- We are beginning to fear the economic impact of the coronavirus outbreak in China. While the disease’s origins remain unclear (there are conspiracy theories around government labs but apparently the most likely source is a cross-over from bats), the virus appears to be more contagious than was SARS, but less contagious than Measles.

- SARS was an extremely deadly virus, but its transmission was largely concentrated within health professionals; by the end of the outbreak it was in effect a “hospital disease” but nevertheless air travel allowed it to spread to a number of locations around the world.

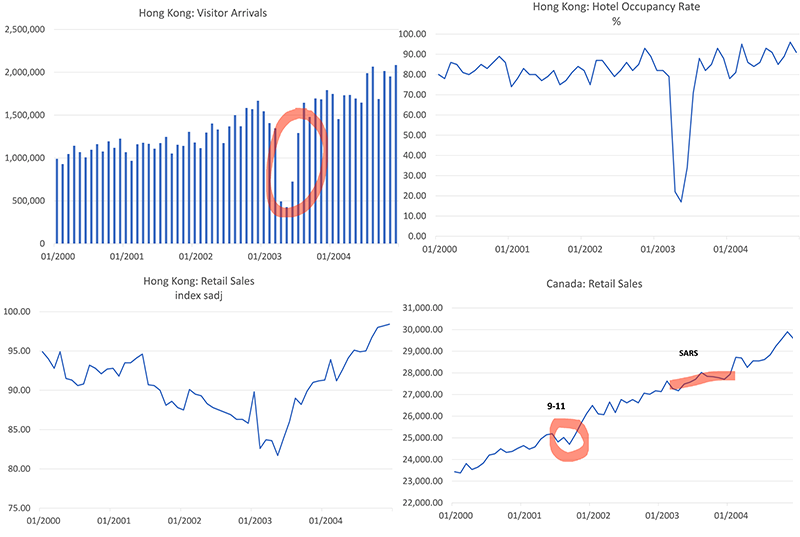

- The economic impact of SARS was of course most keenly felt in Asia, but other countries also witnessed collateral damage – Canada’s retail environment was certainly impacted by the SARS event in 2003. The decline in HK’s retail and tourism sectors was extreme during SARS and the latest disease event will be occurring on top of the political protests.

- From the perspective of the Chinese calendar, this could perhaps not have occurred at a worse time. Clearly there are large scale movements of people around Asia-Pac during the Lunar New Year, although on a seasonally unadjusted basis we note that January – February are usually quite ‘light months’ with regard to retail spending patterns.

- Aside from the obvious human tragedy, the issues that concern us the most are the potential for financial stresses and financial contagion to emerge with regard to China’s foreign creditors, now that extra bank holidays have been announced in the PR; and what this event will do to the internal demand for the RMB and the PRC’s rate of inflation.

- It remains to be seen just how much stress any inability to settle / rollover / recover funds from China’s financial system will have on the country’s substantial list of foreign lenders and trade creditors. The central government’s decision to close China’s banks suggests that there are very real concerns over the true severity of the epidemic but there may now be a risk of financial contagion amongst the country’s external creditors.

- China’s banks owe (conservatively) $2.5 trillion to offshore creditors and there is a further $1.5-$2 trillion in outstanding non-bank debt to foreigners within the system. If China’s financial system remains closed, this hugely important global credit channel (which spreads from the US, via in some cases the EU & Japanese banks, into China, and then out again into the rest of Asia, to Africa and LATAM) could start to experience settlement and counterparty stresses.

- We must also wonder about the financial security of China’s large number of cash flow negative entities and perhaps even some of its new domestic non-bank settlement systems.

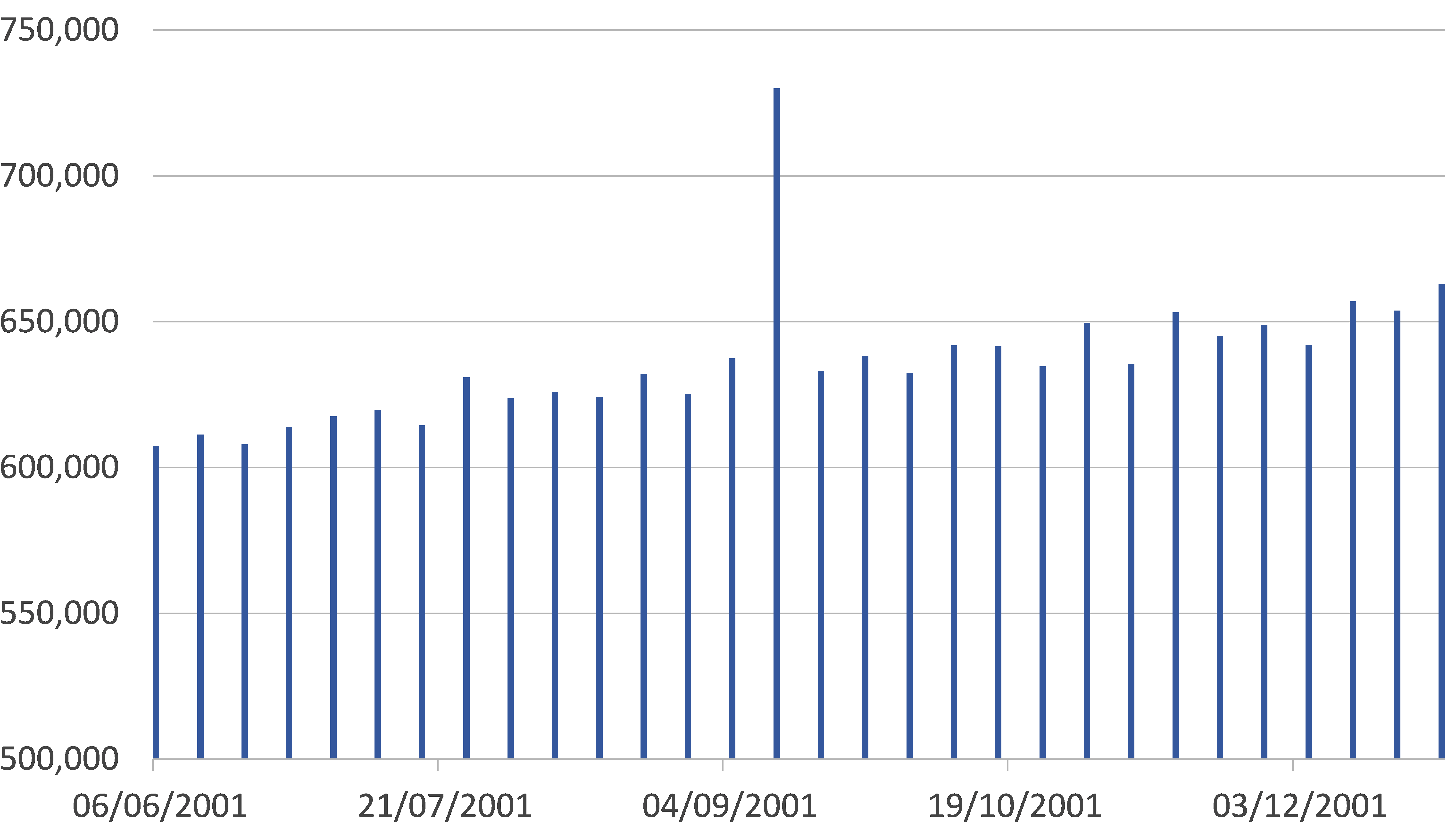

- Historically, it is extremely rare for markets to experience unanticipated bank holidays & closures. Significantly, the Federal Reserve remained resolutely open on 9-11 itself, and for the two subsequent days, even though most of the domestic financial markets were closed. The Fed added $300 billion of liquidity around 9-11 in order that the banks & currency markets could remain open. The USD fell heavily following the attacks, but the CNY has not.

- China’s closure of the banks, the draconian rules on travel, and even the fact that the outbreak(s) has or have occurred may shake the population’s confidence in the state and, by implication, peoples’ confidence in the RMB as a store of value (since one cannot divorce the concept of confidence in the currency and confidence in the state that backs it…..).

- China’s rate of inflation has already been under pressure over recent months as a result of the Swine ‘flu epidemic and, if people now decide to hoard food and fuel in response to the ‘shutdown’ (while at the same time the shutdown compromises the economy’s supply potential), we may well see a significant inflationary shock to China. There are already reports of episodes of rice hoarding occurring.

- We must also wonder about the financial security of China’s large number of cash flow negative entities and perhaps even some of its new domestic non-bank settlement systems.

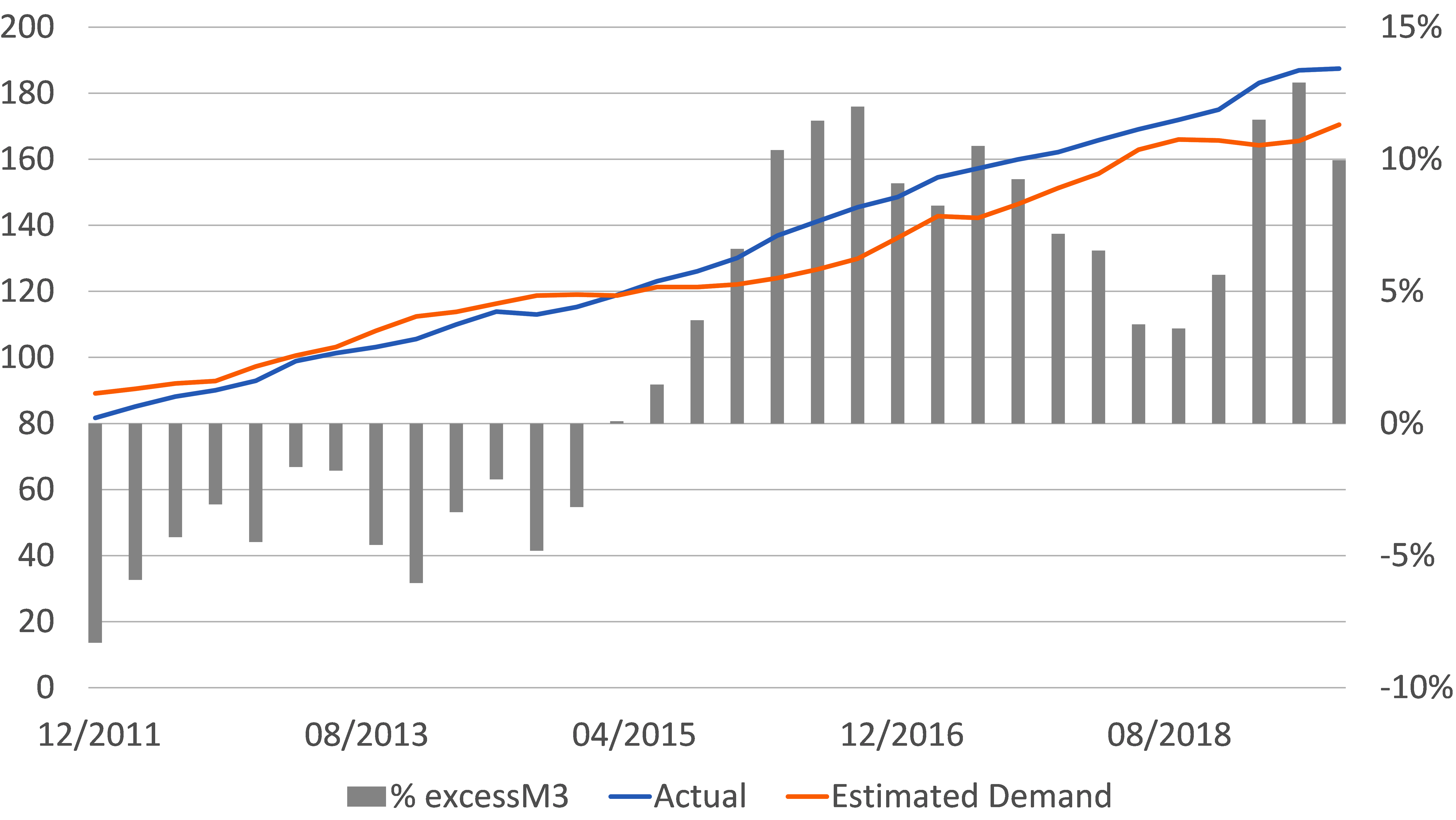

- Given that the country has very high existing levels of excess money balances, we have long maintained that a ‘shock’ to the system could have surprisingly inflationary consequences, particularly if it leads to a change in ‘inflation expectations’.

- At the very least, the disease outbreaks (swine and human) are undermining the level of real disposable incomes available to households in China for discretionary forms of expenditure.

- The closing down of domestic transport networks will not only impact the airlines & railways; it will also have some impact on the economy’s wider supply potential and on supply chains both at home and potentially abroad.

- We have long been concerned that the wider effects of an inflationary shock or event in China, given the country’s key position within global supply chains, could reverberate around the World. As we have noted elsewhere, virtually all of the global inflation shocks since the early 1990s (including 1994, 2000 and 2007) had their roots in Asia’s export pricing.

- Japan’s Kobe earthquake in 1995 was relatively localized in terms of its immediate effects but it nevertheless contributed to a 2 – 3% decline in nationwide Industrial Production. The tragic Sendai Quake of 2011 reduced aggregate Japanese IP by more than 15% and the event caused parts shortages around the world - and even a halt in auto production in parts the US auto sector.

- In aggregate, Japan’s exports fell by more than 10% MoM following the March 2011 ‘Quake on a seasonally adjusted basis and Wuhan is a centre of China’s manufacturing & export sectors.

- On paper, Hubei Province only produces around 4% of total industrial output in China and Wuhan in theory accounts for only 1% of China’s total exports. However, we suspect that these figures understate the true economic importance of the Yangtze area to the national & international economies.

- We are in no position to judge whether the spread of the virus will go ‘exponential’ over the coming weeks, but we understand that this question could be answered as soon as the end of this week given the disease’s characteristics.

- In any case, the WHO looks set to declare an emergency that will pose an obvious ‘demand-side’ shock to the global economy but also a less transparent ‘supply-side shock’, even if the disease remains confined within areas of the PRC.

- These effects will of course be magnified should the virus ‘jump’ to other Regions and our sense is that the UK is not well prepared at this time for such an event. Trump’s handling of any pandemic will clearly be a factor in the coming elections.

SARS Impact

USA: FOMC Balance Sheet

USD million around 9/11

China: Inflation

% YoY, PY=100

China: M3 and the demand for money

RMB trillion, % stock