Summary

- US Treasury (UST) yields traded in a narrow range during the month. Factors such as the second wave of COVID-19 infections in Europe, lingering volatility in US equities and continued lack of consensus on further fiscal support weighed on market sentiment. Overall, the 2-year yield ended 0.3 basis points (bps) lower, while the 10-year yield was down 2.1 bps from end-August levels.

- Asian credits returned -0.47% in September, as spreads widened by 17.5 bps in the month. Losses were tempered by carry and gains from USTs. The month saw a deluge of new issuances, with a whopping 80 new issues amounting to US dollar (USD) 41.5 billion being raised in the primary market.

- Within the region, monetary authorities left their respective policy rates unchanged, while inflation readings were mixed in August. South Korea and Malaysia announced further fiscal stimulus. Separately, index provider FTSE Russell announced that it will add Chinese government bonds (CGBs) to its flagship World Government Bond Index.

- The coming months may see a rise in volatility, as some of the downside risks that we have been monitoring have ticked up somewhat. We deem it prudent to keep a neutral duration for now. On currencies, we are cautious on the South Korean won (KRW) and Chinese yuan (CNY).

- We expect Asian credit spreads to continue tightening slowly, though downside risks remain. These include the rising geopolitical tensions between the US and China, uncertainties relating to the looming US election, a more severe resurgence of COVID-19 and the economic recovery potentially stalling after the strong initial bounce.

Asian rates and FX

Market review

UST yields trade in a narrow range in September

The month started with overall risk sentiment weakened by the sharp technology stocks-led fall in US equities and the inability by the US Congress to reach a consensus on an additional fiscal stimulus package. Furthermore, the rebound in economic indicators decelerated and labour market recovery slowed. This was followed by generally positive macro news, such as the Federal Open Market Committee's suggestion that rates would be left low for longer and better-than-expected Chinese economic data. Towards the month-end, sentiment over the Emerging Market (EM) space soured. A confluence of factors including concerns about a second wave of COVID-19 infections in Europe, continued volatility in the US equities markets and a continued lack of consensus on further fiscal support for the economic recovery weighed on market sentiment. Overall, US government debt trading took place within a narrow range throughout the month, with yields ending marginally lower. The benchmark 2-year yield ended 0.3 bps lower, while the 10-year yield was down 2.1 bps from end-August levels.

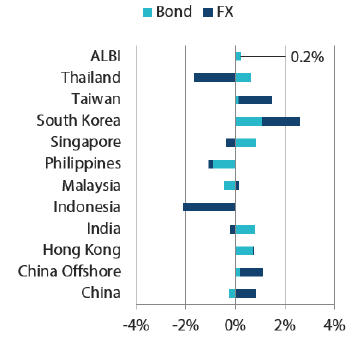

Chart 1: Markit iBoxx Asian Local Bond Index (ALBI)

For the month ending 30 September 2020

For the year ending 30 September 2020

Source: Markit iBoxx Asian Local Currency Bond Indices, Bloomberg, 30 September 2020

Note: Bond returns refer to ALBI indices quoted in local currencies while FX refers to local currency movement against USD. ALBI regional index is in USD unhedged terms. Returns are based on historical prices. Past performance is not necessarily indicative of future performance.

Region’s inflation readings mixed in August

Headline consumer price index (CPI) readings rose in South Korea and Thailand, were unchanged in Singapore and moderated in China, Indonesia and the Philippines. Thailand's deflation eased further in August, with headline CPI inflation improving to -0.50% year-on-year (YoY) from -0.98% in July, driven mainly by a lower decline in energy price inflation on the back of the continued uptick in oil prices. In Singapore, overall inflation was unchanged at -0.4% as a steeper fall in private transport costs offset a more moderate decline in core inflation. Elsewhere, Indonesia's headline inflation moderated further to a record 20-year low, and inflation in China eased due to a slump in pork prices. Similarly, August headline CPI dipped to 2.4% YoY in the Philippines, as demand-side pressures faded. The country’s capital region was placed under a more stringent quarantine level in the first two weeks of the period on account of the acceleration in the number of COVID-19 infections.

Monetary authorities leave their respective policy rates unchanged

In a unanimous vote, the Bank of Thailand (BOT) left its policy rate unchanged for the third consecutive meeting. Accompanying the decision, the central bank raised its gross domestic product (GDP) growth forecast for this year to -7.8% from -8.1%, but lowered its 2021 forecast to 3.6% from 5.0%. Notably, this was the last meeting for outgoing BOT Governor Veerathai Santiprabhob. Similarly, Bank Negara Malaysia maintained its policy rate, with the policy statement having a slightly more upbeat assessment of the global recovery compared to its previous meeting. Elsewhere, Bank Indonesia (BI) left its policy rate unchanged for a second consecutive month, restating the need to support rupiah stability. The central bank also reiterated that swifter budget implementation would be more effective in supporting growth this time. BI said it sees signs of a gradual recovery in both the global and domestic economies, and expects GDP growth to improve to 4.8-5.8% in 2021.

South Korea and Malaysia announce further fiscal stimulus efforts

In a bid to fight the continued economic pressure arising from COVID-19, the South Korean parliament approved a fourth extra budget. The new package, which amounts to around KRW 7.8 trillion, would be used primarily to aid households and struggling small businesses. In Malaysia, the government unveiled another fiscal package to prevent a deeper downturn in the economy. The additional stimulus is worth Malaysian ringgit (MYR) 10 billion and is targeted to support the low-middle income class and small businesses.

China relaxes QFII and RQFII rules; CGBs to be included in FTSE Russell's Global Bond Index

The China Security Regulatory Commission issued a major revamp of regulations for both the Qualified Foreign Institutional Investors (QFII) and RMB QFII (RQFII) programmes. The new regulations will combine both programmes and ease entry requirements for foreign investors. The scope of investments will also be significantly expanded. The new rules will take effect on 1 November and details of its implementation are expected to be announced shortly. Separately, index provider FTSE Russell announced that it will add CGBs to its flagship World Government Bond Index, with the inclusion to take effect from October 2021.

Market Outlook

Staying at a neutral duration for now

The coming months may see a rise in volatility, as some of the downside risks that we have been monitoring have ticked up somewhat. These include rising geopolitical tensions between the US and China and the uncertainties relating to the looming US presidential election. Consequently, we deem it prudent to keep a neutral duration for now.

Cautious on KRW and CNY

Given the uncertainty ahead related to the US elections and the ongoing de-risking by markets, we expect the won and yuan—being relatively more trade sensitive—to underperform their regional peers. The risk of the economic recovery potentially stalling after the strong initial bounce may also weigh on regional currencies.

Asian credits

Market review

Asian credits end lower in September as credit spreads widen

Asian credits returned -0.47% in September, as spreads widened by 17.5 bps during the month. Losses were tempered by carry and gains from USTs. Consequently, high-grade (HG) credits outperformed, returning -0.06% as spreads widened 10.5 bps, with total returns partly cushioned by lower UST yields. High-yield (HY) credits ended the month significantly weaker, registering a total return of -1.86%, as spreads rose 56.6 bps.

The month started with overall risk sentiment weakened by the sharp technology stocks-led fall in US equities and the inability by the US Congress to reach a consensus on an additional fiscal stimulus package. That said, these headlines initially had minimal spillover effect on the Asian credit market. Primary market activity picked up meaningfully at the onset of the month, as issuers tried to front-load issuance to lock in low rates and on concerns of potential market volatility ahead of the US election early in November. The relentless increase in supply was the primary driver that pushed spreads wider. Subsequently, the release of generally positive macro news, such as the Federal Open Market Committee’s (FOMC) suggestion that rates would be left low for longer and stronger-than-expected Chinese economic data, provided some short-lived relief to the ascent in spreads. Near the month’s end, credit spreads jumped meaningfully as sentiment towards the EM space soured. A confluence of factors including concerns about a second wave of COVID-19 infections in Europe, continued volatility in US equities markets and new-issue fatigue among Asian investors triggered the correction in Asian credit markets.

Against this backdrop, all major country segments, save for South Korea which is a relatively defensive space, saw spreads widen in September. Indian credits underperformed. Moody’s downgraded four Indian public sector banks, which was relatively well-flagged; hence, the rating changes had minimal impact on overall Indian credits. However, the meaningful shift in EM sentiment at the month-end affected the Indian credit space, sending overall spreads to widen by nearly 29 bps at the end of September. Meanwhile, weakness in Indonesian credits was partly attributed to news that the government decided to re-impose lockdown measures in Jakarta due to the recent surge in COVID-19 infection rates. In China, Moody’s upgraded the issuer rating of Country Garden by one notch to Baa3 and upgraded the bond rating by two notches to Baa3, on the back of its strengthened credit profile. Separately, Chinese credits in HY names were further weighed down by idiosyncratic risks facing Chinese conglomerate Evergrande Group. Notably, index provider FTSE Russell announced in the month that it will add CGBs to its flagship World Government Bond Index from October 2021. Moody’s downgraded the sovereign ratings of Sri Lanka by two notches to Caa1 from B3 and changed the outlook to “Stable”. While the economic pressure of late has been flagged well in the market and the government has been taking steps to mitigate those issues, the severity of the two-notch downgrade still came as a surprise. Over in Thailand, continued protests demanding reforms to the Thai monarchy undermined investor confidence.

Primary market activity surges in September

Following heavy supply in August, a fresh deluge of new issuances, mostly within the HG space, was seen in September, during which a whopping 80 new issues amounting to USD 41.5 billion were issued. Within the HG space alone, 57 new issues amounting to USD 36.2 billion were raised, including the USD 3 billion three-tranche issue from TSMC Global and the USD 2.4 billion four-tranche issue from CNAC HK Finbridge Co. Meanwhile, the HY space saw 23 new issues totaling USD 5.3 billion.

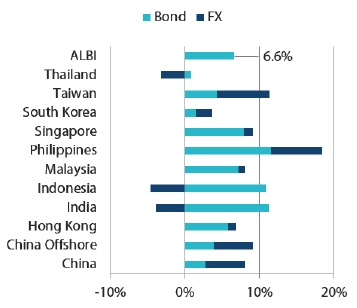

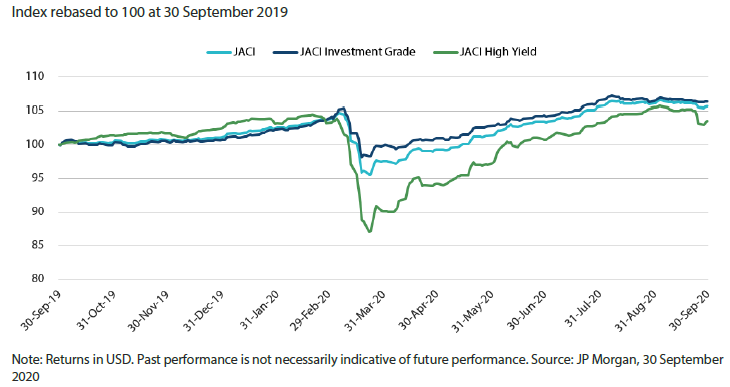

Chart 2: JP Morgan Asia Credit Index (JACI)

Market Outlook

Asian credit spreads to continue tightening slowly despite lingering downside risks

Asian credit spreads are expected to continue tightening slowly over the medium-term. Most Asian economies have likely seen the worst of the economic downturn in 2Q 2020, and high-frequency indicators suggest a recovery is underway, lending support to overall corporate credit fundamentals. Credit-supportive fiscal and monetary policies are also expected to remain in place in most developed and EM countries, even if incremental easing measures are likely to moderate from here. Progress on vaccines development and better treatment for COVID-19 cases further reinforce the positive backdrop.

Nevertheless, given the sharp rally in credit spreads over recent months, the pace of tightening should slow with more regular episodes of market pull-backs. The next few months could be particularly volatile, as some of the downside risks that we have been monitoring have ticked up somewhat. These include rising geopolitical tensions between the US and China and the uncertainties relating to the looming US election. Meanwhile, there remains the risk of a more severe COVID-19 resurgence globally, as well as the economic recovery potentially stalling after the strong initial bounce.