Global stocks have had a wild ride in 2020. The onset of the Covid-19 pandemic initially brought global financial markets to their knees, with the S&P500 dropping by over 33% in USD terms between February and March 2020. The sharp decline was followed by a swift rebound, with most markets clawing back a large part of their losses by the end of June.

Look more closely, however, and you will see that the severity of the impact has been asymmetric across industries. Internet stocks were relatively resilient between February and March, with the iEdge-Factset Global Internet Index dropping by 25% in USD terms. In comparison, airline stocks were among the hardest hit, with the NYSE Arca Global Airline Index falling by over 57%. The internet sector continued to outperform on the rebound, with the index currently almost 10% higher than its pre-Covid-19 peak. This comes as no surprise as internet companies are generally characterised by strong balance sheets with low gearing, short product cycles and relatively lean headcounts—granting them agility to navigate through trying times.

The dominance of the internet sector is not news to anyone: Facebook, Alphabet and Amazon are household names that have long been among the top five most valuable companies in the S&P500. But we believe that their position will be further reinforced in a post-Covid-19 world. Internet stocks are at the intersection of three major themes that are expected to reshape the world in years to come: e-commerce, online advertising and the Internet of Things (IOT).

E-commerce

The e-commerce subsector accounts for about 30% of the iEdge-Factset Global Internet Index. Major component stocks that derive the bulk of their revenues from e-commerce are Alibaba, Amazon, JD.com, eBay, Baidu, Pinduoduo and Z Holdings (formerly Yahoo Japan).

There is tremendous potential for e-commerce to grow if companies can shift consumer purchasing patterns to online purchasing channels. Bank of America Merrill Lynch estimates that global penetration can increase from 11% to over 25% in the long term. This will be supported by the following factors:

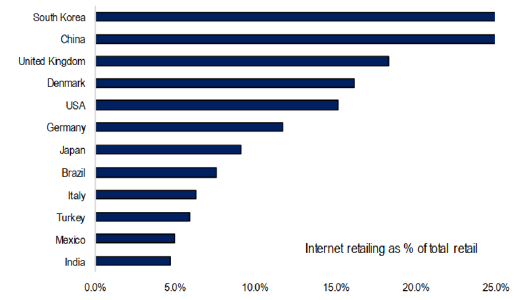

- Large potential room for growth. E-commerce penetration is highest in South Korea and China. However, in 2019, e-commerce accounted for only about 25% of retail in South Korea and China, and even less in other countries—a testament to its tremendous room for growth.

Chart 1: Internet retailing as a proportion of total retail (2019)

Source: Euromonitor, Credit Suisse Research, May 2020

- Convenience and speed. Convenience has always been a selling point for e-commerce. Individuals can purchase their goods and services anywhere and anytime without visiting physical stores. With greater optimisation in supply chains, e-commerce companies will be able to reach consumers with greater speed.

- Rise in online offerings. The number of goods and services exclusive to brick-and-mortar stores is diminishing. More and more of these items can be purchased online with greater convenience and speed.

- Bridging the gap between in-store and online experiences. With the rise of online user-engagement tools such as augmented reality, the gap between in-store and online experiences will be narrowed.

- Increased e-commerce customer loyalty. The growth in subscription models that are prevalent among e-commerce companies (e.g. Amazon’s Amazon Prime) is likely to give rise to long-term customer loyalty and retention.

Online advertising (social media and search engine)

The iEdge-Factset Global Internet Index will benefit from the secular shift to online advertising and rising share of digital advertisement spending as this sub-sector accounts for about 27% weight in the index. Major component stocks that derive the bulk of their revenues from online advertising are Alphabet (Google), Facebook, Twitter and Naver.

We believe that there is still significant runway for growth for advertising across social media (e.g. Facebook, Twitter) and search engines (e.g. Google). These platforms can provide a higher degree of advertisement targetability through deep analysis of consumer data and consequently this translates to higher conversion rates. Compared to traditional media, these platforms are also able to provide richer content (e.g. interactive ads) and generate online conversations, increasing consumer engagement and stretching the possibilities of advertising. A short-term revenue driver will be the 2020 US presidential election as total political advertisement spending is expected to hit USD 6 billion, with a large portion going to online advertisements on platforms such as Facebook, Google and Twitter.

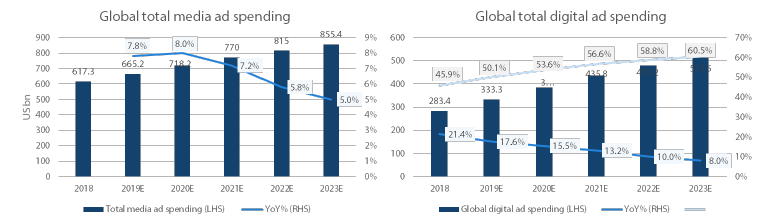

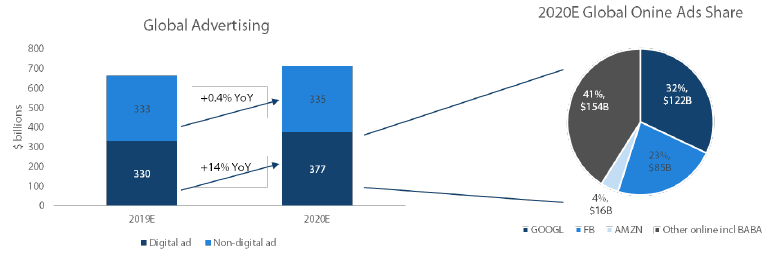

This growth is also supported by empirical evidence. Citi Research expects global advertisement spending to continue to increase into the foreseeable future, with growth rate of the digital advertising space higher than that of traditional platforms.

Chart 2: Global media ad spending versus digital ad spending

Source: eMarketer, Citi Research, April 2020

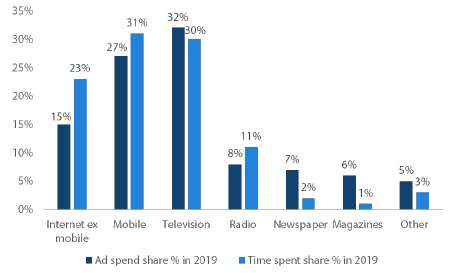

Furthermore, data seem to point to an overspending in traditional advertisement platforms (television, newspapers, magazines etc.), with the percentage spent on advertisements exceeding the media consumption percentage. Therefore, there is room to shift marketing budgets globally to digital sphere segments such as the internet and mobile advertising.

Chart 3: US media consumption versus ad spending

Source: Credit Suisse European Media Team, May 2020

Internet of Things (IOT)

The core principle behind IOT is the connection of various disparate devices via the internet, with these devices all collecting and sharing data. The integration of various unique streams of data in real time allows for an enhanced level of digital intelligence, creating a smarter and more responsive world; this would not have been possible if these devices were operating individually.

McKinsey & Company reports that investments in IOT are projected to grow at 13.6% annually through 20221 and Statista reports that end-using spending of IOT solutions worldwide will reach USD 1,567 billion by 2025. The following are the key drivers of the IOT revolution:

- Developments in 5G technology will spur growth in IOT due to enhanced internet connectivity via larger bandwidth and better network performance. It will be especially beneficial to wide-area IOT networks that extend over large geographical areas as their main bottleneck previously was the inability to transmit large volume of data over distances efficiently.

- Sensor technology that is embedded in IOT devices to collect data will continue to become more sophisticated and cost efficient.

- Computing power has increased a hundredfold in the past 15 years. This will allow for real-time processing and analysis of the data collected to generate actionable insights.

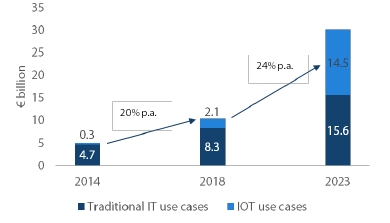

Chart 4: Revenue pools for device-enablement platforms for IOT and IT, 2014-2023

Source: McKinsey & Company, May 2020

Covid-19 has caused a leap forward in the digital revolution

The Covid-19 pandemic has necessitated social distancing and the formation of new habits. It has also brought about a level of digitization globally that would otherwise have only been achieved in the next 10 or 20 years. In a recent interview with Business Insider, Shopify’s CEO commented on the magnitude of this acceleration by suggesting that “the future we imagined for 2030 has been pulled forward to the present”. We all knew the digital revolution was coming: Covid-19 simply brought it forward. Internet companies are among the key players poised to benefit from this shift.

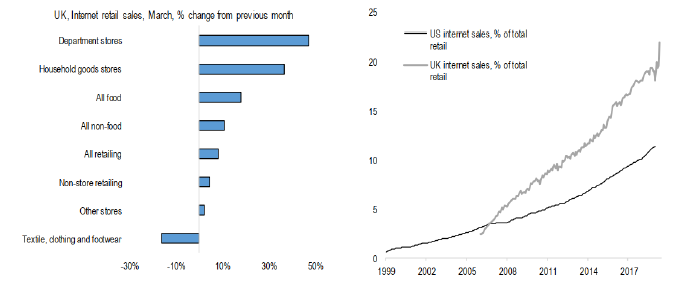

The switch to online retail has been accelerated by the pandemic as individuals reduce their visits to brick-and-mortar stores to minimise risk of exposure to the virus. Recent US aggregated credit and debit card data also suggested that e-commerce penetration increased to a peak of 35% during the last week of April, up from only 15% at the beginning of the year. This acceleration can also be seen very distinctly in the UK, with internet sales surging in the month of March 2020.

Chart 5: US and UK internet retail sales in March 2020

Source: Euromonitor, Credit Suisse Research, May 2020

We believe the pandemic could change the way consumers buy goods online over the longer term. Specifically, we could see higher penetration in demographics that were previously less comfortable purchasing online and in certain product categories that have historically had lower penetration such as groceries, home personal care and consumer package goods. For example, Amazon’s recent announcements that it plans to hire about 100,000 personnel and prioritise medical supplies and household staples clearly points to positive demand indicators for its rising online grocery business.

Furthermore, as e-commerce platforms grow, companies can tap on the network effect for further monetisation opportunities. Alibaba becoming a key mobile payments provider and Amazon creating its own music offerings are testament to this.

The rise of new social media platforms such as TikTok and the increased consumption of digital media sources during the pandemic will likely propel advertisers to shift their budgets to focus on more digital advertisements.

Chart 6: Digital ad spend is set to grow in 2020

Source: JPMorgan, eMarketer, October 2019

Finally, Covid-19 will speed up the adoption of IOT on a personal and institutional level, in our view. To contain the outbreak, governments would ideally want to be able to collect individual health data in real time, process the data and act on it as soon as possible—something that IOT seems suited for. Work has already started: Singapore is developing a wearable device for every citizen for contact tracing and researchers globally are looking into modifying wearables (e.g. Fitbit or Apple Watch) to detect Covid-19 symptoms before they show up.

Are you on board?

The Covid-19 pandemic could have a lasting impact on the way we live and interact. In this new normal, some businesses are likely to benefit while others could quickly become irrelevant. With the acceleration in the digital revolution, e-commerce, social media, search engine and IOT companies will be at the forefront of this growth. Global internet companies are set for a quantum leap into the future, and we think it is time to buckle up for the ride.

Reference to individual stocks is for illustration purpose only and does not guarantee their continued inclusion in the strategy’s portfolio, nor constitute a recommendation to buy or sell.