Summary

- It was a difficult month for Asia Pacific stocks as the fallout from the novel coronavirus (Covid-19) pandemic and plummeting oil prices sent markets into a tailspin. Despite a late rally in March, the MSCI AC Asia ex Japan Index still suffered significant losses of 12.1% in US dollar (USD) terms for the month. Within the region, Indonesia and India were the hardest-hit markets, while China and Malaysia were the most resilient.

- Stocks in the ASEAN region, including those of Indonesia (-29.4% in USD terms), the Philippines (-21.7%), Singapore (-19.9%) and Thailand (-17.4%), were among the worst performers in Asia in March, as curbs in tourism-related activities and widespread business disruptions due to the Covid-19 pandemic deepened fears of a severe recession in their respective economies. Plunging 25.1% in USD terms, Indian stocks also felt the full brunt of the market rout in March.

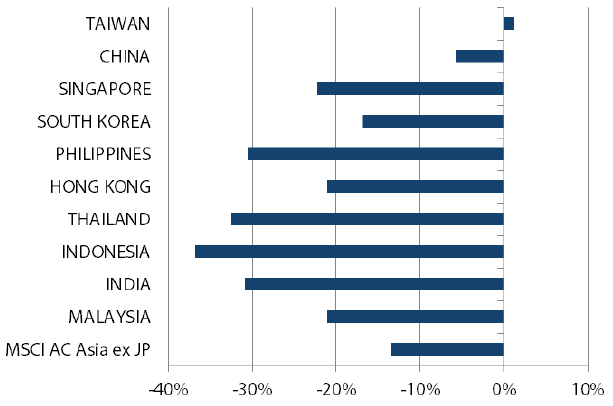

- China was the best performing market in Asia during the month, falling just 6.6% in USD terms, owing to effective containment of the coronavirus outbreak and the promise of policy stimulus.

- With a looming global recession and tightened financial conditions, global economic prospects now rest on how governments and central banks respond to the unprecedented crisis. As the world heals, we expect an acceleration in structural trends that were already evident pre-Covid-19, namely digitalisation, localisation and increased targeted stimulus in areas such as renewables, 5G capex and automation. These structural shifts continue to be reflected in our bottom-up stock selection.

Asian equity

Market review

Asian equities slump on Covid-19 fallout

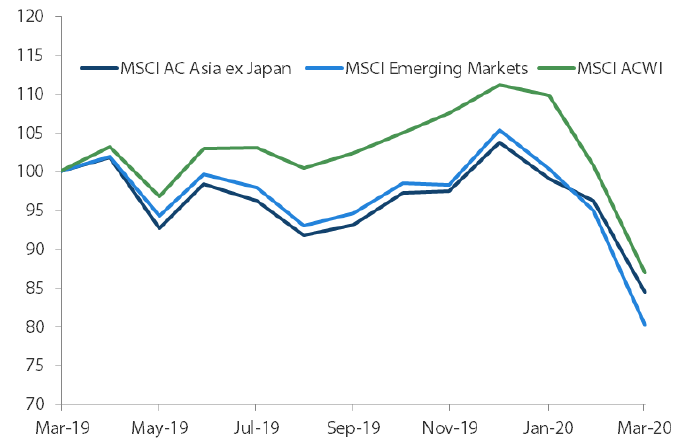

It was a difficult month for Asia Pacific stocks as the fallout from the novel coronavirus (Covid-19) pandemic and plummeting oil prices sent markets into a tailspin.

The virus-induced stock market rout in March saw some of the biggest daily sell-offs since the 2008 Global Financial Crisis, prompting global governments and central banks to roll out massive fiscal support measures and monetary stimulus, including deep interest rate cuts as well as quantitative easing, to stabilise markets and reduce the economic impact from the Covid-19 outbreak.

The US Federal Reserve, for instance, implemented emergency rate cuts of 50 basis points (bps) and 100 bps respectively on 3 March and 15 March 2020, bringing the Fed funds rate to 0–0.25%. Regional central banks, including those in Hong Kong, Indonesia, Malaysia, the Philippines, South Korea, Taiwan and Thailand, also slashed rates in a significant way during the month to provide liquidity in their respective markets and give support to their virus-hit economies.

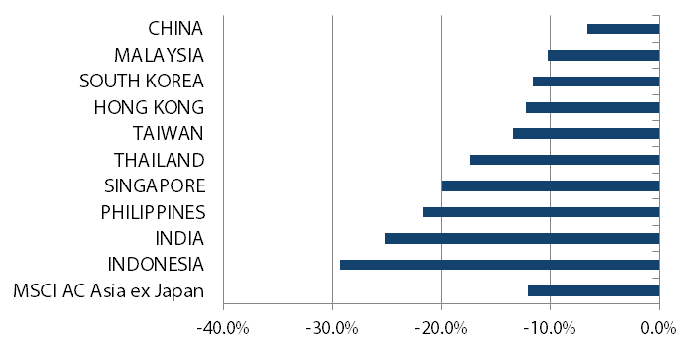

Despite the late rally in March, the MSCI AC Asia ex Japan Index still suffered significant losses of 12.1% in US dollar (USD) terms for the month. Within the region, Indonesia and India were the hardest-hit markets, while China and Malaysia were the most resilient during the one-month period.

1-year market performance of MSCI AC Asia ex Japan versus Emerging Markets versus All Country World Index

Source: Bloomberg, 31 March 2020. Returns are in USD. Past performance is not necessarily indicative of future performance.

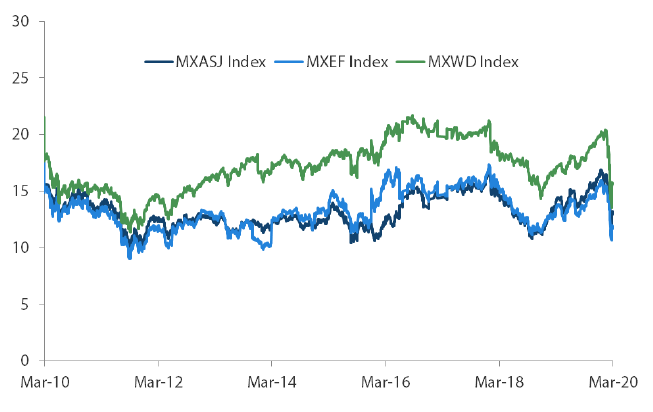

MSCI AC Asia ex Japan versus Emerging Markets versus All Country World Index price-to-earnings

Source: Bloomberg, 31 March 2020. Returns are in USD. Past performance is not necessarily indicative of future performance.

Indonesian and Indian stocks hardest hit in the region

Stocks in the ASEAN region, including those of Indonesia (-29.4% in USD terms), the Philippines (-21.7%), Singapore (-19.9%) and Thailand (-17.4%), were among the worst performers in Asia in March, as curbs in tourism-related activities and widespread business disruptions due to the Covid-19 pandemic deepened fears of a severe recession in their respective economies. A slew of fiscal stimulus packages were announced by the governments of Singapore, Thailand, Indonesia and Malaysia during the month, but these measures generally failed to ignite investors’ appetite for ASEAN stocks. Within Southeast Asia, Malaysian stocks (-10.2% in USD terms) were the most resilient during the month, as the country rolled out fiscal stimulus worth USD 58 billion—an equivalent to 17% of the country’s GDP and the biggest in the ASEAN region.

Plunging 25.1% in USD terms, Indian stocks also felt the full brunt of the market rout in March. This steep sell-off occurred despite a collapse in oil prices, which has historically tended to support equities in the energy-reliant populous nation. Stocks in India fell hard after the country went into a 21-day lockdown towards the month-end after the number of coronavirus cases surged.

China stocks outperform

Elsewhere, North Asian stocks tracked the regional downturn with those in Taiwan, Hong Kong and South Korea posting USD losses of 13.4%, 12.2% and 11.6% respectively in March. China was the best performing market in Asia during the month, falling just 6.6% in USD terms, as effective containment of the coronavirus outbreak and the promise of policy stimulus led China stocks to fare better than their regional peers.

MSCI AC Asia ex Japan Index1

For the month ending 31 March 2020

Source: Bloomberg, 31 March 2020

For the period from 31 March 2019 to 31 March 2020

Source: Bloomberg, 31 March 2020

1ote: Equity returns refer to MSCI indices quoted in USD. Returns are based on historical prices. Past performance is not necessarily indicative of future performance.

Market outlook

Covid-19 outbreak to further accelerate digitalisation, de-globalisation and localisation

The outlook for the global economy has changed significantly over the past month as the outbreak of Covid-19 moved beyond Asia to the rest of the world. With a looming global recession and tightened financial conditions, global economic prospects now rest on how governments and central banks respond to the unprecedented crisis. On that measure, North Asia and the more developed parts of the region not only have the financial capacity to do what is needed, but also have a bureaucracy with the capability of making the right decisions in a targeted approach towards fiscal stimulus, in our view. One of the key strengths of Asia is its functioning and competent public civil service in a large part of the region, and that is on full display now as evidenced by its reasonable success in containing the virus outbreak thus far. The aforementioned are why MSCI Asia Ex Japan has outperformed the MSCI World Index on a year-to-date basis. As the world heals, we expect an acceleration in structural trends that were already evident pre-Covid-19, namely digitalisation, localisation and increased targeted stimulus in areas like renewables, 5G capex and automation. These structural shifts continue to be reflected in our bottom-up stock selection.

Positioned in areas of structural growth and innovative technology

China, in particular, has signalled to the market its strategic objective of pushing new infrastructure spending as the country attempts to mitigate the economic impact of Covid-19. This is in line with its new policy regime of “quality over quantity”, and a departure from pure traditional infrastructural fiscal stimulus, which it has relied on heavily in the past. We expect this new infrastructure spending to be related to technology, network and renewables, such as 5G base stations, data centres, ultra-high voltage grids and electric vehicle charging stations. A meaningful development of these new infrastructures will provide tailwinds for the structural growth of software companies and online services companies, all of which are well represented in our portfolio. We also continue to be positioned in other areas of domestic structural growth, such as insurance, healthcare and industrial automation.

In the medium term, China’s spending on new infrastructure alongside increasing global technology capital expenditure investment will continue to lift technology supply chains based in Taiwan and South Korea. As global supply chains get disrupted and the world embarks on expansive fiscal spending plans as necessitated by the Covid-19 crisis, we believe that Taiwan, South Korea and China will become increasingly attractive, not least because they produce goods that are desired by the world and possess strong fiscal balance sheets. Hence, we continue to be well positioned in this region, with a focus on long-term beneficiaries of 5G, Internet of things, renewables and cloud development within the technology universe.

Less sanguine on India and ASEAN

Whilst we continue be positive on India’s long term outlook due to an extended period of reforms instituted by the popular Modi-led government, a corollary by-product of the reforms is a temporary slowdown in economic growth accompanied by pains in the non-bank financial sector. Unfortunately, this short-term weakness also puts India in a disadvantaged position to tackle the Covid-19 outbreak head-on, especially with an under-developed healthcare system. In light of the escalating short-term macro risks, we have been active in managing portfolio risks but remain invested in structural areas that should benefit from formalisation, under-penetration and long term growth, namely private banks, real estate and logistics.

The ASEAN region, similar to India, is also not in a position of strength to weather this ongoing Covid-19 crisis. A combination of deteriorating political situations and relative inaction on virus curtailment leave us more cautious and selective on ASEAN overall.

Appendix

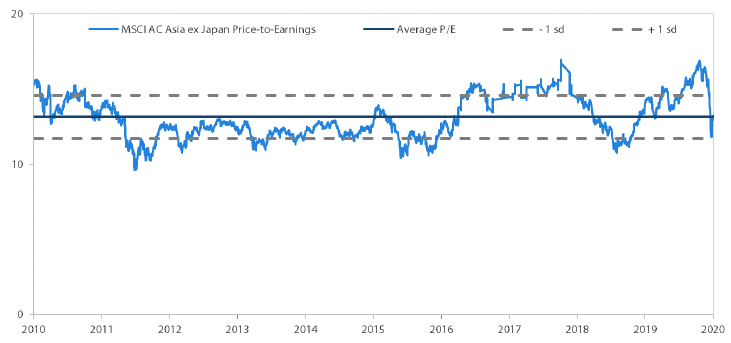

MSCI AC Asia ex Japan price-to-earnings

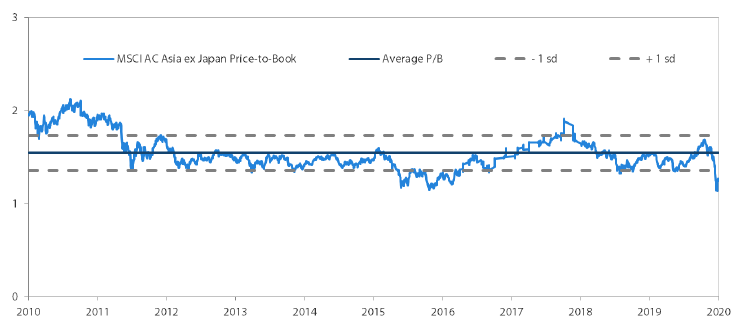

MSCI AC Asia ex Japan price-to-book

Source: Bloomberg, 31 March 2020. Ratios are computed in USD. The horizontal lines represent the average (the middle line) and one standard deviation on either side of this average for the period shown. Past performance is not necessarily indicative of future performance.