Introduction

Japanese economic growth has slowed considerably from the boom years that lasted from the 1950s to the 1970s, and despite numerous initiatives under the government’s “Abenomics” economic policies, the country’s rate of growth has been stuck around a modest 1%. Japan is an aging, mature economy and it is difficult to envisage the country again experiencing the kind of robust growth seen in the past. Japanese companies have also struggled amid stagnant economic growth, with many suffering from a number of inefficiencies. But the COVID-19 pandemic is forcing drastic changes upon Japanese society. We believe that this will serve as a catalyst for Japanese corporations to address inefficiencies and improve returns, presenting them with a new growth opportunity. Any growth among companies, however, is likely to be uneven, with the emergence of the intangible economy expected to deepen the divide between leading and laggard firms.

Inefficiencies Japanese companies need to address

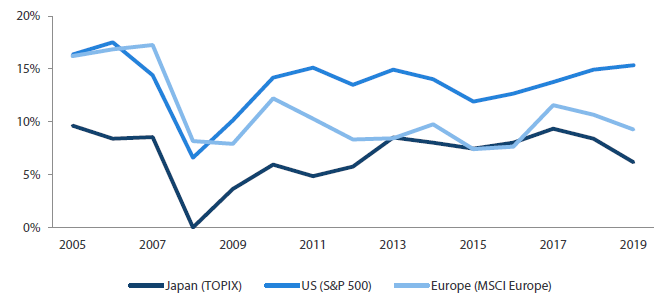

The return on equity (ROE) of Japanese companies provides a good example of their standing relative to US and European peers (Chart 1). Shareholders of Japanese companies have been suffering from low ROE with the gap between their US and European peers steadily widening. The low ROE shows that governance reform and attempts to improve capital efficiency have not borne much fruit, at least at an aggregate level.

Chart 1: ROE of Japanese, US and European companies

Source: FactSet data compiled by Nikko AM

The low ROE can be attributed to investments into capital, research and development (R&D) and human resources not producing the desired results. In terms of investment efficiency (how much marginal output can be expected for each unit of capital investment and R&D), Japanese companies have remained competitive with their overseas counterparts in areas such as materials and industrials. But in growth areas, notably information technology (IT), healthcare and communication services, they clearly lag their US peers in investment efficiency.

Similarly, investment into human resources by Japanese companies has failed to improve labour productivity. According to Japan Productivity Center data, in 2018 Japan was ranked 21st out of the 36 OECD countries—and lowest among the G7 nations—with productivity per employee at roughly USD 81,000. With Abenomics, Japan tried to improve labour productivity and boost profitability, but to no avail. Lacklustre labour productivity can be traced to factors often associated with Japan Inc.: low corporate profitability and high labour input. Inefficient and long working hours, slow adoption of IT and pressure to lower the prices of goods and services have robbed Japan Inc. of profitability.

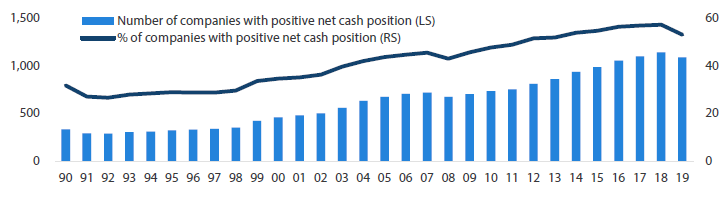

Such inefficiency has curtailed investment options, and many Japanese companies have become cash rich as a result. Nearly half of the TSE First section companies are net cash positive (Chart 2). While some have argued that this is a good thing, the phenomenon is not something to be welcomed when corporate inefficiency is the cause.

Chart 2: Number and proportion of companies with positive net cash position

Source: Nikko AM

Future growth opportunity

The flip side of the inefficiencies that plague Japanese companies is that there is great growth potential for firms if these are addressed. This means their ROE could improve and in turn shore up equity prices. The COVID-19 pandemic could fundamentally alter the way we live and work, and the current crisis could also last much longer than the Global Financial Crisis and change Japanese companies in ways previously unimaginable. Prime Minister Shinzo Abe’s work-style reform, which included reducing long working hours and allowing work to be more flexible, had struggled to gain traction among Japanese companies. But the pandemic has managed to do in a few months what the initiative had not been able to achieve over several years. Fujitsu, for example, announced in July that it would allow 80,000, or about 60%, of its employees to work from home and that it would halve its office space by 2022. We believe that such structural reforms will improve the profitability of companies and unlock their value. Other examples of companies initiating changes include Itochu Corporation, which opted to take full control over convenience store chain FamilyMart, and Seven & i Holdings, which will acquire US convenience store operator Speedway. We are hopeful that Japanese companies will continue to make such changes and that they will lead to improvements in labour productivity.

The rise of the intangible economy

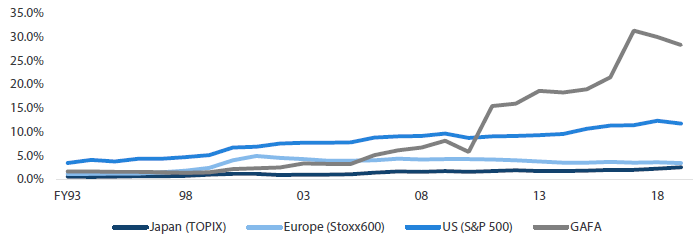

Economic and corporate growth is not an easy topic to analyse, but we believe that one crucial factor for Japan will be intangible assets. Chart 3 shows that Japanese companies hold only a fraction of the intangible assets held by their US peers. This is a disadvantage for Japanese companies, as non-physical assets such as technology, brands, software and data have become important revenue earners, giving the likes of GAFA their dominant status.

Chart 3: Intangible assets/Overall assets – Japan, US, Europe and GAFA

Source: FactSet data compiled by Nikko AM

In Capitalism without Capital: The Rise of the Intangible Economy, Jonathan Haskel and Stian Westlake argue that the ability to deploy non-physical assets is increasingly becoming the main source of long-term success after major developed economies began to invest more in intangibles, at the expense of tangibles, during the 21st century. However, the intangible economy is also expected to increase the gap between leader and laggard firms, with intangible economic characteristics such as “scalability” (intangible assets can be used an unlimited number of times) and “synergies” (intangible assets are complementary and increase in value when used in combination) providing an advantage to the former.

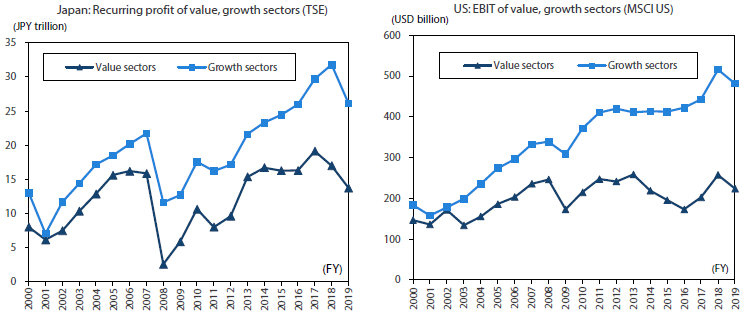

Such polarization between leader and laggard companies is also expected to gather momentum in Japan. For example, the gap between value and growth sectors may only widen going forward. In the past, not much separated the two, but the gap between them has steadily widened over the past decade (Chart 4). This could be a sign that, along with some other developed economies, Japan is also evolving into an intangible-rich economy.

Chart 4: Polarization between sectors

Source: FactSet, SMBC Nikko Securities

Conclusion

Japan is a mature economy, with many of its corporations grappling with inefficiencies. But if these inefficiencies are addressed and the misallocation of various resources corrected, Japanese equities have much room for gains, in our view. The increasing role of the intangible, digital economy is expected to lead to further polarization between leader and laggard firms in Japan. Under such polarization, the key for growth investing strategies will be identifying the leaders. As firms attempt to address inefficiencies and become more efficient, value investment strategies will also come into focus, with active strategies certainly playing a key role.