Summary

- Regional markets staged a big rebound in April, as the daily number of Covid-19 cases in several regional countries started to fall. Continued fiscal and monetary stimulus also lifted sentiment. The MSCI AC Asia ex Japan Index surged 9.0% in US dollar (USD) terms for the month.

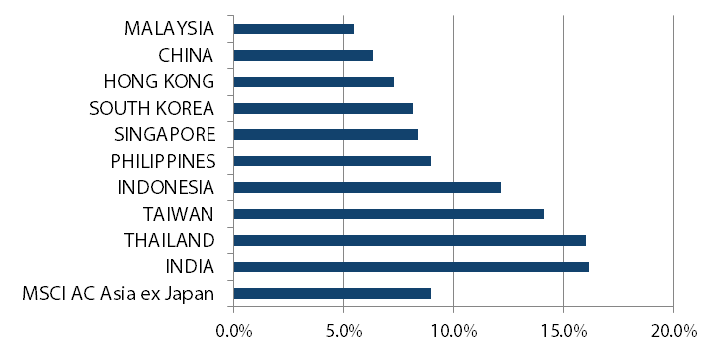

- Shrugging off rumours of a sovereign credit rating downgrade, Indian stocks surged 16.1% in USD terms and outperformed all other regional peers in April. In the ASEAN region, the standout performers were Thailand and Indonesia, which turned in double-digit USD gains for the month.

- China stocks lagged their regional peers with monthly USD gains of 6.3%, as investors turned cautious after the country's 1Q 2020 GDP shrank 6.8% on a year-on-year basis.

- Notwithstanding the hit to the global economy thus far, and the potential write-off of 2020, we remain watchful for large discrepancies between value and price in businesses that we believe are well positioned for the future. Overall, we are positioned in areas of innovative technology and remain more positive on North Asian markets than those of India and ASEAN.

Asian equity

Market review

Asian equities stage a big rebound in April

After three consecutive months of losses, Asian stocks finally ended their losing streak in April with the regional markets staging a big rebound as the daily number of Covid-19 cases in several regional countries started to fall. Continued fiscal and monetary stimulus by Asian governments and central banks, as well as rising optimism as countries started to gradually ease their lockdown measures also lifted regional equities in April. This was despite major turmoil in the oil market notwithstanding an OPEC+ deal.

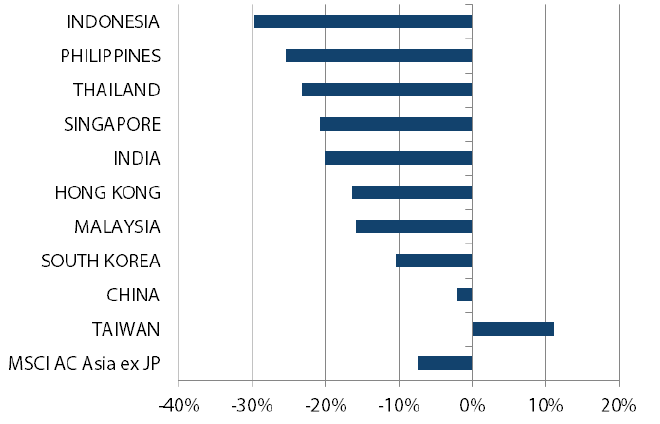

Most Asia ex-Japan currencies finished higher in April against a flat US dollar (USD). Cyclicals bested defensives, while value outperformed strongly as a style. For the month, the MSCI AC Asia ex Japan Index rose 9.0% in USD terms and all Asian equity markets saw positive monthly returns. Within the region, India and Thailand were the best performers, while Malaysia and China were the laggards.

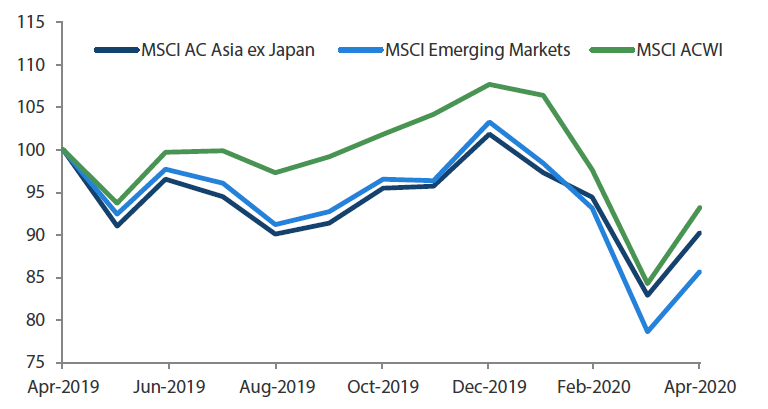

1-year market performance of MSCI AC Asia ex Japan versus Emerging Markets versus All Country World Index

Source: Bloomberg, 30 April 2020. Returns are in USD. Past performance is not necessarily indicative of future performance.

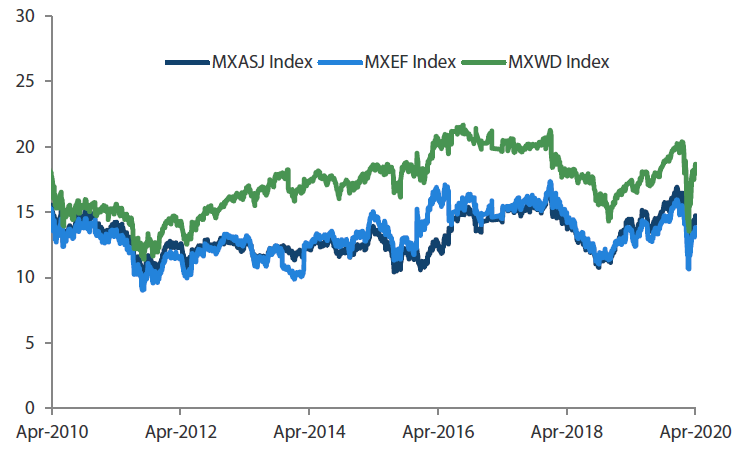

MSCI AC Asia ex Japan versus Emerging Markets versus All Country World Index price-to-earnings

Source: Bloomberg, 30 April 2020. Returns are in USD. Past performance is not necessarily indicative of future performance.

India and Thailand outperform

Shrugging off rumours of a sovereign credit rating downgrade, Indian stocks surged 16.1% in USD terms and outperformed all other regional peers in April. Market sentiment was lifted by the Reserve Bank of India's 25 basis points repo rate cut to 3.75% and the announcement by the Indian government that it would partially ease lockdown restrictions, allowing neighbourhood and standalone shops to open.

In the ASEAN region, the equity markets of Thailand (+16.0%) and Indonesia (+12.1%) turned in double digit USD gains for the month, while those in the Philippines, Singapore and Malaysia rose 9.0%, 8.4% and 5.5%, respectively, in USD terms. Despite a slew of disappointing 1Q 2020 economic numbers, sentiment in most ASEAN markets was supported by easing coronavirus cases, further government stimulus and currency gains against the USD. In Singapore, the government announced a set of "circuit breaker" measures at the start of the month to stem the spread of Covid-19 in the community as infection rates among foreign workers living in dormitories surged.

China stocks lag regional peers

North Asian markets tracked the strong regional rebound, with Taiwan rallying 14.1% in USD terms in April, while South Korea and Hong Kong turned in USD gains of 8.2% and 7.3%, respectively. In South Korea, President Moon Jae-in's ruling Democratic Party won the country's general election in April, claiming the biggest majority in the National Assembly by any party since the start of South Korea's democracy in 1987. Elsewhere, China stocks lagged their regional peers with monthly USD gains of 6.3%, as investors turned cautious after the country's 1Q 2020 GDP shrank 6.8% on a year-on-year basis. That is the first GDP decline since China began reporting quarterly data in 1992. Meanwhile, China has set the date for its long-awaited parliamentary meetings, collectively known as "two sessions" or Lianghui. Markets now await these meetings for guidance.

MSCI AC Asia ex Japan Index1

For the month ending 30 April 2020

Source: Bloomberg, 30 April 2020

For the period from 30 April 2019 to 30 April 2020

Source: Bloomberg, 30 April 2020

1ote: Equity returns refer to MSCI indices quoted in USD. Returns are based on historical prices. Past performance is not necessarily indicative of future performance.

Market outlook

Pandemic exposes fragility but galvanises resilience

“People often claim to hunger for truth but seldom like the taste when it’s served up”, noted George R.R. Martin, author of best-selling novel series A Song of Ice and Fire (better known as A Game of Thrones). And so it is with what the Covid-19 pandemic has brought to light—nationalism, protectionism, social and economic inequality (of nations, and people within nations), inadequacy of infrastructure (especially healthcare), the fragility of business models and relationships, efficient functioning of government (and the lack thereof), and the damage done to nature. On the brighter side, it has also highlighted human ingenuity and resilience, the ability of cooperate, and global interconnectedness (despite de-globalisation since 2008).

The long-term investment implications are an acceleration of some trends (reconfiguration of global supply chains, ever-increasing digitisation, greater awareness of the environment and sustainability in ESG) and the rise of new trends (redirection of investment into services and technology infrastructure, Modern Monetary Theory, potential for greater discord among nations). Hence, notwithstanding the hit to the global economy thus far, and the potential write-off of 2020, we remain watchful for large discrepancies between value and price in businesses that are well positioned vis-à-vis our understanding of the future, with enduring moats and clear ESG agendas.

Positioned in areas of innovative technology

China has been circumspect in the manner in which it has attempted to stimulate the domestic economy, with spending on infrastructure directed towards the new—technology, network and renewables-related—rather than the old. This continued commitment to quality over quantity and ample latitude on policy (both fiscal and monetary) is reassuring for the longer term even as the domestic market is looking to the Lianghui for near-term direction. Our holdings in software companies and online services companies, as well as insurance, healthcare and industrial automation, reflect this.

A “China+1” strategy is reshaping supply chains, particularly in technology, which augurs well for Taiwan and South Korea. Both these countries are home to more than a handful of global technology leaders; these countries also boast strong fiscal balances. We continue to be well positioned in these countries within the technology universe.

Selective in India and ASEAN

India’s economy will be severely tested by the Covid-19 outbreak given an under-developed healthcare system, and a large informal cash-based economy. However, the longer-term dividends accruing from reforms initiated over the past few years are undeniable. We continue to focus on structural trends, such as formalisation of the economy and greater digital penetration via holdings in private banks, digital services and logistics.

Like India, the ASEAN region is ill-positioned to handle the Covid-19 pandemic, owing to reactive politics and challenging economics. Broadly, we remain unenthused on ASEAN, where we have only select holdings that benefit from global trends.

Appendix

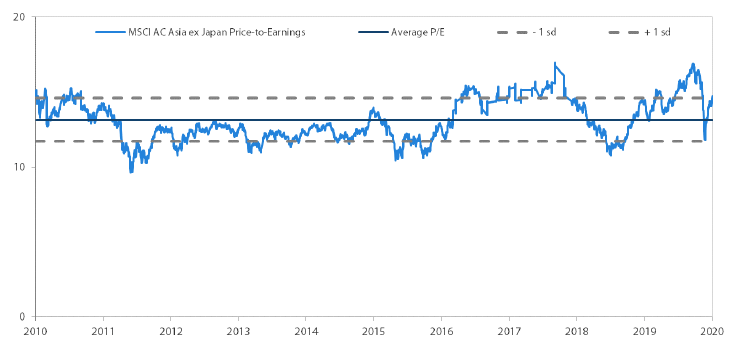

MSCI AC Asia ex Japan price-to-earnings

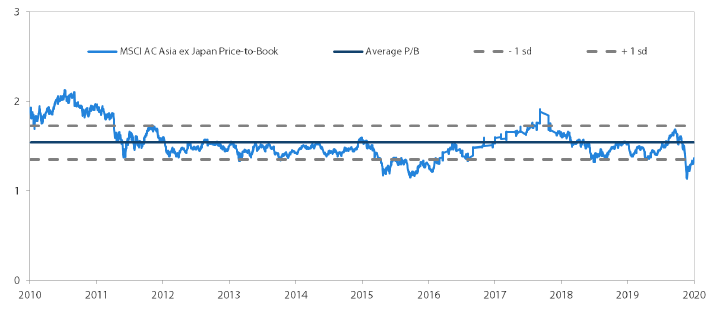

MSCI AC Asia ex Japan price-to-book

Source: Bloomberg, 30 April 2020. Ratios are computed in USD. The horizontal lines represent the average (the middle line) and one standard deviation on either side of this average for the period shown. Past performance is not necessarily indicative of future performance.