 12.1% in USD terms over the month, weighed down by coronavirus outbreak concerns and the country’s disappointing full-year 2019 GDP growth of 5.0%, which was below the government’s 5.3% target.

Political chaos in Malaysia; India tracks regional downturn

Elsewhere, stocks in Singapore, Malaysia and the Philippines fell 7.1%, 6.4% and 5.9%, respectively, in USD terms during the month. As part of its 2020 budget announcement, the Singapore government said it would allocate 6.4 billion Singapore dollars to support frontline businesses, workers and households during the Covid-19 outbreak. In Malaysia, political chaos arose toward the month-end after Prime Minister Mahathir Mohamad submitted his resignation. After a week of political twists and turns, Muhyiddin Yassin, the president of Mahathir’s Parti Pribumi Bersatu Malaysia, was sworn in as Malaysia’s eighth prime minister on 29 February. In India, stocks retreated 7.3% in USD terms in February as Moody’s slashed the country’s 2020 GDP growth forecast to 5.4% from 6.6%. The ratings agency expects weakness in the global economy caused by the coronavirus outbreak to hurt India’s recovery.

China stocks buck downtrend

Bucking the regional downturn, China stocks turned in USD gains of 1.0% for the month, buoyed by the stimulus measures of the PBOC, which took steps to support the Chinese economy by reducing interest rates and flushing the market with liquidity. The other North Asian markets, namely Hong Kong (-1.4% in USD terms) and Taiwan (-1.9% in USD terms), experienced relatively mild sell-offs in February, while South Korean stocks slumped 7.4% in USD terms, as confirmed Covid-19 cases in the country surged during the month.

MSCI AC Asia ex Japan Index1

For the month ending 29 February 2020

Source: Bloomberg, 29 February 2020

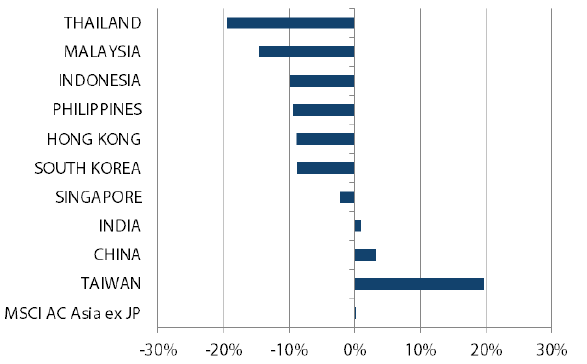

For the period from 29 February 2019 to 29 February 2020

Source: Bloomberg, 29 February 2020

1Note: Equity returns refer to MSCI indices quoted in USD. Returns are based on historical prices. Past performance is not necessarily indicative of future performance.

Market outlook

Covid-19 outbreak to further accelerate digitalisation, de-globalisation and localisation

While a significant amount of commentary and airtime has been devoted to Covid-19 and the severe economic disruption it has caused, it is important in our view to focus on some of the key long-term implications and macro shifts that are building as a result of the outbreak.

Firstly, Asian markets have held up better than their global developed and emerging peers on year-to-date basis, despite the virus originating in China. The rapid response of governments and healthcare services, which are well experienced in dealing with these scares, have helped limit the spread so far. Secondly, the US dollar, which usually attracts demand during crises, has not behaved like a safe haven. Instead, it has weakened relative to other developed currencies on the prospect of sharper rate cuts from the US Federal Reserve. Lastly, we have witnessed an acceleration in trends that were already evident before the virus hit, namely digitalisation, de-globalisation, localisation and increased targeted stimulus in areas like renewables, 5G capital expenditure and automation. These trends continue to be reflected in our bottom-up stock selection.

Positioned in areas of structural growth and innovative technology

China’s focus on quality, rather than quantity, will be tested by the economic impact from Covid-19 and there is an increasing likelihood that the authorities will ease restrictions in traditional stimulus areas of infrastructure and property to support growth in the near term. That being said, we continue to see more targeted stimulus going towards strategic development goals including 5G, technology and renewables. Increased usage of online services over this virus period will result in some structural shifts in areas of payments, education, gaming and commerce. Hence, we continue to be positioned in areas of domestic structural growth, such as insurance, healthcare, software and industrial automation.

The ubiquity and increasing sophistication of technology in our daily lives have positive long-term implications for the supply chain, the bulk of which is based in Taiwan and South Korea. Nonetheless, the absence of a clear resolution of the US-China technology cold war and demand downgrades from key global downstream players, such as Apple, warrant more near-term caution in the hardware space. We continue to focus on long-term beneficiaries of 5G, Internet of things, renewables and cloud development within the technology universe.

Beneficiaries of supply chain disruptions

India’s sluggish GDP prints have overshadowed a pick-up in some of the country’s advance indicators of late, namely the two consecutive months of improvement in PMIs. Several structural reforms, in tandem with the global slowdown, have put pressure on the Indian economy. But with 18 months of monetary easing and corporate tax cuts, the Indian economy looks well placed to rebound following the resolution of Covid-19. The Modi government is cognisant of the opportunity to play a much larger role in the global supply chains. We remain invested in areas that should benefit from formalisation, under-penetration and long-term growth, namely private banks, real estate and logistics.

ASEAN, and notably Indonesia, is the other region that ought to benefit from the redesign of supply chains, which currently rely heavily on China. But a combination of deteriorating political situations and relative inaction on virus curtailment leave us less sanguine on the ASEAN region as a whole.

Appendix

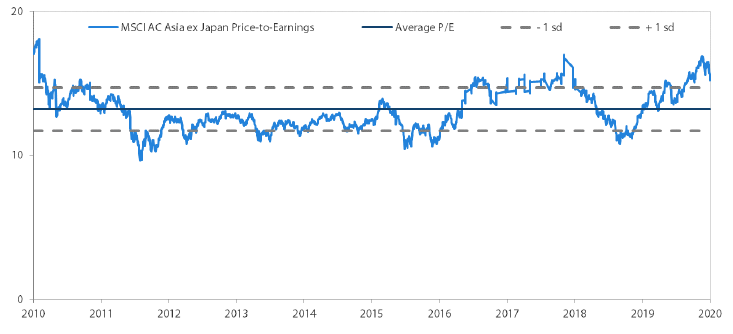

MSCI AC Asia ex Japan price-to-earnings

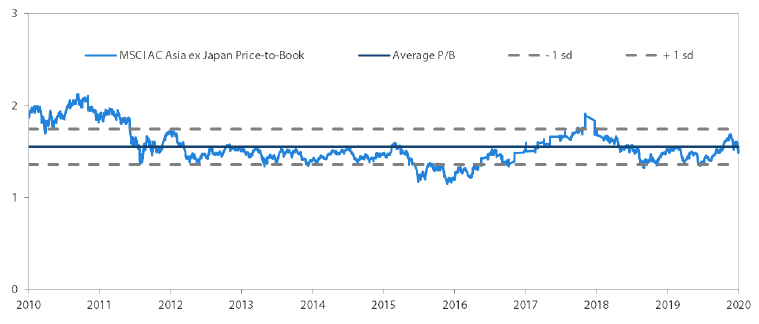

MSCI AC Asia ex Japan price-to-book

Source: Bloomberg, 29 February 2020. Ratios are computed in USD. The horizontal lines represent the average (the middle line) and one standard deviation on either side of this average for the period shown. Past performance is not necessarily indicative of future performance.