Summary

- US Treasury (UST) yields experienced volatile moves in March, whipsawing through the month as fear and anxiety due to the global spread of Covid-19 gripped markets. Overall, 2-year and 10-year UST yields ended the month at 0.25% and 0.67% respectively, about 67 basis points (bps) and 48 bps lower than prior month.

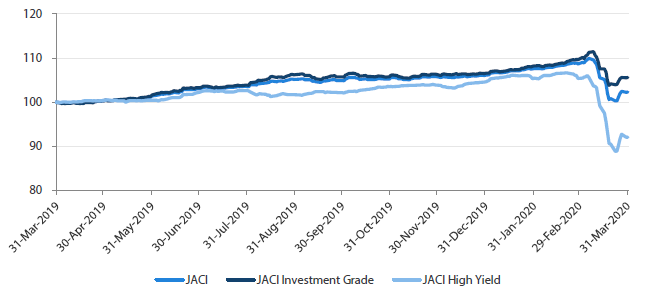

- Asian credits returned -5.83% in March, driven by the sharp widening in credit spreads of 143 bps which more than offset the fall in UST yields. Asian high-grade (HG) credits performed better than their high-yield (HY) counterparts, declining 3.67%, with spreads widening 100 bps. Asian HY credit spreads widened by 366 bps, for a total return of -12.63%.

- Because of the weak market conditions, primary market activity for Asian credits lowered sharply in March. The HG space saw 8 new issues amounting to about USD 3.6 billion, while the HY space saw approximately USD 2.2 billion of new issues across 9 transactions.

- The region’s Inflation readings were mostly lower. Central banks released aggressive fiscal and monetary policies to support their virus-hit economies. Most Asian countries have also imposed lockdowns and travel restrictions to stem the spread of the virus. Meanwhile, Fitch affirmed Thailand's BBB+ credit rating but downgraded its outlook from positive to stable.

- We continue to favour Philippine bonds and are slightly positive on Indian bonds. We are, however, cautious on Indonesian bonds amid the ongoing weakening in global sentiment. On currencies, we are cautious on the Malaysian ringgit (MYR) and Indonesian rupiah (IDR) but expect the Philippine peso (PHP) to outperform.

- We expect Asian credits to remain volatile until the virus outbreak stabilises globally. However, long-term investment opportunities are beginning to emerge, in our view. We believe that the combination of monetary, fiscal and credit policies that have been announced by governments around the world can still drive a meaningful global economic recovery later in the year.

Asian rates and FX

Market Review

USTs experience volatility in March

In March, UST yields experienced volatile moves, whipsawing through the month as fear and anxiety driven by the global spread of Covid-19 gripped the markets. The World Health Organization officially declared the outbreak a global pandemic and concerns toward the spread and severity of the virus deepened as cases increased in Europe, the US and Asia. At the start of the month, the G7 countries announced coordinated support plans to address the economic impact of the outbreak, while the US Federal Reserve (Fed) made a surprise policy rate cut of 50 bps. This only provided temporary relief as the decline in oil prices following the disagreement amongst OPEC+ members further impacted risk sentiment and sent yields tumbling. In mid-March, the Fed made another emergency cut of 100 bps and implemented quantitative easing. However, continued risk aversion pushed investors to the safety of US dollar cash and prompted a sharp rise in UST yields. At the end of the month, the US Senate approved a stimulus package worth USD 2 trillion. Overall, 2-year and 10-year UST yields ended the month at 0.25% and 0.67% respectively, about 67 bps and 48 bps lower than prior month.

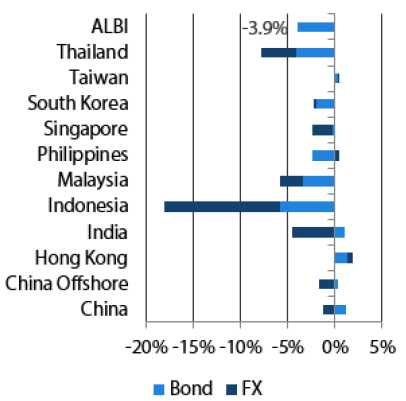

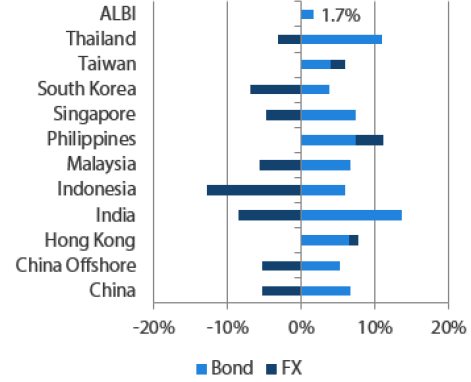

Markit iBoxx Asian Local Bond Index (ALBI)

For the month ending 31 March 2020

For the year ending 31 March 2020

Source: Markit iBoxx Asian Local Currency Bond Indices, Bloomberg, 31 March 2020

Note: Bond returns refer to ALBI indices quoted in local currencies while FX refers to local currency movement against USD. ALBI regional index is in USD unhedged terms. Returns are based on historical prices. Past performance is not necessarily indicative of future performance.

Inflationary pressures in the region fall

The region's consumer price inflation readings for February were mostly lower, providing room for central banks to ease. Inflation in the Philippines eased to 2.60% year-on-year (YoY) from 2.9% in the prior month; Malaysia's inflation fell to 1.3% YoY from a 20-month high of 1.6% in January; and Thailand's inflation came in at 0.74% YoY vs expectations of 0.80%. Singapore’s inflation results for February were disappointing; at -0.1%, core inflation turned negative in February for the first time in over a decade. Inflation in China and India also moderated in February. Indonesia was the exception as its inflation was a slightly higher-than-expected at 2.98%, although this was still within the target range.

Central banks announce monetary and fiscal policies

Regional central banks released aggressive monetary and fiscal policy measures to support their virus-hit economies. Bank Indonesia slashed its key rate to 4.50% and announced a USD 24.6 billion Covid-19 budget, which will widen the budget deficit to 5.07% of GDP. The Philippine central bank resorted to a sharp 50 bps rate cut, while the Bank of Thailand reduced rates to a record low of 0.75%. Malaysia's central bank slashed its interest rate by 25 bps for a second policy session in a row and announced a MYR 250 billion stimulus package. In Singapore, the government earmarked close to SGD 55 billion, which is about 11% of the country’s GDP, to fight the effects of the pandemic. The Monetary Authority of Singapore also re-centred the SGD NEER midpoint slightly lower and reduced the slope to zero, while making no changes to the policy bandwidth. Elsewhere, China's central bank cut its 7-day reverse repo rate by 20 bps to 2.2% while India cut rates and plans to issue certain series of government bonds under the “fully accessible route” (FAR) scheme for foreign portfolio investors.

Travel restrictions imposed to stem the virus; Fitch downgrades its outlook on Thailand

Most Asian countries have imposed lockdowns and travel restrictions to stem the spread of the virus. Separately, Fitch affirmed Thailand's BBB+ credit rating but downgraded its outlook from positive to stable.

Market outlook

Philippine bonds expected to outperform; cautious on Indonesian bonds

The global impact of the Covid-19 virus pandemic has continued to deepen. While the situation in South Korea and China seems to have stabilised, Europe has been hit heavily, and the number of new cases in the US appears destined to keep rising with greater testing now available. Global growth concerns have increased, prompting global bond yields to fall drastically. In light of the outbreak, Asian central banks have been reducing their growth forecasts and maintaining accommodative monetary policies to help support their economies. Within the Asian bond market, we continue to favour the Philippines as the BSP's accommodative policy stance has supported the country's bonds. We are also slightly positive on Indian bonds. The country's inflation has tapered off, providing room for RBI to ease rates further if needed. Meanwhile, we are cautious on Indonesian bonds and the IDR amid the ongoing weakening in global sentiment.

Cautious on MYR and IDR; expect PHP to outperform

On currencies, we are cautious on the MYR and as mentioned earlier, the IDR. Both Malaysia and Indonesia are expected to suffer from substantial fiscal deficit widening due to lower revenue and additional budget stimulus. In addition, the environment of low oil and commodities prices would not be conducive for the terms of trade of both countries. Meanwhile, we continue to favour the PHP and expect it to outperform. We believe that the country's lower reliance on tourism and global trade, as well as its healthy remittance flow, provide resiliency to the currency that keeps it at an elevated level.

Asian credits

Market Review

Asian credit spreads widen on the pandemic and slide in oil prices

Asian credits returned -5.83% in March, driven by the sharp 143 bps widening in credit spreads, which more than offset the fall in UST yields. Asian HG credits performed better than their HY counterparts, declining 3.67%, with spreads widening by 100 bps. Asian HY credit spreads widened 366 bps and total return for the month was -12.63%.

The month saw extreme volatility across the global fixed income markets, driven primarily by the global outbreak of Covid-19, which brought significant disruptions to daily life and economic activity across the world. While the situation in South Korea and China seem to have stabilised, the virus outbreak soon deepened in Europe, the UK and the US, which has witnessed a massive spike in new cases. Sharply higher infection numbers have also been reported across Asia. In addition to the Covid-19 outbreak, the OPEC+ talks failed, causing a steep drop in oil prices as Saudi Arabia and other Middle East producers slashed prices and ramped up production.

Under these circumstances, financial markets across all asset classes, including USTs, have been extremely volatile. Global credit spreads widened significantly from end-February to the third week of March, and Asian credit spreads have followed that trend. There were also significant dislocations along the credit curve, as front-end spreads have widened, sometimes by greater magnitude than those of the longer-end spreads. UST yields also rose around mid-March as funds sought to sell the most liquid assets to meet redemptions, although the situation has since normalised after the Fed’s intervention.

Faced with such significant global market disruptions, policymakers across the world raced to introduce policies and measures to calm the markets. While initially feeble and disjointed, global monetary and fiscal efforts became more coordinated and forceful by the end of March and succeeded in stabilising key segments of the global fixed income markets. However, credit spread levels remain much wider relative to end-February levels despite rebounding sharply in the last week of March; furthermore, liquidity has not fully normalised, even in the US investment grade corporate bond market.

Meanwhile, both hard currency and local currency emerging market (EM) bond markets remain weak on growth prospect concerns, fiscal strain and external vulnerability arising from fiscal and monetary responses to Covid-19, global market conditions, lower oil prices, disruptions to supply chains and the imminent global demand shock. In Asia, for example, over the past week, Indonesian and Indian USD credits have lagged the spread tightening seen in other countries, such as China, Hong Kong, South Korea and Singapore. Asian credit market conditions improved in the last week of March, but sentiment remains fragile and dislocations along the credit curve persist for most credits.

Primary market activity plummets in March

Given the weak market conditions, there was only a trickle of new Asian credit issuances in March. The HG space saw 8 new issues amounting to about USD 3.6 billion, including a USD 2 billion four-tranche issue by China Cinda HK. Meanwhile, the HY space saw approximately USD 2.2 billion of new issues across 9 transactions. Given the improvement in sentiment in the last week of March, primary market activity is likely to pick up in April.

JP Morgan Asia Credit Index (JACI)

Index rebased to 100 at 31 March 2019

Note: Returns in USD. Past performance is not necessarily indicative of future performance. Source: JP Morgan, 31 March 2020

Market outlook

Asian credit to remain volatile until stabilisation of virus outbreak globally, but long-term opportunities are beginning to emerge

Although aggressive central bank actions and unprecedented government fiscal measures have allowed market conditions to pull back from the extremely weak levels seen in mid-March, the Asian credit market is likely to remain volatile in the near-term until the virus outbreaks in Europe and the US stabilise. The risks of a sharp rise in infections across EM countries, including those in Asia, and the continued weakness in oil prices are also factors that could prevent a quick return to normalcy.

The containment measures adopted to stem the Covid-19 outbreak are likely to have a deep, if temporary, impact on economies around the world. The credit fundamentals of corporates, financial institutions and even sovereigns are likely to weaken, making negative credit rating actions inevitable. We currently do not expect widespread defaults to occur across the Asian credit universe, although default rates are still likely to be higher compared to recent years. At the same time, thanks to the big swing in valuation that already took place in March, we also see the potential for significant upside and outperformance from credit selection once the virus outbreak is contained and the rates and credit market dislocations are reversed. The combination of monetary, fiscal and credit policies that have been announced by governments around the world can still drive a meaningful global economic recovery later in the year, in our view.