From global to local—lockdown insights and what it might mean for investors

By Iain Fulton

While everyone’s individual experience of this global pandemic has been different, there are many shared experiences that we hope readers will be familiar with. In short, the adaptations we have made as a society have changed the way we live and work. Might these new behaviours give a clue as to what industries and companies will prosper in the years ahead? Well, yes and (likely) no, but at least the task of observing our recent past may help us make sense of the present while giving us a clue about what might be round the corner. This article aims to cover a few observations we’ve made during lockdown that we believe could impact future returns for investors.

Obviously, our thoughts are with those who may have lost loved ones, their job or who may be dealing with other illnesses where treatment has become more difficult in these challenging times.

Front line health care workers have done an exceptional job under gruelling circumstances and for that we must be grateful. Vital supply chain personnel have kept food, power and communication networks operating while coping with a vast surge in demand. We are filled with admiration for these people and hope others recognise the valuable contribution they have made and continue to make.

A long-term shift in income equality is badly needed as many of these roles are vastly underpaid relative to the value they deliver to society. As investors, we have a responsibility to find companies that can help address these and other social problems. We’ll cover this later in the piece.

While these individual circumstances vary significantly, the lockdown experience and responses by policy makers have also held great similarities around the world. Many of us have seen wholesale changes to the way we live and work. Many countries are responding to the economic challenges with similarly dramatic fiscal and monetary stimulus. These lifestyle changes and policy efforts will shape economies, industries and markets over the coming years. This is one thing we can be certain of.

Unfortunately, the harsh reality is that this seems the only thing we can be truly certain of. The potential range of social, political, economic and environmental consequences from all of this seem vast and rightly make us feel uncertain about any attempt to predict what lies ahead.

As investors, how do we deal with this uncertainty? Can we identify how people and companies are adapting to today’s environment and might this give us clues as to what lies ahead? Here are some of the shared experiences we’ve seen and what we think it means for our investments…

Source: Shutterstock

Shared experience number 1: Working from home

As investors, we can count ourselves as fortunate to still be able to work safely and effectively from home. To do this, we have relied heavily on technology. While isolated physically, we have remained connected professionally and socially to our colleagues, family and friends via video links, messaging platforms, social media and other forms of software. We’ve learned how to work and interact while in remote locations, and the complex task of looking after people’s savings has continued throughout.

In short we have adapted the same way as many others have. Our children have used more technology for remote learning and we have all relied heavily on online platforms for shopping, entertainment and different forms of consumption. Companies have responded in kind to this unprecedented demand for technology. Cloud infrastructure and software spending has accelerated due to the surge in demand, as so many companies globally deploy a new IT infrastructure to meet the need for more flexible working in the long term.

Our portfolio has clearly benefited from this surge in demand for products and services that help us work, consume and be entertained from home. With the cloud infrastructure beneficiaries like Microsoft, Amazon, Adobe and Accenture; home delivery firms like Amazon, Meituan Dianping and HelloFresh; and video gaming businesses like Nintendo, Tencent and Sony, we have around a third of the portfolio invested in direct beneficiaries of this trend. It is possible that this all just represents a windfall and a ‘pull forward’ of demand. However, the scale of infrastructure roll out and the habits formed by this new pattern of consumption may make these trends longer lasting than many think. We are more wary of valuations now and have taken some profits, but we remain constructive on the duration of these trends and especially for those companies showing improving profitability within them.

Shared experience number 2: The importance of mental and physical health and well being

With risk factors from the virus being increased by underlying health conditions, it is not surprising that the health and wellness trend in consumption has accelerated. As we have switched from global to extreme local living, many of us have gotten to know our own neighbours and neighbourhoods much better than we did before. We’ve been forced to slow down and consider what really matters to us.

Communities have pulled together in times of need and families have gathered round the dinner table in ways that they may not have done for many years (if at all!). Food has understandably been a priority for all and there has been a boom in scratch cooking as people look to save money, minimise waste and learn new skills. For many, exercise has also been a key means of dealing with stress although the volume growth in the global snack category suggests this too may have been a powerful attraction for many!

The trend towards healthy living seems inexorable now, but our need to make good health outcomes affordable for all of society will be even more critical in the coming years as financial pressures increase. We remain focused on healthcare companies that can lower the cost of healthcare delivery while improving outcomes for patients. LHC (at home nursing care) and Philips (Healthcare IT) are direct beneficiaries of this trend, while Bio-Techne, Danaher and LabCorp help provide the products and services that enable researchers to uncover much needed breakthrough treatments. The long-term prospects for these firms seem sound given underlying demographics and the need to find value-for-money treatments. We have maintained just over 20% of the portfolio invested in a combination of these healthcare firms, along with innovative food companies such as Kerry Group and HelloFresh, which are long-term beneficiaries of the health and wellness trend.

Source: Shutterstock

Shared experience number 3: The limitations of technology and science

Too much of a good thing can often be bad for you. While technology has been a lifeline for many during lockdown and share prices reflect this importance to our lives, we must remember that it has limitations. Could the acceleration of life online be isolating the elderly people that lockdown policies are designed to protect?

Access to IT equipment has been a major challenge for children from families at the lower end of the income scale. Could this compound an already wide gap in educational attainment? Humans are social animals and there is no real substitute for face-to-face contact and a real life atmosphere. (Anyone who has watched the digitally enhanced crowd coverage at recent sports fixtures will understand). The experience can be hollow and can leave you questioning what really happened. Likewise, social media and 24-hour rolling news coverage puts everything in black and white. The narrative creates an insatiable demand for “heroes and villains”. In the UK, it could be argued that this fear of making a wrong decision and being cast as the villain led our politicians to place too much emphasis on the complex modelling of behavioural scientists.

Modelling from a small data set gives a large scope for error and it can be argued that while decision makers waited for data to confirm a trend, the resulting delay allowed the virus to take greater hold leading to a worse public health outcome, longer lockdown and greater economic damage.

Many of these early models were found to be sadly lacking. The problem was not their use; it was likely that we didn’t pay enough attention to their assumptions and limitations. We need our political decision makers to do exactly that—make difficult decisions based on available evidence. The outcome is highly uncertain and mistakes will be made, but arguably the fear of retribution (via social media?) can cause decision making to be too slow and not conservative enough in the UK’s case.

So, what does this insight mean for investment and our portfolio? The political consequences of the pandemic are likely to be substantial. There is a great need for increasing income inequality to be addressed while the environmental challenges we face are large. There is every chance that fiscal policy will move in a more socially populist and environmentally friendly direction, while taxation will likely be directed at addressing the income divide.

The ramifications of this are unclear and there is more work for us to do in this area. For now, we have around 10% of the portfolio invested in companies that offer environmentally-friendly solutions in construction and power infrastructure, such as SolarEdge, Schneider and Kingspan, and in clean air we own Daikin, Woodward and Johnson Matthey. The long-term prospects of companies in these areas seem underappreciated today and we are hopeful that we will find more quality companies in these industries going forward.

Conclusion

These are only a few observations that we can reasonably make from our time in lockdown. Technology adoption should continue apace, but we must be aware of its limits. Algorithms will not solve the problems facing society—people will. The corporate sector must become part of the solution not part of the problem. We are investing behind the people and companies that we think can make the difference to deliver better, more affordable healthcare outcomes for all and those that are providing cleaner solutions in power infrastructure and air quality. As investors, we need to take more responsibility for ensuring the companies we invest in are governed in ways that promote an improved social outcome also. The path ahead is uncertain but we believe concentrating on these fundamentals can help give the best outcome possible for our clients.

Source: Shutterstock

Portfolio positioning

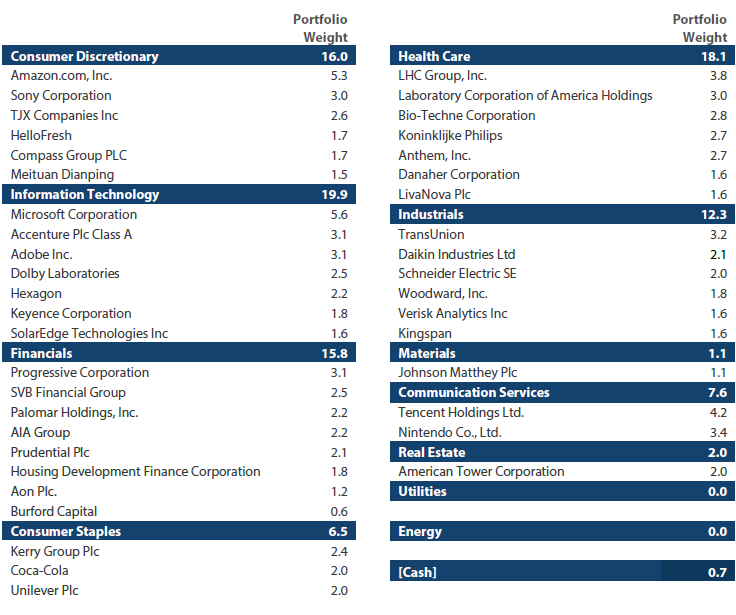

The table below highlights our Global Equity Strategy holdings as of the end of June 2020.

Reference to individual stocks is for illustration purpose only and does not guarantee their continued inclusion in the strategy’s portfolio, nor constitute a recommendation to buy or sell.

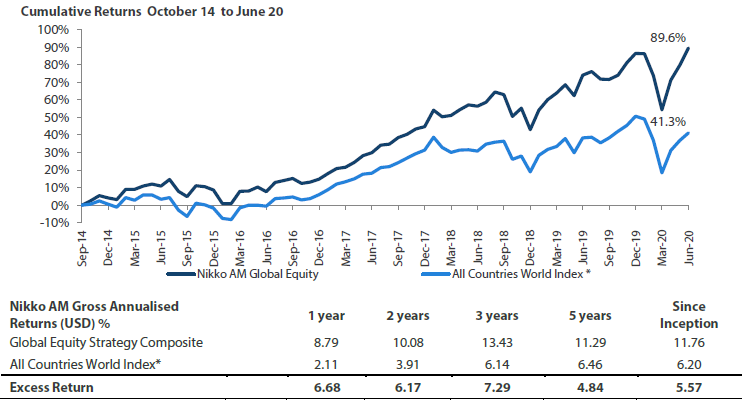

Global Equity Strategy Composite Performance to Q2 2020

*The benchmark for this composite is MSCI All Countries World Index. The benchmark was the MSCI All Countries World Index ex AU since inception of the composite to 31 March 2016. Inception date for the composite is 01 October 2014. Source: MSCI. Returns are based on Nikko AM Global’s (hereafter referred to as the “Firm”) Global Equity Strategy Composite returns. The Firm claims compliance with the Global Investment Performance Standards (GIPS®) and has prepared and presented this report in compliance with the GIPS. Returns for periods in excess of 1 year are annualized. Returns are AUD based and are calculated gross of advisory and management fees, custodial fees and withholding taxes, but are net of transaction costs and include reinvestment of dividends and interest. Past performance does not guarantee future returns. For more details, please refer to the performance disclosures found at the end of this document. Data as of 30 June 2020.

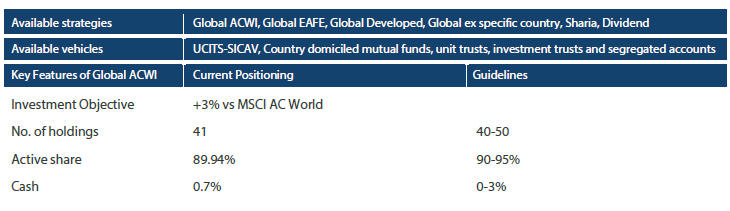

Nikko AM Global Equity: Capability profile and available strategies (as at 30 June 2020)

Past performance is not indicative of future performance.

This is provided as supplementary information to the performance reports prepared and presented in compliance with the Global Investment Performance Standards (GIPS®). Nikko AM Representative Global Equity account. Source: Nikko AM, FactSet.

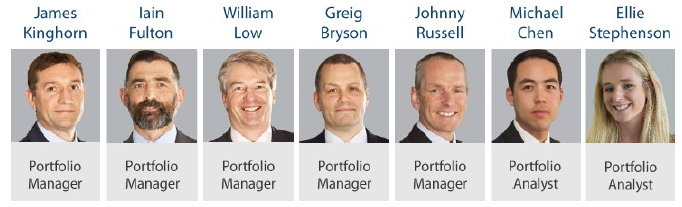

Nikko AM Global Equity Team

This Edinburgh based team provides solutions for clients seeking global exposure. Their unique approach, a combination of Experience, Future Quality and Execution, means they are continually “joining the dots” across geographies, sectors and companies, to find the opportunities that others simply don’t see.

Experience

Our five portfolio managers have an average of 23 years’ industry experience and have worked together as a Global Equity team for eight years. Two portfolio analysts, Michael Chen and Ellie Stephenson joined in 2019 and are the first in a new generation of talent on the path to becoming portfolio managers. The team’s deliberate flat structure fosters individual accountability and collective responsibility. It is designed to take advantage of the diversity of backgrounds and areas of specialisation to ensure the team can find the investment opportunities others don’t.

Future Quality

The team’s philosophy is based on the belief that investing in a portfolio of “Future Quality” companies will lead to outperformance over the long term. They define “Future Quality” as a business that can generate sustained growth in cash flow and improving returns on investment. They believe the rewards are greatest where these qualities are sustainable and the valuation is attractive. This concept underpins everything the team does.

Execution

Effective execution is essential to fully harness Future Quality ideas in portfolios. We combine a differentiated process with a highly collaborative culture to achieve our goal: high conviction portfolios delivering the best outcome for clients. It is this combination of extensive experience, Future Quality style and effective execution that offers a compelling and differentiated outcome for our clients.

About Nikko Asset Management

With USD 235.4 billion* under management, Nikko Asset Management is one of Asia’s largest asset managers, providing high-conviction, active fund management across a range of Equity, Fixed Income, Multi-Asset and Alternative strategies. In addition, its complementary range of passive strategies covers more than 20 indices and includes some of Asia’s largest exchange-traded funds (ETFs).

*Consolidated assets under management and sub-advisory of Nikko Asset Management and its subsidiaries as of 30 June 2020.

Risks

Emerging markets risk - the risk arising from political and institutional factors which make investments in emerging markets less liquid and subject to potential difficulties in dealing, settlement, accounting and custody.

Currency risk - this exists when the strategy invests in assets denominated in a different currency. A devaluation of the asset's currency relative to the currency of the Sub-Fund will lead to a reduction in the value of the strategy.

Operational risk - due to issues such as natural disasters, technical problems and fraud.

Liquidity risk - investments that could have a lower level of liquidity due to (extreme) market conditions or issuer-specific factors and or large redemptions of shareholders. Liquidity risk is the risk that a position in the portfolio cannot be sold, liquidated or closed at limited cost in an adequately short time frame as required to meet liabilities of the Strategy.