Summary

- US Treasury (UST) yields were mixed in performance, remaining range-bound at low levels. Optimism towards the development of a COVID-19 vaccine significantly improved risk sentiment, pushing yields of some maturities higher. Meanwhile, US-China tensions resurfaced. Overall, 2-year and 10-year UST yields ended the month at 0.16% and 0.65%, respectively, about 3.3 basis points (bps) lower and 1.3 bps higher than the prior month.

- Asian credits returned 2.07% in May, driven by a 33 bps tightening in credit spreads. The improvement in risk sentiment led high-yield (HY) credits to outperform; they gained 3.02% with their spreads contracting 49 bps. High-grade (HG) credits registered a total return of +1.79%, with spreads tightening 24 bps.

- In May, HG issues continued to dominate new supply, with a total of 16 new issues amounting to US Dollar (USD) 11.1 billion. Some primary market activity picked up within the HY space, with nine issues amounting to USD 2.3 billion in the month.

- Regional inflation readings fell further in April, while first quarter GDP growths deteriorated. Governments further ramped up their fiscal stimulus efforts, in a bid to fight the economic pressure from COVID-19. Central banks in India, South Korea, Malaysia and Thailand lowered their policy rates. At the National People’s Congress, China’s government refrained from committing to an annual GDP growth target.

- The COVID-19 outbreak continues to crimp economic activity and demand, prompting governments to announce sizable stimuli to boost growth. Going forward, we prefer Singaporean, South Korean and Thai bonds to Indian and Indonesian bonds. On currencies, we expect the Philippine peso (PHP) and Thai baht (THB) to outperform the Korean won (KRW) and Chinese yuan (CNY).

- We expect Asian credit spreads to continue grinding tighter from still elevated levels. However, this trend improvement will undoubtedly be punctuated by periods of weakness as investor sentiment remains fragile due to the unprecedented nature of the economic shock. We continue to monitor downside risks to this moderately constructive outlook.

Asian rates and FX

Market review

A mixed performance for UST yields

UST yields were mixed in performance, remaining range-bound at low levels. US economic data remained grim, as disruptions associated with COVID-19 persisted. Notably, nonfarm employment dropped by 20.5 million in April, with unemployment surging to 14.7%. The pandemic also put downward pressure on inflation, with headline consumer price index (CPI) moderating to 0.30% year-on-year (YoY) in April. Longer-dated UST yields faced upward pressure in the month, after the US treasury department unveiled plans to ramp up the sale of longer-duration securities to finance the country's ballooning fiscal deficit, although a bleak economic outlook from US Federal Reserve (Fed) Chair Jerome Powell managed to offset some of the upward pressure on yields. Powell’s views raised expectations that policymakers may push rates below zero next year, though this was rejected by the Fed chair himself soon after. Optimism that COVID-19 vaccine developments were making progress sparked a significant improvement in risk tone mid-month, pushing UST yields higher. Meanwhile, US-China tensions resurfaced. Earlier on, the US moved to tighten sales to Huawei Technologies and restrict US federal pension investments in China. Tensions ratcheted up further by end-May after China passed a new national security law for Hong Kong, prompting Washington to declare that Hong Kong is no longer autonomous from Beijing. Overall, 2-year and 10-year UST yields ended the month at 0.16% and 0.65%, respectively, about 3.3 bps lower and 1.3 bps higher than the prior month.

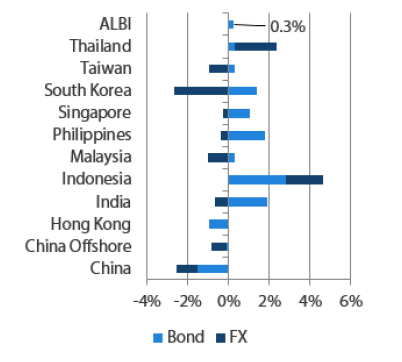

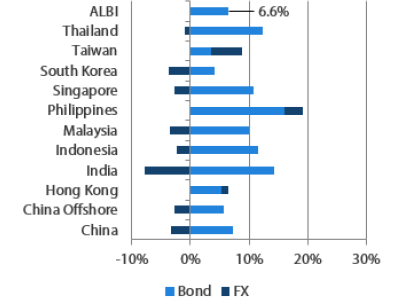

Markit iBoxx Asian Local Bond Index (ALBI)

For the month ending 31 May 2020

For the year ending 31 May 20200

Source: Markit iBoxx Asian Local Currency Bond Indices, Bloomberg, 31 May 2020

Note: Bond returns refer to ALBI indices quoted in local currencies while FX refers to local currency movement against USD. ALBI regional index is in USD unhedged terms. Returns are based on historical prices. Past performance is not necessarily indicative of future performance.

Inflationary pressures moderate further in April

The sharp decline in global crude oil prices prompted lower CPI readings in the Philippines, Indonesia, Malaysia and Thailand, with the annual consumer inflation rates in the latter two falling deeper into negative territory. Meanwhile, the slowdown in China's consumer inflation was led by falling prices of pork and non-food items. Elsewhere, South Korea's consumer inflation declined to a six-month low as suppressed consumer spending weighed on price growth.

Growth deteriorates in the first quarter

First quarter GDP growth in the region’s countries slowed as the COVID-19 outbreak crimped economic activity and demand. GDP growth in Indonesia dropped substantially to 3.0% YoY from 5.0% in the fourth quarter, falling below the central bank's forecast of 4.3%. A collapse in consumer confidence in March prompted a marked drop in private consumption growth. The Thai economy slipped into recession after its GDP contracted 1.8% YoY in Q1 2020. In the Philippines, GDP growth fell to -0.2% in the same period, against expectations of an increase, despite enhanced community quarantine measures which were put in place mid-March. In contrast, Malaysia's first quarter GDP unexpectedly expanded, rising 0.7% YoY, even as the spread of COVID-19 took a toll on exports and domestic demand.

Governments further ramp up fiscal stimulus efforts

A number of governments announced additional fiscal support measures in May to fight negative pressures on their economies arising from COVID-19. Indonesia unveiled measures including tax relief for businesses, an interest payment subsidy and financial support to key state-owned enterprises. As a result, the government now expects the 2020 budget deficit to widen to 6.3% from 5.07% of the country’s GDP. Meanwhile, Singapore announced a fourth stimulus package. The Singapore dollar (SGD) 33 billion "Fortitude Budget" will provide specific support to saving jobs and brings the total cost of COVID-19 support to nearly SGD 100 billion. Elsewhere, India's Prime Minister Narendra Modi announced an Indian rupee (INR) 20 trillion package, amounting to roughly 10% of the country’s GDP, which included previously announced fiscal and monetary measures. Separately, the government also revealed that gross market borrowings are set to increase by INR 4.2 trillion in FY 2021. Notably, some countries began gradually lifting COVID-19 restrictions during the month in a bid to restart parts of the economy that were shut due to the pandemic.

Central banks in India, South Korea, Malaysia and Thailand lower policy rates

Monetary authorities in India, Malaysia, South Korea and Thailand reduced their policy rates in an attempt to soften the economic impact of the COVID-19 outbreak. Bank of Thailand's (BOT) Monetary Policy Committee (MPC) voted 4-3 to cut rates by 25 bps, with the three dissenters preferring to keep rates unchanged. The Reserve Bank of India, in an unscheduled meeting, lowered the policy rate by 40 bps, while the Bank Negara Malaysia and Bank of Korea slashed interest rates by 50 bps and 25 bps, respectively. Notably, all four central banks sounded more cautious in their growth outlooks, clearly leaving the door open for further monetary policy easing.

China omits annual growth target for 2020

For the first time in many years, the Chinese government refrained from committing to an annual GDP growth target at the National People's Congress, amid "big uncertainties in the economy and trade." Premier Li Keqiang's work report described the country as facing an "unpredictable" time, as he set an open-ended fiscal deficit ratio target of "over 3.6% of GDP". The premier also announced that central government special bonds will be re-introduced, with a net issuance quota set at Renminbi (RMB) 1.0 trillion, whereas the quota for net local government special bonds will be raised to RMB 3.75 trillion for 2020 from RMB 2.15 trillion for 2019. With regard to monetary policy, the government pledged to employ tools including reserve requirement ratio cuts, rate cuts and re-lending to deliver M2 and outstanding aggregate financing growth that is meaningfully higher than last year.

Market outlook

Prefer Singaporean, South Korean and Thai bonds to Indian and Indonesian bonds

The COVID-19 outbreak continues to crimp economic activity and demand, prompting governments to announce sizable stimuli to boost growth. This increases the chance of further fiscal slippage and poses risk to bond supply outlook for the rest of the year, in our view.

Against such a backdrop, we prefer Singaporean, South Korean and Thai bonds to Indian and Indonesian bonds. We believe that Singapore's safe-haven status in the region, flush domestic liquidity and ability to tap past reserves to fund the government's increased fiscal spending are factors that will continue to support the demand for Singapore government securities. Light foreign positioning in Thai bonds should allow that market to remain relatively more resilient to any broad-based sell off. Feeble growth and soft inflation (deflation in the case of Thailand) will keep Thai and South Korean bonds supported. Meanwhile, we believe it is prudent to stay defensive on duration positioning for Indian and Indonesian bonds until the market adapts to the higher supply ahead.

Prefer PHP and THB to KRW and CNY

We expect the PHP and THB to outperform the KRW and CNY. Thailand's current account balance swung into a deficit in April on the absence of tourism revenue and a rise in dividend repatriation. That said, the gradual reopening of borders may boost demand for the THB as the tourism sector recovers. With three dissenters favouring no policy change at the latest MPC meeting, the BOT may stay on hold for now, which could lend further support to the currency. Meanwhile, we expect the PHP to remain resilient, owing to lower reliance on tourism and global trade, low oil prices and a narrowing current account deficit as infrastructure spending slows. In contrast, we see the rapid escalation in US-China tensions leading to volatility for the KRW and CNY. The won's sensitivity to global trade and risk sentiment is also likely to cause the currency to underperform regional peers in the near term.

Asian credits

Market Review

Asian credit spreads tighten as COVID-19 vaccine hopes improve risk sentiment

Asian credits returned 2.07% in May, driven by a 33 bps tightening by credit spreads. The improvement in risk sentiment led HY credits to outperform; they gained 3.02% with their spreads contracting 49 bps. HG credits registered a total return of +1.79%, with spreads tightening 24 bps.

Asian credits experienced a relatively slow start to the month as major regional markets were shut for holidays. Nonetheless, market tone was largely positive, owing to the rebound in oil prices and better-than-expected trade and credit data from China. Mid-month, optimism about progress in the development of a COVID-19 vaccine led spreads to tighten meaningfully. Hopes for a pick-up in economic activity supported the recovery in risk asset prices as lockdown restrictions were eased further. Meanwhile, US-China tensions resurfaced with restrictions imposed on Huawei to limit the company’s access to semiconductor supply. By end-May, tensions further escalated after China passed a new national security law for Hong Kong, prompting the US to declare that Hong Kong was no longer autonomous from China. The souring of US- China relations muted the rally in spreads. Indian credits outperformed due to the positive sentiment boost from policymakers’ declaration of further measures to prop up the economy. Meanwhile, Hong Kong credits underperformed as developments over the national security law and renewed social unrest weighed on sentiment.

Primary market activity remains active

HG issues continued to dominate new supply in May, with a total of 16 new issues amounting to USD 11.1 billion. This included the USD 3 billion three-tranche issue by Sinopec Group and USD 2.5 billion three-tranche issue from Indonesia Asahan Alumini. Meanwhile, there was some pick-up in HY primary market activity, with nine issues amounting to USD 2.3 billion in the month.

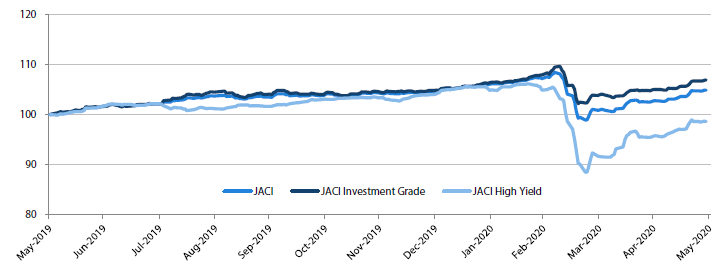

JP Morgan Asia Credit Index (JACI)

Index rebased to 100 at 31 May 2019

Note: Returns in USD. Past performance is not necessarily indicative of future performance. Source: JP Morgan, 31 May 2020

Market Outlook

Asian credit spreads to grind tighter from still-elevated levels, though downside risks remain

Economic data to be released over the next few months, and for 2Q as a whole, are likely to show record-setting deterioration, with a slight hint of this already showing up in the 1Q numbers. Likewise, company earnings and credit fundamentals for 2Q and 1H 2020 are likely to weaken sharply.

That said, decisive central bank actions to inject liquidity and improve credit and funding markets, alongside significant fiscal stimulus measures, have provided investors with some reassurance that a worst case scenario involving widespread business failures, sustained high unemployment and systemic financial collapse has been averted. Additionally, the flattening of the COVID-19 curve in Europe and the US, alongside plans to ease movement restrictions in phases, have led to optimism that the global economy will gradually reopen with a recovery underway—albeit at a more moderate pace than previously thought.

These factors have helped to foment a constructive market tone, especially for credit. Therefore, we expect credit spreads, including those in Asia, to continue grinding tighter from still-elevated levels, even though this trend improvement will undoubtedly be punctuated by periods of weakness as investor sentiment remains fragile due to the unprecedented nature of the economic shock.

We continue to monitor downside risks to this moderately constructive outlook, including the extent of resurgence in new COVID-19 cases once mobility restrictions and social distancing measures are relaxed, and the re-emergence of geopolitical tensions between the US and China.