Summary

- Regional markets dipped marginally in May, as the escalation in bilateral tensions between the US and China outweighed optimism over the gradual reopening of economies around the world. Sentiment was also weighed down by China’s recent move to impose a new security law on Hong Kong. The MSCI AC Asia ex Japan Index declined by 1.2% in US dollar (USD) terms over the month.

- All equity markets in the ASEAN region with the exception of Singapore turned in positive returns in May. Malaysia and Thailand were buoyed by interest rate cuts, while Singapore—the month’s worst-performing market in the ASEAN region—slumped 3.2%, as the country cut its 2020 GDP growth projection further.

- In India, despite a 40 basis points (bps) cut in the repo rate by the central bank, stocks retreated 2.8% in USD terms on the back of a gloomy economic outlook for the country.

- Slumping 8.4% in USD terms, Hong Kong was the month’s hardest hit market in the region, as China's move to impose a new security law on the city state heightened concerns about its future stability and global trade prospects.

- The trends we identified in recent commentaries remain very much in play, albeit with added risks from geopolitical confrontations in the lead up to the US elections and China’s aptly-timed territorial claims being extended. Valuations remain close to crisis-level lows across many of the regional markets, particularly in the hardest hit “old economy” sectors, where we are now finding some attractive long-term investments.

Asian equity

Market review

Regional equities dipped marginally due to worsening US-China tensions

Asian stocks fell marginally in May as the escalation in bilateral tensions between the US and China outweighed optimism over the gradual reopening of economies around the world. Market sentiment in the region was also weighed down by China’s recent move to impose a new security law on Hong Kong, which as a result could lose some of its trade privileges with the US, according to the Trump administration. Stronger enforcement and greater integration with China may actually encourage tourist flow back into Hong Kong, which has seen dwindling tourist arrivals since the start of protests almost one year ago.

For the month, the MSCI AC Asia ex Japan Index declined by 1.2% in USD terms. Within the region, Malaysia and Thailand were the month’s best performing markets, while Hong Kong and Singapore were the worst performers.

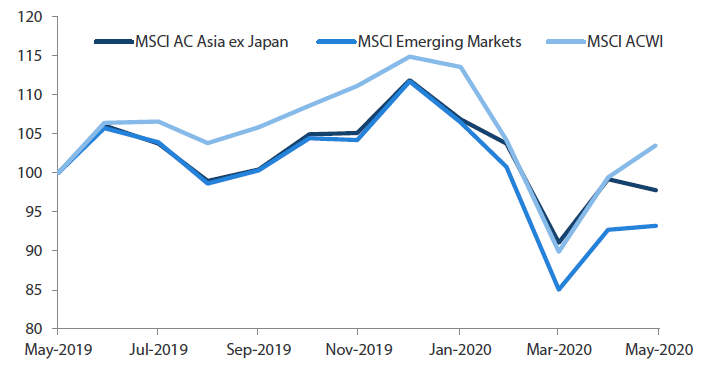

1-year market performance of MSCI AC Asia ex Japan versus Emerging Markets versus All Country World Index

Source: Bloomberg, 31 May 2020. Returns are in USD. Past performance is not necessarily indicative of future performance.

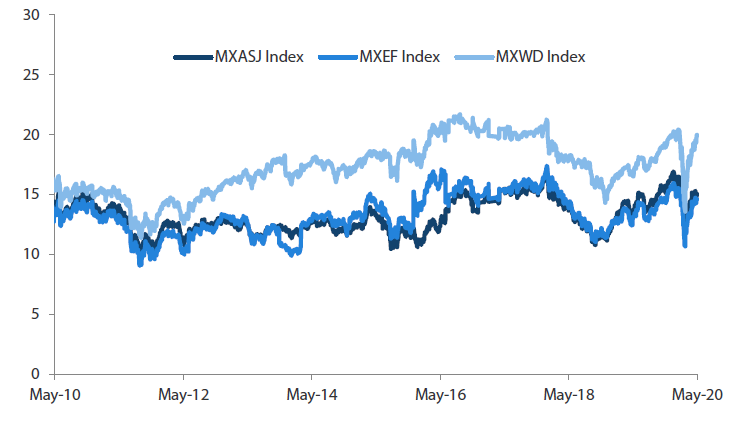

MSCI AC Asia ex Japan versus Emerging Markets versus All Country World Index price-to-earnings

Source: Bloomberg, 31 May 2020. Returns are in USD. Past performance is not necessarily indicative of future performance.

Malaysia and Thailand outperform; Singapore slumps

All equity markets in the ASEAN region with the exception of Singapore turned in positive returns in May, which saw decent USD gains for Malaysia (4.8%), Thailand (4.4%), Indonesia (3.3%) and the Philippines (1.6%).

In Malaysia, stocks were buoyed by a confluence of factors, including the government’s announcement of an upcoming economic recovery plan, a 50 basis points (bps) interest rate cut by Bank Negara Malaysia and better-than-expected 1Q 2020 economic growth, which printed 0.7% on a year-on-year basis.

In Thailand, a 25 bps rate cut by the Bank of Thailand as well as recovery hopes from the Covid-19 pandemic lifted stocks in May. Conversely, Singapore—the month’s worst-performing market in the ASEAN region—slumped 3.2%, as the country cut its 2020 GDP growth projection further from a range of -1% and -4% to -4% and -7%.

Indian stocks fall

In India, despite a 40 bps cut in the repo rate by the Reserve Bank of India, stocks retreated 2.8% in USD terms in May on the back of gloomy economic outlook for the country. Rating agency Fitch, for instance, expects the Indian economy to contract by 5% this fiscal year compared to its previous forecast for a growth of 0.8%.

Most North Asian markets fall, Hong Kong stocks nosedive

Elsewhere, South Korean stocks rose 2.2% in USD terms for the month, lifted by strong performance from technology stocks and a 25 bps policy rate cut from the Bank of Korea. Other North Asian markets, however, tracked the regional downturn in May, with Taiwan and China turning in USD losses of 2.5% and 0.5%, respectively.

Slumping 8.4% in USD terms, Hong Kong was the month’s hardest hit market in the region, as China's move to impose a new security law on the city state heightened concerns about its future stability and global trade prospects. The US no longer views Hong Kong as autonomous from China and the Trump administration threatened to rescind the city’s special trade status by subjecting Hong Kong exports to the same tariffs as those from China. In addition, renewed street protests in the financial centre also curbed risk appetite for Hong Kong stocks.

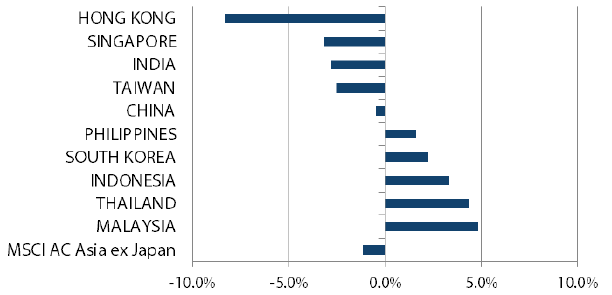

MSCI AC Asia ex Japan Index1

For the month ending 31 May 2020

Source: Bloomberg, 31 May 2020

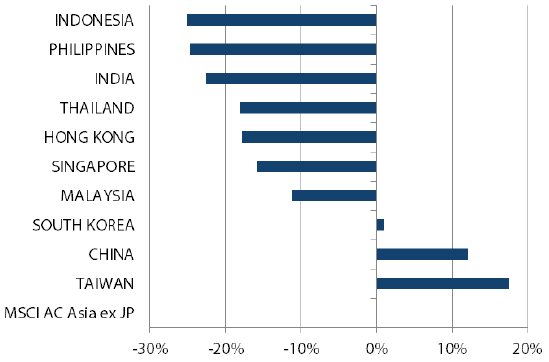

For the period from 31 May 2019 to 31 May 2020

Source: Bloomberg, 31 May 2020

1ote: Equity returns refer to MSCI indices quoted in USD. Returns are based on historical prices. Past performance is not necessarily indicative of future performance.

Market outlook

Valuations of regional markets remain attractive

The trends we identified in recent commentaries remain very much in play, albeit with added risks from geopolitical confrontations in the lead up to the US elections and China’s aptly-timed territorial claims being extended. China and the majority of Asian countries, despite being the first group of nations inflicted by Covid-19, have generally handled the pandemic well and are either on a path back to normality or discussing lockdown exit strategies with the disease seemingly under control. Valuations remain close to crisis-level lows across many of the regional markets, particularly in the hardest hit “old economy” sectors, where we are now finding some attractive long-term investments.

Staying invested in attractively-priced structural growth areas

In China, the National People’s Congress meetings concluded much the same as the policies we have become accustomed to under President Xi Jinping’s stewardship, which focuses on quality over quantity. While this year’s growth target was dropped, we think this is sensible and perhaps a chance to do away with the annual growth target for good.

Domestic support has proceeded with increased municipal debt issuances and targeted fiscal stimulus, particularly in areas of strategic industry development, namely 5G, digital, automation and environmental. We continue to favour areas of attractively-priced structural growth, namely software, healthcare, insurance and select consumer sub-sectors.

Taiwan and South Korea have been amongst the least impacted by virus containment measures, and their respective technology and digital services sub-sectors have performed exceptionally well during this difficult period. We now find valuations rather rich across these markets; when evaluating these markets, the prospect of further dislocation from the US-China tech war that looks set to escalate may need some consideration.

Selective in India and ASEAN

India has endured a longer and more haphazard lockdown period than most other countries, but it is beginning to ease restrictions outside of urban hotspots. With less fiscal room to manoeuvre, stimulus measures have largely been directed at the poorest in society, and it will take some time for the country as a whole to return to normality. However, the longer-term dividends accruing from reforms initiated over the past few years are undeniable, and the crisis has forced even greater consolidation and formalisation across most sub-sectors. We remain invested in private banks, digital services and logistics and have been adding to specific consumer subsectors.

Like India, markets in the ASEAN region have been hit hard by Covid-19, while support packages have been mixed, depending on the strength of sovereign balance sheets. We are seeing further evidence of supply chain re-location benefiting some ASEAN markets but the opportunities for investment remain limited.

Appendix

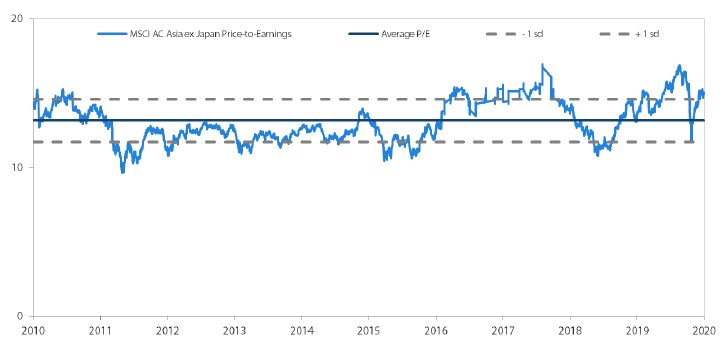

MSCI AC Asia ex Japan price-to-earnings

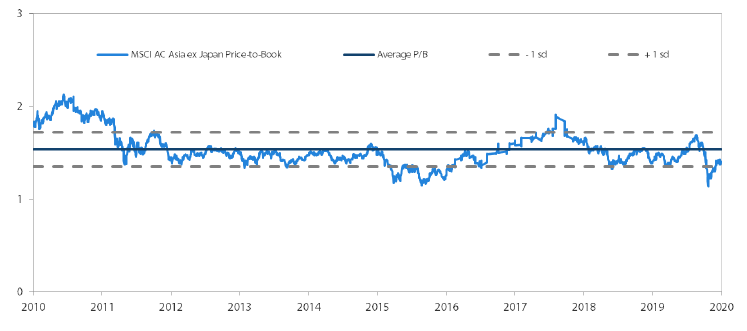

MSCI AC Asia ex Japan price-to-book

Source: Bloomberg, 31 May 2020. Ratios are computed in USD. The horizontal lines represent the average (the middle line) and one standard deviation on either side of this average for the period shown. Past performance is not necessarily indicative of future performance.