Overview

Shell-shocked by the recent carnage in global equities amid heightened volatility caused by the Covid-19 pandemic, many investors may have pondered if they have made the right decision by investing in stocks. Some could even have doubts about the merits of holding equities as part of a diversified investment portfolio. Indeed, losing faith in underperforming asset classes during deep market sell-offs is understandable as the pain of losses far outweighs the satisfaction of gains.

Nonetheless, equity investors shouldn’t let any short-term market volatility jeopardise their long-term investment objectives. History has shown that stocks have always managed to recover from severe downtrends over time, make new highs thereafter and outperform many other asset classes over the long term. Furthermore, equities continue to remain an appropriate asset class that offers long-term protection against inflation. As such, despite the recent deep sell-off in global equity markets amid the Covid-19 pandemic, we believe that long-term investors should stay the course and keep faith in equities, which should remain a key part of their diversified investment portfolios, in our view.

Long-term outperformance of equities

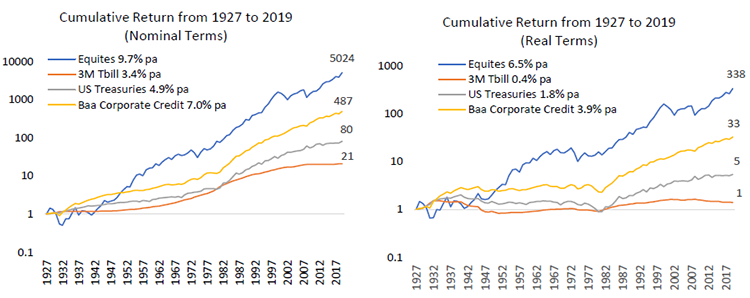

Over the long-run, equities have proven their ability to outperform government bonds and corporate credits by a large margin. Referencing data from 1927 to 2019, the annualised nominal returns of equities were 9.7% in US dollar (USD) terms, whereas US Treasury bonds and Baa-rated corporate credit returned 4.9% and 7%, respectively (see Chart 1). Over time, the difference in cumulative return between equities and fixed income is glaringly substantial.

Chart 1: Equities tend to outperform bonds over the long run

Source: New York University, Aswath Damodaran, as at end 2019.

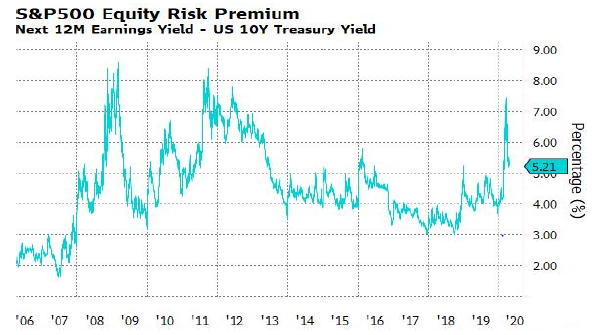

The excess returns of equities over the risk-free rate is termed the equity risk premium. Currently, the equity risk premium of US stocks is still elevated (see Chart 2). Going forward, we continue to believe that the equity risk premium can be monetised as a source of investment return, as stocks continue to deliver capital appreciation and produce attractive dividend yield above the risk-free rate. Our optimism is anchored on our belief that buying equities is akin to owning a fractional interest in productive businesses and not simply about purchasing a piece of paper asset.

Chart 2: US equity risk premium still looks elevated

Source: Bloomberg, as at April 2020

Propensity to recover from losses and make new highs subsequently

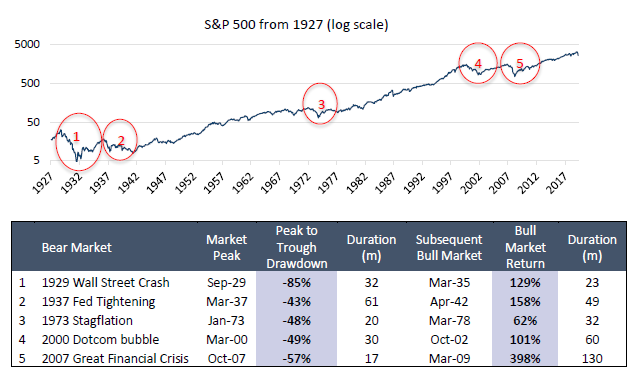

Owing equities, however, comes with risks, as stocks are subjected to large drawdowns during periods of market uncertainties. Nonetheless, equities—as history has shown—have rebounded after every crisis and even breached new highs subsequently. Referencing five of the worst equity drawdowns since 1927, stocks had suffered peak-to-trough drawdowns of around -40% to -85%. But no permanent impairment was experienced by investors unless they impatiently sold out of stocks during the market downturns. During subsequent bull markets, equities recovered all the earlier losses and generated higher returns thereafter (see Chart 3). As such, exiting equities in the midst of a deep sell-off could do more harm than good to investors, especially those with a long-term investment horizon.

Chart 3: Equities always rebound from sharp drawdowns and generate strong returns thereafter

Source: Bloomberg, Robert Shiller, as at 31 March 2020

Protection against inflation over the longer term

On the back of the recent economic shocks triggered by the Covid-19 pandemic, the immediate fear of investors is that prices around the world could start falling and a deflationary spiral may push the global economy into a deep recession.

Given the unprecedented fiscal and monetary stimulus rolled out by governments and central banks around the world so far this year to stem the economic fallout from Covid-19, there is currently a lot of liquidity in the global economy and financial markets. This massive injection of liquidity is necessary to cushion the pandemic’s devastating negative impact. We do not rule out the possibility of a spike in inflation and inflation expectations subsequently, as stimulus measures could be difficult to withdraw if the pandemic situation is contained within a year. If inflation does spike, then equities will be an appropriate asset class to be in, in our view, given their ability to turn in returns higher than inflation rates.

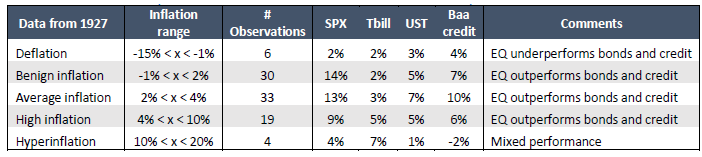

Based on data from 1927, equities had outperformed government bonds and corporate credits during inflationary periods when inflation ranged from 4% to 10%. Equites also outperformed when inflation was between -1% and 4%. When inflation was above 10% (an extreme level), T-bills performed best, followed by equities (see Table 1).

Table 1: Performance of equities and other asset classes across different inflation periods

Source: New York University, Aswath Damodaran

Active equity investing

To achieve excess returns versus the market, especially during down markets, active equity investing will be key. In our view, active equity investing is a dynamic endeavour. Indeed, structural market changes may result in equity investment strategies that had performed well in the past not delivering the same outperformance going forward. An example is value investing, which had generated outperformance in the past but greatly underperformed in recent years.

One instance how we responded dynamically to the changing investment landscape was our deliberate decision to tilt towards quality and growth factors instead of value since 2009. This was one of our most important alpha contributors in recent years. We have also persisted with the quality tilt in 2017, when many in the industry started leaning towards value.

Since late 2018, however, we have enhanced our favourable views toward the value factor. But unlike traditional value strategies, which focus mostly on investing in businesses in the mature and turnaround phases of the corporate life cycle, we look at businesses of all phases in the corporate life cycle. These include businesses that are young and accelerating in growth to those that are compounding their competitive advantages, or operating in a slowing, maturing and turnaround stages.

All things considered, investment managers need to be adaptive at analysing companies in different stages of the corporate life cycle, where business risks and competitive environments are very different. The focus on active management and quality businesses has provided downside protection during this year’s sell-off in equities.

Managing short- to medium-term equity risk

Despite the current uncertainties due to the Covid-19 pandemic, equity market risk and volatility can be managed by being nimble and having a structured framework to assess the markets continuously. Having a well-managed dynamic asset allocation overlay or a hedging programme are examples of good ways to be nimble.

There are no shortages of short-term downside risks in equities right now, when there is poor visibility on how much lower stocks can fall or the time period investors have to wait before markets bounce back up again. Of late, market movements have been influenced by a confluence of factors, including the pandemic situation, global governments’ and central banks’ responses to the Covid-19 fallout, and the impact of the pandemic to the real economy. We can expect the path forward to be uneven, to say the least.

As such, we are closely monitoring the following three broad set of signposts:

- Response from global authorities

Policy makers, governments and central banks around the world are now willing to “do whatever it takes” to reduce the economic fallout from Covid-19 and to stem the spread of the pandemic. This includes deploying massive fiscal and monetary interventions as well as enforcing stringent lockdowns or other social distancing measures. - Plateauing of the global spread of the Covid-19 virus in some regions

After nationwide lockdowns and tough social distancing measures implemented by many countries around the world, the global outbreak of Covid-19 seems to be plateauing of late in some regions. However, the world isn’t out of the woods yet, and the risk of another peak in Covid-19 infection rate is likely unless countries prudently ease their lockdowns or when better treatment or a vaccine is ready. - Impact on the world economy

At the moment, the outlook for the world economy in the wake of the Covid-19 pandemic remains very murky. We would not be surprised if the GDP of major economies decline -5% to -10% in the first half of 2020. By monitoring high frequency economic and activities data, we are informed that even after countries start to ease their lockdowns, economic recovery will be uneven, ranging from 40% to 80% of pre-Covid-19 economic growth levels. Recovery of traditional services and personal consumption are also expected to be slower and shallower compared to industrial production.

The reading of the signposts will help us navigate the market uncertainties brought about by the pandemic. The signposts also help indicate when stocks will make a sustainable comeback.

Conclusion

All in all, despite the stock market upheaval of late due to the fallout of the Covid-19 pandemic, long-term investors shouldn’t lose faith in equities, which have always demonstrated their ability to bounce back from bear markets over time and make new highs thereafter. This is why equities should remain an important part of a well-diversified, long-term focused investment portfolio. A seasoned and active equity manager could manage short- to medium-term risks on behalf of investors as well as take advantage of market trends and short-term volatility to achieve alpha. As such, equity investors with long-term investment objectives should stay the course and keep faith in stocks, which should remain a key part of their diversified investment portfolios.