The state of play

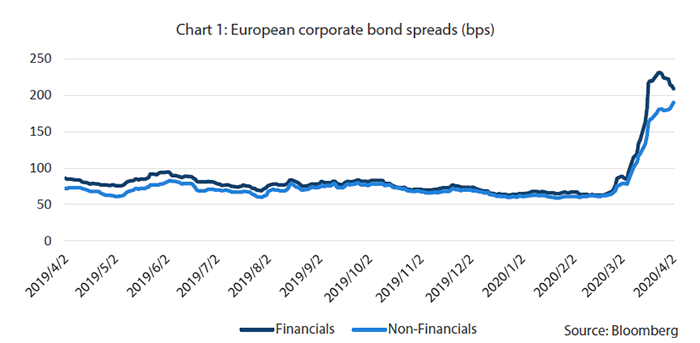

The European corporate bond market has faced significant losses since its spreads hit lows in February 2020. Non-financial credit spreads have widened by more than 120 basis points (bps) while spreads of financial bonds have increased by almost 170 bps (Chart 1). The lockdown in response to the coronavirus epidemic has impacted economic as well as social life; its implications for the European corporate sector scared investors and triggered the sell-off. In addition to the changed economic reality, bleak market technicals have further pressured bond spreads, and over the last couple of weeks the market has seen substantial outflows. While tighter regulatory requirements have already reduced banks’ risk appetite over the last few years, the current situation in which traders work from home with limited interaction with other traders has also reduced willingness to bid for bonds.

What does all of this mean for the overall European corporate bond market and its sub-sectors? We dare not speculate when the situation could normalise with the European workforce returning to its factories and offices. Neither do we want to speculate on when the number of infections will plateau or what the mortality rate will be. At this moment we think it is more important to focus on the known facts, such as the support the European Central Bank (ECB) is providing to the market, and the implications for spread performance.

Here we have to distinguish between the corporate bond purchases supporting the non-financial sector and regulatory relaxation helping the banks. Let us start with the non-financials. As of mid-March, the size of the non-financial corporate bond universe was EUR 1.3 trillion, of which EUR 700 billion were ECB-eligible corporate bonds (defined by iBoxx indices). Currently the ECB owns EUR 141 billion of eligible bonds (or as much as EUR 200.2 billion, when considering non-iBoxx corporate bonds) and analysts expect the central bank to buy an additional EUR 15–30 billion per month until the end of the year. The ECB has committed itself to purchase EUR 1.2 trillion of bonds across the fixed income spectrum, which would eventually make it the owners of a substantial part of the corporate bond market. Previously the ECB was constrained by self-imposed restrictions, i.e. issuer limits. But some of these limits have been lifted, enabling the ECB to move more aggressively. We expect the central bank to continue refining the design of its different bond purchase programs in order to improve access to the bond market and achieve their overall goals.

At the moment the ECB is shifting the focus of its corporate bond purchases from supporting its inflation goals and controlling volatility to becoming the ultimate backstop for European corporates. By employing such a backstop, the ECB’s actions will increasingly drive the spreads in the market, meaning that spreads are most likely to tighten on a medium-term basis.

Considering such a development, we would strongly argue for holding credit exposure to European corporates as most bonds that are sold will ultimately end up with the ECB at some point, and this will have a positive impact on bond valuations. While the technical side provides an argument for holding a long position in non-financials, our positive view on the banking sector is driven by fundamental and regulatory considerations.

Banks to the rescue

Back in 2008 banks played a role in causing the global financial crisis, but this time they could provide the cure. Governments as well as central banks have announced massive support programs and the banking sector will play an important role in bringing money to the people and companies in need. Banks are now getting paid 75bps if they borrow money from the ECB and lend to their customers—a massive incentive to lend.

In mid-March the ECB relaxed regulatory constraints on banks in the eurozone, freeing up EUR 120 billion of common equity. The latter will lead to an additional lending capacity of EUR 1.8 trillion. One of the measures announced was an easing of NPL (non-profitable loans) provision rules. If a loan is backed by a government guarantee, banks will not have to apply provisions for NPLs. On the flip side, banks are being asked by the regulator to stay measured when it comes to dividend distributions and to preserve capital.

Beside the regulatory changes, another argument that supports our bullish view of bank bonds is improved fundamentals. Capital ratios have massively improved over the last decade, as has asset quality, thanks to a benign economic environment and a healthy reduction in NPLs. Because of regulatory and fundamental improvements, at the moment banks are the last sector in which we would expect default rates to increase. Within the different layers of the banking capital structure we have identified senior non-preferred bonds as the most attractive re-entry point for investors.

In this paper we predominantly discussed the opportunities in the European corporate bond market in light of recent actions by the ECB. But most readers are aware that other central banks have introduced corporate bond purchase programs as well and regulators worldwide have also given greater leeway to banks. However, at the moment we see Europe in a truly unique position, given the volume of the ECB’s bond purchases relative to the overall market size and the relatively unconstrained nature of the program. Other central banks such as the US Federal Reserve are also going to buy corporate bonds. But the Fed will focus its direct purchases solely on the short-end of the curve and limit itself to investment grade bonds (while the ECB can buy crossover credits). In addition, the US corporate bond market is much larger in size than its European equivalent. Therefore, we expect the relative impact of spread tightening in Europe to outpace that of the US and have adjusted our Global Credit strategy accordingly. Nonetheless, we should see a significant stabilisation in bond valuations in all markets where central banks will provide support by direct purchases of corporate bonds and by encouraging banks to lend.