Dr Jekyll and Mr Hyde

By James Kinghorn

Here in Edinburgh, entering our fifth week of lockdown, we are restricted to one hour of exercise a day. During the week, my one hour is typically spent walking my dog first thing in the morning. While this has been a standard routine of mine for many years, the recent restrictions have made this walk a very precious part of the day, something I previously took for granted.

Myrtle, Braidburn Valley Park

The park I walk in has a fascinating history; just a few metres from where I took the photo is a path called the Fly Walk. This is famous, locally, as the route Robert Louis Stevenson1 used to follow when travelling between his home in Swanston (south of the city) to the City of Edinburgh.

He is best remembered for the many incredible novels he wrote including Treasure Island, Kidnapped and The Strange Case of Dr Jekyll & Mr Hyde. However he lived an extraordinary life beyond literature. He was an extensive traveller despite suffering from ill-health for most of his life.

1 Robert was born and brought up in Edinburgh and lived the majority of his first 29 years in or around the city. Like many inspirational and creative geniuses of that time he lived a short life by today’s standards and died in Samoa in 1894 at the age of 44.

Source: Robert Louis Stevenson, iStock

He spent his final years in Samoa, where he wrote some of his finest work, and made a name for himself as an active supporter of human rights, justice, liberty and equality. Integrating himself into Samoan society and fighting for their culture and values.

Indeed he was a champion of many of the values and attributes that we expect of the companies and management teams we invest in today. Companies that look after all stakeholders, encourage diversity and empower employees, provide a service to the communities they operate in, understand and work with suppliers and are valued by their customers.

The vast majority of listed companies outline their values in their ESG and sustainability reports. This information is important for helping investors understand the values of the companies they invest in and how well they look after their employees, customers, suppliers and communities.

When economies around the world perform well it's relatively easy for companies to look after the interests of stakeholders, as has been the case in recent years. However it is far more challenging when times are tough. Robert Louis Stevenson's novel The Strange Case of Dr Jekyll and Mr Hyde is a good analogy. The current COVID-19 crisis will throw a spotlight on those companies that behave like Dr Jekyll and stand by their values, and those that become a Mr Hyde, turning their back on all things ESG as the crisis unfolds. We are already seeing signs of this and the crisis will test companies like never before.

Source: Jekyll and Hyde dictionary, iStock

A sustainable business model must look after all stakeholders in good times and bad. The quality of a company goes way beyond just balance sheet strength and profitability. The way companies behave also helps mark them out as long-term winners. Companies that can do the right thing in times of stress are something to be valued.

We’ve been paying close attention to how our investments have behaved over the last couple of months. Clearly, for the vast majority, sales and profits are under significant stress as demand across most industries has collapsed. However, a crisis also provides opportunity. Opportunities to enhance the reputation of the firm and help win market share as the world exits the crisis. Our investments are behaving in the right way, supporting their stakeholders.

AIA, our Asian life insurer, provided free COVID-19 insurance for millions of customers, employees and representatives across its region. It has donated thousands of items of personal protection equipment, implemented initiatives to expedite approval for all COVID-19 health-related issues, and cancelled deductibles. It has also funded clinics and provided full risk protection policies for employees in many hospitals across the region.

Progressive Corp, the US auto and home insurer, returned USD 1 billion in premiums to customers to reflect the fact that most customers aren’t using their vehicle as frequently. It’s providing customers that can’t afford to renew or pay their premium with relief by continuing cover through the period. Agents are being supported with grants, and while the majority of employees can work from home, those that can’t are also being supported.

Unilever, the global consumer goods firm, donated over EUR 100 million in the form of soap, sanitisers and food. It is also providing EUR 500 million in cash relief to customers and suppliers to help them manage their business through this crisis. And for its employees, Unilever is offering three months of protection to the entire workforce as a result of this disruption.

Philips, the European health care company donated a range of diagnostic imaging, patient monitoring and respiratory equipment through the Philips Foundation. It’s also provided financial support for the purchase of personal protective equipment in Italy. And while it’s been busy ramping up production of ventilators and continuous positive airway pressure equipment, the company is ensuring fair access to these products to developing countries.

Future Quality investing is about analysing all aspects of a firm to understand its sustainable competitive advantage and we firmly believe that a company must treat all stakeholders well to sustain this competitive advantage. All good businesses go through challenging periods. The current crisis has, and will, continue to make life very difficult for many companies. How these companies behave is how they will be remembered by their stakeholders. Robert Louis Stevenson is sometimes credited with saying “Life is not a matter of holding good cards, but of playing a poor hand well.” Most companies have been dealt a poor hand in this crisis, how they navigate through this period and the way they conduct themselves will have repercussions for many years.

Opportunities

The recent market turmoil has presented us with a few opportunities to buy great companies at a great price. A couple of names we’ve invested in recently include Palomar Holdings and Kerry Group. In March, we invested in Palomar Holdings—a U.S. property and casualty insurer. It is an innovative, technology-enabled insurer that target underserved insurance markets in the US, with the majority of sales derived from earthquake insurance. The company’s superior IT and data analytics allows it to provide customers with more granular pricing and flexible products than competitors. It has increased its distribution and added new niche lines. It is growing rapidly, but generates strong profitability due to its strong underwriting and risk transfer programme.

We also took a position in Kerry Group, a European food company that’s a leader in specialty ingredients. It is well placed to address the changing consumer trends in food, such as health and wellness, convenience, clean label and sustainability. It has invested heavily in technology, and it’s this proprietary IT infrastructure and integrated solutions platform that gives it a competitive advantage. The company a large runway of growth providing solutions for packaged food companies around the world.

Final thought

It was a brilliant Scot, June Almeida, who first discovered the coronavirus in 1964. We are waiting patiently for today’s scientists to develop therapies to help treat this new coronavirus and help alleviate some of the chaos and suffering. There have been numerous experts predicting the unpredictable over the last few weeks with regard to COVID-19. We are not going to add to this noise nor pretend to know when life will return to a new normal.

What we do know is that at some point in the future governments must allow the population back to work. We know that the global economy has sustained significant damage, and we know that fiscal and monetary policies globally have injected significant amounts of liquidity into the system to help repair this damage. We also know that at some point, the COVID-19 crisis will pass.

Investing in companies that have sustainable and enduring franchises, management teams with clear and sound strategies and values and strong balance sheets—all at the right price—continues to be a sensible approach to investment management.

Portfolio positioning

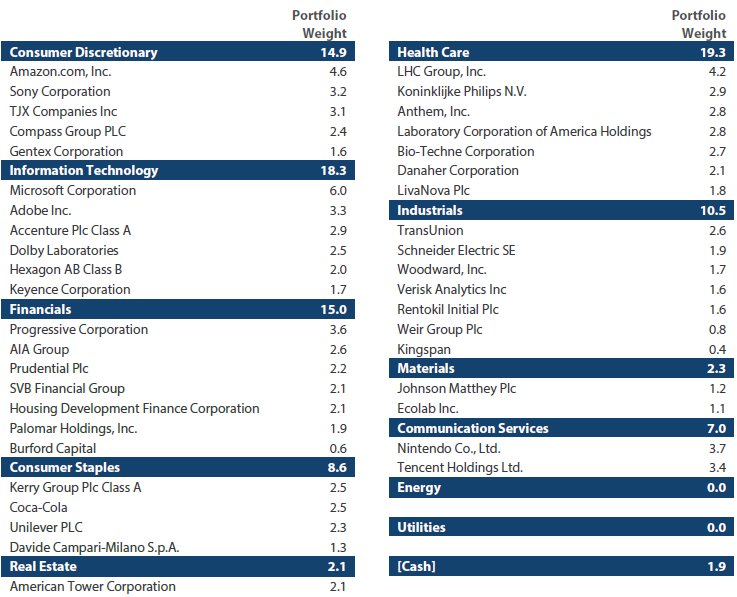

The table below highlights our Global Equity Strategy holdings as of the end of March 2020.

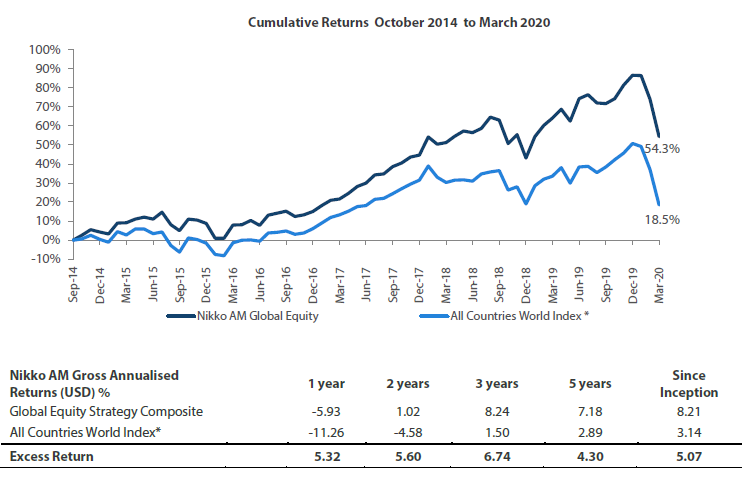

Global Equity Strategy Composite Performance to Q1 2020

*The benchmark for this composite is MSCI All Countries World Index. The benchmark was the MSCI All Countries World Index ex AU since inception of the composite to 31 March 2016. Inception date for the composite is 01 October 2014. Source: MSCI. Returns are based on Nikko AM Global’s (hereafter referred to as the “Firm”) Global Equity Strategy Composite returns. The Firm claims compliance with the Global Investment Performance Standards (GIPS®) and has prepared and presented this report in compliance with the GIPS. Returns for periods in excess of 1 year are annualized. Returns are AUD based and are calculated gross of advisory and management fees, custodial fees and withholding taxes, but are net of transaction costs and include reinvestment of dividends and interest. Past performance does not guarantee future returns. For more details, please refer to the performance disclosures found at the end of this document. Data as of 31 March 2020.

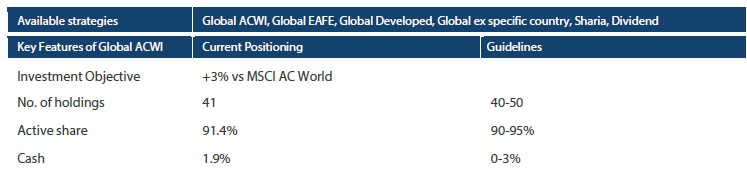

Nikko AM Global Equity: Capability profile and available strategies (as at 31 March 2020)

Past performance is not indicative of future performance.

This is provided as supplementary information to the performance reports prepared and presented in compliance with the Global Investment Performance Standards (GIPS®). Nikko AM Representative Global Equity account. Source: Nikko AM, FactSet.

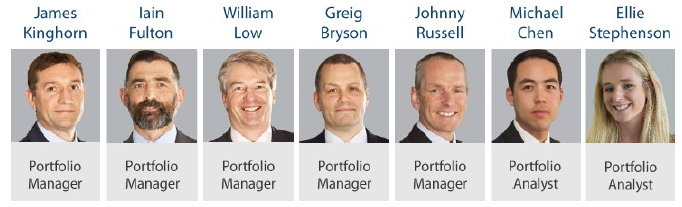

Nikko AM Global Equity Team

This Edinburgh based team provides solutions for clients seeking global exposure. Their unique approach, a combination of Experience, Future Quality and Execution, means they are continually “joining the dots” across geographies, sectors and companies, to find the opportunities that others simply don’t see.

Experience

Our five portfolio managers have an average of 22 years’ industry experience and have worked together as a Global Equity team for eight years. Two portfolio analysts, Michael Chen (joined February 2019) and Ellie Stephenson (joined September 2019) are the first in a new generation of talent on the path to becoming portfolio managers. The team’s deliberate flat structure fosters individual accountability and collective responsibility. It is designed to take advantage of the diversity of backgrounds and areas of specialisation to ensure the team can find the investment opportunities others don’t.

Future Quality

The team’s philosophy is based on the belief that investing in a portfolio of “Future Quality” companies will lead to outperformance over the long term. They define “Future Quality” as a business that can generate sustained growth in cash flow and improving returns on investment. They believe the rewards are greatest where these qualities are sustainable and the valuation is attractive. This concept underpins everything the team does.

Execution

Effective execution is essential to fully harness Future Quality ideas in portfolios. We combine a differentiated process with a highly collaborative culture to achieve our goal: high conviction portfolios delivering the best outcome for clients. It is this combination of extensive experience, Future Quality style and effective execution that offers a compelling and differentiated outcome for our clients.

About Nikko Asset Management

With USD 206.6 billion* under management, Nikko Asset Management is one of Asia’s largest asset managers, providing high-conviction, active fund management across a range of Equity, Fixed Income, Multi-Asset and Alternative strategies. In addition, its complementary range of passive strategies covers more than 20 indices and includes some of Asia’s largest exchange-traded funds (ETFs).

*Consolidated assets under management and sub-advisory of Nikko Asset Management and its subsidiaries as of 31 March 2020.

Risks

Emerging markets risk - the risk arising from political and institutional factors which make investments in emerging markets less liquid and subject to potential difficulties in dealing, settlement, accounting and custody.

Currency risk - this exists when the strategy invests in assets denominated in a different currency. A devaluation of the asset's currency relative to the currency of the Sub-Fund will lead to a reduction in the value of the strategy.

Operational risk - due to issues such as natural disasters, technical problems and fraud.

Liquidity risk - investments that could have a lower level of liquidity due to (extreme) market conditions or issuer-specific factors and or large redemptions of shareholders. Liquidity risk is the risk that a position in the portfolio cannot be sold, liquidated or closed at limited cost in an adequately short time frame as required to meet liabilities of the Strategy.