The global markets surged in 2020 despite the COVID-19 pandemic. While we expect the liquidity-driven rise to continue for a while, we should be prepared for the tide to eventually turn. We identify Japanese industries, notably “Delta ESG” stocks, that could become sources of alpha in the post-pandemic world.

Introduction

Despite the COVID-19 pandemic, we witnessed an impressive bull run by the global equity markets in 2020 thanks to a combination of powerful fiscal stimulus, low interest rates and unprecedented quantitative easing. The Japanese market was no exception with the Nikkei Stock Average soaring to a near three-decade high in December. Looking toward 2021 and beyond, however, we must keep in mind that this classic example of a liquidity-driven rally will eventually end as coronavirus vaccines are developed and rolled out, reducing the need for generous fiscal and monetary stimulus. We believe that once this liquidity-driven rally runs its course, industries affected by policies pertaining to climate change and green energy will become sources of alpha in Japan as the country attempts to make a fundamental shift in its energy policy. Staying invested in the market is key; however, during such a fundamental shift the diversification of exposure will be increasingly important, in our view.

Winds of change and potential sources of alpha

Joe Biden’s US presidential election win in November is likely to either cause a major change, or facilitate initiatives already taking place, in energy policies around the world. Biden is expected to reverse Donald Trump’s environmental and climate policies when he takes office in January. Fighting climate change and protecting the environment will once again become important agendas for Washington and re-joining the Paris climate accord is likely to be one of its first steps under Biden. A major shift in US environmental and energy policy will have a profound impact on the rest of the world, including Japan.

Joining a list of countries pledging to counter climate change, Japan in October announced its goal of becoming carbon neutral by 2050. This is a very challenging goal. Japan now sees a massive shift to hydrogen as necessary if it wants to achieve such an ambitious climate target. Against such a backdrop, industries linked to hydrogen are poised to become providers of alpha, in our view. The first would be the providers of so-called clean energy, notably those linked to solar and wind power that can generate the vast amounts of electricity required to produce hydrogen.

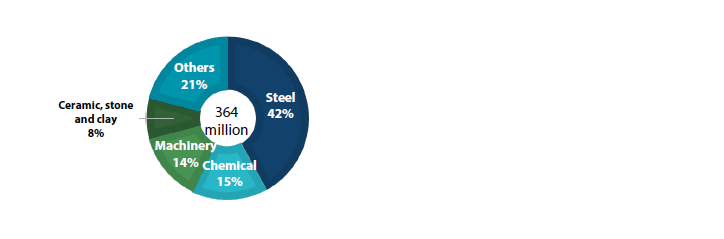

The second, perhaps less obvious, industries are those that will be required to cut carbon dioxide emissions as Japan tries to become carbon neutral. These include manufacturers of chemicals, machinery and steel and can be referred as “Delta ESG (ΔESG)” entities—companies that are currently major emitters of CO2 but have room to develop and improve ESG practices. Such stocks are expected to offer returns if they embrace new environmental rules, especially given low valuation. For example, steel manufacturers, which alone account to 42% of CO2 emitted by Japanese companies, are positioned to adopt new technology that could benefit their bottom line in the long term (Chart 1).

Chart 1: CO2 emissions by industries in Japan

Source: National Institute for Environmental Studies, fiscal year 2019 (preliminary figures)

Two main sources of alpha to be derived from ΔESG: Cyclicals and technologies that contribute to the carbon neutral initiative

The Delta ESG industries—chemical, machinery and steel—are cyclicals, which could have important implications. Cyclicals are closely associated with value stocks, which lost out significantly to growth stocks during the pandemic as ample liquidity flowed into growth sectors such as technology and healthcare. Value stocks have also been on the back foot as they are sensitive to economic cycles and most economies have experienced downturns during the pandemic.

The rollout of vaccines, however, could change the flow of funds in the equity market. Economic conditions will improve if the vaccines succeed in containing the coronavirus, and more money will potentially flow to value stocks, especially Delta ESG-related companies.

In addition, we also expect new and disruptive technologies to become contributors to Japan’s attainment of the carbon neutral goal. For instance, Japanese companies have an abundance of advanced technology related to hydrogen energy, including those linked to automobiles. Japan is also competitive in the area of power-saving semiconductor technology, which can significantly reduce carbon emission from all technology devices.

The equity market is currently supported by low interest rates and ample liquidity. Without these elements the market is likely to lose momentum, and the key will be identifying stocks that could potentially gain despite the market sentiment, such as those associated with Delta ESG and more specifically, carbon neutral-related shares.

Summary: Significant upside potential in Japan equities

Foreign investors are main participants in the Japanese equity market; they are the dominant players generating 60% to 70% of daily volume on the Tokyo Stock Exchange. Buying of Japanese equities by foreign investors have declined steadily since their purchases hit a peak of 20.8 trillion yen in 2015 during the height of the “Abenomics” era. The buying dropped further during the pandemic, with cumulative purchases of Japanese equities by foreign investors falling to 2.8 trillion yen at the end of October. However, the situation appears to be changing amid the vaccine developments, with foreign investors turning massive net buyers of Japanese equities in November for the first time in several months.

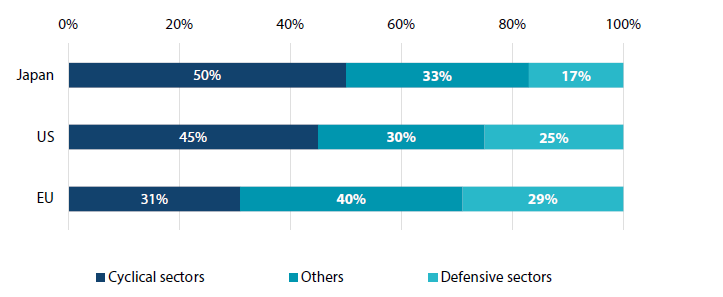

When global economies do eventually recover from pandemic-caused downturns, we expect foreign investors to reconsider their stance on Japan. Seeing that Japan is the most sensitive to economic cycles among the major economies, with the highest proportion of cyclical stocks compared to the US and the EU (Chart 2), we expect foreign investors to increase their allocation to Japan. When they were sellers of Japanese equities, their sales were absorbed by corporate buy-backs and the Bank of Japan’s ETF purchases. Purchases of Japanese equities from these two sources are expected to top JPY 10 trillion going forward. Therefore, the market’s supply-demand conditions will improve further once foreign investors return as the main buyers.

Chart 2: Sector breakdown by country and region

Source: SMBC Nikko Securities

Another source of support for Japanese equities is Japan’s proximity to China. The world’s second biggest economy has seemingly recovered from the COVID-19 shock. To enhance key technologies, in May 2020 the National People’s Congress allowed for RMB 17 trillion (USD2.6 trillion) to be invested by 2025 so that China can boost infrastructure in areas such as 5G and data centres. Economic activity of such scale is expected to generate demand that benefit Japanese businesses as well.

In November, 15 Asian countries representing 30% of the world population and GDP signed the Regional Comprehensive Economic Partnership Agreement (RCEPA). The agreement will eventually eliminate up to 90% of the tariffs on imports between its signatories. This is the first multi-lateral trade treaty between China, Japan and South Korea; the deal will definitely expand trade between Japan and China, in contrast to trade between the US and China.

In sum, unprecedented monetary policies by the world’s central banks will keep boosting the market for some time to come. It is important to stay invested in the market at the moment given the liquidity-driven conditions. However, diversification—such as holding ESG-related shares against technology shares and also holding Japan, China and Asia- focused shares against US-focused shares—will be key as, although we will never know exactly when the tide will eventually turn, this liquidity-driven rally will draw to a close, in our view.