Snapshot

Economic data has been a touch softer of late and is likely to worsen given the US Phase IV fiscal stimulus impasse. Stimulus will eventually be delivered, likely in early 2021, but without stimulus now, more job losses due to the pandemic will become permanent and further slow the recovery. Second and third waves of the virus will also slow the recovery. But importantly, mortality rates have been lower, suggesting that the world continues to learn to live with the virus without requiring broad lockdowns.

While September was a difficult month for risk assets, we do note that it followed a near vertical rally in August which was not sustainable. So far, the sell-off shows as a healthy correction, but likely further deterioration in economic data and election risk ahead means that the correction may not be over just yet. Valuations are more supportive at current levels than a month ago, but they have yet to qualify as cheap.

Over the longer term, we remain relatively sanguine given the stimulus to date and a high likelihood of fresh fiscal stimulus in early 2021. An eventual vaccine will also allow demand to mostly normalise throughout next year. We watch the US dollar as a relative indicator of the likelihood of this outcome, and while there was a resurgence in dollar strength as odds of Phase IV stimulus fell, weakness has resumed, suggesting reflationary conditions are still likely ahead. The risk to this outlook is the degree of demand impairment caused by the failure of more immediate stimulus, so economic data in the coming months will remain critical.

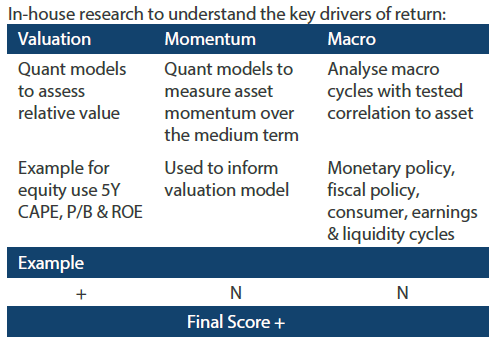

Cross-asset1

We reduced growth to neutral, adding to defensive which is now also scored neutral given the near-term headwinds including the impasse on Phase IV stimulus and the coming US elections that are likely to add to market volatility. While we do not believe these headwinds will derail the recovery—particularly in light of the large stimulus that is likely in early 2021—it does warrant a neutral stance until there is better clarity.

While central banks have essentially done all they can do to ease monetary conditions, it doesn’t replace necessary fiscal stimulus that had been fairly effective in backstopping demand until it expired at the end of July. We reduced both developed market (DM) and emerging market (EM) equities to neutral, adding to defensive growth assets including REITs, infrastructure and high yield. On the defensive side, we reduced inflation assets to neutral, while adding to sovereigns for a smaller underweight. We also reduced growth currencies in favour of defensives, leaving both with neutral scores.

1The Multi Asset team’s cross-asset views are expressed at three different levels: (1) growth versus defensive, (2) cross asset within growth and defensive assets, and (3) relative asset views within each asset class. These levels describe our research and intuition that asset classes behave similarly or disparately in predictable ways, such that cross-asset scoring makes sense and ultimately leads to more deliberate and robust portfolio construction.

Asset Class Hierarchy (team view1)

1The asset classes or sectors mentioned herein are a reflection of the portfolio manager’s current view of the investment strategies taken on behalf of the portfolio managed. The research framework is divided into 3 levels of analysis. The scores presented reflect the team’s view of each asset relative to others in its asset class. Scores within each asset class will average to neutral, with the exception of Commodity. These comments should not be constituted as an investment research or recommendation advice. Any prediction, projection or forecast on sectors, the economy and/or the market trends is not necessarily indicative of their future state or likely performances.

Research views

Growth assets

The growth outlook looks challenged over the near term given the uncertainty around Phase IV stimulus and the election risk in the US. We also note the stubborn pick-up in the spread of the virus globally, though we still believe the world is learning to live with the pandemic, avoiding further lockdowns and allowing demand to continue its path to recovery, albeit at a slower pace.

Recent data out of the US has been softer, owing to the halt in stimulus at the end of July. However, markets always look ahead and the outlook for 2021 is slightly rosier given the stimulus that is likely regardless of who wins the presidential election. Still, the election itself adds to uncertainty as there is an uncomfortably high likelihood of it being contested.

The markets appear to be writing down election risk at the moment, given the outcome of the presidential debate which has lifted the odds of a Biden victory and therefore reduced the possibility of Republicans supporting a legal contest if his victory is sizable. Even still, the political divide has never been wider, and it is difficult to assess reactions after election night no matter the outcome. We therefore remain cautious.

Emerging markets still unloved

There is no question that emerging markets were among the most challenged by COVID-19, due to their weaker medical capacity and the limited amount of available fiscal resources to offset the inevitable downturn caused by lockdowns. India and Latin America, for example, were particularly hard-hit, but despite an improving outlook—both for the slowing spread of the virus and better economic prospects ahead—the asset class remains largely unloved.

We are cautious over the near term but are still sanguine over the longer term given the global stimulus to date and a firmly weaker dollar that is generally a tailwind for emerging market assets. China stimulus is different this time; there is more focus on new infrastructure than old, but overall demand is still supportive and more sustainable as the stimulus feeds more into the real economy rather than another speculative bubble.

However, it is not just China this time that is offering fiscal stimulus to boost demand. The US and Europe are also set to increase their spending on infrastructure that will lend support to demand. Moreover, the US Federal Reserve (Fed) has committed to keeping policy easy, providing ample liquidity that is likely to keep the dollar weak and provide important support for emerging market assets.So far, emerging market currencies have recovered most of their COVID 19-driven losses, but current levels still look cheap considering the firm easing by the Fed and the impending ramp of fiscal stimulus that is likely to gather pace in 2021.

Chart 1: Emerging market currencies

Source: Bloomberg, October 2020

Still, being selective within emerging markets remains critical as the quality varies considerably across the complex. Countries such as Turkey remain critically imbalanced. However, the pandemic has caused sell-offs in other geographies including Latin America (LatAm) that we believe are disproportionate to their outlooks. We therefore stick with quality.

Conviction views on growth assets

- US equities reduced: We reduced our favourable view due to near-term headwinds driven by the delay in stimulus and impending election risk.

- Europe increased: Europe is currently challenged by a second wave of COVID-19, but relative opportunities are still strong as reflationary winds gather pace in 2021.

- Reduced EMEA in favour of LatAm: Geopolitical risk is on the rise in EMEA, driven most recently by the recent clash between Azerbaijan and Armenia, while LatAm remains underappreciated despite an increase in commodity demand and Brazil’s still-firm reform agenda.

- Infrastructure increased: We favour quality infrastructure assets due to their resilient cash flow and earnings profile compared to broader equities over the near term. Most assets, including gas and water pipelines and telecom towers, are barely affected by lockdowns caused by the pandemic.

- REITs underweight reduced: While the outlook is still challenged, valuations are supportive at current levels.

- High yield increased: The near-term outlook remains challenged, but the risk-return profile appears attractive compared to equities.

Defensive assets

Global central banks have been actively promoting their dovish credentials in recent months. Interest rates are being held at historic lows in support of economies hurt by the pandemic and forward guidance suggests that policy will be accommodative for the next few years, or until inflation shows a sustainable rise. Over time this permissive attitude to inflation should work to steepen global yield curves. But in the near term, rising risks and investor concerns are likely to support defensive assets.

As a case in point, inflation expectations measures had started to trend higher but have recently stalled as food prices fell back and doubts over additional US fiscal support emerged. Nevertheless, the case for inflation protection remains in the medium term with global central banks committed to easy monetary policy and a Fed that has moved to an average inflation target, with both developments indicating a higher tolerance for future inflation.

Investment grade credit continues to perform well although spreads widened marginally as risk sentiment deteriorated in September. Ongoing central bank support for the sector under various lending and asset purchase programmes continues to make the yield premium of high grade credit attractive. As a result, we continue to prefer this market over sovereign bonds.

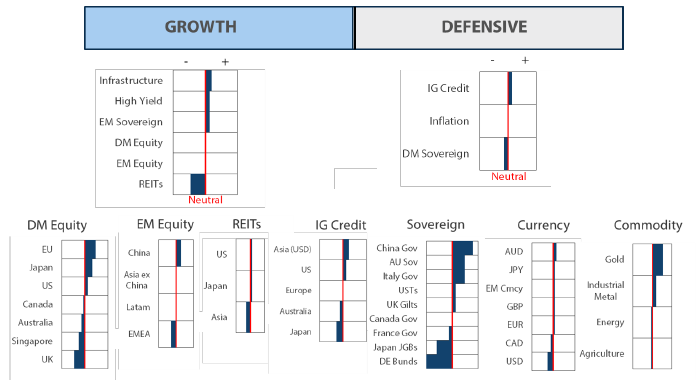

Bank of England flirting with negative rates policy

Like many of the world’s central banks, the Bank of England (BOE) used its remaining interest rate firepower back in March to reduce its official bank rate to its lower effective bound of 0.10%. It has remained there since and BOE forward guidance has indicated that “the Committee does not intend to tighten monetary policy until there is clear evidence that significant progress is being made in eliminating spare capacity and achieving the 2% inflation target sustainably”. While any interest rate increase is far off in the distance, market participants have been speculating about the BOE’s appetite to try a negative interest rate policy if further monetary stimulus is needed in the near term. Chart 2 indicates market pricing of the implied BOE rate turning negative around the middle of 2021.

Chart 2: Market expectations for the Bank of England’s policy rate

Source: Bloomberg, October 2020

BOE officials have indicated that its staff continues to explore the effectiveness of negative interest rates and are actively reviewing the operational considerations related to it. Even still, there have been mixed messages as Governor Andrew Bailey and Chief Economist Andy Haldane have been tempering market expectations while other committee members have been more supportive. In our view, the BOE may not want to utilise negative rates but will eventually be forced into trying it as the UK struggles from a resurgence of COVID-19 infections. A second wave is in full swing where average daily case numbers are now triple the peak number of cases recorded earlier this year. New measures such as curfews and regional lockdowns are being introduced and will become a major impediment to the UK’s economic recovery from the first wave.

It could also be that the BOE is readying a negative interest rate policy in the event of a final no-deal Brexit with only two and a half months remaining in the negotiating period. While the health and economic impact of the pandemic has been front of mind for UK policymakers in recent times, the clock is ticking on a UK/EU trade deal. It’s important to remember that the UK has continued to trade with the EU in 2020 under the status quo so its current challenges are primarily driven by the pandemic. Therefore the UK’s economic challenges will remain even if a trade deal is agreed.

It would perhaps be an understatement to suggest that the confluence of a surge in viral infections with a no-trade deal outcome would be devastating for the UK economy. Nevertheless, this is what the BOE is potentially facing and it stands ready to act decisively. We believe that the odds of negative rates in the UK are underappreciated by market pricing and we have upgraded UK gilts as a result.

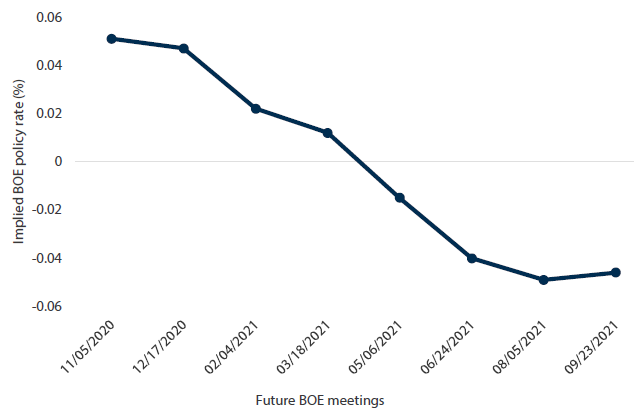

Still constructive on gold

Gold has corrected after hitting an all-time high of USD 2,063.54 per troy ounce in early August, around the same time that US 10-year real yields bottomed at -1.1%. A few factors could likely explain the move. For one, the Fed disappointed investors at its last committee meeting when it tempered expectations of negative interest rates instead of providing more forward guidance. Inflation breakevens, which are mainly driven by changes in oil prices, had also overshot and corrected. Moreover, the rising odds of a Biden win and a Democrat-led Senate in US elections have pushed up the probability of additional fiscal stimulus leading to higher nominal yields.

Chart 3: Gold prices versus US real yields

Source: Bloomberg, October 2020

At this juncture, we view this as a healthy pullback and expect gold to be well supported in the medium term. With respect to monetary policy, global central banks have committed to easy policy settings until data have sustainably improved. They are on standby to add more should it be needed. Furthermore, with the new symmetric inflation target, the Fed is determined to let inflation run hot, unlike in the past. Still, gold is a better hedge against geopolitical events, such as US President Donald Trump deciding to contest the ballot results, or a serious escalation in US-China tensions. There is greater convexity in gold prices with bond yields near their lower bound and this correction provides a better entry point, in our view.

On the other hand, there are also risks to a decisive win for Biden in the coming election. The former US vice president’s infrastructure proposal is likely to add significant new Treasury issuance to the market and restore the US to a stronger economic growth path. Consequently, this could push up bond yields sharply and weigh on gold prices. Likewise, the demand for safe havens will also retreat in this case, reducing demand for Treasuries.

Conviction views on defensive assets

- Take the spread in investment grade (IG) credit: While the contraction of credit spreads has slowed over the last few months, longer-term momentum is still positive and the yield premium of IG credit over sovereign bonds is attractive. Therefore, we continue to expect IG credit to outperform sovereign bonds.

- Higher yields preferred in sovereigns: We continue to prefer higher-yielding sovereign bonds as yields stay low and remain in narrow ranges. In addition to China’s government bonds, we also favour US Treasuries and sovereigns from Italy and Australia.

- Gold still preferred as an inflation hedge: While prices have corrected recently, the underlying support from negative real yields and greater central bank tolerance of higher inflation will sustain demand for gold, in our view.

Process