Snapshot

Following a steady recovery in risk assets over the last few months, the markets appear to be entering an increasingly manic state. Bullish cheers greet macroeconomic data that handily exceeds beaten-down expectations, only to be followed by second doubts as a resurgence of viral infections gathers pace in the US and other parts of the world. Irrespective of the prevailing sentiment of the week, the global economic recovery appears on track as we attempt to look through the noise evident in many economic indicators. Bright spots so far have been the strong rebounds in employment and retail activity. While the longer-term prospects for demand still hinge on the evolution of Covid-19, the early signs of an economic comeback are encouraging.

As authorities learn more about combatting the virus, countries can have much needed debates about balancing the restarting of economic activity with protecting public health. In contrast to the first Covid-19 wave, when testing was inadequate and hospitals were overwhelmed in places such as Italy and New York, a number of governments are now seemingly better prepared. Most countries have significantly boosted capacity in testing and contact tracing, issued public guidance on social distancing and the wearing of masks and introduced local strategies to protect the most vulnerable. These measures are expected to help save lives and slow the spread of the virus and at the same time allow economies to reopen relatively safely.

Because of such progress, many governments may not have to reinstate full countrywide lockdowns. Certain activities will remain restricted, so general economic activity will take some time to return to pre-pandemic levels. Nevertheless, the situation could be more benign relative to the severe conditions witnessed in March and April. Still, an effective and widely available vaccine for Covid-19 is yet to be discovered. On this front, several companies are reporting progress in the race to identify a vaccine and marshal it through the necessary trials.

So far, the fiscal and monetary response from authorities has been significant and policymakers seemingly stand ready to do more. This will continue to assist economies in dealing with the impact of Covid-19, but other risks are also on the horizon. Polls are shifting quickly for the upcoming US elections in November, and this will undoubtedly add to uncertainty as autumn approaches. The relation between China and the rest of the world is also an important potential stress point that the markets will be watching closely. The outlook still favours growth, but uncertainty is on the rise, making it sensible to hedge downside risk.

Cross asset1

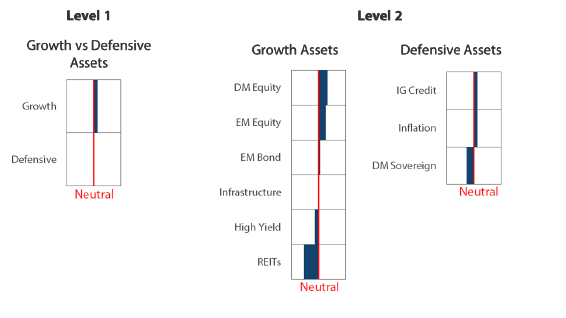

We continue to favour growth assets over defensive assets as the markets responded well to a spike in volatility last month. Even though our view is leaning towards pro-growth assets, we remain respectful of the general unpredictability of the virus, as evidenced by the re-acceleration of new Covid-19 cases in the US; as such, we continue to favour a well-diversified approach.

On the growth side, we still believe select equity markets can see further upside, as demand continues to normalise. Technology and quality stocks in general likely still have an edge in a world of disruption that requires fast, innovative solutions. We took a less cautious view of high-yield credit given the accelerating cyclical upturn and renewed support for energy prices. We took this less cautious view of high yield credit in lieu of sources of income that are more defensive, such as the still struggling REITs sector and listed infrastructure.

On the defensive side, we prefer investment grade credit to sovereign bonds for the yield premium and improving economic prospects that will support corporate credit. We also favour assets that are defensive against inflation, which we believe is a key risk as demand recovers on the back of enormous quantities of stimulus.

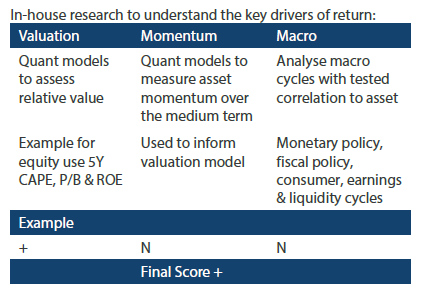

1The Multi Asset team’s cross-asset views are expressed at three different levels: (1) growth versus defensive, (2) cross asset within growth and defensive assets, and (3) relative asset views within each asset class. These levels describe our research and intuition that asset classes behave similarly or disparately in predictable ways, such that cross-asset scoring makes sense and ultimately leads to more deliberate and robust portfolio construction.

Asset class hierarchy (team view1)

1The asset classes or sectors mentioned herein are a reflection of the portfolio manager’s current view of the investment strategies taken on behalf of the portfolio managed. The research framework is divided into 3 levels of analysis. The scores presented reflect the team’s view of each asset relative to others in its asset class. Scores within each asset class will average to neutral, with the exception of Commodity. These comments should not be constituted as an investment research or recommendation advice. Any prediction, projection or forecast on sectors, the economy and/or the market trends is not necessarily indicative of their future state or likely performances.

Research views

Growth assets

The rally in growth assets may have lost some of its momentum in the US due to the second wave of Covid-19, but large amounts of policy support coupled with positive economic surprise appear to be limiting equities from deep downsides. We still like US equities, particularly for their tech sector that appears relatively immune to impact from Covid-19. However, we do see an opportunity set that is broadening beyond the US as demand normalises—particularly in China where stimulus efforts have picked up more recently.

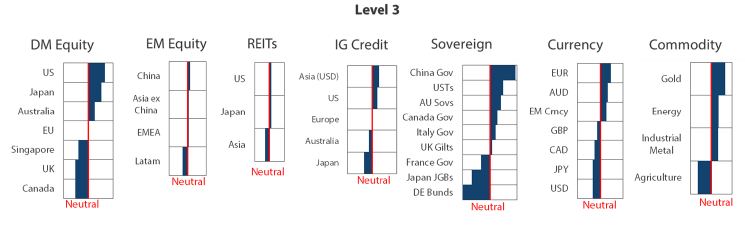

Rotation away from the least dirty shirt?

For nearly a decade, US equities were the strongest performing growth asset, partly because of the ever-dominant tech sector, but also for being the so-called “least dirty shirt” among the wreckage of serial crises in emerging markets with the rest of the world showing disappointing growth. However, conditions might just be aligning to give the rest of the world a chance to outperform.

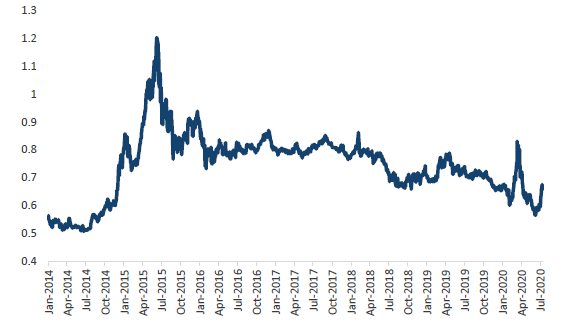

Since 2014, when China experienced a deflationary shock that resonated around the world, capital has been flowing to the US, lifting equities as well as the US dollar. There are numerous drivers of currency performance, but capital flow is certainly an important one. As safe haven-seeking capital flowed into the US, the resulting dollar strength reinforced weakness in the rest of the world in a negative feedback loop.

However, the tide may finally be shifting. Signs of impending reflation are beginning to emerge on the back of giant amounts of stimulus worldwide, and such developments are usually accompanied by a weaker dollar and oftentimes better equity performance outside the US. It is too early to say that we are in the midst of an inflection point of shifting capital flows, but there are early signs that the markets are beginning to price in such a phenomenon.

Chart 1: US equities beginning to underperform as dollar slips

Source: Bloomberg, July 2020

China A-shares breaking out

We enhanced our view on China due to strong fundamentals, which include improving demand thanks to the country’s relative success in managing Covid-19, increasing stimulus and the quieting skirmish with the US that had weighed on equities back in May. While we favour equity fundamentals, we also recognise that A-shares are often driven by local retail flows; in recent weeks, authorities signalled their support for equities, spurring major new speculative inflows.

We do not prefer chasing liquidity-fuelled rallies. But we have long appreciated improving A-share fundamentals driven by government stimulus directed to the private sector—including extensive investment in technology infrastructure—and still-growing consumer demand. That said, liquidity certainly does not hurt, particularly when equities show valuation support as they do now, trading at a still-deep discount relative to the rest of the world.

Chart 2: Shanghai Composite Index 12-month forward P/E versus MSCI ACWI Index's

Source: Bloomberg, July 2020

Conviction views on growth assets

- European equities lifted to neutral: Europe is faring better than the US in avoiding a second wave of Covid-19, and demand is improving, helped by renewed demand from China. Fiscal support has been ample, and the recently announced EU Recovery Fund, if approved, could inject an additional EUR 750 billion to be aimed at the more vulnerable periphery. The strong euro has not weighed on earnings so far.

- Rotate back to Asia in EM: We enhanced our view on China but at the same time took a more cautious view of Latin America (LatAm) and, to a lesser extent, EMEA. LatAm rallied on the back of compelling valuations and recent demand and price support for commodities the region exports. However, valuations are now less compelling while the region is still deeply challenged by Covid-19 and unstable politics.

- High-yield lifted to just below neutral: Spreads have compressed considerably since late March, mainly on the back of central bank and fiscal support, but we see potential for further compression driven by improving fundamentals, including the energy sector that is a significant component of the US index.

- Prefer cyclical over defensive growth: We still prefer equities to more defensive alternatives. We had been holding a cautious view of REITs for their challenging outlook connected with Covid-19, and while we still like infrastructure as an asset class, we took a more cautious outlook to enhance our views elsewhere in growth.

Defensive assets

Significant quantitative easing programmes by central banks have been supportive of growth markets but at the same time have sucked the volatility out of global rates markets. While it is tempting to significantly underweight fixed income in anticipation of stronger economic outcomes, rates may not rise until central banks move aside. Forward guidance from central bank officials has been at pains to show a commitment to easy conditions lasting well into 2021 and beyond. As US Federal Reserve (Fed) Chairman Jerome Powell said last month, the Fed is “not even thinking about thinking about raising rates”.

We view this as quite helpful for many reasons, particularly for multi-asset investors in the face of ongoing uncertainty around Covid-19. Fixed income assets can provide diversification and safety as growth assets recover while central banks guard against any prolonged spike in bond yields. Moreover, stable rates combined with ongoing monetary and fiscal support should create conditions for investment grade credit to shine. As a result, we prefer high-grade credit to sovereign bonds and continue to view gold as an important defensive asset. Precious metals perform well in reflationary environments, particularly when currencies are potentially undermined by easy central bank policies.

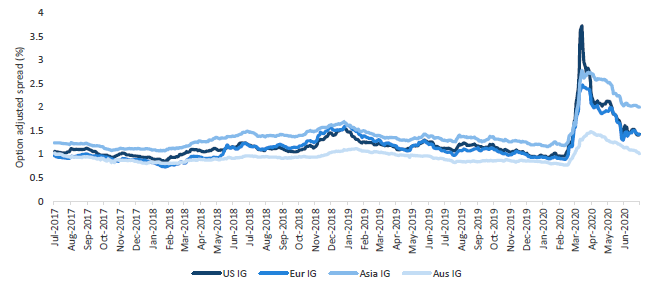

Rotation within investment grade markets

Defensive assets have performed well in the first half, led by traditional safe havens such as sovereign bonds and gold. While returns have been more moderate, investment-grade credit has also delivered solid returns in most regions. Chart 3 shows the option-adjusted spreads (OAS) for a number of high-grade credit markets. The significant spike in spreads is obvious and mirrors the heightened volatility of growth assets experienced earlier this year. However, OAS across markets have recovered from their widest levels to return to spread ranges prior to the pandemic—with one exception.

Chart 3: Investment grade credit OAS

Source: Bloomberg, July 2020

Asian credit spreads have lagged the recovery in spreads in other markets and are still wider than they were prior to the pandemic. Although Asian spreads are often wider than their peers in the US and Europe, the current spread premium is particularly generous. The perceived higher credit quality of US and European corporate bond issuers and better liquidity are two oft-cited reasons for this difference. However, in the current climate, in which Asia has been largely successful in containing the spread of Covid-19, perhaps more so than either Europe or the US, we expect a continued narrowing of the gap between Asian spreads and their peers. As a result, we have increased our favourable view of higher-yielding Asian corporate bonds at the expense of some US and Australian investment-grade credit.

Conviction views on defensive assets

- Investment-grade credit over sovereigns: Credit spreads have continued to tighten over the last month but valuations are still moderately attractive. The global fiscal and monetary response to Covid-19 has been substantial and this should continue to benefit many corporate issuers. As a result, demand should remain strong for high-grade income as investor risk appetite continues to recover.

- Avoid negative-yielding bonds: Perhaps this should go without saying, but yield-to-maturity still matters. If bond yields remain largely range-bound as we expect, then negative-yielding bonds will underperform.

- Prefer gold to inflation-linked bonds (ILBs): A recovery in breakeven inflation rates has quite naturally coincided with the rebound in oil prices although levels are still below the 1.5%–2% range that prevailed in 2019. The economic impact of the coronavirus has been severe and inflation is unlikely to be a concern for policy makers for quite some time. However, gold continues to be an attractive hedge for the reflationary policies of global central banks and expansive fiscal spending programmes. While these policies are necessary, they are also a potential threat to the value of currencies and thus support demand for real assets.

- Cautious on defensive currencies: We retain a cautious view on defensive currencies, namely the dollar and the Japanese yen. Improving economic growth outside of the US and gradual global reflation driven by central bank policies tends to depress demand for the dollar. These improving global conditions are also likely to weaken demand for traditional safe havens such as the yen.

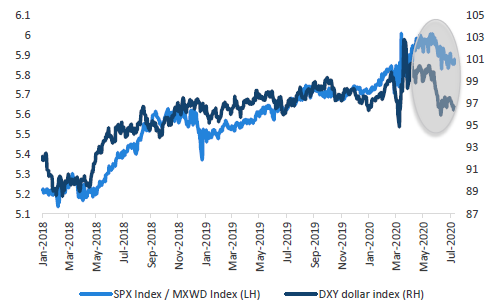

Process