Snapshot

The novel coronavirus (Covid-19) that took on global significance in January has certainly shaken the financial markets and created a massive public health challenge. While investors scramble to educate themselves on the science of epidemiology, filtering through the barrage of daily headlines, we focused on three main components of this rapidly unfolding health crisis.

The first component, not surprisingly, is the virus itself. How does Covid-19 spread from person to person? At what rate does such community spread occur and what impact does it have on the infected victims? These are all important factors to consider.

The second component to track closely is the actions of governments and central banks in response to the virus outbreak and the potential economic impact that follows. Health professionals will learn more about this particular virus, and their discoveries are likely to be reflected in how various countries deal with the outbreak. For example, China took very strict measures of quarantine and restricted the movement of people in the early weeks. Economic disruptions may prove to be the most extreme in China but perhaps less so in other countries. This suggests that the impact on China’s economy will be more V-shaped because of the heavy containment measures taken, but perhaps more U-shaped (with shallower bottoms) in other countries that employ a more balanced containment/mitigation strategy.

The final component is the reaction of financial markets to the first two factors described above. The market reaction has been quite brutal so far. Dealing with sudden uncertainty has never been a strong point of the markets, with volatility spiking. In the short term, the flow of alarming virus headlines will likely continue and the burden is expected to fall on central banks to provide circuit breakers and put a floor under risk assets. In the name of tightening “financial conditions” (also known as falling stock prices), the Federal Reserve (Fed) has begun the process of lowering official interest rates, followed by its peers. While risk assets will welcome lower rates and easier global liquidity, the real economy will likely require a fiscal response from governments. It is this powerful combination of monetary and fiscal policy that will help the global economy recover once this virus pandemic has run its course, in our view.

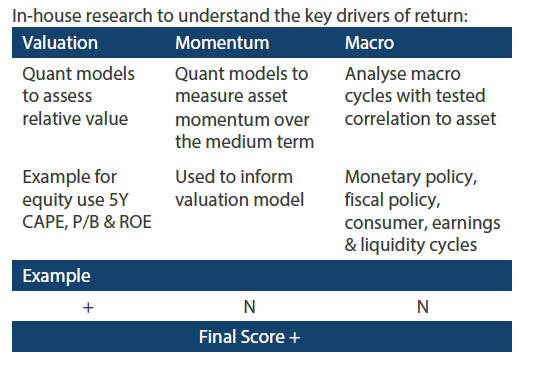

Asset class hierarchy (team view1)

* Average scores for Equity, Sovereign and Credit are weighted average scores, which are computed using market cap weights.

1The asset classes or sectors mentioned herein are a reflection of the portfolio manager’s current view of the investment strategies taken on behalf of the portfolio managed. These comments should not be constituted as an investment research or recommendation advice. Any prediction, projection or forecast on sectors, the economy and/or the market trends is not necessarily indicative of their future state or likely performances.

Research Views

We adjust our asset class views and hierarchies as discussed below.

Global equities

A month ago, US equities seemed as if they could have their cake and eat it too; they were yet to feel the effects of the virus outbreak while benefiting from anticipations that the Fed would pre-emptively cut rates. However, this narrative was suddenly upturned just weeks ago when the number of new Covid-19 cases exploded in countries like South Korea and Italy, quickly becoming apparent that this was a global problem not just limited to China.

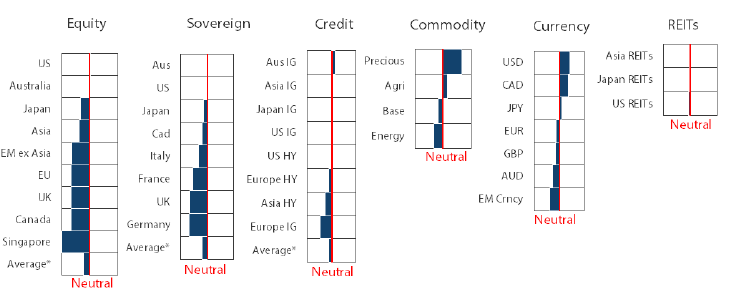

Surprising to many was the swift decline in US equities; on the other hand, China equities still managed to eke out a small positive gain YTD despite enduring a massive societal lock-down to contain the virus, which effectively froze the economy well past the Lunar New Year.

Chart 1: US Equities (S&P 500) versus China Equities (CSI 300)

Source: Bloomberg, March 2020

While some may have viewed the problem initially faced by China to be much graver than disclosed, with their factories not expected to recover quickly, the country seems to be edging back towards normality. New virus cases in China are declining and real time data suggests that the country’s factories are working their way back to productive capacity.

Meanwhile, as China continues to refrain from resorting to a massive credit binge as it did in 2015, the country has pushed a relatively potent array of stimulus geared mostly towards the private sector, including tax breaks, lower rates and ample liquidity aimed at opening up tight bank credit. It is still early to say, but we could begin catching glimpses of a relatively quick recovery.

On the other hand, the rest of the world is just beginning to grapple with a very new problem in which containment may not even be an option considering how porous borders between countries were, which allowed travellers to introduce the virus from multiple locations. Coupled with the lack of test kits and various other government shortcomings, the level of uncertainty over the outbreak is rightly high.

Such uncertainty has inevitably bred caution. Though food retailers may be seeing a temporary boost to sales as shelves are emptied due to “just in case” hoarding, people are expected to change their habits in the intermediate term, curbing their consumption outside the home. Shocks to both the supply chain and the demand side is difficult to assess.

A key factor to watch going forward is the possibility of diminishing uncertainty, whether through a better understanding of the disease or perhaps an eventual, natural hiatus from the problem.

In the meantime, it pays to be cautious towards equities, in our view, but we do see reason to favour places like China, where stimulus is already plentiful and some activity appears to be improving. The US and the rest of the world are still learning to effectively deal with the virus, though value opportunities are emerging.

Global bonds

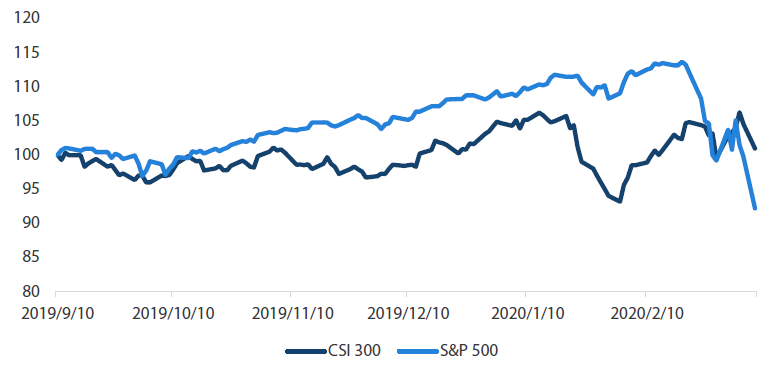

As investor concerns about the spread of the coronavirus increased, global bond yields decreased sharply. Demand for safe haven assets rose when the coronavirus outbreak started to become a prominent market theme around the third week in January. During this period, 10-year US Treasury yields fell from 1.8% to a low of 0.32% before settling around 0.50%. Investor flow data from January and February suggests that Japanese investors were significant buyers of US Treasuries and they may have actually led the rush to safety.

At the same time, market expectations for the Fed Funds rate shifted markedly. We started the year with the markets assigning a roughly 50/50 chance of one easing by the Fed in 2020. But by mid-March the Fed had reduced the benchmark interest rate to a level close to zero and launched a new round of quantitative easing. While some FOMC members had initially expressed scepticism about the need for a monetary policy response in the early weeks of the virus outbreak, the Fed—to their credit—quickly changed its stance to support the economy.

Chart 2: Federal Funds rate and 10yr US Treasury yield

Source: Bloomberg, March 2020

While markets remain virus-headline driven and investors fear worst-case outcomes for the global economy, safe haven demand will likely remain strong. Breaking this cycle probably requires the start of a few events. The first is perhaps obvious, but less alarming news on the spread of virus outside of China, and a peak in new cases globally, would certainly help to calm investors’ nerves. The second would be the emergence of US and global economic data for the first quarter that comes in better than the heavily downgraded forecasts for economic indicators we have begun to see. Virus fears have led investors to expect the worst for upcoming economic data, so indications that economies are holding up better than expected will also work to calm fears. Lastly, demand for safe havens will decrease if investors begin to believe that the Fed’s monetary policy actions are decisive enough and able to provide the risk markets with the support and liquidity needed for an eventual recovery.

Global credit

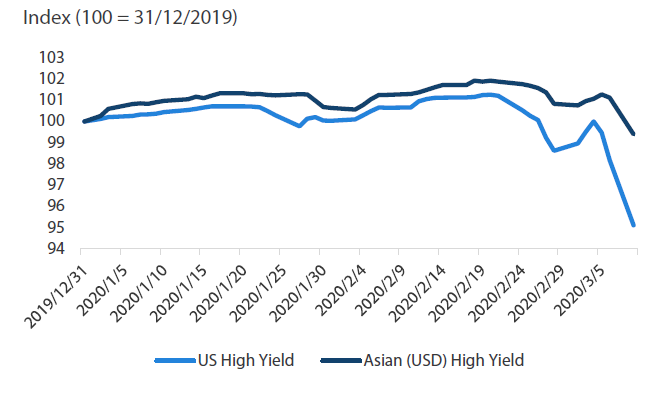

High yield (HY) credit maintained positive returns well into February this year, even as news of the novel coronavirus began emerging from China in January. Also somewhat surprising was the modest outperformance of Asian HY over US HY as shown in chart 3. Aggressive containment actions by the Chinese authorities and liquidity injections from the People’s Bank of China appeared to have been successful in preventing a sharp drawdown. As coronavirus cases began to appear in countries beyond Asia, global equities started to drop and managed to drag HY returns down as well. However, the performance gap between Asian and US HY held and actually began to increase sharply. As Covid-19 cases increase in the US, we expect this HY underperformance to continue. But once the new cases peak, it will present attractive valuations for US HY.

Chart 3: US and Asian (USD) high yield returns

Source: Bloomberg Barclays Indices, Bloomberg, March 2020

FX

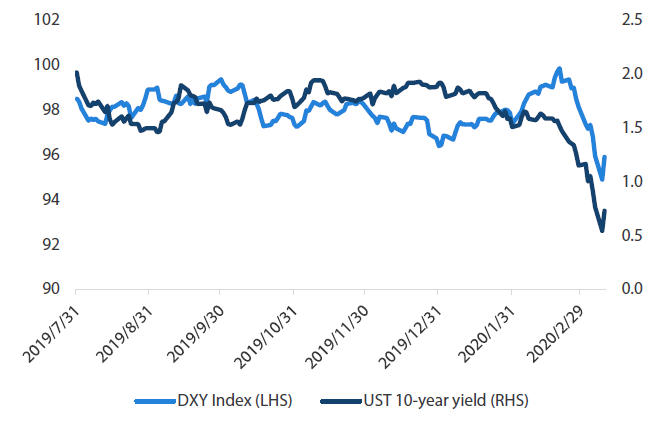

Markets continue to adjust and grapple with the severity and duration of the Covid-19 outbreak and its impact on global growth expectations. Contrary to last month, when the US dollar (USD) strengthened on strong demand for defensive assets, the currency has recently come under significant downward pressure. A sharp decline in US interest rates and compression in yield differentials that lead to a rush to unwind long-USD carry trades drove the dollar lower. This decline by the dollar was the most acute against negative interest rate currencies such as the euro and Japanese yen, both of which strengthened 1.2% and 3.8%, respectively, against the USD since the beginning of the year to the date of writing.

The duration of the USD weakness, in our view, depends on whether the Fed introduces further sizeable rate cuts and keeps downward pressure on US bond yields. The effectiveness of coordinated monetary and fiscal policies employed to mitigate the economic fallout, the containment of Covid-19 and the development of a vaccine for the virus are the key USD drivers in the long term, in our view. The USD might stand to benefit should US growth outperform other developed countries, or should demand for traditional safe haven assets increase.

Chart 4: UST 10Y yield versus Dollar Index (DXY)

Source: Bloomberg, March 2020

Commodities

“It was the best of times, it was the worst of times” is probably the most accurate description for commodities. Just when the markets thought the Covid-19 outbreak was mostly being contained in China, the speed at which the virus then spread globally took everyone by surprise and the markets quickly erupted into chaos. While the situation is still highly fluid, we have turned bearish on crude oil given the demand and supply responses, and moved gold to the top of our hierarchy.

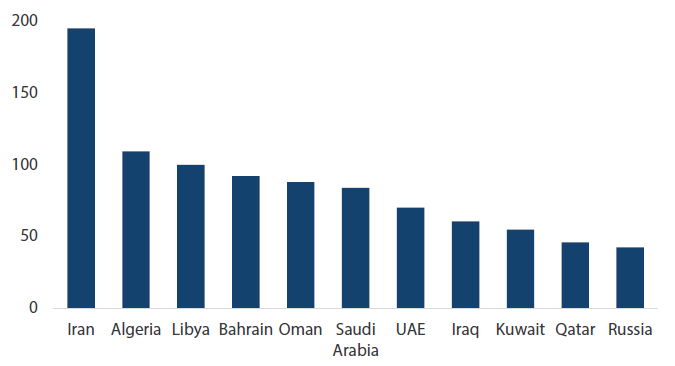

For crude oil, demand destruction is certainly becoming more serious as the Covid-19 outbreak has turned into a global pandemic, and as more travel bans are issued to virus-hit countries. Saudi Arabia signalled its willingness to deepen production cuts to support prices, together with Russia, which was part of an alliance formed in 2016 to manage global supply. We have suggested before that Russia could also consider coming to the negotiation table. However, geopolitical power play pivoted on 6 March, when Russia declined to cut oil production and argued that US shale producers must shoulder the burden of any future production cuts. With much lower fiscal breakeven price and a twin surplus, Russia appears to have a much higher pain threshold. A price war subsequently started, with Aramco immediately lowering prices to its clients in Asia and North America after the meeting. We believe that uncertainties will prevail until the oil market bottoms out.

Chart 5: 2020 Fiscal breakeven oil price assumptions

Source: IMF, Russia Ministry of Finance, March 2020

Gold is on the opposite spectrum, as central banks race to cut rates to buffer their economies from the negative impact of the virus outbreak. The Fed cut the Fed Fund Target rate by 50 basis points (bps) on 3 March following a G7 conference call, implementing its first emergency cut since the 2008 Global Financial Crisis. At that stage, the markets priced in more rate cuts, driving the 10-year Treasury yield to an all-time low, and other central banks followed the Fed. We therefore believe that gold price could continue to march higher on such support from central banks.

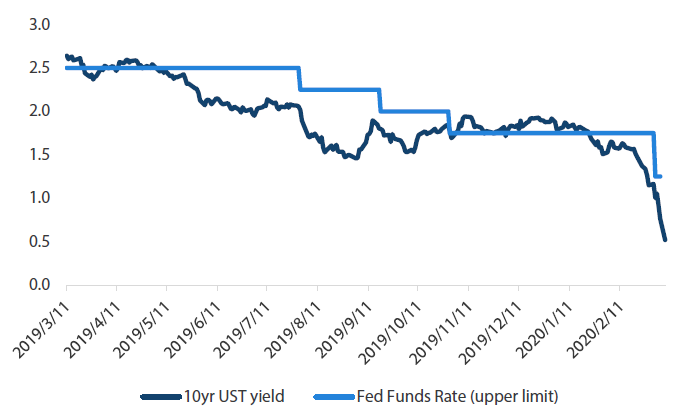

REITs and infrastructure

Together with overall equity markets, REITs and Infrastructure assets plummeted recently, pricing in a severe economic downturn. The coronavirus has spread rapidly around the world, posing considerable headwinds to economic growth. Travelling and leisure activities have weakened significantly, as multiple countries imposed restrictions on visitors from virus-affected regions. For instance, the Singapore government halted the entry of Chinese tourists early in February, while stopping visitors from Iran, South Korea and northern Italy in March. These strict measures helped reduce the spread of the coronavirus at the expense of tourism and shopping activities. Reduced tourism activities could hurt retail REITs because of increased vacancy rates and falling rental incomes. Several leading REITs in Singapore and Hong Kong have already announced supporting packages (e.g. rental rebates) for retail tenants to help them weather this difficult time. Similarly, industrial REITs in Asia may also struggle, due to supply chain disruptions.

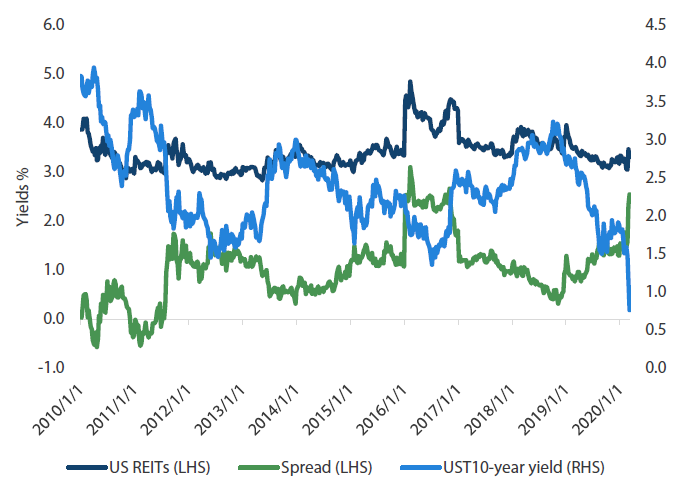

On the other hand, global sovereign yields are sliding to record lows. As we pointed out earlier, falling interest rates typically benefit the valuation of REITs and drive down their financing costs. Now should be a better time for mortgage owners to refinance their loans. As bond proxies in equities, REITs dropped less compared to overall equity markets in the recent rout.

As shown in the chart below, the dividend yield (3.31%) of US REITs currently looks very attractive relative to US Treasury yields of 76 bps. The spread (2.55%) is near its historical high reached during the last decade. Similar developments are taking place in other REITs markets. We believe selected REITs should deserve a place in the portfolio, given favourable low-rates environment and current cheapened valuation levels.

Chart 6: US REITs yields vs US Treasury (10 year) yields

Source: Bloomberg

Process