Summary

- US Treasuries (USTs) rallied in February as concerns over the global economic impact of the novel coronavirus (COVID-19) damaged market sentiment. Towards the end of February, the 10-year UST yield plunged to a record low of 1.12%. Overall, the 2-year and 10-year UST yield ended the month at 0.91% and 1.15%, respectively, down about 40 basis points (bps) and 36 bps from the prior month.

- Driven by the sharp fall in UST yields, Asian credits returned 1.01% in February despite a 21 bps widening in credit spreads. Asian high-grade (HG) credits performed better than their high-yield (HY) counterparts and gained 1.34% thanks to their longer duration; their spreads widened by 14 bps. Asian HY credit spreads widened by 39 bps for a total return of -0.06%.

- Primary market activity for Asian credits declined slightly in February. The HG space saw 36 new issues amounting to about USD 19.2 billion, while the HY space had 31 new issues totalling close to USD 11.8 billion. We expect primary market activity to ease until the market finds its bearings again. The earnings season may further dampen primary market activity as some issuers will soon enter their blackout period.

- Inflation readings were mixed across Asia. The region’s central banks cut rates and reduced their growth forecasts, while Fitch Ratings upgraded its outlook on the Philippines. The People’s Bank of China (PBOC) took steps to support the economy by reducing interest rates and flushing the market with liquidity.

- We continue to expect Asian bonds to perform well. We favour Philippine bonds with the accommodative policy stance of Bangko Sentral ng Pilipinas (BSP) supporting the market. We are also positive on Indian bonds as the Reserve Bank of India (RBI) still has room to cut rates, in our view. On currencies, we are underweight the Singapore dollar (SGD) and Thai baht (THB), and overweight the Philippine peso (PHP).

- We expect Asian credit spreads to come under pressure in the near-term, with the virus outbreak and its containment remaining a key market factor. Some Asian governments have already announced fiscal and monetary easing measures, and we expect others to follow suit. These measures should help mitigate the economic fallout and limit the near-term widening pressure on credit spreads. They should also support a recovery when the spread of the virus is contained.

Asian rates and FX

Market review

USTs rally in February

USTs rallied in February as concerns over the global economic impact of COVID-19 dented market sentiment. The month started with some optimism toward the outbreak being contained. News of drugs that were potentially effective against the virus, supportive policies from China, and robust US economic data helped curb risk aversion and prompted 10-year UST yields to rise in the first week of February. However, the rise was short-lived as the virus spread rapidly in countries outside of China, such as South Korea, Italy and Iran, and dampened market sentiment. Additionally, Apple’s statement that the company may not meet its revenue target due to disruptions caused by the virus outbreak added to the risk-off tone. Towards end-February, the 10-year UST yield plunged to a record low of 1.12%. Overall, the 2-year and 10-year UST yield ended the month at 0.91% and 1.15% respectively, down about 40 bps and 36 bps from the prior month.

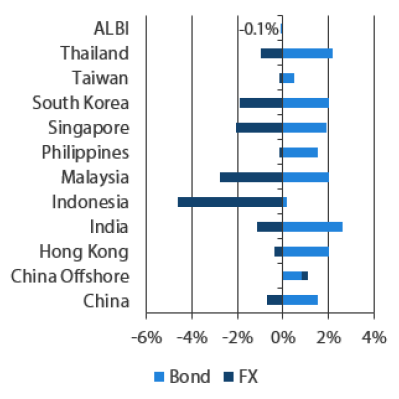

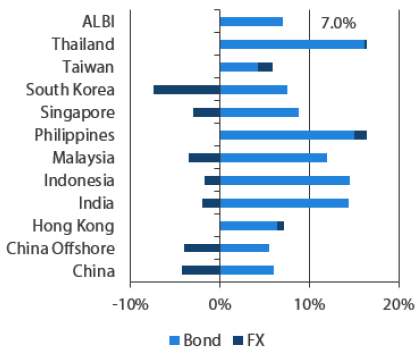

Markit iBoxx Asian Local Bond Index (ALBI)

For the month ending 29 February 2020

For the year ending 29 February 2020

Source: Markit iBoxx Asian Local Currency Bond Indices, Bloomberg, 29 February 2020

Note: Bond returns refer to ALBI indices quoted in local currencies while FX refers to local currency movement against USD. ALBI regional index is in USD unhedged terms. Returns are based on historical prices. Past performance is not necessarily indicative of future performance.

Inflationary pressures in the region mixed

The region’s consumer price index (CPI) readings for January were mixed. Inflation in the Philippines was higher than expected at 2.9% Year-on-Year (YoY); while it accelerated from 2.5% in the prior month, it was still within the BSP’s comfort range. Malaysia’s inflation rose 1.6% YoY following a 1.0% increase in December, while its core CPI rose 1.7% annually. China’s inflation surged 5.4% YoY, primarily due to high pork prices, impact from the COVID-19 outbreak and the Lunar New Year holidays. In contrast, Singapore’s core inflation hit a four-year low of 0.3% YoY, largely due to lower services inflation, a steeper drop in the cost of retail and other goods and rebasing effects. Thailand’s inflation and core inflation remained low at 1.05% and 0.47% YoY respectively, while Indonesia’s inflation came in slightly lower-than-expected at 2.68% YoY.

Regional central banks cut rates, reduce growth forecasts

During the month, some of the region’s central banks cut rates to support their economies impacted by the COVID-19 outbreak. As expected, the Philippine central bank reduced rates by 25 bps to 3.75%. Bank Indonesia also lowered policy rates by 25 bps to 4.75% and cut its 2020 forecast growth rate to 5–5.4%. Elsewhere, the Bank of Thailand surprised the markets by cutting the policy rate to a record low of 1.00% from 1.25%. The Monetary Authority of Singapore issued a statement that its monetary policy stance remains unchanged. However, the central bank reassured the markets that it still has sufficient room to ease within the SGD NEER band. Singapore’s growth forecast for 2020 was downgraded to between -0.5% and 1.5% due to the impact of the virus. Meanwhile, the central banks of South Korea and India maintained policy rates during the month.

Fitch upgrades outlook on the Philippines; PBOC provides stimulus measures

During the month, Fitch Ratings upgraded its outlook on the Philippines to positive and affirmed its “BBB” rating. The upgrade reflects Fitch’s expectations on the country’s continued adherence to sound economic policies and fiscal reforms, which would keep its debt within manageable levels. Separately, the PBOC took steps to support the economy, reducing interest rates and flushing the market with liquidity. Specifically, the central bank reduced its medium-term lending facility rate and loan prime rate.

Market outlook

Asian bonds expected to do well; Philippine and Indian bonds favoured

We are currently moving into the next phase of the COVID-19 outbreak, and the number of cases outside of China have been increasing. This has caused global growth concerns and prompted global bond yields to fall drastically. Meanwhile, Asian central banks have been reducing their growth forecasts and maintaining accommodative monetary policies. Thus, we expect a number of Asian central banks to cut rates to support their economy. Against this backdrop, Asian bonds are expected to continue to do well, and possibly outperform equities in the near-term.

Within the Asian bond market, we favour Philippine bonds because they have become more attractive relative to their peers with BSP's accommodative policy stance providing good support to the market. Going forward, we expect more easing from BSP through both the policy rate and the reserve requirement ratio. We are also positive on Indian bonds as the RBI still has room to cut rates, in our view. We believe that the country's elevated headline inflation is temporary, tapering off in the coming months as vegetable prices ease.

Underweight SGD and THB; favour the PHP

On currencies, we are underweight on the SGD and THB versus the PHP. This is due to Singapore's open economy and Thailand's high reliance on tourism, particularly on visitors from China. We favour the PHP as it is a defensive currency. The country's lower reliance on tourism and global trade, as well as its healthy remittance flow, are reasons that make the PHP resilient and elevated.

Asian credits

Market Review

Asian credit spreads widen on concerns over negative impact of COVID-19 outbreak

Asian credit spreads widened by 21 bps on concerns over the negative impact of the COVID-19 outbreak. Despite the widening, Asian credits returned 1.01% in February, driven by the sharp fall in UST yields. Asian HG credits performed better than their HY counterparts, gaining 1.34% thanks to their longer duration; their spreads widened by 14 bps. Asian HY credit spreads widened by 39 bps for a total monthly return of -0.06%.

The market’s main concern remains the COVID-19 outbreak and its potential impact on the Asian and global economic outlook. Asian credit spreads were resilient during the first half of the month as the spread of COVID-19 within China appeared to have been contained. However late into February, the rapid escalation of virus infections outside of China—in countries and regions such as South Korea, Japan, Europe, and the Middle East—led to a sharp reduction in investor risk appetite. This compounded already existing concerns that the outbreak could negatively impact global economic growth through supply chain disruptions and weaker demand from China. Fundamentals concerns aside, technicals for Asian credit remained robust earlier in February with lower volumes of new supply and still positive emerging market hard currency bond fund flows. There was some moderation, however, towards the final week of February.

Primary market activity slightly lower in February

New issuances of Asian credit reopened with smaller volumes in February. The HG space saw 36 new issues amounting to about USD 19.2 billion, including a USD 1 billion issue by Adani Electricity Mumbai, a USD 1.5 billion two-tranche floating rate note by the Korea Development Bank, and a USD 1.45 billion issue by Indonesia’s PT Pertamina Persero. Meanwhile, the HY space had 31 new issues totalling close to USD 11.8 billion, with the Chinese property segment being a significant contributor. Primary market activity is expected to ease until the market finds its bearings again. The earnings season may further dampen primary activity with some issuers soon entering their blackout period.

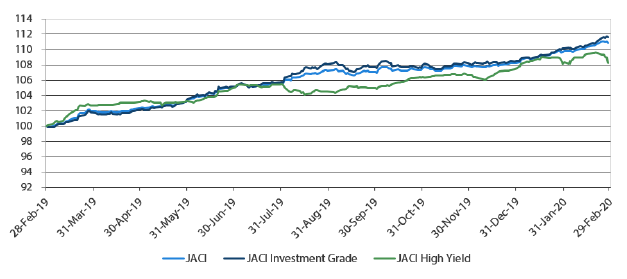

JP Morgan Asia Credit Index (JACI)

Index rebased to 100 on 29 February 2019

Note: Returns in USD. Past performance is not necessarily indicative of future performance. Source: JP Morgan, 29 February 2020

Market Outlook

Credit spreads under pressure near-term, outbreak containment remains key

With COVID-19 outbreak concerns going global, credit spreads in Asia have widened in tandem with the sharp sell-off in risk assets. Asian issuers, from sovereign, financial to corporate, will likely see some near-term pressure on credit fundamentals, considering the extent of the outbreak and the lengthy disruptions to global economic activity it could cause. We do, however, believe most will be able to keep their credit ratings intact given their adequate buffers heading into this period. Following the sharp widening in credit spreads in the final week of February, valuation has also become more attractive. However, the near-term direction of spreads will be dictated by how the outbreak evolves outside China, as well as the fiscal and monetary responses of global governments to support business and consumer confidence. In this regard, Asian governments, notably those of China, Hong Kong, and Singapore, have already announced significant fiscal and targeted monetary and credit easing measures, and we expect others to follow suit. These measures should help mitigate the economic fallout and limit the near-term widening pressure on credit spreads. They should also support a recovery when the spread of the virus is contained.