Summary

While reviewing the overnight market on 21 April 2020, no doubt we were not alone in taking a moment or two to comprehend the numbers we saw. West Texas Intermediate, the US benchmark set out of Cushing, Oklahoma, was showing a price for the May contract as low as negative USD 37 per barrel. This is the first time in history the benchmark future fell below zero. What got us to this point is a confluence of events related to demand weakness from COVID-19 lockdown and rapidly filling storage, exacerbated by a herd of investors trying to pick the bottom. Shocking and unprecedented, but with the benefit of hindsight perhaps not unwarranted. The silver lining is the shock and awe of oil’s rapid price fall is leading to material supply reductions at a time when COVID-19 driven demand losses could be starting to improve. While the very near-term is likely to remain volatile, we could see stability return in coming months and an even more robust longer-term outlook in a post COVID-19 world.

A moment in oil history

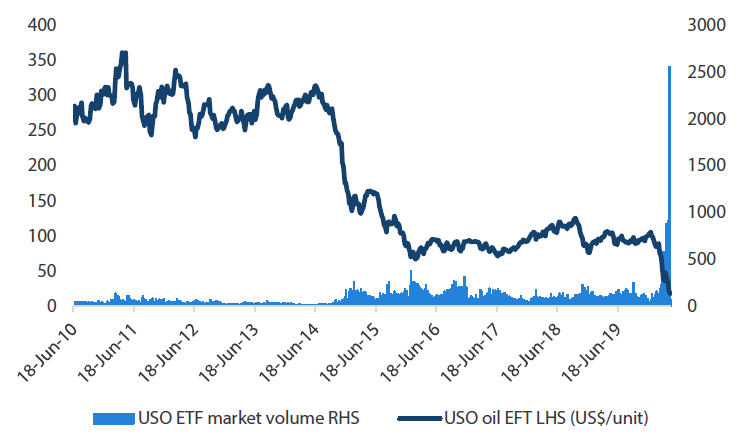

The historic event took place in the WTI futures market, and while many commentators focus on the fact it was isolated to “paper” markets, it only eventuated because of real concerns in the physical market. A unique feature of WTI futures is that holding a contract obligates the bearer to take delivery if they hold the contract into expiry. Normally, experienced traders would actively manage their exposures, rolling early if there are signs of trouble ahead, not wanting to be on the receiving end of thousands of barrels of the Permian’s finest with nowhere to park it. However, the sheer volume of investors, many of them retail, seeking simple exposure to oil markets piling in to ETFs with simple, almost robotic, strategies meant a larger-than-normal volume of open contracts had to be sold in the days leading up to the expiry of the May contract.

Chart 1 US oil Fund LP Oil ETF price and volumes

Source: IRESS, Nikko AM

This came at a time of heightened concerns around oil demand and storage. So, finding a buyer of large volumes at short notice was clearly close to impossible, resulting in sellers effectively paying someone to take physical delivery rather than be left holding the can. While the May contract got as low as negative USD 37/bbl, it closed out in positive territory at around USD 10/bbl, which is a more accurate reflection of the true value of the oil; a price showing the challenges faced by producers pushing oil in to a rapidly filling storage environment with weak demand and a price highlighting the economic pain felt by US onshore producers with a breakeven price of USD 40/bbl and above.

Supply reacting incredibly fast—will it react in time?

The commitment by OPEC+ in early April to cut 9.7 mbpd (million barrels per day) was not the panacea the market sought; despite this cut being possibly complimented by voluntary cuts from other smaller producer nations and other atypical demand sources such as governments buying excess supply to fill strategic reserves. OPEC’s announcement came at a time of peak bearishness for demand. Also, US and Canadian cuts were mooted but not secured; it’s one thing to restrict output from sovereign-owned Middle Eastern oil companies, it’s another to force restrictions in one of the world’s largest capitalist nations.

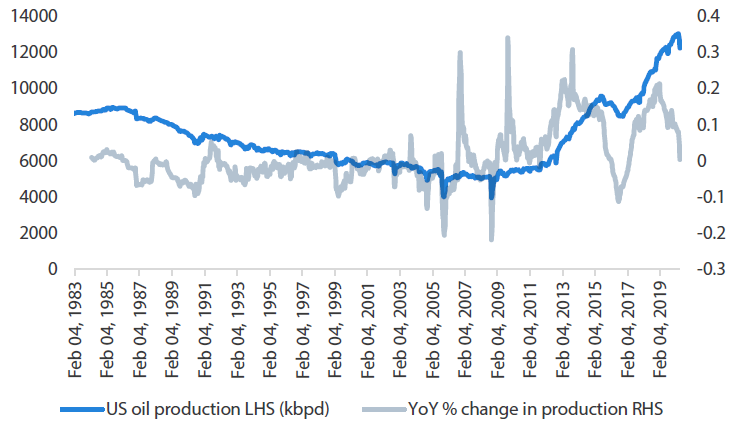

Chart 2 US oil production history

Source: EIA weekly data, Nikko AM

Enter the historically low WTI price—the impact on US production has been surprising, both in terms of its speed and volume impact. The US rig count has fallen around 40% over the past six weeks, the steepest decline since 1975. So far we have seen a decline in US oil production of just under a 1 mbpd from the recent peak of almost 14 mbpd, and the sharp drop in rigs is likely to mean further reductions of perhaps another 1–2 mbpd in coming weeks. That would result in a total of 2–3 mbpd supply out of the US.

Canadian oil sands are also feeling the pinch, and even more so given typical discounts the heavy crudes fetch relative to the US benchmark; Kallanish estimate around 600 kbpd (thousand barrels per day) supply out of Canada.

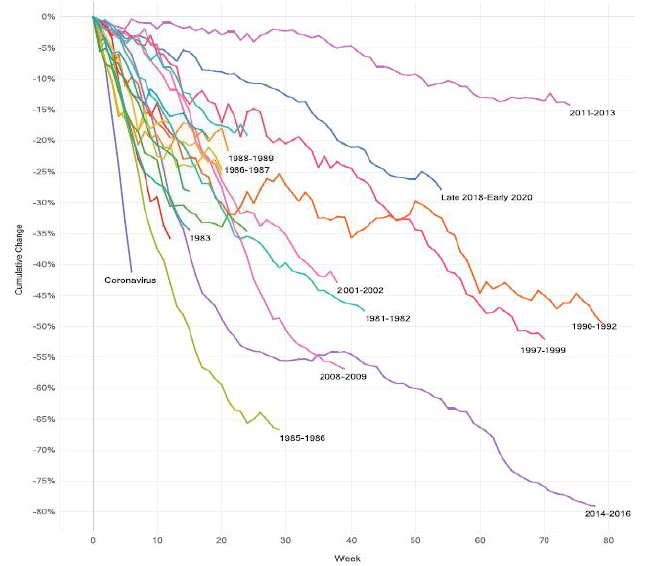

Chart 3 US rig count decline events since 1975

Source: Macquarie Research

So, combining OPEC+, North America and SPR fills, we can make a good case for around 15 mbpd of oil production rapidly lost from global supply.

When supply and demand meet (and start to diverge, in a good way)

But is this enough? The oil demand loss forecasts range around the 25 mbpd, peaking in April. This means that while supply is leaving, it is not exiting fast enough to prevent global storage from filling. The big question is how much time do we have? The answer is a difficult one, as it is not only physical storage that’s the issue. It is also the constraints in getting the oil to storage via tankers, trains and pipelines. While some forecasters predict we will fill the remaining ~400mmbbl of global oil storage by sometime in May, the transport issue may fortunately assist in slowing the rate of storage fill. It will likely see widening differentials between regional benchmarks as more land-locked, infrastructure constrained producers receive bigger discounts compared to their offshore or coastal peers, but this may induce further supply out of the market. Overall, without some form of action, the world would run out of room to store oil and even the more robust Brent crude could see negative prices.

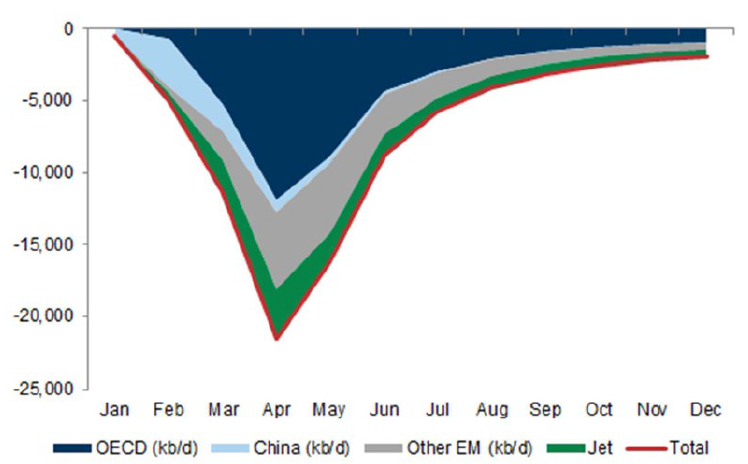

Chart 4 Goldman Sachs estimated demand impact from COVID-19

Source: Goldman Sachs Investment Research

But we are seeing action on the supply side as mentioned, which should increase over coming weeks? On the demand side, with the world starting to gradually ease restrictions, oil consumption should start to climb. Goldman Sachs estimates that April will see peak loss in demand of ~25 mbpd, but by mid- to late-May, this could reduce to ~15 kbpd, meeting the rate of supply cuts discussed earlier. We would expect much less price volatility at this point. By June, demand losses could fall further to 10mbpd, which would start to see the globe draw from the bulging inventories and that may lead to some strength returning to Brent pricing.

Clearly, the biggest risk to this outlook is a second wave of the COVID-19 pandemic, resulting in a return to the economic lockdown. Another risk, albeit longer term, is how a post COVID-19 world views business travel and commuting; have we managed to conduct business well enough to reduce our need to revert to past practices? Given business travel accounts for around 15% of oil use, it is something to be mindful of. The WTI ETF issue may also come back again as the June contract rolls next month, but some ETF strategies have changed to spread contract exposure over multiple forward periods, which should mitigate this risk somewhat.

So, what about the longer term?

If the scenario above plays out and global inventories show meaningful declines, it will clearly be supportive of oil prices. This will likely induce production to return as markets seek balance. However, it seems unlikely we will see a rapid increase in oil production to pre COVID-19 levels without a meaningful lift in the price of oil.

High-cost producers, particularly those in the US shale patch reliant on high-yield debt markets, may find it more difficult to attract financing for continuing development. Clearly, at the right oil price, funds will become available, but investors hurdle rates may be adjusted higher to account for the increase in perceived risks fresh in their memories. A steepening of the global cost curve would be supportive of higher long-term prices, relative to pre COVID-19 levels.

The other factor is potential reservoir damage from shut-in wells; older producing wells are often given extended life by the application of secondary recovery, which can be achieved by injection of water or gas in the rock to increase pressure. If these wells get shut in, oil can settle and make restart expensive, requiring higher prices to incentivise restart.

Are negative prices the tonic for a healthier long-term supply outlook?

Our positive long-term view on oil has been predicated on the requirement for higher cost oil to replace natural decline, which required higher long-term prices. This has not changed; indeed the difficult-to-predict result of the COVID-19 crisis will likely provide reinforcement to this thesis, as ultra-low prices drive out production. When the dust settles, and global demand returns to “normal” levels, prices will need to be stronger to bring back lost supply.