Summary

- US Treasury (UST) yields ended the month largely unchanged. The month opened to strong risk sentiment, helped by US President Donald Trump's response to Hong Kong's new security law, and positive data released from the US and China. Yields fell after policymakers struck a cautious tone over the economy’s recovery at the Federal Open Market Committee (FOMC) meeting. Towards the month-end, sentiment fluctuated between optimism for the reopening of economies and concerns over a second wave of COVID-19 infections. Overall, 2-year and 10-year UST yields ended the month at 0.15% and 0.66%, respectively, about 1.3 basis points (bps) lower and 0.3 bps higher than the prior month.

- Asian credits returned 2.08% in June, driven by a 25 bps tightening in credit spreads. Positive risk sentiment led high-yield (HY) credits to outperform; they gained 3.91% and their spreads contracted 74 bps. High-grade (HG) credits registered a total return of +1.55%, with their spreads tightening 13 bps.

- In June, a total of 81 new issues amounting to US dollar (USD) 35.12 billion were raised in the primary market. Within the HG space, 47 new issues amounting to USD 24.86 billion were raised. Primary market activity within the HY space also picked up: a total of 34 issues amounting to USD 10.26 billion were raised during the month.

- Regional inflation readings fell further in May, due mostly to a moderation in food prices. The Bangko Sentral ng Pilipinas (BSP) and Bank Indonesia (BI) reduced their policy rates, in a bid to soften the economic pressure arising from COVID-19. In China, regulators tightened control over structured deposits while the benchmark lending rate was left unchanged for the second straight month.

- Going forward, we expect Indonesian and Indian bonds to outperform. Following BI’s lowering of the policy rate, we believe there is room for further cuts in the future. The Reserve Bank of India (RBI) is also likely to continue its proactive response to evolving conditions. We believe the central bank still has plenty of tools that it can use to inject liquidity in the market, which should provide support for bonds. On currencies, we expect the Philippine peso (PHP) and Thai baht (THB) to outperform.

- We expect Asian credit spreads to continue tightening from still-elevated levels. However, given the sharp rally in the second quarter, the pace of tightening should slow with more market pull-backs as investor sentiment remains fragile due to the unprecedented nature of the economic shock. We continue to monitor downside risks to this moderately constructive outlook.

Asian rates and FX

Market review

UST yields end the month largely unchanged

The month opened to strong risk sentiment, reflecting overall relief over US President Donald Trump's response to Hong Kong's security law. The notable absence of harsh sanctions aimed at China triggered a strong rally in risk assets, and a sharp rise in UST yields. Risk-on sentiment was further fuelled by significantly stronger-than-expected US domestic data; on the other hand, the social unrest and nation-wide protests triggered by the death of George Floyd in Minneapolis did not have a strong effect on risk-on sentiment. Markets increasingly priced in an improving global macro backdrop after the US economy shockingly added 2.5 million jobs in May, against consensus expectations of another decline of around 8 million jobs.

China's data revealed continued normalisation in manufacturing activities. The ascent in yields was halted and yields subsequently fell after policymakers struck a cautious tone on economic recovery prospects at the FOMC meeting and signalled that interest rates are likely to remain at current levels through the end of 2022. The resurgence of infections in some US states and a COVID-19 outbreak in Beijing also contributed to the reversal in sentiment. Towards the month-end, sentiment fluctuated between optimism over the reopening of economies and concerns over a second wave of COVID-19 infections. Overall, 2-year and 10-year UST yields ended the month at 0.15% and 0.66%, respectively, about 1.3 bps lower and 0.3 bps higher than prior month.

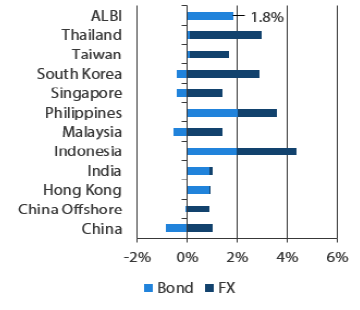

Markit iBoxx Asian Local Bond Index (ALBI)

For the month ending 30 June 2020

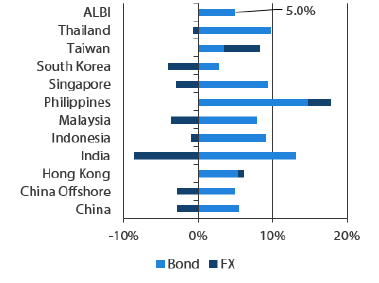

For the year ending 30 June 2020

Source: Markit iBoxx Asian Local Currency Bond Indices, Bloomberg, 30 June 2020

Note: Bond returns refer to ALBI indices quoted in local currencies while FX refers to local currency movement against USD. ALBI regional index is in USD unhedged terms. Returns are based on historical prices. Past performance is not necessarily indicative of future performance.

Inflationary pressures moderate anew in May

Regional headline consumer price index (CPI) prints fell further in May, due mostly to a moderation in food prices. Headline CPI in the Philippines eased to 2.1% year-on-year (YoY) from 2.2%, dropped to 2.4% from 3.3% in China and fell to 2.19% from 2.67% in Indonesia. Elsewhere, negative inflation pressure in Thailand and Singapore gained traction. Headline CPI of these two countries were -3.44% and -0.8%, respectively, whereas the annual consumer inflation rate in Malaysia remained unchanged at -2.9%.

Monetary authorities in Indonesia and the Philippines cut policy rates

The BSP and BI both reduced their policy rates in a bid to soften the economic pressure arising from COVID-19. The Indonesian central bank announced a 25 bps rate cut and left the door open for further easing, after staying on hold in the previous two meetings. According to BI, the decision was essential "to maintain economic stability and to support economic recovery". Meanwhile, the BSP slashed interest rates by a larger 50 bps, taking the total rate cuts in this cycle to 175 bps. According to the central bank, it lowered rates to help "mitigate downside risks to growth and boost market confidence".

Regulators tighten control over structured deposits

During the month, policymakers moved to deter financial arbitrage and re-divert funds to real economic activity. Cognisant of the fact that some corporates have been taking advantage of lower borrowing rates to invest in structured deposits for yield pick-up instead of utilising cheap funding for commercial activity, the China Banking and Insurance Regulatory Commission reportedly gave window guidance to select large- and mid-sized banks to downsize their structured deposits, with rules varying according to the size of the bank. Separately, China left its benchmark lending rate unchanged for the second straight month.

Moody's downgrades India's sovereign rating; Fitch revises India's outlook to negative

In June, Moody's downgraded India's sovereign rating to Baa3 and kept the outlook on "negative", as it sees downside risks to growth and the financial sector. Fitch affirmed India's rating at BBB- but revised the outlook to "negative", also expressing concerns over the financial sector. Standard & Poor’s (S&P), however, affirmed India's BBB- rating and maintained its "stable" outlook, albeit noting that the COVID-19 pandemic "will exacerbate India's weak fiscal settings". With these actions, India now has a negative rating outlook from two of the three rating agencies, although it has managed to keep its investment-grade rating under all three agencies.

S&P places Malaysia's sovereign rating on negative outlook

S&P Global Ratings revised its outlook on Malaysia to "negative", citing a significant economic impact from COVID-19. The rating agency added that the country's net indebtedness could surpass 60% of GDP, amid forecasts for a contraction in real GDP this year and higher fiscal deficits in 2020 and 2021.

Market outlook

Indonesian and Indian bonds expected to outperform

We believe that decisive action by major central banks to inject liquidity and improve funding markets will continue to support the hunt for carry when risk sentiment stabilises. The US Federal Reserve (Fed) has also reiterated that interest rates would be kept lower for longer, which is expected to support capital flow into Asia. Regional bonds continue to provide relatively attractive real yield, and foreign positioning remains relatively light. These factors support our constructive view on regional bonds over the medium term.

That said, we will continue to monitor downside risks, particularly the risk of new waves of COVID-19 cases globally and re-emergence of geopolitical tensions between the US and China, which could dampen risk sentiment anew in the near term. However, we note that actions by governments and central banks (particularly the Fed) are likely to prevent a steep decline in markets, should risk aversion prevail.

Against such backdrop, we expect Indian and Indonesian bonds to outperform. Following BI's lowering of the policy rate this month, we believe that there is room for further cuts in the future. Meanwhile, the finance minister has announced that the government is close to sealing a deal for the central bank to purchase over Indonesian rupiah (IDR) 400 trillion of select government bonds, to alleviate some of the fiscal financing pressure. This development should marginally ease supply concerns. Meanwhile, the RBI is likely to continue its proactive response to evolving conditions. We believe the central bank still has plenty of tools that it can use to inject liquidity in the market, which should provide support for bonds. Furthermore, the possibility of debt monetisation in the latter part of the year should marginally ease concerns about additional bond supply.

PHP and THB expected to outperform

We expect the PHP and THB to outperform. Thailand's current account balance swung back into a deficit in May. The gradual reopening of borders may boost demand for the THB, as the tourism sector recovers. With three dissenters favouring no policy change at the latest monetary policy committee meeting, the Bank of Thailand may stay on hold for now, which could lend further support to the currency. Meanwhile, we maintain that the PHP is likely to remain resilient, owing to lower reliance on tourism and global trade, low oil prices and a narrowing current account deficit as infrastructure spending slows.

Asian credits

Market Review

Asian credits stage a strong rally

Asian credits returned 2.08% in June, driven by credit spreads tightening 25 bps. Positive risk sentiment led HY credits to outperform, gaining 3.91%, with spreads contracting 74 bps. HG credits registered a total return of +1.55%, with spreads tightening 13 bps.

The month opened to a strong rally in risk assets, spurred on by better-than-expected US and Chinese economic data that fuelled hopes of a stronger global economic recovery in the second half of the year. There was also a sense of relief around the measured response by the US to China’s push to introduce a new national security law for Hong Kong. The European Central Bank’s announcement of a larger-than-expected increase in its Pandemic Emergency Purchase Programme, extension of the net purchase period under the programme to at least mid-2021, and reinvestments also contributed to the tightening in credit spreads by reinforcing the policy backstop message. Towards mid-June, however, risk sentiment was dampened by renewed concerns about a potential second global COVID-19 wave following a localised outbreak in Beijing, along with the continued rise in new daily cases in some US states, as well as some large Emerging Market (EM) countries such as Brazil, India and Indonesia. Risk sentiment recovered slightly after the Fed announced it has begun directly purchasing individual corporate bonds under its Secondary Market Corporate Credit Facility. Asian credit spreads traded more or less range-bound in the second half of the month, as the market was torn between the conflicting forces of better-than-expected economic data and underlying policy support on one hand, and worrying COVID-19-related developments on the other.

In June, Moody’s downgraded India’s sovereign rating to Baa3 and kept the outlook on “negative”. Fitch affirmed India’s rating at BBB- but revised the outlook to “negative”. Standard & Poor’s (S&P), however, affirmed India’s BBB- rating and maintained its “stable” outlook, which was a positive surprise. Despite the negative rating actions and a border tension with China, Indian credits continued to outperform in June, although they did weaken slightly towards the month-end. South Korean credits underperformed during the month, although this was more a reflection of their low-beta nature amidst the broad risk-on environment rather than any negative reaction to the brief rise in tensions with North Korea. Hong Kong credits also underperformed, although their spreads still ended tighter amid caution ahead of China’s passage of the new security law. Towards month-end, S&P affirmed Hong Kong’s sovereign rating at AA+, and maintained its “stable” outlook. S&P also affirmed Malaysia’s sovereign rating at A-, but revised the outlook to “negative”.

Primary market activity surges in June

The month saw a total of 81 new issues amounting to USD 35.12 billion being raised in the primary market. Within the HG space, 47 new issues amounting to USD 24.86 billion was raised. This included the USD 2.5 billion three-tranche Indonesia sovereign Sukuk issue, the three-tranche USD 2.0 billion issue from CNPC Global Capital and USD 2.0 billion Tier 2 capital securities from China Construction Bank. Primary market activity within the HY space also picked up: a total of 34 issues amounting to USD 10.26 billion were raised during the month.

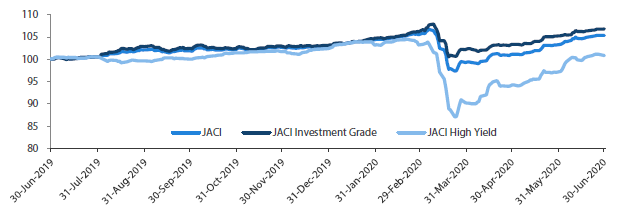

JP Morgan Asia Credit Index (JACI)

Index rebased to 100 at 30 June 2019

Note: Returns in USD. Past performance is not necessarily indicative of future performance. Source: Bloomberg, 30 June 2020

Market Outlook

Asian credit spreads to grind tighter from still-elevated levels, but downside risks remain

Economic data to be released for 2Q 2020 is likely to show record-setting deterioration, with a slight hint of this already seen in the 1Q 2020 numbers. Company earnings and credit fundamentals for 2Q 2020 and 1H 2020 are likely to weaken sharply.

That said, decisive central bank actions to inject liquidity and improve credit and funding markets, alongside significant fiscal stimulus measures, have reassured investors that a worst case scenario involving widespread business failures, sustained high unemployment and systemic financial collapse have been averted. Despite a worsening of the COVID-19 situation in the US and some large EM countries, the flattening of the COVID-19 curve in Europe and East Asia have led to optimism that the global economy remains on track for a modest recovery.

We expect credit spreads, including those in Asia, to continue tightening from still-elevated levels. However, given the sharp rally in the second quarter, the pace of tightening should slow with more regular episodes of market pull-back as investor sentiment remains fragile due to the unprecedented nature of the economic shock.

We continue to monitor downside risks to this moderately constructive outlook. Such perceived risks include a second COVID-19 wave in the US, still rising cases in India and Indonesia, a resurgence of dollar strength, macro indicators for June and July showing much slower recovery after the initial rebound, deepening US-China tensions and geopolitical concerns emanating from Hong Kong.