Summary

- US Treasuries (USTs) traded in a relatively narrow range in April, following extreme volatility in the previous month. Downbeat economic data and unprecedented oil price turbulence anchored yields at low levels, while policy support from the Federal Reserve (Fed) and optimism towards the re-opening of economies offset some of the downward pressure on yields. The 2-year and 10-year UST yields ended the month at 0.20% and 0.64%, respectively, about 5 basis points (bps) and 3 bps lower than the prior month.

- Asian credits returned 1.81% in April, driven mainly by an 18 bps tightening by credit spreads, although UST yields also declined. The significant improvement in risk sentiment led high-yield (HY) credits to outperform, gaining 4.46%, with spreads contracting 89 bps. High-grade (HG) credits registered total returns of +1.05%, with spreads tightening 3 bps.

- In April, there were 22 new Asian credit issues which raised a total of USD 18.64 billion in the market. Most were from the HG space, which saw a total of 19 new issues amounting to USD 17.7 billion. The HY space remained tepid, with just 3 issues amounting to USD 0.94 billion in the month.

- Inflation readings within the region fell, owing largely to lower oil prices. Regional central banks injected more liquidity into the financial system and announced further supplementary budgets to help economies cope with the impact from COVID-19. Meanwhile, credit rating agencies downgraded their outlooks on Indonesia and Thailand.

- We favour Philippine, Thai and Chinese bonds as we expect the respective governments to provide further support measures. On currencies, we continue to favour the Philippine peso (PHP) as the country's lower reliance on tourism and global trade, as well as its healthy remittance flow, make the peso resilient.

- We expect Asian credit markets to remain volatile as investors wait for more clarity. Nevertheless, we see a certain selection within the credit market potentially outperforming once the virus outbreak is contained. The combination of monetary, fiscal and credit policies that have been announced by governments around the world can still drive a meaningful global economic recovery later in the year, in our view.

Asian rates and FX

Market review

UST yields end lower

USTs traded in a relatively narrow range in April, following extreme volatility in the previous month. Downbeat economic data and unprecedented oil price turbulence anchored yields at low levels, while policy support from the US Fed and optimism towards the re-opening of economies offset some of the downward pressure on yields. The month opened to significantly soft data from the US, as March nonfarm payrolls dropped 701,000 and the unemployment rate rose to 4.4%. Overall market sentiment did not, however, remain sombre for long. The Fed's announcement of an additional USD 2.3 trillion in emergency financing for businesses, as well as state and local governments, triggered positive risk momentum. China's data revealing a broad-based recovery in March further supported positive risk momentum. Thereafter, a shortage in physical storage amid diminishing demand drove West Texas Intermediate (WTI) oil prices to negative levels, sparking another swing in sentiment. Towards the month-end, optimism about the possibility of economies re-opening boosted risk sentiment anew. Overall, 2-year and 10-year UST yields ended the month at 0.20% and 0.64%, respectively, about 5 bps and 3 bps lower than the prior month.

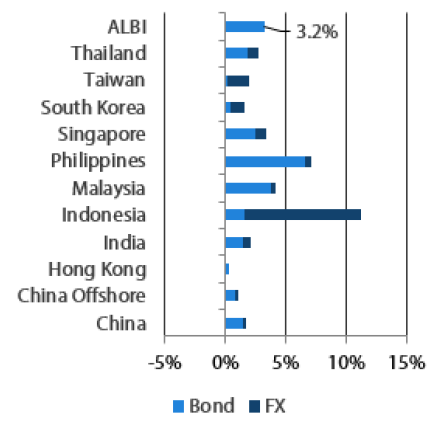

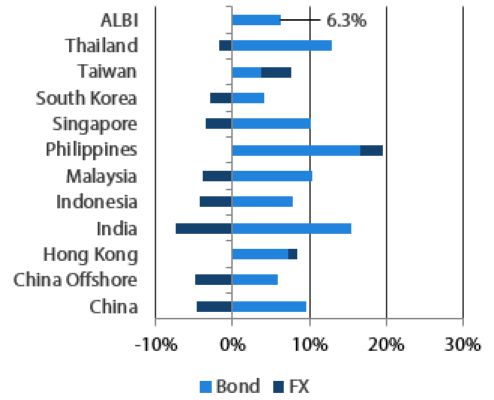

Markit iBoxx Asian Local Bond Index (ALBI)

For the month ending 30 April 2020

For the year ending 30 April 2020

Source: Markit iBoxx Asian Local Currency Bond Indices, Bloomberg, 30 April 2020

Note: Bond returns refer to ALBI indices quoted in local currencies while FX refers to local currency movement against USD. ALBI regional index is in USD unhedged terms. Returns are based on historical prices. Past performance is not necessarily indicative of future performance.

Inflationary pressures in the region fall

Regional headline consumer price index (CPI) prints mostly fell in March, due in part to lower oil prices. Headline CPI in the Philippines eased to 2.5% year-on-year (YoY) from 2.6%, while a similar gauge in China slowed to 4.3% from 5.2%. Malaysia and Thailand's annual consumer inflation rates both turned negative, to -0.2% and -0.54%, respectively. In Singapore, core inflation fell deeper into negative territory on the back of a steeper decline in the cost of services. Elsewhere, the lower headline CPI print in India was due mainly to a broad-based moderation in food inflation.

Central banks inject further liquidity into the financial system

Regional central banks announced further measures aimed to channel liquidity to the economy. Apart from lowering the Reserve Requirement Ratio (RRR) for rural banks and small city commercial banks by 100 bps, the People's Bank of China also cut the interest rate it pays on banks' excess reserves by 37 bps. In addition, China's central bank reduced the one-year and five-year loan prime rates, and lowered the rates for both the Medium-term Lending Facility and Targeted Medium-term Lending Facility. Elsewhere, the Philippine central bank delivered an off-cycle 50 bps policy rate cut, while Bank Indonesia lowered the RRR of conventional banks and shariah banks and announced further macro-prudential measures. In South Korea, the central bank expanded the range of bonds eligible for its open market operations. Meanwhile, the Reserve Bank of India reduced the reverse repurchase rate by 25 bps; it also announced a more calibrated tranche of targeted long-term repo operation to direct liquidity to shadow banks and stepped up purchases of debt in the secondary market.

Governments announce further supplementary budgets

Regional policymakers continued to roll out expansionary fiscal measures in April to cope with the devastating impact caused by the COVID-19 outbreak. In Singapore, the government announced a SGD 5.1 billion stimulus package days after a set of circuit breaker measures were introduced to stem the spread of COVID-19 in the community. This was subsequently boosted by a further SGD 3.8 billion. Similarly, the finance minister of Thailand revealed a third fiscal stimulus package worth THB 1 trillion, although details of the stimulus remain scarce. Elsewhere, South Korean President Moon Jae-in said that the government is preparing a third supplementary budget, and that it is looking to sharply increase subsidies to secure jobs and help businesses stay afloat.

Credit rating agencies downgrade their outlook on Indonesia and Thailand

Standard & Poor’s revised its outlook for Indonesia's sovereign credit rating to “negative”. According to the credit rating agency, the move is to reflect weakened public and external debt positions amid "currency [and] fiscal stress". Separately, Moody's Investors Service changed its outlook on Thailand's sovereign credit rating to “stable”, noting that the drivers of the outlook change to “positive” have become significantly less likely to materialise. Notably, both revisions had marginal impact on bonds.

China's first quarter GDP growth slides 6.8%; bank lending surges in March

China’s first quarter growth registered a sharp 6.8% contraction as the COVID-19 outbreak paralysed economic activity. That said, separate data showed high frequency economic indicators rebounded in March, as lockdowns were gradually lifted. Meanwhile, Chinese credit data jumped in March. Aggregate financing increased by RMB 5.15 trillion, trumping expectations of a RMB 3.14 trillion rise. This was supported in part by robust credit bond issuance. Financial institutions offered RMB 2.85 trillion of new loans in the month, about RMB 1 trillion more than expected, and three times more than February's RMB 906 billion.

Market outlook

Philippine, Thai and Chinese bonds expected to outperform

Regional policymakers have taken unprecedented steps to backstop their economies, prompting significant improvement in risk tone. However, extensions of lockdowns and wide-scale social restrictions will further constrain economic growth, warranting additional fiscal stimulus to support businesses and households. This means markets will have to grapple with concerns over fiscal funding and a possible increase in bonds supply.

Against this backdrop, our preferences are for Philippine, Chinese and Thai government bonds. We share the view that the Bangko Sentral ng Pilipinas is likely to remain active in providing further support measures via policy rate or RRR cuts. This, together with the relatively high carry that Philippine bonds offer should support demand for the space. Similarly, we believe that the Bank of Thailand will ease monetary policy further, as growth remains weak and inflation low. For now, the additional bond supply looks manageable, in our view. China's central bank will likely step up monetary stimulus as well, via RRR cuts, policy rate cuts and relending policies, which should further support the rally in Chinese government bonds.

Expect PHP to outperform

We continue to favour the PHP and expect it to outperform. The country's lower reliance on tourism and global trade, as well as its healthy remittance flow, are reasons that make the peso resilient and should keep it elevated.

Asian credits

Market Review

Asian credit spreads tighten as risk sentiment improves

Asian credits returned 1.81% in April, driven mainly by an 18 bps tightening by credit spreads, although UST yields also declined. The significant improvement in risk sentiment led HY credits to outperform, gaining 4.46%, with spreads contracting 89 bps. HG credits registered total returns of +1.05%, with spreads tightening 3 bps.

The month started with more bad news on the COVID-19 pandemic keeping sentiment under pressure, as infections and fatalities continued to increase. Many Asian countries are still trying to contain the pandemic with lockdowns, and the effects of the virus is starting to be reflected by economic data. Sentiment took a turn after the Easter holidays thanks to the Fed’s additional measures, the COVID-19 situation showing some improvement in Europe and US President Donald Trump’s plans to reopen the economy. Credit spreads stabilised and tightened with greater policy support from regional policymakers and positive economic data from China revealing a relatively broad-based recovery in March. However, shortage in physical storage amid diminishing demand drove WTI oil prices to negative levels, sparking another swing in sentiment. The implosion in the oil market caused spreads of HY credits to partially reverse the tightening seen since early April. Towards the month-end, investors were encouraged by an improvement in COVID-19 data; while macroeconomic indicators were poor, the possibility of global economies gradually re-opening was seen as a positive sign. Investor sentiment improved further in late April with a US pharmaceutical company announcing that it had some early success in finding a medical solution to COVID-19.

Performance diverged across countries in April. Indian credits outperformed after significantly widening in March. Sentiment was partially lifted by the Indian central bank’s announcement of a second tranche of liquidity boost for the economy. Chinese, Philippine, Malaysian and Indonesian credit spreads also tightened in the month. In contrast, there was pronounced weakness in Thai financials’ subordinated debt after Fitch downgraded some of the Thai bank Tier 2 subordinated debt ratings to high-yield. However, the issuers have retained their investment grade rating.

Primary market activity reopens

In April, 22 new issues raised a total of USD 18.64 billion in the market. Most of these were from the HG space, which saw a total of 19 new issues amounting to USD 17.7 billion. This included a mammoth USD 6 billion three-tranche issue by Petronas and a large USD 4.3 billion Indonesian sovereign issue. Primary market activity within the HY space remained tepid, with just 3 issues amounting to USD 0.94 billion in the month.

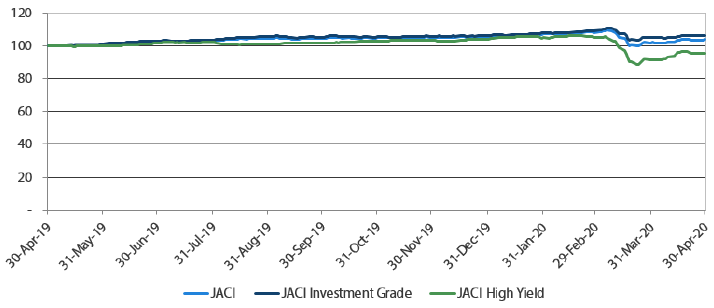

JP Morgan Asia Credit Index (JACI)

Index rebased to 100 at 30 April 2019

Note: Returns in USD. Past performance is not necessarily indicative of future performance. Source: JP Morgan, 30 April 2020

Market Outlook

Asian credit markets to remain volatile as investors wait for more clarity with more economies to reopen

Market conditions have improved in April, as we witnessed China showing signs of economic recovery and a flattening of the COVID-19 curves in Europe and the US. This has led to optimism that the global economy will reopen eventually. Risk-on sentiment was also fuelled by decisive central bank actions, which included the loosening of fiscal policies to lessen the pain of current economic woes. That said, markets will likely remain volatile and fundamentals are expected to remain under pressure given the sharp slowdown in economic growth led by the sudden stop in activities. Moreover, uncertainty remains over the depth and length of this slowdown, while the crude oil complex continues to be under pressure. Much hinges on whether social distancing measures can contain the COVID-19 pandemic. However, the reopening of economic activities will likely be gradual, which means the economy will not return to normalcy any time soon. Nevertheless, we see potential for upside and outperformance from credit selection once the virus outbreak is contained. The combination of monetary, fiscal and credit policies that have been announced by governments around the world can still drive a meaningful global economic recovery later in the year, in our view.