Introduction

The Australian market declined sharply from the 20 February high of 7,160 to the 23 March low of 4,536, and has since recovered to over 6,000 at the time of writing.

The decline was driven by fears and uncertainty of the extent of the medical crisis, and the economic consequence of isolation and the social distancing measures that were intended to slow the spread of COVID-19.

The subsequent rally was driven by responsive monetary and fiscal policy measures and an easing of fear as isolation measures bettered the initial forecasts of cases, deaths and duration of the economic shutdown.

Australian market consensus on earnings per share for the next 12 months has declined 20% compared to a year ago. Whilst the broad market segments of industrial and resources have both seen surprisingly similar earnings expectation—falls of -20.8% and -22.0%, respectively—there are significant moves within categories at the next sublevel.

Industrial earnings expectations, excluding banks, have declined 15.5%. This segment contains a larger proportion of companies less affected by the social distancing and shutdown measures, including defensives such as food retailing, consumer staples and health care.

Expectations for bank earnings have fallen 30.4% in anticipation of compressed net interest margin (NIM), expectations of rising bad debts, remediation charges and anticipated forward provisioning of loan losses.

Resource companies, excluding oil, have seen earnings expectations decline only 11.6% compared to a year ago.

Iron ore has stayed strong due to supply disruption in Brazil and consistent deliveries to China, while oil companies have seen earnings expectations fall by 68.2% compared to a year ago. This is a reflection of the demand/supply imbalance and consequent heavy fall in benchmark BRENT from USD 60 per barrel to a low of USD 20 per barrel, which has since rebounded to around USD 40 per barrel (at the time of writing).

Dividends: Deny, defer or diminish?

The overall market dividend expectations for the S&P/ASX 200 Index have declined 30%.

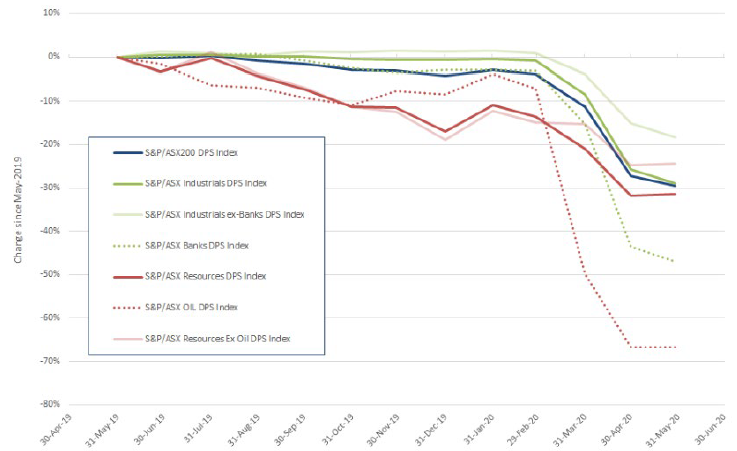

Chart 1 Dividend estimate pathway

Source: FactSet, as at 31 May 2020

The extent of the decline vs earnings varied by subgroup, with the worst groups being oil and banks—dividend expectations are down 66.8% and 46.9% (respectively) compared to a year ago. The most robust dividend segment has been industrial ex-banks, which declined by 18.3%.

The pass-through effect of a lower oil price on largely contracted volumes is transparent in the likely impact on oil group dividends. The downgrades to oil earnings and dividends were brutal, but the circumstances of the limits on storage capacity at one particular oil derivative contract expiry demonstrated supply discipline by OPEC+. Increasing demand as economies restart should mean these downgrades pass in the medium term. The flattening of the dividend expectations and earliest of uplift in earnings is evident in Chart 2.

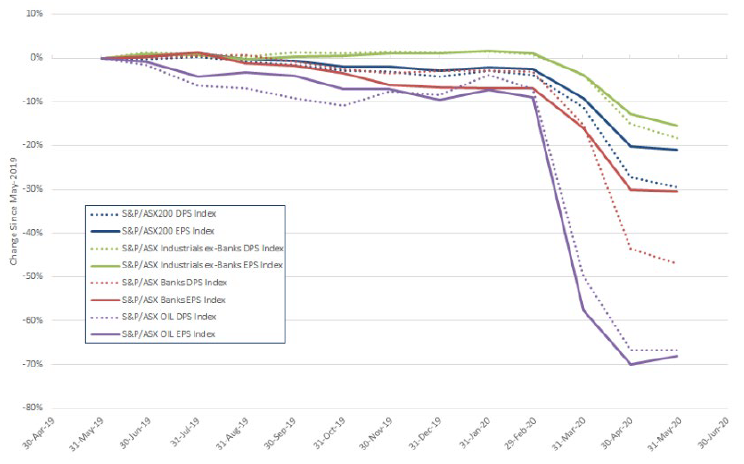

Chart 2 Earnings vs dividend estimate pathway

Source: FactSet, as at 31 May 2020

While the proportionately greater decline in dividend (46.9%) vs the fall in earnings (30.4%) is significant in terms of the overall market dividend, the reasons behind the decline aren’t as clear.

All dividend distributions are at the discretion of company boards. An “abundance of caution” has been behind most decisions to deny, defer or diminish dividends by proportions greater than the effect justified by the earnings decline.

Banks are special in so far as they operate under a forward looking problem loan provisioning regime and are accountable to financial regulators, including APRA, which set priority to solvency, lending and dividends.

In early April 2020, APRA directed banks and insurance companies to exercise caution in making dividend payments. This is consistent with action of financial regulators offshore, but is counter to earlier messaging that the dividends remain a matter for boards.

The forward looking nature of loan loss provisioning estimates, which necessarily include probabilistic estimates of loan losses, will likely be used to raise provisions and reduce reported profit. This would be consistent with the new APRA directive. Further, the Australian Banking Association six-month foreclosure moratorium will extend the typical period in which arrears become bad loans and charged off against the provision. The impact of bank dividend reductions and deferrals by absolute size and proportion are what make this feel like a ‘drought’.

Whilst the uncertainty regarding the bank dividends is disconcerting, in the circumstances, the consensus expectations imply that investors are prepared for a six month dividend suspension before the restart of the economy takes shape and boards regain confidence reinstate deferred dividends.

Dividend yields

The Australian market has a history of reliable dividend returns.

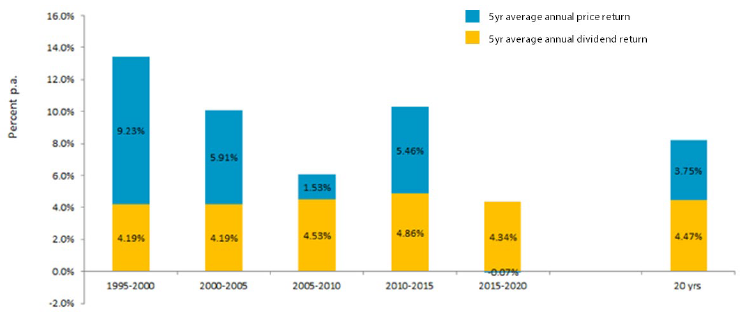

Chart 3 S&P/ASX 200 Accumulation Index – Total return composition (% to May 2020)

Source: S&P/ASX; IRESS. Time periods are rolling five-years/periods to May.

The forward dividend yield expectation has declined from 4.6% (slightly above the 20 year average of 4.5%) in May 2019 to 3.5% for the year ahead in May 2020.

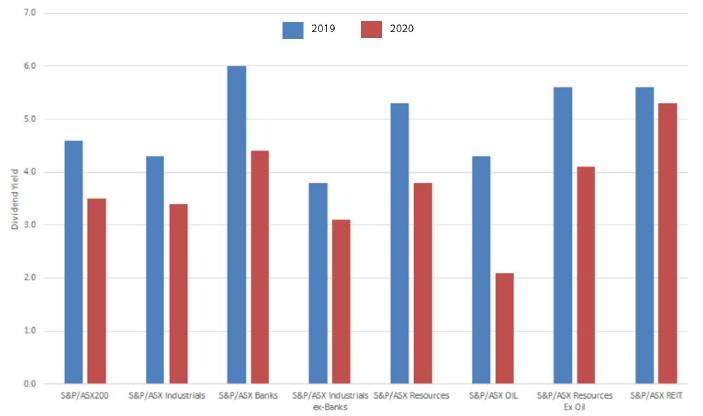

Chart 4 Market expectations for dividend yield comparison: May 2019 – May 2020

Source: FactSet

Explores what and a general convergence towards 3.0%

This dividend per share drought is a direct consequence of the impact on earnings and business confidence. The dividend yield convergence is a result of extreme unconventional monetary policy, which has crushed yields in traditional competing yield financial assets.

The exceptions of oil at 2%, likely to be upgraded with a sustained recovery in the oil price, and likely downgrades to REITs, with heighted likelihood of asset valuation write-downs, will results in the need for re-capitalisation and associated distribution cancellations. This situation is strangely familiar in so far as clients have asked, hypothetically, “What would we do if all shares had the same dividend yield?”

Our answer has always been continued reliance on our assessment of a company’s intrinsic value to assess the opportunity vs prevailing share prices and seek to capture that in our portfolio positioning.

Portfolio positioning entering COVID-19 and action taken

Valuations have been distorted by fears of the economic impact and a flight to safety to those companies that are expected to be relatively unaffected by isolation and distancing measures. Despite the partial recovery in market prices, the impacts on relative valuation have extended pre-COVID-19 premiums for ‘growth’ and ‘momentum’ as well as market preference for balance sheet safety and dividend certainty.

In late 2019, the portfolio was positioned for an anticipated recovery in global growth entering 2020. As COVID-19 cases took hold in China, before spreading to the rest of the world, the likely decline in global growth just from China and the likelihood of lower interest rates and consequence for banking led to our highest value action, which was to reduce bank exposure from +3% to -4% due to the inherent leverage, risk to NIM from falling interest rates, rising bad debts due to the shut-down and low loan growth.

This move was counter-intuitive for an income-focused fund, however our active management of our Nikko AM Australian Share Income Fund (Fund) and valuation projections and recognition of dividend uncertainty led us in the right direction.

Proceeds from the bank sales were applied to superior value opportunity with less risk in domestic, relatively defensive insurance, telecommunications, food and infrastructure.

As the case numbers in China peaked, we observed resilience in iron ore shipment deliveries. This, combined with an under-geared balance sheet after an asset rationalisation program and an expectation of stimulus in China, led us to increase resources via Rio Tinto Limited (RIO).

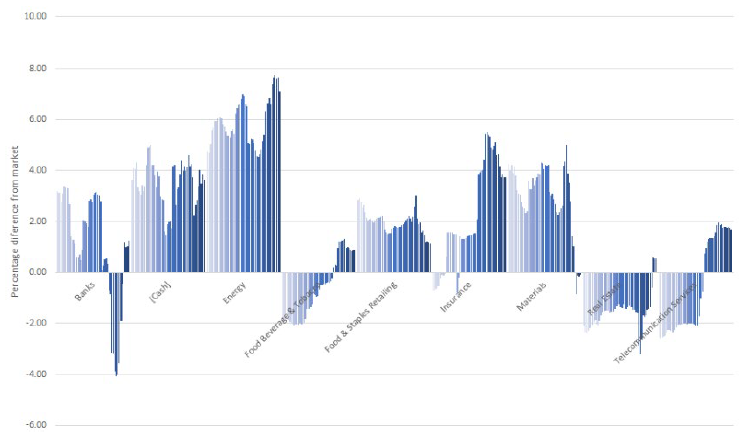

Chart 5 shows the change in Fund positioning relative to the market in selected industry groups over the year to May 2020.

Chart 5 Nikko AM Australian Share Income Fund position vs market (year to 31 May 2020)

Source: Nikko AM, FactSet

The Fund has continued to be run with the goal of generating a yield above that of the market and consistent with the Nikko AM’s comparative value analysis (CVA). Our company valuations were re-estimated on a conservative expectation of a shut-down impact of two quarters and that the first isolations measures will be the last to be removed.

Post the market lows, the Fund has re-assessed the relative valuations and actioned sales in strong relative performing names including personal protective equipment supplier Ansell Limited (ANN), retailers Coles Group Ltd (COL) and Wesfarmers Ltd (WES), iron ore miner RIO and general insurance Suncorp Group Ltd (SUN).

In anticipation of making it to the other side of the medical crisis, and in the context of the forthright government and Reserve bank actions to support those most affected as well as the market valuation distortions, the Fund has reversed the bank selling and bought back to market weight on deeply discounted prices to our assessed valuation.

Defending our position in oil was also counter-intuitive for an income fund in the face of obvious pressure on earnings and dividends. Our work and confidence in management and the underlying assets, combined with patience in a baseline assumption of the oil market normalising, enabled us to ride out the worst of the oil price moves and gladly support calls for capital.

The Fund also provided support to existing positions by participating in all capital raisings in the companies held going into the crisis, in an expectation that with our support and confidence in assets and business models they will make it out. This has included childcare operator G8 Education Ltd (GEM), National Australia Bank Ltd (NAB), Lendlease Group (LLC) and Oil Search Limited (OSH).

Activity in the Fund during the subsequent rally on brightening expectations of relaxation of isolation measures has been consistent with the Fund goal and application of CVA.

Risk remains elevated

The nature of the post COVID-19 business operating environment is unclear. Consumer willingness to go out and employee caution and practicalities of a return to the office will weigh on consumption.

Businesses have deferred investment decisions. Social distance measures remain in force. The risk of a second wave or significant outbreak remain high until there is a vaccination or herd immunity to COVID-19.

The Economist notion of “The 90 percent economy” sums up the broad based constraint on activity and likely challenges to generating adequate returns.

Australia has been very fortunate to have acted promptly to isolate and support those companies and individuals most affected.

The fiscal programs of other G7 nations add to sovereign indebtedness, which by necessity is being neutralised by central bank asset purchases. This may not be sustainable. Perception that this may crack could cause yield sensitive assets to become volatile.

These factors lead to a preference for less risk, i.e. higher cash balance and generally smaller position sizes and a bias to domestic plays.

Conclusion

We have continued to apply our investment process taking particular note of the impact of social distancing, border closures, travel bans, financial leverage and economic activity. For the companies directly exposed, the question of survival and need to raise capital dwarfs the dividend decision.

There are few companies that benefit relatively or suffer less from the current events. We note the valuation distortions that will be the source of funding for those companies we are prepared to back to make it to the other side.

The COVID-19 episode will pass and the dividend drought will break as activity and confidence return.

We remain confident that the rolling 5-year income objective of a grossed-up dividend yield greater than the S&P/ASX 200 yield with long-term capital growth will be met.

Important Information

This material was prepared and is issued by Nikko AM Limited ABN 99 003 376 252 AFSL No: 237563 (Nikko AM Australia). Nikko AM Australia is part of the Nikko AM Group. The information contained in this material is of a general nature only and does not constitute personal advice, nor does it constitute an offer of any financial product. It is for the use of researchers, licensed financial advisers and their authorised representatives, and does not take into account the objectives, financial situation or needs of any individual. The information in this material has been prepared from what is considered to be reliable information, but the accuracy and integrity of the information is not guaranteed. Figures, charts, opinions and other data, including statistics, in this material are current as at the date of publication, unless stated otherwise. The graphs and figures contained in this material include either past or backdated data, and make no promise of future investment returns. Past performance is not an indicator of future performance. Any economic or market forecasts are not guaranteed. Any references to particular securities or sectors are for illustrative purposes only and are as at the date of publication of this material. This is not a recommendation in relation to any named securities or sectors and no warranty or guarantee is provided.