Key points

- Mergers and acquisitions (M&A) activity by Japanese companies is thriving, having doubled since the start of Abenomics in 2012 to roughly 4,000 cases in 2019 according to latest industry figures.

- Corporate governance reform has hastened M&A activity by prompting companies to use idle cash more effectively.

- Corporate governance reform is also prompting companies to use M&A for restructuring and to drive future growth.

- M&A activity is increasing against a backdrop of changing demographics, with a declining population prompting Japanese companies to create value both inside and outside of the country through M&A. The Bank of Japan’s easy monetary policy also provides a cheap, abundant source of cash for companies to fund their acquisitions.

- The rise in M&A activity has been accompanied by an increase in hostile deals, which are becoming an accepted part of Japan’s corporate landscape.

Japan’s booming M&A market

M&A activity at a record high

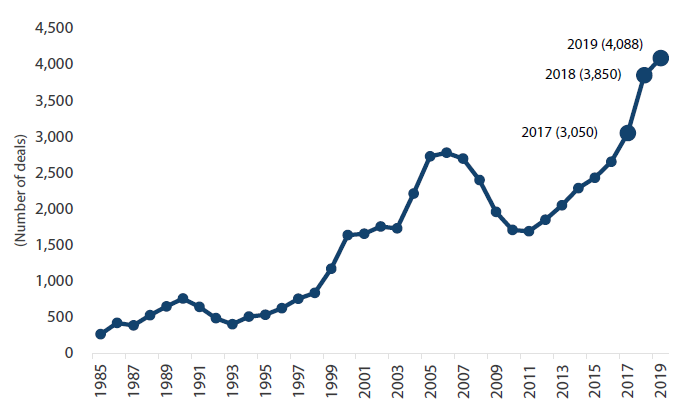

M&A activity in Japan is thriving, bouncing back from a downturn in the wake of the global financial crisis and doubling since the start of Abenomics in 2012. According to M&A advisory firm Recof, Japanese M&A activity topped 4,000 cases in 2019, reaching a record high for the third consecutive year (Chart 1). M&A activity has been boosted by recent reforms to Japanese corporate governance and stewardship codes. Under the reforms, shareholders have become more vocal about the management of the companies they invest in. As a result, M&A, along with share buybacks and payments of higher dividends, have become a channel for companies to use their ample cash reserves more effectively. Japan’s macroeconomic backdrop has been conducive to M&A, which have boomed since the launch of Abenomics. Japanese companies, faced with a steady domestic population decline, are increasingly seeking growth opportunities outside of the country through M&A and are also attempting to improve profitability at home through restructuring.

Chart 1: Number of M&A deals hit a record high for the third successive year in 2019

Source: Recof

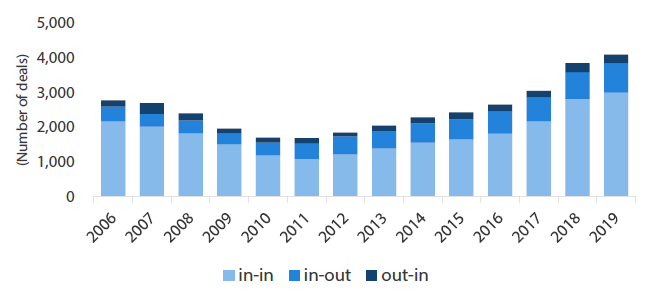

Cash for M&A is something many Japanese companies have in abundance. As of the March 2019 financial year-end, Japanese corporations (excluding financial and insurance firms) held JPY 223 trillion in cash and deposits, according to Ministry of Finance data. As Chart 2 shows, all types of M&A activity (in-in, in-out, out-in) increased in 2019.

By number, in-out deals made up less than a quarter of the total in 2019. But by value, in-out deals accounted for JPY 10.376 trillion out of the JPY 18.029 trillion in total deals recorded that year. In 2019, some of the largest M&A deals by value were in-out transactions, which included a purchase by Asahi Group Holdings of Australia-based Carlton & United Breweries from Anheuser-Busch InBev and Sumitomo Dainippon Pharma acquiring five subsidiaries from Roivant Sciences. These large cross-border deals reflect the trend of Japanese companies increasingly seeking to boost shareholder value by engaging in enterprises outside of the country.

Chart 2: Breakdown of M&A activity by type

Source: Recof

In terms of numbers, in-in transactions made up the bulk of M&A deals in 2019. Within in-in deals, transactions linked to business succession plans topped 600 cases. Such deals are expected to increase steadily as the aging top management of many SMEs are faced with either maintaining succession of their companies through mergers or folding their businesses if they cannot find a successor.

Out-in M&A also increased slightly in 2019. Deals included French auto parts maker Faurecia’s acquisition of Clarion and the purchase by Johnson & Johnson of cosmetics company Ci:z Holdings.

Acquisitions by investment funds also on the rise

Acquisitions of companies by investment funds, such as private equity (PE) firms, are also on the rise, with the number of deals reaching a new record high of 877 in 2019 (Chart 3). Of these deals, investments into venture companies by corporate venture capital (CVC) and venture capital (VC) funds amounted to 555 cases.

Chart 3: Acquisitions by investment firms at record highs

Source: Recof

The surge in acquisitions by investment funds shows that institutions such as PE firms, often branded as opportunistic vultures in the past, are now winning acceptance. Japanese companies are increasingly utilising PE firms when trying to improve their business structure through divestiture and other corporate restructuring methods.

PE funds gaining more acceptance?

Recent examples of PE firms gaining more acceptance include Toshiba’s sale of its memory chip unit Toshiba Memory in 2018 to a consortium led by Bain Capital. Okinawa-based Orion Breweries completed a management buyout (MBO) in 2019 and came under the control of an entity formed by Carlyle Group and Nomura Holdings. In 2017 KKR purchased Nissan-backed auto parts manufacturer Calsonic Kansei and also acquired Hitachi’s power tools unit Hitachi Koki, playing a role in Nissan and Hitachi’s restructuring efforts.

M&A for restructuring, future growth

Hitachi

Hitachi is an example of a company using M&A to push through structural reform and create new growth opportunities. The conglomerate has reduced the number of its subsidiaries from 22 in 2009 to just four by 2019; at the same time, it has acquired assets in an effort to pivot into fields such as infrastructure and information technology (IT). Hitachi announced in 2019 that it plans to spend up to JPY 2.5 trillion on M&A over a three-year period for its “2021 mid-term management plan”, up from JPY 0.5 trillion allocated for the “2018 mid-term management plan”.

Some of Hitachi’s recent M&A activity include:

- Purchase of Switzerland-based ABB’s power grid unit in 2018 for JPY 700 billion, Hitachi’s largest cross-border deal to date

- Purchase of US cloud systems integrator REAN Cloud in 2018 by Hitachi Vantara, a wholly-owned subsidiary of Hitachi

- Purchase of US robotics company JR Automation in 2019

- Hitachi Payments, a wholly-owned subsidiary of Hitachi, partnering with the State Bank of India (India’s largest commercial bank) in 2019 to form a digital payments platform

- Decision in 2019 to merge its vehicle components unit with Honda’s three suppliers to better respond to an industry shift to electric vehicles and automated driving

- Decision in 2019 to sell its subsidiary Hitachi Chemical to Showa Denko

- Announcement in January 2020 that it will take full control of subsidiary Hitachi High-Technologies via a tender offer

Mergers play a role as companies dissolve or reshape parent-subsidiary listings

The last two cases from Hitachi are examples of a company dissolving or changing traditional parent-subsidiary dual listings. Parent-subsidiary listings have come under growing scrutiny in light of the ongoing corporate governance reform. The system is seen creating conflicts of interest between a parent company, which usually has a controlling share of its subsidiary, and minority shareholders of the subsidiary company. An increasing number of companies are dissolving their parent-subsidiary listings. A recent example is Mitsubishi Chemical Holdings, which opted to make its drug-making unit Mitsubishi Tanabe Pharma a wholly-owned subsidiary late in 2019 through a takeover bid.

Other examples of prominent M&A activity: Pharmaceuticals, beverage makers

Pharmaceuticals and beverage companies provide other examples of Japanese corporations increasing their presence outside of the country not only to tap the global market for revenue and continued growth, but to stay abreast of their larger foreign competitors. Takeda Pharmaceutical set a milestone in 2018 with its USD 62 billion purchase Ireland’s Shire. Acquisitions by Sumitomo Dainippon Pharma and Astellas Pharma ranked among Japan’s largest in-out deals of 2019.

The aforementioned purchase of Carlton & United Breweries by Asahi Group turned the beverage maker into the third biggest beer company in the world by sales. Asahi Group has already bought European beer makers such as Italy’s Peroni and Czech brewer Pilsner Urquell recently as Japan’s population decline and changing tastes have weighed on domestic beer consumption.

Japanese companies are expected to keep targeting foreign businesses in the areas of technology and industrial arenas due to spiking research and development costs, which could make purchasing existing know-how an attractive option compared to developing it independently.

Breaking taboos: Hostile bids on the rise

Hostile takeovers make a comeback

Takeover bids (TOBs) in Japan have also increased along with the surge in M&A. According to Recof, the number of TOBs rose from 45 in 2018 to 48 in 2019, with total value reaching a record high JPY 3.4 trillion. A key development was that five of the TOBs in 2019 were hostile takeovers, the highest number since 2006. Hostile deals were once considered taboo in Japan but such views could be changing. The introduction of the stewardship and corporate governance reform codes have made shareholders more critical of companies deploying defensive measures against hostile takeovers if such steps are seen to protect inefficient management. Companies are also pursuing takeovers more aggressively as they face pressure to create greater shareholder value under the reform codes.

Recent examples of hostile takeovers and attempts

- Trading firm Itochu Corp set the tone early in 2019 when it launched a hostile takeover by buying a controlling stake in sporting apparel maker Descente.

- An attempt by travel agency HIS to take over hotel operator Unizo Holdings in 2019 forced the latter to look for a white knight; Unizo turned to Lone Star, eventually agreeing to Japan’s first ever employee buyout that would position the Texas-based fund as a minority shareholder. But Unizo has drawn in other bidders, with Blackstone and Fortress Investment also trying to buy the Japanese company.

- A takeover battle erupted in 2019 when glass maker Hoya Corp made an unsolicited bid for NuFlare Technology, trying to thwart Toshiba Corp’s attempt to buy NuFlare. Hoya’s takeover bid, while unsuccessful, had won votes from many institutional investors despite being hostile in nature.

- In January 2020, Maeda Corp made a tender offer for Maeda Road Construction in January. But according to media reports Maeda Road opted to oppose the TOB, turning Maeda Corp’s attempt into a hostile bid.

- Also in January, a fund backed by activist investor Yoshiaki Murakami launched a hostile bid for Toshiba Machinery, which threatened to adopt poison pill measures to thwart the acquisition.

- Underlining the shifting market attitude towards hostile bids, the CEO of Daiwa Securities Group told the Nikkei business daily recently that his company will support hostile TOBs as needed.

Hostile TOB attempts will naturally draw in a friendly white knight, as in the case of Unizo, or a less hostile buyer. The whole process is positive for undervalued companies, in our view. Competition for corporate control, whether through a hostile bid or not, is a healthy process that often produces the natural owner of an enterprise. The competitive bidding will help the market discover the intrinsic worth of undervalued companies. We therefore believe the process is not only positive for undervalued companies, but the market as a whole.

Conclusion

Japan’s M&A boom reflects regulatory and fundamental changes that companies and investors face. The introduction of corporate governance and stewardship codes has led to greater attempts to enhance shareholder value with M&A serving as the means; changing demographics have encouraged Japanese enterprises to utilise M&A in a bid to seek new growth opportunities. Mergers and acquisitions are playing a key role as Japanese companies restructure by dissolving parent-subsidiary relationships or seek to absorb rivals through hostile bids. We believe that both activities—the dissolution of parent-subsidiary relationships and hostile takeovers—will uncover previously overlooked worth and help create shareholder value.

Any references to particular securities are for illustrative purposes only and are as at the date of publication of this material. This is not a recommendation in relation to any named securities and no warranty or guarantee is provided.