Summary

The recent sell-off in Asian REITs triggered by the Covid-19 pandemic presents a good entry point for long-term investors to gain exposure to Asia’s biggest landlords. With attractive valuations, sustainable income stream and eye-catching dividend yields, regional REITs, whose medium to long-term outlook remains positive, increasingly look appealing, especially in the current “lower for longer” interest rate environment.

Increasing appeal of Asian REITs

There are not many safe ports in the midst of the harrowing and virulent storm that is currently sweeping across global financial markets. Notwithstanding their defensive characteristics, Asian real estate investment trusts (REITs) were not spared the ordeal during the recent market turmoil, triggered by panic selling by investors in the wake of the novel coronavirus (Covid-19) pandemic.

Although many equity markets around the world have rebounded off their recent lows, the flight to safety towards cash and other safe-haven assets still seems to be the mantra of many shell-shocked investors. But with attractive valuations and eye-catching dividend yields in the aftermath of the recent market carnage, Asian REITs’ inherent attractiveness as an asset class with stable income and long-term structural growth potential is increasingly becoming hard to ignore.

Backed by long-term leases, many regional REITs should continue to generate healthy rental revenue in the interim despite the threat of a virus-hit global economic downturn. To be sure, not all REIT sectors will be negatively impacted by the imminent recessions brought forth by Covid-19 disruptions. REITs in resilient subsectors such as healthcare, data centres and e-commerce logistics facilities will be relatively buffered. While in the harder-hit retail REITs space, those with non-discretionary-anchored properties could still see defensive foot traffic during recessional times.

At the same time, declining interest rates around the world, as global central banks mount an all-out attempt to bolster economic activities with deep rate cuts to combat the recessionary impact of Covid-19, should support the valuations of bond proxies such as REITs, which could also get a boost from massive fiscal stimulus of governments worldwide. In addition, the hunt for attractive yields could be a powerful structural driver for REITs.

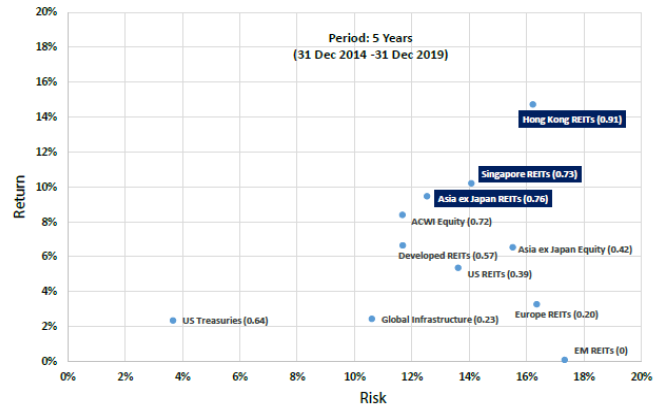

As one of the fast-growing asset classes in the region in terms of market capitalisation, Asian REITs not only have relatively more attractive dividend yields and higher Sharpe ratios as compared to REITs of other regions, they also have relatively low correlations to global REITs, international stocks and US Treasuries, and would continue to provide diversification benefits to investors’ overall asset allocation.

Beneficiaries of falling rates

In a pre-emptive move to contain the economic and financial fallout of the Covid-19 pandemic, the US Federal Reserve (Fed) recently unleashed emergency interest rate cuts of 50 basis points (bps) and 100 bps respectively on 3 March and 15 March 2020, bringing the Fed funds rate to 0–0.25%. Regional central banks, including those in Hong Kong, Indonesia, Malaysia, the Philippines, South Korea, Taiwan and Thailand have also slashed interest rates in a significant way in recent weeks to provide liquidity in their respective markets and give support to their virus-hit economies. In Singapore, the Monetary Authority of Singapore has similarly eased monetary policy in late March by reducing the pace of the Singapore dollar’s appreciation to zero, owing to a deterioration in macroeconomic conditions and expectations of weak economic growth.

Falling interest rates typically bolster the valuations of REITs, which are key beneficiaries of lower borrowing costs. Declining rates not only drive down the financial costs for REITs, boosting their income and revenue due to lower interest expenses; they also provide cheaper funding costs or lower the costs of capital for REITs to do accretive property acquisitions. [An accretive acquisition is the purchase of an asset that leads to an increase in the acquiring REIT’s distribution per unit (DPU)].

Furthermore, a decline in interest rates, which depresses the yields of fixed income securities, tends to increase the relative attractiveness of REITs in terms of dividend yields. As at 31 March 2020, 10-year US Treasuries and 10-year Hong Kong government bonds were yielding less than 1%, while the yield of 10-year Singapore government bonds was less than 1.4%. Meanwhile, the average dividend yield of Asian REITs, as measured by the FTSE EPRA Nareit Asia ex Japan (Net Total Return) REIT Index, was in excess of 7% during the same timeframe.

Not all REITs are vulnerable to the threat of recession

Widespread fears of a severe and prolonged global economic downturn induced by the Covid-19 pandemic have dashed investors’ hopes for an ongoing period of strong fundamentals and robust growth in the regional property and REIT markets. These concerns have weighed down the valuations of many Asian REITs, which on average were down more than 18% as measured by the FTSE EPRA Nareit Asia ex Japan (Net Total Return) REIT Index on a year-to-date basis as at 31 March 2020.

Retail and hospitality REITs have been particularly hard hit during the recent market rout as shopping, dining, travelling and tourism-related activities are curbed due to the current lockdown restrictions and stay at home measures imposed by several Asian countries in their bid to curtail the spread of the coronavirus. Retail REITs, for instance, typically function as mall operators, collecting rents and generating cash flows from leases. Due to the impact of Covid-19, investors are concerned that mall operators could face increased vacancies and long-drawn-out disruptions in rental payments as more retail shops face financial difficulties and cash flow problems. In addition, rental rebates and relief given out by retail REITs to struggling tenants, whose businesses are negatively impacted by Covid-19, could also lead to DPU declines. However, REITs with non-discretionary-anchored properties that provide essential goods could see defensive foot traffic during recessional times.

Elsewhere, in the office REIT space, building owners are also facing challenging times as many companies are currently functioning with minimal on-site staffing as business continuity plans and work-from-home (WFH) measures kicked in due to the Covid-19 pandemic. To be sure, an extended WFH trend in the corporate world as well as a rise in unemployment levels could potentially result in lower demand for office space and put a dent on the revenue growth of office REITs in the long run.

Fortunately, Asia’s office sector is buffered by a very low level of vacancy and limited upcoming supply in the next few years. In Singapore, for instance, there is also a growing likelihood of reduced supply in the country’s office space as older buildings are redeveloped and partially converted for other uses as part of the Urban Redevelopment Authority’s new masterplan.

Furthermore, the rise of unique and new economy-driven property segments, namely data centres and e-commerce logistic hubs and others, in recent years have given REITs more access to non-traditional and differentiated property areas, which are driven by secular themes, such as big data, the rise of e-commerce and the rollout of 5G wireless networks. This has resulted in the REIT market becoming less cyclical in nature.

Indeed, REITs in hard-wearing sectors, such as healthcare, data centres and e-commerce logistics facilities could be less affected by a recession and may even benefit from the Covid-19 outbreak. For example, regional REITs that manage healthcare properties in the healthcare space, namely hospitals, medical office buildings, clinics and life sciences research facilities, could remain resilient as virus-testing procedures, treatment and healthcare needs mount due to the Covid-19 outbreak. Healthcare REITs are also protected by master leases structured with generous downside protection. Likewise, data centres could see a rise in demand as the coronavirus pandemic leads to a sharp rise in internet shopping, e-commerce, video conferencing and online entertainment as more people stay at home or work from home as social distancing measures are implemented across the world.

All things considered, it is not all doom and gloom for the entire REIT sector in the Asia ex-Japan region. We believe that an experienced and active fund manager will be able to separate the wheat from the chaff in the REITs arena even as economic uncertainties set in. While the hard-hit hospitality and retail REITs are currently out of favour as Covid-19 fears persist, structural growth plays such as data centres and healthcare REITs will continue to look attractive. As for REITs negatively affected by the Covid-19 crisis, it is important for long-term investors to differentiate those whose impacts are permanent and the ones that are temporary. For good-quality REITs, which are only temporarily affected and should see activity returning to pre-crisis level, this market correction provides a good long-term entry point for patient investors with a long-term horizon.

A rapidly growing asset class with attractive risk-adjusted returns

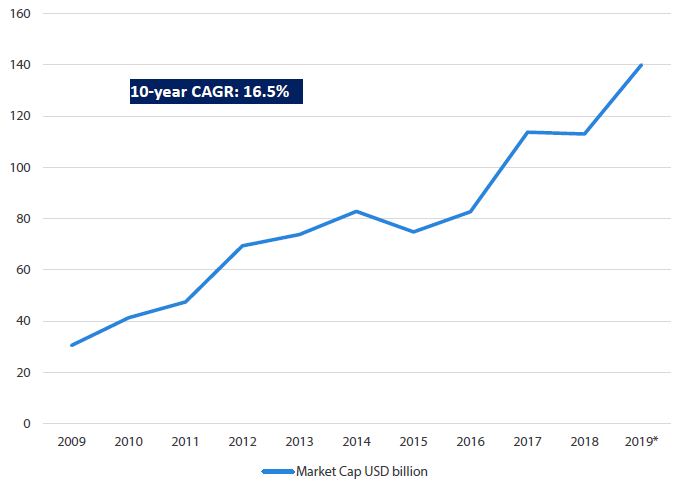

For longer-term-focused investors, the attractiveness of regional REITs remains intact. Asian REITs continue to be one of the fastest growing asset classes in the region, expanding in terms of depth and breadth. The sector is also becoming more liquid as the number of listings and total market capitalisation have grown significantly in the last decade. For instance, total market capitalisation for REITs listed in Asia ex-Japan has grown in excess of USD 100 billion since the first REIT listing in 2002 (see Chart 1).

Chart 1: Market Capitalisation of Asian REITs

Source: Bloomberg, Nikko AM as at *30 September 2019, as measured by the FTSE EPRA Nareit Asia ex Japan REIT Index

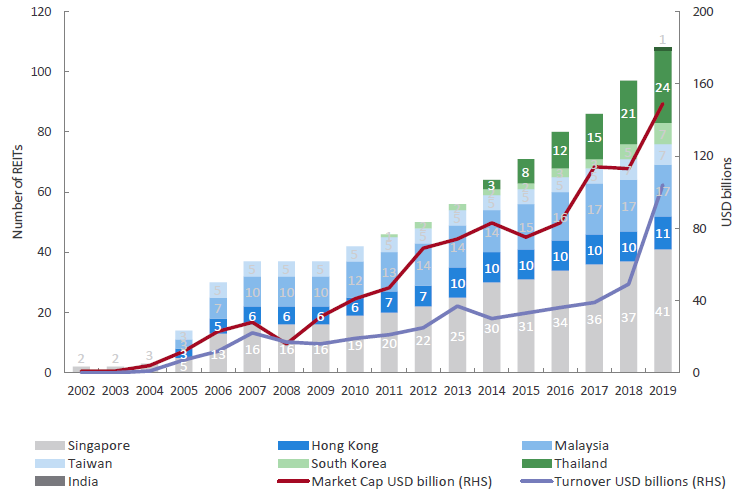

Currently, the majority of REITs in Asia are listed in Singapore and Hong Kong. Since the listing of the city state’s first REIT (CapitaLand Mall Trust) back in 2002, Singapore has seen initial price offerings (IPO) of another 40 REITs, of which seven were foreign-currency-denominated, bringing the total number of listings to 41 (see Chart 2). Hong Kong, on the other hand, has 11 REIT IPOs since 2002. The REITs listed in these two developed Asian economies together make up over 80% of market capitalisation of the asset class in the Asia ex-Japan region. However, the listing trend of regional REITs is broadening beyond Singapore and Hong Kong to different Asian markets including Malaysia, Thailand, South Korea and India, which listed its first REIT in 2019. We expect more countries in Asia to offer REIT products over time.

Chart 2: Growth of the Asia ex-Japan REIT market

Source: Bloomberg, Nikko AM as at 31 December 2019

Over the last five years, Asian REITs have generated higher Sharpe ratios vis-à-vis REITs in other regions, owing to higher returns for per unit of risk taken (see Chart 3). In addition, regional REITs have relatively low correlations as compared to global REITs and global listed infrastructures (see Table 1), and would continue to provide diversification benefits to investors’ overall asset allocation.

Chart 3: Asian REITs exhibit better risk-adjusted returns

Source: Bloomberg as at 31 December 2019

Table 1: Asian REITs have low correlation with other asset classes

Source: Bloomberg as at 31 December 2019

Outlook for Asian REITs

Without a doubt, the Covid-19 pandemic has dealt a harsh blow to economies and financial markets around the world, including those of Asia, stoking fears of a severe and prolonged global economic recession. As a result of pervasive risk aversion, a compression in credit conditions and the prospect of weaker property fundamentals, Asian REITs have come under selling pressure of late. Despite short-term headwinds, the outlook for regional REITs over the medium to long term continues to look positive, in our view, especially in the current “lower for longer” interest rate environment.

We believe that long-term drivers such as positive structural reform in the region, a potential shift in global growth leadership from the US to Asia and the emergence of new property segments with structural growth, such as data centres and e-commerce logistic facilities, should continue to support revenue growth and enhance fundamentals in the Asian REIT sector.

Within the region, we are mostly positive on REITs in Singapore and India over a three-year basis. In Singapore, business parks fundamentals continue to improve due to a lack of supply as well as supportive demand from companies in the technology and pharmaceutical sectors. The logistics sector should also benefit from the easing of supply coupled with strong demand from the e-commerce sector. While their short-term outlook seems uncertain due to the coronavirus pandemic, the office and hotel markets should recover and see healthy income growth over the medium to long term as supply peaks. Moreover, Singapore’s status as a gateway to Asia as well as a wealth management hub with its business-friendly environment will likely continue to benefit office REITs, which have exposure to some of the best office assets in the region.

In India, we are positive on REITs that own high-quality offices, as demand for such space in key cities is far outpacing supply.

In Hong Kong, given the lack of immediate resolutions to its political crisis, we think social unrest in the territory could persist for a while. Meanwhile, the Chinese government is tackling Hong Kong’s societal and political issues through an accelerated development of the Guangdong-Hong Kong-Macau Greater Bay Area (GBA), which covers about 56,000 square kilometres. The GBA will be positive for real estate in Hong Kong over the longer term. Its position as a financial hub and gateway to China continue to give Hong Kong office REITs an edge. The office market in the Central region will remain supported by an extended period of low supply, while mainland companies continue to drive office demand within Hong Kong Central in the medium term due to the accelerated GBA development.

All in all, in our view, the recent sell-off in Asian REITs brought about by the Covid-19 pandemic presents a good entry point for long-term investors to gain exposure to Asia’s biggest landlords and to buy into an attractive asset class with a decent yield and sustainable income stream.