Summary

Investing in Asian small-cap stocks is a potentially lucrative proposition. To achieve sustainable success in this area, however, requires an active, dexterous and experienced investor, whose extensive research insights and on-the-ground knowledge will allow him or her to sniff out the potential winners and avoid the losers in the under-researched universe of small-cap stocks.

Small hidden gems

Eighteenth century German philosopher Immanuel Kant, who coined the maxim “Look closely. The beautiful may be small”, seemed to find beauty in certain small things when exploring the concept of aesthetics. To be sure, philosophers aren’t the only ones with the perception that small is beautiful; investors of small-capitalisation (cap) stocks are also seeing beauty, not to mention potential long-term gains, in smaller, lesser-known listed companies with an undersized market cap.

Nimble, fast growing and at an early stage of development, small-cap companies have the ability to seize market opportunities at a quick pace, generate exceptional earnings growth and internally compound capital faster than their big-cap peers. Those with robust business models and innovative strategies could grow exponentially, particularly if their niche products or services are successful. Indeed, many of the big, successful companies around the world started out as diminutive, entrepreneurial and innovative firms with a remarkable ability to grow.

Potentially rewarding but also risky

On the flip side, any product failures, dramatic slowdown in sales or a surge in the cost of capital can be devastating for small-cap companies, especially those that are highly specialised in niche markets. Small-cap stocks also tend to be vulnerable to the loss of key executives.

In general, small-cap companies are not well covered by equity analysts and have sparse publicly available information compared with big-cap firms. This creates market inefficiencies and possible security mispricing in the small-cap space. Volatility and illiquidity are other risk aspects associated with small-cap stocks, which tend to have thinner trading volumes, wider buy/sell spreads and larger intraday price movement relative to big-caps. All it takes is a handful of big sell orders from investors, for instance, to send prices of illiquid small-cap stocks tumbling. On the other hand, large buy orders can also drive up stock prices fairly quickly for small caps.

Small-cap investing is unsuitable for investors who are not prepared to do extensive research work and analyses on these potentially lucrative counters, in our view. To achieve sustainable success in the area of small-cap investing requires ample dexterity from an active and experienced investor, who has extensive research insights and on-the-ground knowledge, in order to sniff out the potential winners and avoid the losers in this under-researched area.

Opportunities abound in Asia

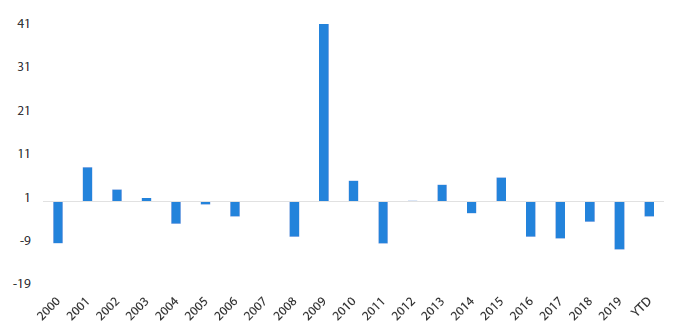

Asia—the economic growth engine of the world and the land of opportunities— remains one of most attractive and varied regions in the world for investors to seek out potential small-cap multi-baggers. For investors looking for another dimension of diversification and alpha generation within their Asian equity portfolios, small-cap stocks are indeed worthy of consideration. Regional small caps (as measured by the MSCI Asia ex Japan Small Cap Index) had generated decent outperformance versus Asian big-cap stocks (as measured by the MSCI Asia ex Japan Index) in distinct years, especially during a recovery phase after a major market selloff, such as in 2001 and 2009 (see Chart 1).

Chart 1: Relative performance (%) of Asia ex-Japan small caps* versus regional big caps*

Source: Bloomberg, 30 June 2020

*Asian small-cap stocks in the above chart are represented by the MSCI Asia ex Japan Small Cap Index, while regional big-cap stocks are denoted by the MSCI Asia ex Japan Index, all of which are quoted in US dollars. Returns are based on historical prices. Past performance is not necessarily indicative of future performance.

More importantly, the Asian small-cap universe offers active investors a wide opportunity set to perform bottom-up stock selection. For instance, on top of the myriad of non-benchmark small-cap counters in the region, there are more than 1,400 stocks in the MSCI Asia ex-Japan small cap universe to choose from, as compared to the Asian large- and mid-cap space, which has around 1,190 stocks (as at 30 June 2020), according to the MSCI Asia ex Japan Index.

Active investing drives alpha

All in all, Asian small-cap investing encapsulates the true essence of active equity investing. It is a unique equity space where active stock selection truly adds value and drives alpha. (Alpha is generally defined as returns in excess of a benchmark’s performance). On the other hand, passive investing in the Asian small-cap arena has disappointed investors in recent years, given the demise of the iShares MSCI All Country Asia ex Japan Small-Cap ETF in August 2015 and the subsequent underperformance of regional small-cap stock indices versus those of Asian big caps from 2016 to 2019.

For investors who want exposure to Asian small-cap winners, buying an ETF with holdings of over 1,000 stocks may not be appropriate, as it would include many unprofitable regional small-cap stocks. We believe that passive investing will not capture the best returns from the pick of the bunch in the Asian small-cap space, where potential losers outnumbered potential winners. Looking beyond market beta (or benchmark returns), active stock picking, in our view, is the most compelling approach to extract the best long-term returns from Asian small caps. The essence of small-cap investing is finding the winners of tomorrow. Good fund managers expect to add substantial alpha beyond the benchmark.

On the whole, we believe that there is inefficiency in the Asian small-cap market, where stock prices do not accurately reflect their true value. As a result, there is a lot of room for active fund managers to generate excess returns for investors. Promising Asian small-cap stocks, such as those with strong balance sheets, sustainable earnings and positive fundamental changes, could be identified after thorough analyses of their financial statements as well as through insights garnered from industry conferences, management calls and company visits.

In our view, the ability to speak the local languages of the Asian markets gives fund managers an edge in the Asian small-cap arena, where management teams have the tendency to communicate in the native tongues of their respective countries. For example, many of the top executives of small companies in China do not speak English. The only way to communicate with them is through Mandarin. Having multilingual fund managers and analysts gives investment teams an edge in this aspect. Furthermore, communicating with smaller companies in Asia in local languages also helps to build rapport with the management teams of these firms and enables investment teams to understand the nuances of individual markets.

In a nutshell, investing in Asian small-cap stocks can be a potentially rewarding proposition. We believe that investors who lack the skillset to do research on these under-researched small companies should delegate the investment to an active and experienced fund manager with the ability to sniff out potential winners and avoid the losers in the lucrative but uncertain universe of Asia small-cap stocks.